Asset Performance Management Market Size & Insights:

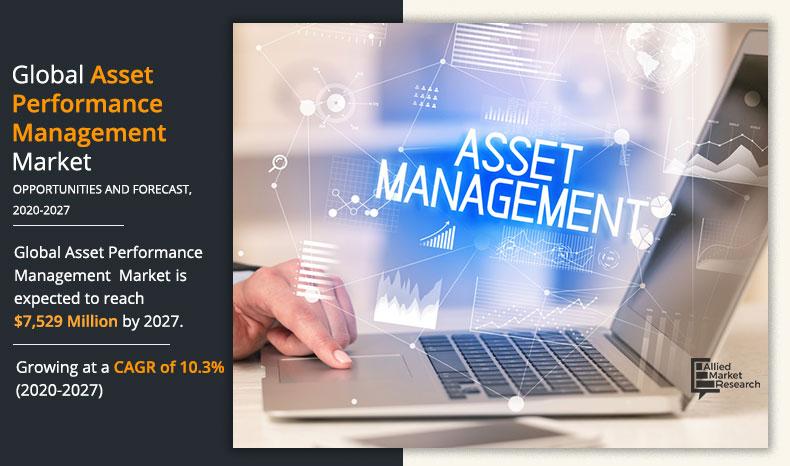

The global asset performance management market size was valued at USD 3,463 million in 2019, and is projected to reach at USD 7,529 million by 2027, growing at a CAGR of 10.3% from 2020 to 2027.

Asset performance management software helps in interpretation and analysis of all data of assets provided in both input and output format through which operator can continuously explore and investigate overall asset performance to gain decisive insights for asset utilization planning. By using the application of statistical methods and tools of older asset performance data, asset performance management software conducts predictive forecasting to derive decision-making insights and inputs. It helps organizations to optimize its availability and reliability of physical asset. And facilitates strategic & informed decision-making before the point of actual break down in asset, which may cause delay in production. In addition, it helps to enhance maintenance of asset, monitor the condition of the running assets and processes for real-time responses in decision-making regarding the replacement and maintenance. The results are mostly utilized by operational head, managers, security personnel, and key decision-makers of organizations to make accurate decision to reduce unplanned work and enhance asset life.

The solution segment dominated global asset performance management market share in 2019, and is expected to maintain this trend during the forecast period as most of the organizations have started adopting asset performance management software to manage the various problems related to the maintenance of assets and obtain real-time information regarding the failure of assets beforehand. However, the services segment is expected to witness the highest growth, owing to growing adoption of these services as it facilitates a complete view of decision making, business goals, rapid implementation of software, maximizes the value of existing installation by optimizing it, and minimize the deployment cost & risks.

The on-premise segment dominated global asset performance management market share in 2019, and is expected to maintain this trend during the forecast period owing to increased adoption of on-premise based asset performance management software is in government public sector unit and aerospace & defense industry where the policies regarding data security are critical. Also, on-premise based asset performance management solution allows organizations to have control over security & other connectivity issues and improves the scalability, speed, reliability, and connectivity of organizations. However, the cloud-based segment is expected to witness the highest growth, as it does not involve capital cost as well as requires low maintenance, and hence it is highly preferred by small and medium scale enterprises.

By Deployment Mode

Cloud is projected as one of the most lucrative segments.

North America dominates the asset performance management market, owing to High penetration of industrial internet of things (IIoT), growing use of Artificial Intelligence (AI) and other smart connected devices is one of the major factors that drives the growth of the market in North America. In addition, surge in demand for digital transformation across numerous end users and increase in convergence of different technologies, such as cloud computing and artificial intelligence (AI) have created a strong impact on the region and managed to increase its IT budget.

However, Asia-Pacific region is expected to observe highest growth rate during the asset performance management market forecast period, owing to increasing demand of asset performance management across Asia-Pacific due to the emergence of high end cutting edge manufacturing machinery, growing need of mass production and major shift toward digitization by SME’s impact positively on the growth of the market. In addition, the government & public sector unit along with defense sector companies in Asia-Pacific is actively investing in asset performance management solutions and services, which is expected to drive the asset performance management market growth.

The report focuses on the growth prospects, restraints, and asset performance management market analysis. The study provides Porter’s five forces analysis of the asset performance management industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the asset performance management market trends.

By Enterprise Size

SME's are projected as one of the most lucrative segments.

Segment Review:

Asset performance management market is segmented on the basis of component, deployment mode, enterprise size, industry vertical, and region. By component, it is classified into software and services. By deployment model, the market is categorized into the on-premise and cloud-based. By enterprise size, it is bifurcated into small & medium size enterprise and large size enterprises. By industry vertical, it is classified into energy and utilities, oil and gas, manufacturing, mining and metals, healthcare and life sciences, chemical and pharmaceuticals, government and defense, information technology and telecom, food and beverages, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Industry Vertical

Healthcare & Life Sciences industry is one of the most significant segments.

