Asia-Pacific Usage-Based Insurance Market Research - 2030

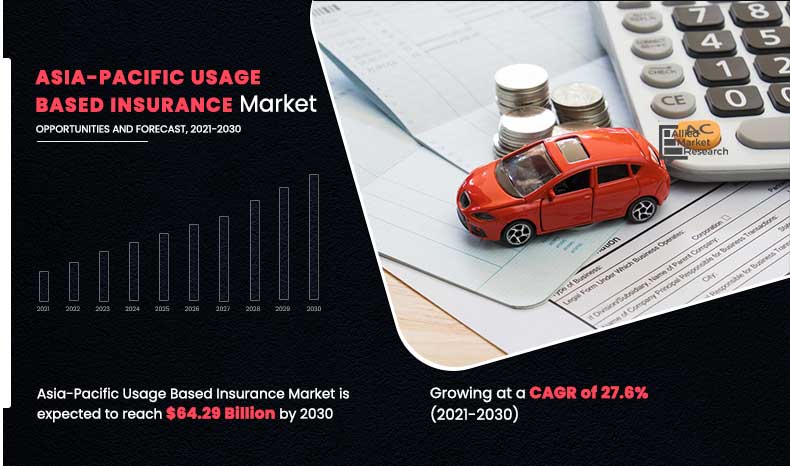

The Asia-Pacific usage-based insurance market size was valued at $5.64 billion in 2020, and is projected to reach $64.29 billion by 2030, growing at a CAGR of 27.6% from 2021 to 2030.

Usage-based insurance is a form of coverage in which the premium is directly proportional to the amount of time the vehicle is used. This sort of insurance is mostly offered in developed nations, the bulk of the market's top players are growing their operations in Asia-Pacific emerging countries. Furthermore, insurers use UBI plans to align driving habits of people with the premiums they charge. Telematics device, which is a system put in automobiles, monitors vehicle's speed, time, and distance travelled, which is then sent to insurance providers, which then charges insurance premiums appropriately.

Growth in adoption of usage-based insurance among end users, owing to its various features such as providing accurate and timely data collection methods and flexible insurance premiums boosts the Asia-Pacific usage-based insurance market growth.

In addition, factors such as higher possibility of vehicles being recovered, in case it is stolen and lower fuel consumption positively impacts growth of the Asia-Pacific UBI market. However, high installation cost of telematics and various data security issues are expected to hamper the market growth. On the contrary, adoption of advance technology such as smartphone-based UBI & hybrid-based UBI and increase in concerns regarding driver’s safety across the globe are expected to offer remunerative opportunities for expansion of the Asia-Pacific usage-based insurance market during the forecast period.

The black-box based UBI segment is expected to garner a significant share during the forecast period. This is attributed to penetration of black box-based insurance is increasing among higher risk policy holders, such as a young or new driver, in Asia-Pacific, which is anticipated to increase the demand for such programs in the region. However, the smartphone-based UBI segment is expected to grow at the highest rate during the forecast period, owing to convenience provided for data collection through smartphone app drives the smartphone-based UBI services.

The report focuses on growth prospects, restraints, and analysis of the Asia-Pacific usage-based insurance market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Asia-Pacific usage-based insurance market share.

Segment Review

The Asia-Pacific usage-based insurance market share is segmented on the basis of type, technology, vehicle age, vehicle type, and country. In terms of type, the market is fragmented into pay-as-you-drive, pay-how-you-drive, and manage-how-you-drive.

Depending on technology, it is bifurcated into OBD-II-based UBI programs, smartphone-based UBI programs, hybrid-based UBI programs, and black-box-based UBI programs. As per vehicle age, it is bifurcated into new vehicles and used vehicles. In terms of vehicle type it is segmented into light-duty vehicle (LDV) and heavy-duty vehicle (HDV). Country wise, it is analyzed across China, Japan, Australia, Thailand, Singapore, Rest of Asia-Pacific.

Some of the key players operating in the Asia-Pacific usage-based insurance market include ASSICURAZIONI GENERALI S.P.A, Allianz SE, Aviva, AXA, Liberty Mutual Insurance, Mapfre S.A., TomTom International, Octo Group S.p.A, SIERRA WIRELESS, and VODAFONE LIMITED. These players have adopted various strategies to increase their market penetration and strengthen their position in the Asia-Pacific usage-based insurance industry.

By Policy Type

Pay-as-you-drive segment is projected as one of the most lucrative segments.

Covid-19 Impact Analysis

Insurance industry plays a major role in economic growth by providing financial protection to people, assets, and businesses of a country against uncertain events. Hence, insurance business has become a massive contributor toward a country’s development. The pandemic has changed prospects of every business sector, and the insurance industry is no exception. The Asia-Pacific usage-based insurance industry has been positively impacted by the outbreak of the COVID-19 pandemic. As per several surveys, almost 40% of trips have decreased, usage of public transportation for commuting to work reduced to 0%, and the total distance of short trips has increased. All these factors decline the need for car insurance and drops the number of claims nearby to 50%, which is profitable for car insurance companies only in short term. However, in long term, Asia-Pacific usage-based insurance market size is anticipated to boost by the pandemic, owing to implementation of travel restrictions and less usage of cars, which enables consumers to take usage-based insurance to reduce premium costs.

