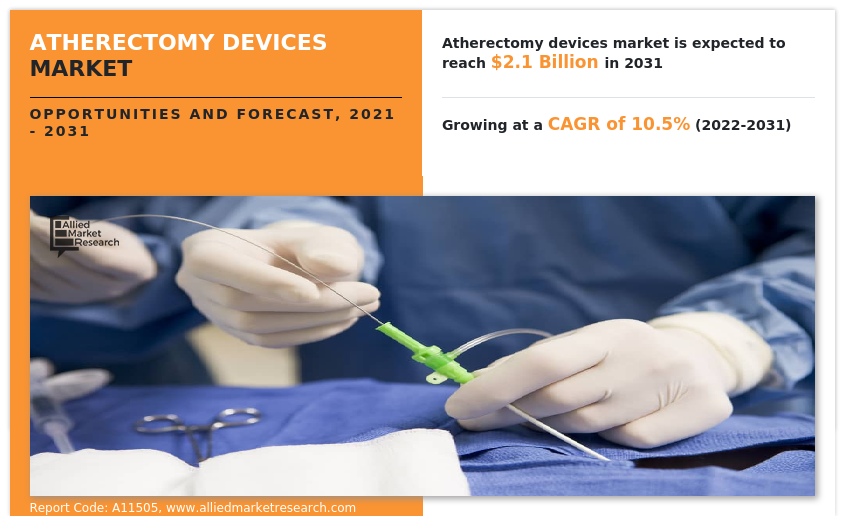

Atherectomy Devices Market Research, 2031

The global atherectomy devices market was valued at $787.1 million in 2021 and is projected to reach $2111.97 million by 2031, growing at a CAGR of 10.5% from 2022 to 2031. The atherectomy devices refers to the medical devices used to treat atherosclerosis by removing plaque from arteries. Atherosclerosis is a condition in which plaque builds up inside the arteries, causing them to narrow and reducing blood flow. Atherectomy devices use a variety of methods to remove plaque, including cutting, grinding, or vaporizing it.

Market Dynamics

The growth of the Atherectomy Devices Market Size is driven by several factors that are contributing to its growth and development. One of the key drivers is the rising prevalence of cardiovascular diseases such as coronary artery disease and peripheral artery disease. Coronary artery disease (CAD) and peripheral artery disease (PAD) are both conditions that involve the buildup of plaque within arteries, which can narrow and harden the blood vessels, leading to reduced blood flow and potentially serious health complications. Atherectomy devices are minimally invasive medical devices that are used to remove plaque buildup from the walls of arteries. According to 2020 report by Centers for disease control and prevention, about 697,000 people in the U.S. died from heart disease in 2020. Center for disease control and prevention is a health agency of the U.S. It keeps track of health trends, tries to find the cause of health problems and outbreaks of disease, and responds to new public health threats. Thus growing prevalence of CAD in PAD patients is expected to drive the demand for atherectomy devices in the coming years.

Furthermore, the growth in geriatric population is expected to contribute in growth of Atherectomy Devices Industry. The geriatric population, which is the group of people aged 65 years and above, is growing at a rapid pace around the world. As this population continues to increases, age-related diseases, including peripheral artery disease (PAD) will also increase.

In addition, use of atherectomy devices in minimally invasive procedures is expected to increase the Atherectomy Devices Market Growth. Traditionally, treatment of plaque buildup has been invasive and involved open surgery, which can be risky and require a long recovery time. However, with the development of atherectomy devices, physicians can perform less invasive procedures that allow for quicker recovery times and lower risk of complications. Patients prefer minimally invasive procedures because it offer faster recovery times and fewer complications. However, Limited availability of skilled healthcare professionals is key factor anticipated to hamper the Atherectomy Devices Industry growth.

The atherectomy devices market is segmented into Product and End User.

