Asset-Based Lending Market Research, 2031

The global asset-based lending market size was valued at $561.5 billion in 2021, and is projected to reach $1,721.38 billion by 2031, growing at a CAGR of 12.2% from 2022 to 2031.

A loan that is backed by an asset is referred to as asset-based lending. In other words, in asset-based lending, a borrower's asset is used as collateral for the loan that the lender has approved. In asset-based lending, the borrower's assets serve as collateral for the loan. Accounts receivable, inventory, marketable securities, and property, plant, and equipment are a few examples of assets that can be used to secure a loan.

Asset-based lending is less risky than unsecured lending (a loan that is not secured by an asset or assets) since the loan is secured by an asset, and as a result, a lower interest rate is paid. In addition, the more liquid the asset, the less risky the loan is considered and the lower the interest rate demanded. Further, asset-based loans are easier and quicker to obtain than unsecured loans and lines of credit. Thus, these factors notably contribute towards the asset-based lending market growth.

However, higher interest rates than conventional bank loans have and the risk of losing the collateral if borrower default on the loan is the major factor hindering the growth of the asset-based lending market.

On the contrary, there is growing usage of advanced technologies in asset-based lending market is expected to boost the market in the coming years. Furthermore, the growing reliance on digital banking is expected to provide lucrative opportunities for the asset-based lending market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the asset-based lending market outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the asset-based lending market forecast.

Applications and Financial Solutions

The asset-based lending market is expected to witness significant growth in recent years, driven by the increase in the demand for secured business loans and collateralized lending solutions. Asset-based lending is a form of financing where a borrower secures a loan using assets such as inventory, accounts receivable, or real estate as collateral. This type of financing offers businesses a viable solution when traditional loans may not be an option, especially for those with limited credit histories or facing cash flow challenges.

In an asset-backed financing arrangement, the lender’s risk is mitigated by the value of the assets pledged as security. This presents a attractive choice for companies seeking to secure funds rapidly without requiring substantial creditworthiness. The adaptability and promptness of asset-based lending enables businesses to obtain working capital, support growth projects, or tackle short-term liquidity challenges.

The asset-based lending market has become particularly appealing for small and medium-sized enterprises (SMEs) that may find it difficult to secure conventional financing. With the backing of valuable assets, these businesses can tap into a broader range of financing options, unlocking capital that may otherwise be out of reach.

With the rising need for adaptable financing solutions, the asset-based lending market sector is projected to expand, offering advantages to both lenders and borrowers. The capability to use assets as collateral for financing allows companies to sustain consistent cash flow, efficiently manage their operations, and seize new opportunities, thereby fostering long-term financial success.

The asset-based lending market is segmented into Type, Interest Rate and End User.

Segment Review

The asset-based lending market is segmented based on type, interest rate, end user, and region. By type, it is categorized into inventory financing, receivables financing, equipment financing, and others. By interest rate, it is bifurcated into fixed rate and floating rate. Based on end user, it is segmented into large enterprises and small and medium-sized enterprises. By region, the asset-based lending market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

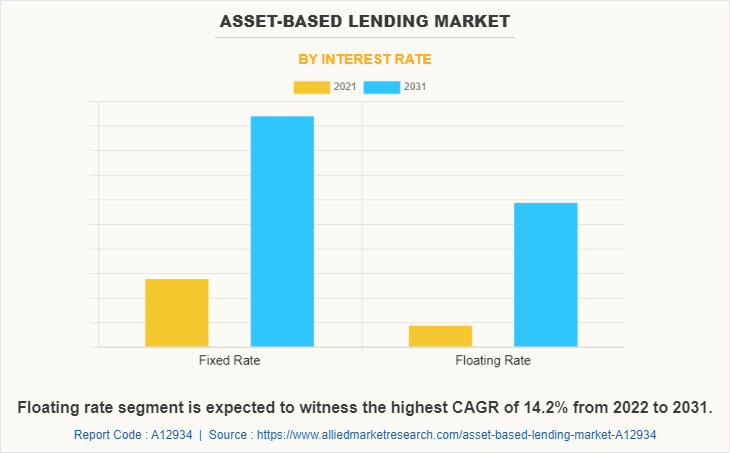

By interest rate, the fixed rate segment attained the highest asset-based lending market share in 2021. This is attributed to the fact that a fixed rate loan's principal benefit is that it shields the borrower against unexpected and possibly large increases in monthly payments in the event that interest rates rise. Furthermore, loans with fixed rates are simple to comprehend and don't differ much from lender to lender.