Furthermore, usage-based insurance is one of the largest revenue sources for the general insurance industry and accounted for more than 35% in overall insurance premium collection in 2019. In addition, most states require drivers to have auto insurance, which implies that purchase of new automobile constitutes a major proportion of these premiums.

By Technology

Black-box segment is projected as one of the most lucrative segments.

Top Impacting Factors

Growth In Adoption Of Usage-based Insurance Among End Users

Growth in adoption of IoT-enabled telematics auto insurance is enabling insurers to collect behavioral data on each driver. Insurers can use this data to process risk-related information on individual level over time. Moreover, IoT solutions for UBI helps insurers to improve product offerings and generate targeted marketing campaigns. Insurance companies can gain a competitive advantage by refining driver-scoring algorithms with service provider partners. In addition, using IoT devices, different data points can be established. Monitor variables such as how long a user drives and their overall behavior in front of the wheel, including how they use their breaks, at what speed they move around, and other important metrics. Furthermore, UBI car insurance is being used to track various data points in vehicles with the purpose of making engineering improvements or helping make better decisions like calculating an insurance risk premium, which, in turn, propels the Asia-Pacific usage-based insurance market growth.

Higher Possibility Of Vehicles Being Recovered, When Stolen Or Low On Fuel

Growth in adoption of auto telematics has enabled users to monitor fuel consumption at various scenarios and help drivers predict optimal gear and driving speed. Furthermore, solutions such as FleetLocate help end users to track vehicles, monitor their health, and gauge how they are being driven. In addition, usage-based insurers install IoT devices in vehicles in end users, which are small enough to be concealed inside a vehicle and quick and easy to install. In addition, it also provides instant support to police in case of theft, which in turn is major factor driving the growth of the Asia-Pacific usage-based insurance market. Moreover, these solutions offer a long-life and battery-based device, which can be placed in multiple spots within a vehicle, rendering detection of devices, thus, increasing life of vehicles. Furthermore, insurance providers have developed geolocation capabilities based on network triangulation, which can estimate location of stolen vehicles. Network provider receives regular data from cars and as soon as a jamming attempt is detected, the device switches to recovery mode. This means that the network estimates location of vehicles for every message received, allowing security companies to dispatch the nearest recovery team. Therefore, UBI insurance increases profits and reduces expense of insurers.

By Country

Rest of Asia-Pacific would exhibit the highest CAGR of 30.9% during 2021-2030.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the Asia-Pacific usage-based insurance market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Asia-Pacific usage-based insurance market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the Asia-Pacific usage-based insurance market from 2021 to 2030 is provided to determine the market potential.

Asia-Pacific Usage-Based Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By Vehicle Age |

|

| By Vehicle Type |

|

| By Country |

|

| By Key Market Players |

|

Analyst Review

According to insights of CXOs of leading companies, the insurance industry plays a major role in economic growth by providing financial protection to individuals, assets, and businesses against uncertain events. Hence, business of insurance has become a massive contributor toward development of a country. Increase in economic strength of developing nations such as China and India is expected to provide lucrative opportunities for the market growth.

Key providers of the Asia-Pacific usage-based insurance market such as Sierra Wireless, ALLIANZ, and AXA account for a significant share in the market. With larger requirement from Asia-Pacific usage-based insurance, various companies are establishing partnerships to increase usage-based insurance capabilities. For instance, in December 2021, Allianz Partners and Uber announced a partnership in which Allianz Partners will provide protection and security for independent drivers and couriers who partner with Uber and Uber Eats. The coverage includes various compensation payments for loss of income in case of on-trip accidents, injury, or hospitalizations. In addition, active Uber partners also enjoy significant off-trip benefits, for instance, paid sick leave for up to 15 days, maternity and paternity payments, and inconvenience compensations for court attendance.

In addition, with increase in demand for usage-based insurance services, various companies are expanding their current services to continue with rise in demand. For instance, in December 2021, Aviva Life Insurance, a private insurance company, has launched Aviva Nivesh Bima. Nivesh Bima is a non-linked, non-participating, individual savings life insurance plan that provides guaranteed moneyback at every fifth policy year, in addition to a lump sum payout at maturity. It offers features such as fixed benefit pay-out on maturity or death, limited premium paying term, and an option to enhance the coverage through an add-on accidental death benefit. The plan also offers tax benefits to customers.

Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in July 2021, Generali signed an agreement in connection with the purchase of the majority of shares held by AXA and Affin in the joint ventures, approximately 53% of AXA Affin General Insurance Berhad (49.99% from AXA and 3% from Affin and minorities) and AXA Affin Life Insurance Berhad (49% from AXA and 21% from Affin), respectively. The acquisitions will position Generali as one of the leading insurers in the Malaysian market, creating the second P&C insurer by market share and entering the country’s life insurance industry.

Loading Table Of Content...