Asia-Pacific Light Detection and Ranging System Market Overview:

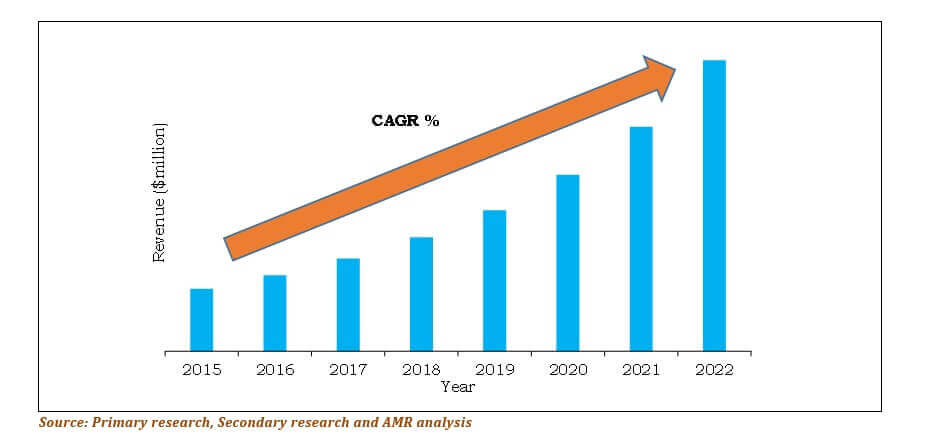

Asia-Pacific (LiDAR)Light Detection and Ranging System Market is expected to garner $205.6 million by 2022, registering a CAGR of 25% during the forecast period 2016 - 2022. The report incorporates the study of Asia-Pacific LiDAR market that focuses on types of LiDAR systems.

LiDAR is an emerging technology that helps to capture high-definition 3D data of geospatial surfaces. The product types are differentiated into airborne/aerial, mobile, short range and terrestrial/stationary. Aerial LiDAR devices are defined as LiDAR systems mounted on aircrafts or drones. Mobile LiDAR are those mounted on vehicles, turbines and other moving objects. Static/terrestrial LiDAR are mounted on land surface or buildings, towers, etc. All of the LiDAR operating in range of about 0-10 meters are considered as short-range LiDAR.

These systems are increasingly employed over conventional surveying methods owing to their ability to provide highly accurate data and 3D images in a shorter time duration. LiDAR systems have replaced conventional surveying methods and statistical analysis owing to the in-depth analysis requirement in different application areas. The widespread awareness about the advantages of LiDAR usage in varied industry verticals is a major factor driving the LiDAR market in Asia-Pacific. Countries, such as China, Japan, South Korea and others, have started using LiDAR technology in civil engineering and forestry applications. Increased spending capabilities and rising government initiatives have led to the rise in the usage of LiDAR technology in different application areas, which further supplements the market growth and creates opportunities for the market players to enhance their market share.

The innovations in the laser technology help to bring price corrections in LiDAR products. Simultaneously, the changing demands and preferences of the urban population unveil newer LiDAR applications apart from conventional military applications. The sophistication of 3D imaging technology leads to increased corridor mapping activities by the LiDAR. The market is likely to experience continued dominance from defense and corridor mapping applications.

PROPERTIES OF LIDAR SENSOR

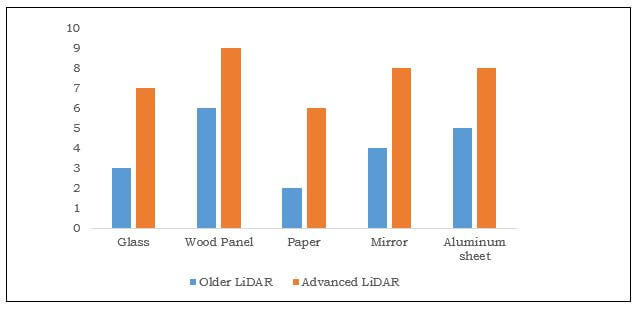

| LiDAR series | Range | Resolution | Cost |

| Older LiDAR | less than 8m | 1 | $15,000 |

| Advanced LiDAR | 18–30m | 0.25 | $8,000 |

Key players adopt product launch and R&D as their key strategies to meet the customer demands and increase their customer base. Acquisitions, joint ventures and partnerships are likely to help players to set a common technology platform and share the technological requirements, which in turn would enhance their product portfolio in less investment and increase their market share across Asia-Pacific.

