Asset Finance Software Market Research, 2032

The global asset finance software market was valued at $3.8 billion in 2022, and is projected to reach $11.1 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

Asset finance software refers to specialized computer programs, designed to manage and streamline the process of financing and managing IT assets such as associated contracts, asset tracking, and invoice management. This software helps businesses and financial institutions track and monitor asset acquisition, depreciation, maintenance, and leasing. It can also assist with tasks such as generating financial reports, analyzing asset performance, and ensuring compliance with regulations. The software aims to optimize the utilization and financial management of assets throughout their lifecycle.

Increase in demand for streamlined financial operations drives the growth of the asset finance software market by enabling businesses to efficiently manage their assets, optimize resource allocation, and improve overall financial planning and reporting. Furthermore, the automation of asset management processes to help track and manage assets drives the market growth. In addition, the need for improved risk assessment and compliance measures contributes to the growth of the asset finance software market by prompting businesses to seek advanced solutions that can effectively manage and mitigate risks associated with lending and asset management.

However, the data privacy and security concerns and the high installation cost of the asset finance software hamper the market expansion. However, increase in adoption of technology in financial processes creates lucrative growth opportunities for the asset finance software market by enhancing efficiency, accuracy, and accessibility in managing asset-based transactions. Thus, this factor is expected to provide lucrative growth opportunities for the asset finance software market growth in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the asset finance software market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the asset finance software market outlook.

Segment Review

The asset finance software market is segmented into asset type, deployment mode, enterprise size, end user, and region. By asset type, the market is differentiated into hard assets and soft assets. Depending on deployment mode, it is fragmented into on-premise and cloud. By enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. By end user, the market is divided into banks, transportation, IT and related services, construction, healthcare, agriculture, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

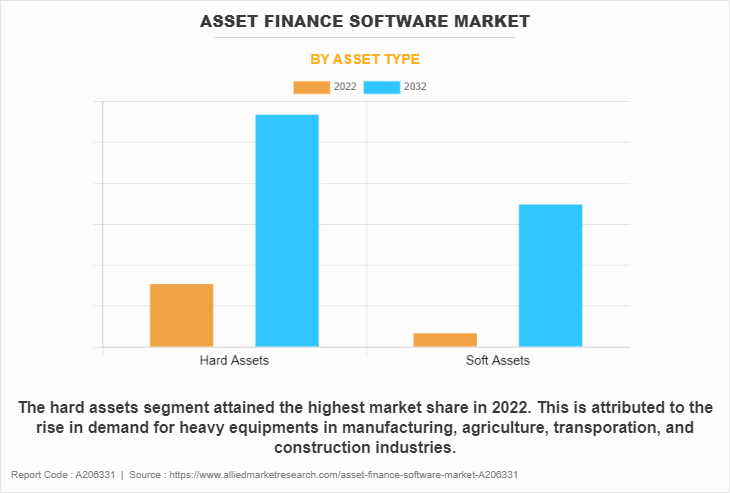

By asset type, the hard assets segment acquired a major asset finance software market share in 2022. The growth of the hard assets segment is attributed to increase in demand for efficient asset management and the growing adoption of asset finance solutions by businesses to optimize operations, better tracking and maintenance of physical assets, and the need for accurate valuation and risk assessment. However, the soft assets segment is expected to be the fastest-growing segment during the forecast period. Soft assets refer to software, licenses, and other intangible assets. Businesses are increasingly relying on technology and software to operate efficiently, which has led to rise in demand for financing these intangible assets.

Region-wise, North America dominated the market in 2022. North America has taken a major position in infrastructure development and technology adoption. The asset finance software market is being driven by the existence of significant IT corporations and growing digitization in the U.S. and Canada. Furthermore, increase in usage of connected, smart, and secure technologies for asset-centric applications is expected to boost the market growth. However, Asia-Pacific is expected to be the fastest-growing region during the forecast period. Asia-Pacific is emerging as one of the fastest-growing geographical marketplaces, with significant market growth potential. The increasing adoption and deployment of modern technologies, such as cloud-based solutions, drives the demand for subscription-based asset finance software.

The key players operating in the asset finance software market include Odessa, FIS, NETSOL Technologies, Alfa Financial Software Limited, Banqsoft, CGI Inc., Lendscape Limited, ieDigital, Oracle, and CHG-MERIDIAN. These players have adopted various strategies to increase their market penetration and strengthen their position in the asset finance software industry.

Market Landscape and Trends

The asset finance software providers in the market launched asset finance products such as loan asset management software and financial asset management software using leading-edge integration protocols to connect easily with other systems and enable lenders to update workflows and accelerate their digitalization plans regardless of existing infrastructure or data formats. For instance, in January 2022, HPD Lendscape, a global leader in secured finance technology, launched Lendscape Asset Finance, a new solution designed to help banks and lenders boost productivity by streamlining everyday administrative tasks. Lendscape's features include an intuitive UI, asset-level accounting, and the ability to manage all leases and loans on a single platform.

COVID-19 has accelerated the adoption of asset finance software, owing to shifted consumer behavior towards digital and contactless solutions. During the pandemic, many businesses shifted to remote work. This affected the need for asset finance software, as companies required digital tools to handle their operations from various locations. Furthermore, the pandemic accelerated digital transformation efforts across industries. Businesses realized the importance of automating and streamlining their operations. Asset finance software became crucial in this process, helping companies digitize their leasing and financing workflows. Thus, these factors accelerated the growth of asset finance software market size during the pandemic.