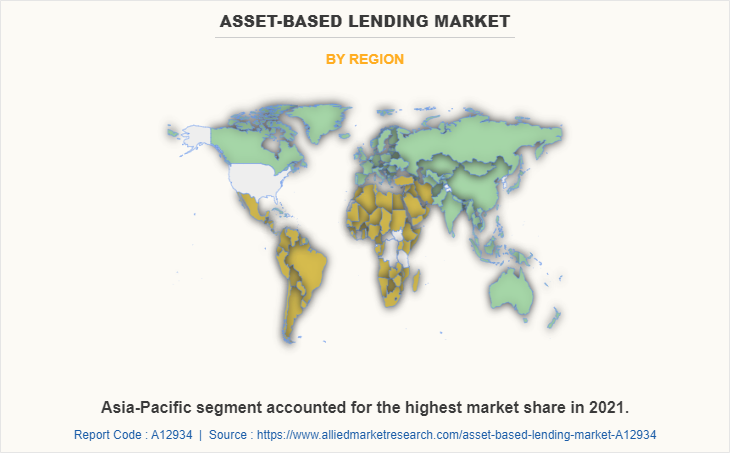

By region, Asia-Pacific attained the highest asset-based lending market size in 2021. This is attributed to the fact that the phenomenal growth of digital banking has led to declining usage of physical bank branches with an increasing threat of digital players capturing a substantial market share. Further, the growing of new age fintech companies have also now started venturing out from the traditional payments and transactions.

For instance, on September 13, 2024, Cleveland-Cliffs successfully amended its $4.75 billion asset-based lending (ABL) facility as part of the financing for its pending acquisition of Stelco Holdings Inc1. This amendment, which includes increased commitments from several major banks, reinforces Cleveland-Cliffs' strong financial position and supports its growth strategy in the United States and Canada.

Types Insights

Asset-based lending (ABL) in the asset-based lending industry, is a financial strategy that allows businesses to secure loans using their assets as collateral. The primary types of asset-based lending include inventory financing, receivables financing, equipment financing, and others.

Inventory Financing: This type of asset-based lending allows businesses to use their inventory as collateral for a loan, unlocking working capital. It's especially useful for retailers and wholesalers with seasonal sales fluctuations, helping them maintain operations during low-sales periods. The loan value is tied to the inventory's value, considering factors like condition and turnover rates.

Receivables Financing: In this form asset-based lending, allows businesses to use outstanding invoices as collateral for funding, improving cash flow by converting unpaid invoices into immediate capital. It's beneficial for companies with long payment cycles or rapid growth, helping maintain operations without waiting for customer payments. Loan amounts are often based on the creditworthiness of the customers who owe the receivables.

Equipment Financing: This type of asset-based lending uses business equipment or machinery as collateral for a loan, ideal for industries like construction, manufacturing, or transportation. It allows businesses to upgrade or purchase new machinery without large upfront capital. The equipment's value typically dictates the loan terms.

Others: In addition to the primary forms of ABL, there are other specialized forms, such as real estate-backed lending, intellectual property-based financing, and inventory-financed lines of credit. These options cater to businesses with unique asset structures or specific financial needs.

Competitive Analysis

The report analyzes the profiles of key players operating in the asset-based lending market such as Lloyds Bank, Barclays Bank PLC, Hilton-Baird, JPMorgan Chase & Co., Berkshire Bank, White Oak Financial, LLC, Wells Fargo, Porter Capital, Capital Funding Solutions Inc., and Crystal Financial. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the asset-based lending market.

Recent Product Launches in the Market

In February 2025, Kilo Fund Management announced the extension of its $50 million asset-backed senior secured revolving credit facility. This expanded facility supports the company's growth by providing tailored commodity finance solutions to industrial and wholesale users of metals, food, agricultural commodities, and energy inventories.

In January 2025, NN, Inc. launched its new asset-based lending (ABL) facility as part of its balance sheet optimization strategy. This facility provided the company with increased financial flexibility and supported its growth initiatives.