Top Impacting Factors:

The growth of the global asset performance management market is driven by factors such as increasing need to generate maximum economical return on the assets and growing need for the maintenance of assets on basis of risk, which are driving the asset performance management software market growth. Moreover, factor such as emerging use of cloud-based APM software among the end users, further boosts the growth of the APM market globally. However, lack of knowledge while selecting the solution that perfectly match with enterprise business and less awareness of cyber security restrain the growth of the asset performance management solution market globally. Furthermore, the emergence of technology such as industrial internet of things (IIoT) and increasing demand of big data analytics in the industrial vertical will create lucrative opportunity in the asset performance management software market globally.

Increasing need to generate maximum economical return on the assets

Organizations across the asset-intensive industries are constantly being challenged to deliver maximum return on assets (ROA) while working with data integrity challenges, minimal budgets, and lack of insight into the factors driving asset performance. Asset performance management solutions are helping organizations to save millions of dollars by streamlining their maintenance operations and enable organizations to better understand the health of their equipment and keep it running safely to meet production/manufacturing objectives.

Hence, it has become a popular option for enabling asset-intensive organizations to get the most value out of their expensive investments on equipment. For instance, according to the Schneider Electric’s press release in February 2018, it growing momentum was observed surrounding customer adoption of the company's Asset Performance Management (APM) solutions. This increasing growth in adoption of Asset Performance Management (APM) solutions was primarily driven by its investments in the cloud, advanced machine learning, and augmented reality (AR), along with the new partnership with MaxGrip, Schneider Electric’s solution has empowered its customers to maximize their return on capital investment and to improve profitability.

By Region

Asia-Pacific region is projected as one of the most significant segments.

Key Benefits for Stakeholders:

- This study includes the asset performance management market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and asset performance management market opportunity.

- The asset performance management market is quantitatively analyzed from 2019 to 2027 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the asset performance management market.

Asset Performance Management Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | INFOR INC., INTERNATIONAL BUSINESS MACHINES CORPORATION, SAP SE, ABB GROUP, ORACLE CORPORATION, GE DIGITAL, AVEVA INC., SAS INSTITUTE INC., BENTLEY SYSTEM, SIEMENS AG |

Analyst Review

In accordance with several interviews that were conducted of the top level CXOs, the adoption of asset performance management software has increased over time to boost the decision-making capability of organizations and improve their business insights. In addition, the ability of this software to provide different opportunities for businesses and gain new insights to run the business efficiently is increasing its popularity among end users. Furthermore, many healthcare, chemical, pharmaceutical and manufacturing industries are investing in asset performance management software to increase security and reduce maintenance related issues in organizations, which is impacting positively on the growth of the market.

Moreover, growing need for quick and timely decision-making and the ability of asset performance management software to provide immediate actions in response to situations arise in operation of assets drive its adoption among enterprises due to the competitive nature of businesses. Furthermore, continuous rise in technology and diversity of assets in enterprises generate the need for performance monitor software to derive meaningful insights, relationships, and patterns from unorganized assets. However, asset performance management software needs sufficient volume of meaningful data to efficiently operate, which can be obtained by effective monitoring of assets. This acts as a challenge for small organizations to implement asset monitoring system, considering the high costs involved, which is anticipated to hamper the growth of the market.

The CXOs further added that the market is expected to witness significant growth in the future, due to increase in use of industrial internet of things platforms and rise in adoption of artificial intelligence oriented business models among organizations. For instance, organizations such as Vale Fertilizant, SIG Combebloc, American Illinois and Oman Gas Company, are heavy users of asset performance management software to enhance customer relationships. The adoption of asset performance management software helps them to implement strategic decisions to bring positive transformation, which results in high-quality customer service. Moreover, rise in investments in artificial intelligence & tools among every industry vertical is boosting the revenue growth.

The presence of a significant number of providers in the global asset performance management software market increases the competitive rivalry among key players. Therefore, APM software providers are differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies such as artificial intelligence, machine learning, in-memory technologies, and multi-enterprise visibility into their offerings to gain a competitive edge and retain their market position. The market is concentrated with major players consuming 50–60% of the share. The degree of concentration will remain the same during the forecast period. The vendors operating in the market are taking several initiatives such as new product launches and product developments to stay competitive in the market and to strengthen their foothold in the market. In addition, companies are heavily investing in R&D activities to develop advanced asset performance management software, which is opportunistic for the market. For instance, in October 2020 Siemens energy and Bentley system collaborated to launch new asset performance management for oil and gas industry. This strategic move Enhances equipment uptime and reliability while reducing maintenance costs and safety risk.

Loading Table Of Content...