Asia-Pacific Advanced Wound Care Market Research - 2032

Traditional and advanced wound care products are used to treat acute and chronic wounds. Chronic wounds are wounds that take substantial time to heal and are expensive to treat. Advanced wound care is emerging as a standard solution for treating chronic wounds. Traditional wound care products are being increasingly substituted with advanced wound care products owing to their efficiency and effectiveness in managing wounds by enabling rapid healing. The Asia-Pacific advanced wound care (AWC) market was valued at $1,658 million in 2017, and is projected to reach $3,655 million by 2025, registering a CAGR of 10.4% during the forecast period.

The growth of the market is attributed to the rapid increase in prevalence of chronic diseases such as diabetes, changes in lifestyles, and attempts to reduce surgical costs by reducing the duration of hospital stays. Other factors such as favorable reimbursement scenario, increase in healthcare expenditure by the government, and rise in inclination toward wound care products that enhance therapeutic outcomes drive the growth of the advanced wound care market. However, high cost of advanced wound care products and low awareness, especially in the under-developed countries are the factors expected to restrain the market growth.

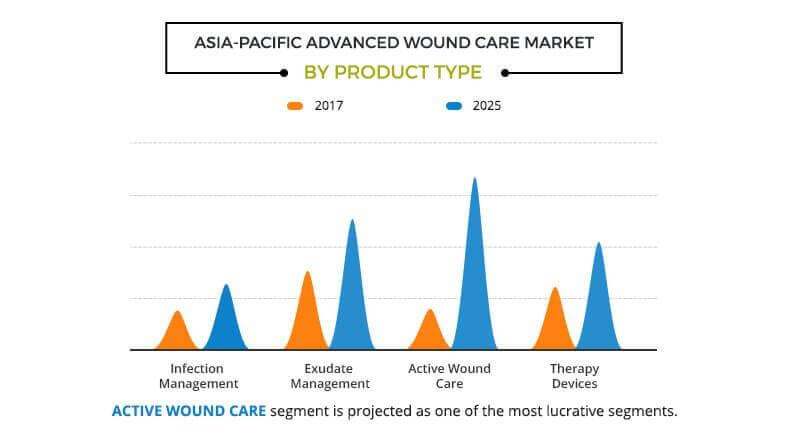

Product Segment Review

Based on product, the market is categorized into infection management, exudate management, active wound care, and therapy devices. Active wound care segment is the most lucrative market, growing at a high CAGR. This is attributed to low toxicity and biocompatibility characteristics of the products and increase in prevalence of chronic diseases such as diabetes.

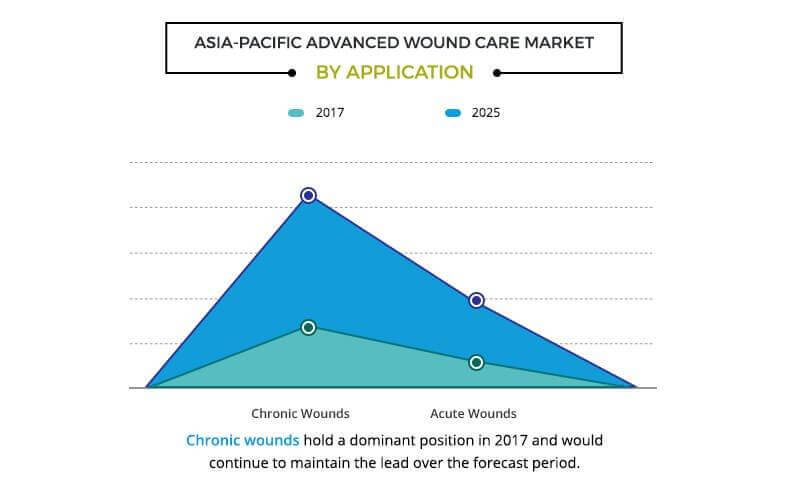

Application Segment Review

Based on application, the market is bifurcated into chronic wound care and acute wound care. Chronic wound care segment is the dominant segment in the Asia-Pacific AWC market in 2017 and is expected to maintain its dominance during the forecast period. This is attributed to rise in aging population, improvement in diagnosis of chronic wounds, and increase in awareness regarding the importance of using advanced wound care to treat chronic wounds

Asia-Pacific Advanced wound care Market: Key Countries

Country wise, the market is analyzed across Singapore, Malaysia, Japan, China, India, South Korea, Australia, and rest of Asia-Pacific. Japan accounted for the largest market share in the Asia-Pacific advanced wound care market in 2017 and is expected to maintain its dominance throughout the forecast period. However, China is expected to grow at the highest rate during the forecast period.

Companies have adopted product development and product launch as their key development strategies in the advanced wound care market. The key players of the advanced wound care market studied in this report are 3M Company, Smith & Nephew plc, Coloplast A/S, Medtronic plc, Acelity L.P. Inc., Cardinal Health, Inc., ConvaTec Group Plc, Essity Aktiebolag (BSN Medical GmbH), B. Braun Melsungen AG, and Mölnlycke Health Care AB.

Other prominent players in the value chain include Hollister Incorporated, Medline Industries, Inc., Johnson & Johnson, Baxter International, Triage Meditech, Integra Lifesciences, and Derma Sciences Inc.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis of the current market trends from 2014 to 2025 to identify the prevailing opportunities.

- The market forecast and opportunities have been provided from 2018 to 2025.

- Market estimations are based on a comprehensive analysis of the key developments in the industry.

- The Asia-Pacific market is comprehensively analyzed with respect to product and country.

- In-depth analysis based on country helps understand the regional market to assist in strategic business planning.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

Asia-Pacific Advanced Wound Care Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By END USER |

|

| By COUNTRY |

|

| Key Market Players | Cardinal Health, Inc., Medtronic Plc. (Covidien Ltd.), Acelity L.P. Inc., Coloplast A/S, Mlnlycke Health Care AB, ConvaTec Group Plc, Smith & Nephew Plc., Essity Aktiebolag (BSN Medical GmbH), B. Braun Melsungen AG, 3M Company |

Analyst Review

Advanced wound care products are mostly used in the treatment of chronic wounds that require significant amount of time to heal and require expensive treatment. Advanced wound care products are gradually replacing traditional wound care products, as advanced wound care products have better efficacy and efficiency at managing and treating chronic and acute wounds.

The advanced wound care market has fueled the interest of the healthcare industry, owing to its use in managing wounds by enabling rapid healing, few issues concerning drainage and, in certain cases, less risk of an infection.

Rapid increase in incidence of chronic diseases such as diabetes, changes in lifestyles, and attempts to reduce surgical costs by minimizing the duration of hospital stays are the major factors that drive the growth of the Asia-Pacific advanced wound care market. In addition, favorable reimbursement scenario, increase in healthcare expenditure by the government, and rise in inclination toward wound care products that enhance therapeutic outcomes are anticipated to boost the demand for advanced wound care in the near future, thereby propelling the market growth. However, stringent regulations towards advanced wound care, high cost of the treatment, and low reimbursement policy are projected to hamper the market growth.

Loading Table Of Content...