Recent Partnership in the Market

In February 2025, Encina Lender Finance (ELF) partnered with Cardo AI to revolutionize the asset-based finance market. This collaboration aimed to deliver faster, more efficient funding solutions for originators and greater capital deployment opportunities for institutional investors. By integrating advanced technology and expertise in structuring asset-backed credit facilities, they are setting new industry standards, making structured credit more accessible, data-driven, and efficient.

In March 2025, The Bank of Queensland partnered with Trade Ledger to upgrade its asset finance lending capabilities. This collaboration aimed to enhance the bank's digital lending platform, making it more efficient and accessible for customers seeking asset-based loans. This initiative aligns with the broader trends in the asset-based lending market, where technology is increasingly leveraged to streamline operations and improve customer experience

Market Landscape and Trends

The asset-based lending market is anticipated to witness several noteworthy trends in the market. The logical progression of the services offered by a receivables financier is asset-based lending, or ABL. The ABL provider will consider all of the client company's assets, including fixed assets like property, raw materials, stock, equipment and machinery, and other assets in addition to funding just the assets that are the most liquid, the debtors. The ABL lender will take into account the whole worth of the collection of assets and develop a financing package based on that value as of the moment (and going forward). This is expected to drive the asset-based lending market in the upcoming years.

For instance, on August 19, 2024, EverBank launched a new Asset-Backed Finance (ABF) division, following the merger of its Fund Finance and Specialty & Lender Finance businesses. This new division focused on structured lending solutions across various asset classes, including fund finance, middle-market private credit, consumer and commercial financial receivables, and structured real estate. The formation of the ABF division represents a significant milestone in EverBank's growth, aiming to provide comprehensive finance solutions to alternative asset managers and the private capital industry.

Further, it gives the ABL community the chance to reevaluate some of the conventional ways of executing ABL from the perspective of developing technologies. Process optimization is made possible by emerging technology. In general, this can improve user experience, save expenses, and increase compliance. Furthermore, all firms have the perspective that they need to use both current and emerging technology to better their operations. Therefore, these are the major market trends for the asset-based lending market, accelerating the asset-based lending market in the upcoming years.

The pandemic had a positive impact on asset-based lending market owing the increased demand for loans due to lockdowns. Some businesses had changed their revolving credit facilities from secured cash-flow-based to asset-based lines of credit as a result of the financial hardship brought on by the COVID-19 pandemic. These facilities were applicable to businesses in retail, wholesale (such as equipment-rental and food-and-beverage companies), and general distribution, where large quantities of inventory are more typical. Thus, the pandemic had a positive impact on asset-based lending industry.

Top Impacting Factors

Aids in Improving Liquidity

The asset-based lending market is anticipated to witness considerable growth during the forecast period. The most significant advantage that asset-based finance offers to a business is increased liquidity. Users can have stable finances and predictable cash flow if used properly. Companies that are expanding quickly, have constrained cash flow, or rely on seasonal income and can use this benefit to stabilize operations. Further, asset-based lending arrangements can be the best source of funding for many firms, especially non-investment grade corporations and organizations in transition that cannot normally be eligible for a cash flow loan.

Furthermore, the introduction of a new attractive product by key players in the market is further boosting the growth of the asset-based lending market in the upcoming years. For instance, in April 2022, UK-based mid-sized lender Metro Bank launched a new asset-based lending (ABL) product. The bank offered a credit of $ 2,444,500 (£2m) or more against a wide range of assets such as stock, plants, debtors, machinery, and commercial property. Thus, this factor is propelling the growth of the asset-based lending market.

Easier Qualification Criteria for Asset-based Lending

A bank loan or business line of credit are more difficult to get approved for than asset-based financing programs. The business needs to have a short track record of profitability and reasonable financial controls. In addition to that, the organization need to have assets that can be borrowed against. The accounts receivable are the asset that can be leveraged most easily. Because they can be quickly converted into cash, invoices from reputable commercial clients make excellent collateral. The majority of lenders favor funding invoices with a 70-day payment term. Equipment and inventory are additional collateral that the businesses may use to qualify for ABL program. Thus, the easier qualification criteria for asset-based lending is fueling the growth of the asset-based lending market.