Segmental Overview

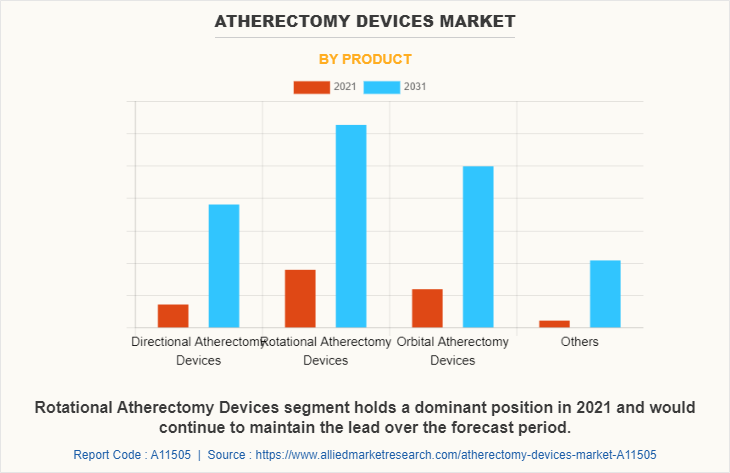

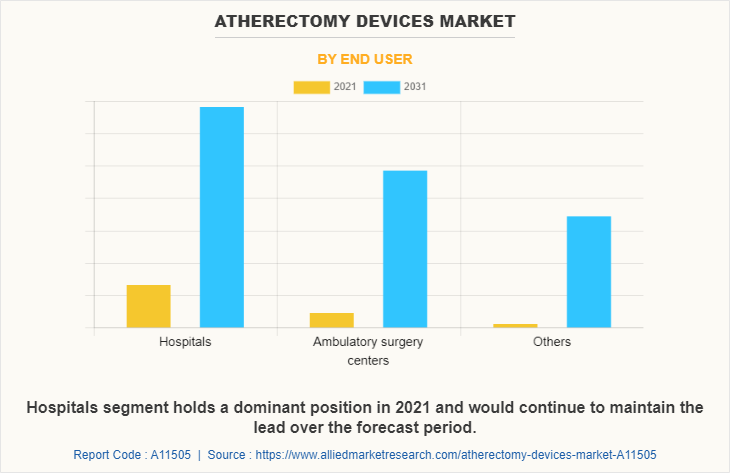

The atherectomy devices market is segmented on the basis of product type, end user, and region. On the basis of type, the atherectomy devices market is classified into directional atherectomy devices, rotational atherectomy devices, orbital atherectomy devices, and others. By end user, it is fragmented into hospitals, ambulatory surgical centers, and others. Region wise, the Atherectomy Devices Market Size is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product Type:

On the basis of product type, the atherectomy devices market is classified into directional atherectomy devices, rotational atherectomy devices, orbital atherectomy devices, and others. The rotational atherectomy devices segment accounted for the largest Atherectomy Devices Market Share in 2021 owing to its high efficiency in removing plaque from the arterial walls due to its rotating burr. However, orbital atherectomy devices is projected to register highest CAGR during the forecasted period owing to use of small, diamond-coated, orbital sanding disc that rotates and gently sands away the plaque buildup.

By End User:

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, and others. Hospitals occupied Atherectomy Devices Market Share in 2021 owing to preference of large number of patients. However, ambulatory surgery centers is projected to register highest CAGR during the Atherectomy Devices Market Forecast period owing to affordable cost at ambulatory surgery centers.

By Region:

Region wise, North America is expected to witness highest growth, in terms of revenue, owing to increase in adoption of atherectomy devices by patients, rise in awareness about the peripheral artery disease, and surge in healthcare infrastructure drive the growth of the Atherectomy Devices Market. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. In addition, major players operating in North America include Boston Scientific Corporation, Cardiovascular Systems, Inc, Becton, Dickinson and Company, and Angio Dynamics Inc.

However, Asia-Pacific is anticipated to witness notable growth, owing to factors such as increase in per capita spending, growth in medical tourism, and rise in disposable incomes. In addition, the region has a large population, and a significant portion of this population is aging. As people age, they are at an increased risk of developing cardiovascular disease, which may require treatment with atherectomy devices.

Competition Analysis

Competitive analysis and profiles of the major key players that operate in the AI in genomics market are Medtronic plc, Koninklijke Philips N.V., Boston Scientific Corporation, Cardiovascular Systems, Inc., Becton, Dickinson and Company, AngioDynamics Inc., Rex medical, Nipro Corporation, Invamed medical, and Avinger Inc. Major players have adopted product launch, product approval, acquisition, agreement an branding as key developmental strategies to improve the product portfolio of the invisible orthodontics market.

Some Examples of Product Approval in The Market

- In January 2019, Cardiovascular Systems, Inc. announced that Japan’s Ministry of Health, Labor and Welfare (MHLW) has approved the Diamondback 360 Coronary Orbital Atherectomy System (OAS) with Classic Crown (Classic Crown) and ViperWire Advance Coronary Guidewire FlexTip (FlexTip.

- In September 2019, Cardiovascular Systems, Inc. announced U.S. Food and Drug Administration (FDA) PMA approval of the new ViperWire Advance Coronary Guide Wire with Flex Tip (ViperWire Advance with Flex Tip).