Top Impacting Factors

Increase in Demand for Streamlined Financial Operations

The increase in demand for streamlined financial operations drives the growth of the asset finance software market by enabling businesses to efficiently manage their assets, optimize resource allocation, and improve overall financial planning and reporting. This software helps automate processes such as asset tracking, lease management, and depreciation calculations, leading to better operational efficiency and cost savings. As organizations seek to enhance their financial management, the demand for asset finance software solutions has risen to meet these needs.

For instance, in October 2021, NETSOL Technologies, Inc., a global business services and enterprise application solutions provider, announced an expansion of its strategic partnership with leading IT and business consulting services firm, CGI in Europe. The two companies teamed up to offer NETSOL's premier, next-generation NFS Ascent platform to the global finance and leasing industry, supported by CGI's local business consulting, IT integration, and managed service solutions.

Need for Improved Risk Assessment and Compliance Measures

The need for improved risk assessment and compliance measures drives the growth of the asset finance software market by prompting businesses to seek advanced solutions that can effectively manage and mitigate risks associated with lending and asset management. These software tools offer features such as data analytics, predictive modeling, and automation, which help financial institutions make more informed decisions and ensure compliance with regulations, ultimately boosting efficiency and reducing potential losses. As regulatory requirements become more stringent, the demand for such software solutions continues to increase. Therefore, this factor drives the growth of the asset finance software market.

Adoption of Technology in Financial Processes

Increasing adoption of technology in financial processes creates lucrative growth opportunities for the asset finance software market by enhancing efficiency, accuracy, and accessibility in managing asset-based transactions. Automated workflows, real-time data analysis, and streamlined documentation improve decision-making, risk assessment, and customer experience. This technological shift attracts businesses seeking to optimize asset finance operations, thus driving demand for specialized software solutions to meet these evolving needs.

For instance, in December 2021, Alfa, a global provider of asset finance software and services, announced a successful project go-live with PEAC Finance. Completed in July 2021, the project delivered an Alfa Systems upgrade alongside the implementation of new business for the Barclays Asset Finance operation. The upgrade to Alfa Systems version 5.6 gave PEAC access to new features, including support for risk-free interest rate products and usage-based billing, alongside a comprehensive redesign of the UI to improve user experience and increase operational efficiency. Therefore, these factors are expected to provide lucrative growth opportunities for the asset finance software market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the asset finance software market analysis from 2022 to 2032 to identify the prevailing asset finance software market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the asset finance software market segmentation assists to determine the prevailing asset finance software market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as asset finance software market trends, key players, market segments, application areas, and market growth strategies.

Asset Finance Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.1 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 375 |

| By Asset Type |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | FIS, Lendscape Limited, Odessa, CHG-MERIDIAN, ieDigital, Banqsoft, Oracle Corporation, CGI Inc., Alfa Financial Software Limited, NetSol Technologies |

Analyst Review

Asset finance software offers a comprehensive range of functionalities beyond basic asset tracking. It facilitates preventive maintenance planning, work order management, resource allocation, inventory control, reporting, and analytics. Key players in the market have adopted various strategies such as business expansion, partnership, and product launch to improve their product portfolio and provide small and medium-sized enterprises (SMEs) customers with asset finance services online. For instance, in September 2020, Barclays Business Banking announced the first High Street bank to partner with Propel, a specialist asset finance provider, to offer equipment and vehicle finance via an online platform to one million of their small and medium-sized (SME) customers.

Furthermore, in August 2022, the British Business Bank announced a new ENABLE Funding facility to Propel, one of the UK’s largest and fastest-growing independent asset finance providers. The new facility allows Propel to provide around £165 million ($191.78 million) of finance to smaller businesses across the UK. In addition, in October 2022, CHG-MERIDIAN acquired OPC Asset Solutions, an asset lifecycle manager based in Mumbai. The acquisition was part of the CHG-MERIDIAN Group's strategy with its focus on growth, internationalization, and sustainability.

The COVID-19 outbreak has had a moderate impact on the asset finance software market. The pandemic accelerated digital transformation efforts across industries. Businesses realized the importance of automating and streamlining their operations. Asset finance software became crucial in this process, helping companies digitize their leasing and financing workflows. However, the economic uncertainty caused by the pandemic led to decreased business investments and a decline in asset purchases. This resulted in reduced demand for asset finance solutions. Companies became cautious about taking on new financial commitments, impacting the software providers' sales and revenue.

The key players in the asset finance software market include Odessa, FIS, NETSOL Technologies, Alfa Financial Software Limited, Banqsoft, CGI Inc., Lendscape Limited, ieDigital, Oracle, and CHG-MERIDIAN. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for asset finance software across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The asset finance software market is segmented into asset type, deployment mode, enterprise size, end user, and region. By asset type, the market is differentiated into hard assets and soft assets. Depending on deployment mode, it is fragmented into on-premise and cloud. By enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. By end user, the market is divided into banks, transportation, IT and related services, construction, healthcare, agriculture, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Asset Finance Software.

The asset finance software market is projected to reach $11.24 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

The key players operating in the asset finance software market include Odessa, FIS, NETSOL Technologies, Alfa Financial Software Limited, Banqsoft, CGI Inc., Lendscape Limited, ieDigital, Oracle, and CHG-MERIDIAN

Loading Table Of Content...

Loading Research Methodology...