Access to Large Sums of Money

Small business owners often do not have the financial capability to raise funding in the debt or equity markets. This can make starting a business extremely expensive and risky. However, with a asset-based lending, it is possible to cover all business startup expenses with availing mortgage loan. This also makes it significantly less intimidating for business owners without extensive resources to obtain a relatively large amount of funding. In addition, by consolidating all financing on one loan, asset-based lending helps to access large sum of money for small businesses. Therefore, this is a major driving factor for the asset-based lending market.

Opportunity

Growing Reliance on Digital Banking is Shaping Asset-Based Lending

The surge in the reliance on digital banking is transforming the asset-based lending market, presenting significant opportunities for both lenders and borrowers. One of the key benefits of digital banking in ABL is the automation of credit evaluations and approval workflows. Utilizing sophisticated algorithms and machine learning, lenders can assess assets more swiftly and precisely, greatly shortening the duration required for loan origination. Digital platforms also allow for real-time monitoring of collateral, which enhances risk management and provides greater transparency for both borrowers and lenders. Consequently, lenders can make more informed choices, while borrowers enjoy quicker and more convenient access to funds.

Moreover, digital banking has expanded the availability of asset-based lending, allowing small and medium-sized enterprises (SMEs) to engage in the asset-based lending market. In the past, asset-based lending was mainly utilized by larger firms with solid credit histories. However, digital platforms currently equip smaller businesses with the resources and information necessary to obtain loans, frequently without requiring comprehensive documentation or prolonged approval times. This opening up of access is promoting a more inclusive lending atmosphere.

Furthermore, the integration of digital banking with emerging technologies such as blockchain and artificial intelligence is further enhancing the security and efficiency of asset-based lending, ensuring faster, more secure transactions, reducing the risk of fraud and improving the overall borrower experience, supporting in the expansion of the asset-based lending market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the asset-based lending market analysis from 2022 to 2031 to identify the prevailing asset-based lending market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the asset-based lending market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global asset-based lending market trends, key players, market segments, application areas, and asset-based lending market growth strategies.

Asset-Based Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.7 trillion |

| Growth Rate | CAGR of 12.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Type |

|

| By Interest Rate |

|

| By End User |

|

| By Region |

|

| Key Market Players | Barclays Bank PLC, Berkshire Bank, Porter Capital, JPMorgan Chase & Co., Lloyds Bank, White Oak Financial, LLC, Hilton-Baird Group, SLR Credit Solutions, Capital Funding Solutions Inc., Wells Fargo |

Analyst Review

The market for asset-based lending is witnessing a rise owing to increased demand for automated underwritings, growth in internet of things (IoT) & cloud-based service use, and surge in acceptance of these technologies. In addition, asset-lending and mortgages have undergone a considerable transition similar to other sectors of banking, which is in many aspects reinventing and redefining this vital area for both current and future market participants. Furthermore, automated follow-up calls, automated loan granting, automated document management, and automated reporting are anticipated to boost the growth of the market in upcoming years.

The COVID-19 outbreak had a moderate impact on the asset-based lending market. Moreover, the pandemic led to a huge demand for digital lending services that are provided through channels that do not require any physical touch, including over the phone via the contact center, on mobile devices, or via desktop applications.

The asset-based lending market is fragmented with the presence of key players such as Lloyds Bank, Barclays Bank PLC, Hilton-Baird, JPMorgan Chase & Co., Berkshire Bank, White Oak Financial, LLC, Wells Fargo, Porter Capital, Capital Funding Solutions Inc., and Crystal Financial. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for asset-based lending across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The asset-based lending market is estimated to grow at a CAGR of 12.2% from 2022 to 2031.

The asset-based lending market is projected to reach $1,721.38 billion by 2031.

Aids in improving liquidity, Easier qualification criteria for asset-based lending and Access to large sums of money majorly contribute toward the growth of the market.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as Lloyds Bank, Barclays Bank PLC, Hilton-Baird, JPMorgan Chase & Co., Berkshire Bank, White Oak Financial, LLC, Wells Fargo, Porter Capital, Capital Funding Solutions Inc., and Crystal Financial.

The key growth strategies of asset-based lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...