- In January 2021, Cardiovascular Systems, Inc. announced that it has received CE Mark for its Diamondback 360 Coronary Orbital Atherectomy System (OAS) and ViperWire Advance Coronary Guide Wire with Flex Tip (ViperWire Advance with Flex Tip).

- In October 2021, BD (Becton, Dickinson and Company), announced that it has received 510(k) clearance for expanded indications from the U.S. Food and Drug Administration (FDA) for the Rotarex Atherectomy System..

- In August 2022, AngioDynamics, Inc. announced that it has received 510(k) clearance of an expanded indication for the Auryon Atherectomy System to include arterial thrombectomy.

- In September 2021, Deep Genomics announced the start of a collaboration with Mila, the Quebec Artificial Intelligence Institute. This collaboration will allow the company to join Mila's community and to take advantage of the recruitment activities offered by the research institute.

Some Examples of Product Launch In The Atherectomy Devices Market

- In October 2022, Cardiovascular Systems, Inc. announced the full market release of the 2.00 Max Crown for Peripheral Orbital Atherectomy Systems (2.00 Max Crown).

- In January 2020, AngioDynamics, Inc. announced the launch of the PATHFINDER I: Post-Market Registry (PATHFINDER I-Registry, EX-PAD-05), a pilot study to evaluate the safety and efficacy of the Company’s AURYON Atherectomy System in the treatment of de novo, re-stenotic, and in-stent restenosis (ISR) lesions in infrainguinal arteries of patients with Peripheral Artery Diseases (PAD).

- In September 2020, AngioDynamics, Inc. announced the launch of the Auryon Atherectomy System, a newly-developed innovative technology for the treatment of Peripheral Artery Disease (PAD),including Critical Limb Ischemia (CLI) and In-Stent Restenosis (ISR)

Some Examples of Acquisition In The Atherectomy Devices Market

- In June 2020, BD (Becton, Dickinson and Company), announced that it has completed the acquisition of Straub Medical AG, a privately-held company that develops and sells medical atherectomy and thrombectomy devices that treat peripheral arterial disease (PAD) and venous disease. BD welcomes more than 80 new associates who add valuable experience and expertise as well as key technologies

Some Examples of Agreement in The Atherectomy Devices Market Size

- In February 2023, Abbott and Cardiovascular Systems, Inc. (CSI), announced a definitive agreement for Abbott to acquire CSI, a medical device company with an innovative atherectomy system used in treating peripheral and coronary artery disease. Under terms of the agreement, CSI stockholders will receive $20 per common share at a total expected equity value of approximately $890 million.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the atherectomy devices market analysis from 2021 to 2031 to identify the prevailing Atherectomy Devices Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the atherectomy devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global atherectomy devices market trends, key players, market segments, application areas, and market growth strategies.

Atherectomy Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.1 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cardiovascular Systems, Inc., Invamed medical, Avinger Inc., AngioDynamics Inc., Koninklijke Philips N.V., Nipro Corporation, Becton, Dickinson and Company, Boston Scientific Corporation, Medtronic plc, Rex medical |

Analyst Review

This section provides various opinions of top-level CXOs in the global atherectomy devices market. According to the insights of CXOs, increase in demand for atherectomy devices and rise in investments for atherectomy devices globally are expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives and higher spending for atherectomy devices have piqued the interest of several companies to develop atherectomy devices.

CXOs further added that increase in adoption of atherectomy devices for treatment of atherosclerosis and rise in prevalence of cardiovascular diseases & Peripheral Arterial Disease (PAD) are expected to boost the growth of the market. In addition, increase in demand for minimally invasive procedures across the globe has surged its demand, thus driving the growth of the market.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in adoption of atherectomy devices by physicians, rise in number of PAD, and developments in healthcare infrastructure. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of atherectomy devices and surge in number of key players manufacturing atherectomy devices.

The key trends in the Atherectomy Devices Market are the increasing prevalence of peripheral artery disease (PAD), the rising adoption of minimally invasive surgery, and a surge in technological advancement in Atherectomy Devices.

Yes, the competitive landscape included in the Atherectomy Devices market report.

North America is the largest regional market for Atherectomy Devices.

The base year for the report is 2021.

The top companies that hold the market share in Medtronic plc, Koninklijke Philips N.V., Boston Scientific Corporation, Cardiovascular Systems, Inc., and Becton, Dickinson and Company.

There are 10 Atherectomy Devices manufacturing companies are profiled in the report

The forecast period in the report is from 2022 to 2031

The total market value of the Atherectomy Devices Market is $787.12 million in 2021.

Loading Table Of Content...

Loading Research Methodology...