SEGMENT OVERVIEW

The Asia-Pacific LiDAR market, by type is segmented into terrestrial, aerial, mobile, and short-range systems. A terrestrial LiDAR, also known as a ground-based LiDAR system is a laser scanner integrated with a highly accurate GPS system. This LiDAR possesses an exceptional ability to produce 3D images of land at coastal and other areas. Taking into consideration the natural hazards in Asia-Pacific, ground movements such as landslides can be analyzed and measured by satellite imagery. However, the problem associated with the traditional satellite imagery was that vertical cliffs could not be viewed at an oblique angle and the fast coastal changes could not be traced. Thus, terrestrial LiDAR systems are used to resolve these problems by providing accurate measurements at a safe distance.

China is the largest revenue-generating country in the Asia-Pacific terrestrial LiDAR market and is expected to maintain its dominant position throughout the forecast period.

CHINA TERRESTRIAL LIDAR REVENUE, 2015-2022 ($MILLION)

The components of the Asia-Pacific LiDAR market are sub-segmented into laser generator, inertial navigation system (INS), camera, GPS/GNSS receiver, and microelectromechanical system. The use of these components depends on their respective applications.

Corridor mapping and seismology exploration & detection are some of the major application areas of LiDAR systems. The others segment includes pollution modelling, coastline management, and metrology. In 2015, corridor mapping was the highest revenue-generating application owing to its increasing adoption to plan urban modelling, flood mapping, and forestry application.

COUNTRY LEVEL ANALYSIS

The countries included in the Asia-Pacific LiDAR systems market are China, Japan, India, South Korea, and Rest of Asia-Pacific. The systems capable of detecting low level nearby wind turbulence and shear during non-precipitative conditions are being adopted in China. For instance, In September 2015, Mitsubishi Electric

Asia-Pacific LiDAR Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Component |

|

| By Application |

|

| By End User |

|

| By Country |

|

| Key Market Players | Airborne Hydrography AB, Leica Geosystems Inc. (Hexagon), RIEGL Laser Measurement Systems GmbH, 3D Laser Mapping Inc., Faro Technologies Inc., Quanergy Systems, Inc., Saab Group, Optech Inc. (Teledyne Technologies), Aerometric Inc., Raymetrics S.A. |

Analyst Review

The Asia-Pacific Light Detection and Ranging (LiDAR) market is expected to signify a gradual development with the increasing rate of adoption in corridor mapping, seismology, exploration, detection, and other applications. The demand for high resolution images and accurate data has propelled the market growth. However, the rate of adoption of these systems is limited as LiDAR equipment is expensive. Nonetheless, rise in the adoption of autonomous vehicles in the emerging countries and use of standardized data formats are expected to fuel the market growth.

Airborne LiDAR systems are adopted in Asia-Pacific for forest management, monitoring environmental changes, mining, town planning improvement, and other applications. Corridor mapping is the most widely preferred application for LiDAR systems in Asia-Pacific because of massive implementation in China. Among the end users of such systems, civil engineering depicts the strongest market due to excessive adoption in infrastructure planning.

LiDAR systems are majorly adopted in China, followed by Japan, South Korea, and India. The higher market share in China is attributed to the increase in implementation of airborne LiDAR systems to map smart grids. However, India is projected to be the fastest growing country due to the rise in deployment of LiDAR systems for transportation and infrastructure developments.

Manufacturers focus on product innovation, technological upgradation, and product portfolio expansion to maintain their market position. Product launches and R&D are the key strategies adopted by market players to sustain the competitive market.

Loading Table Of Content...