Athleisure Market Summary, 2032

The global athleisure market size was valued at $2 billion in 2022, and is projected to reach $3.2 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. The athleisure market, a branch of the fashion and apparel industry, includes clothing designed for both athletic activity and relaxed, everyday use. Over the past 10 years, the term "athleisure," which combines the terms "athletic" and "leisure," has gained popularity as a consequence of a rising focus on health and wellness, changing lifestyle preferences, and the fusion of exercise and fashion. Customers who are fashion-conscious, active, fitness lovers, and those searching for comfortable, utilitarian clothing for everyday activities have all found a place in the athleisure sector. The trend, which has changed not just the garment industry, has made it harder to distinguish between traditional sporting wear and casual attire.

Fitness enthusiasts show a high propensity to pay premium prices for fitness-related products, which are necessary to achieve their fitness goals. Fitness has become one of the major parts of the daily routine of a substantial number of consumers. An increase in participation in sports and fitness activities has led to a more comprehensive approach of customers toward fitness and sports-related products.

On the other hand, the female apparel segment is highly fragmented. Fashionable athleisure products has witnessed surge in demand, due increase in the adoption for apparel from female consumers. In addition, a shift in female physical activity participation is one of the major factors that boost the demand for athleisure products. An increase in the number of female fitness models, sports players, and athletes developed a holistic approach of female consumers toward sports and fitness.

Moreover, the ongoing trend of healthy aging has witnessed increased popularity among the geriatric population. The requirement for performance-boosting fitness products is expected to increase among the geriatric population, owing to an increase in health & fitness associated with aging. This factor increases the demand for athleisure among elderly consumers, owing to performance-boosting features of active wear such as enhanced grip, wicking, and back support. Thus, an increase in the participation of customers triggers the athleisure market demand.

Athleisure is the trend of wearing cloths specifically designed for athletic workout which is now applicable for gym goers as well as casual wear. Athleisure wear has become increasingly acceptable to be worn in various social environment even at workplaces. Most of consumers find active wear comfortable and flexible which is attributable to the kind of material used to design such apparels or footwear.

Synthetic fabrics such as polyester and nylon are the most commonly used materials in such athleisure apparels, which altogether tend to provide the best combination of the required properties. As per the CBI report, the global sports and fitness clothing market is expected to be valued at US$231 billion by 2024. Though performance sportswear accounts to higher value athleisure market share, athleisure segment is expected to grow at significant rate in terms of value sales.

The rise in trend of health and wellness is one of the key influential factors that has been driving the value sales athleisure market growth. Consumers around the globe have been taking their fitness activity into serious consideration by indulging themselves in various sports and fitness activities. Thus, fitness industry is highly being promoted among these target segments. On the other hand, different fitness influencers have been promoting active wear that has caught the attention of target customers. This has bought an athleisure cult, with active wear being worn on runways, social gathering as well as gyms.

Segment Overview

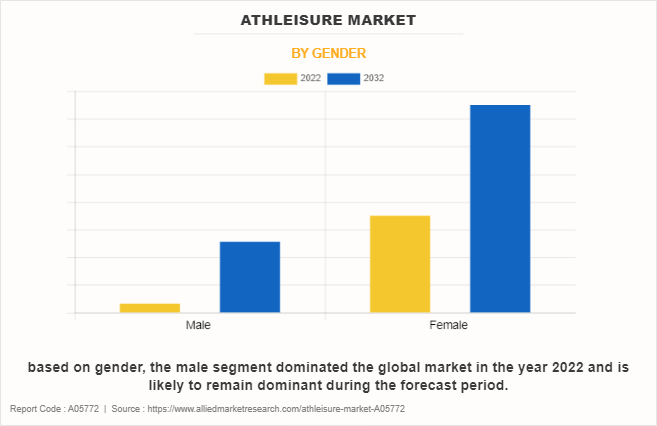

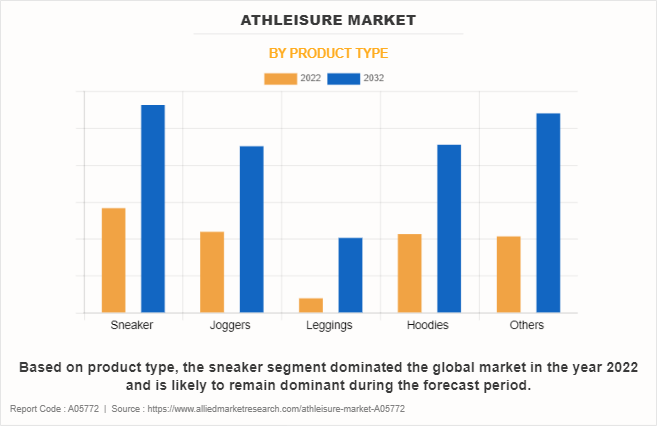

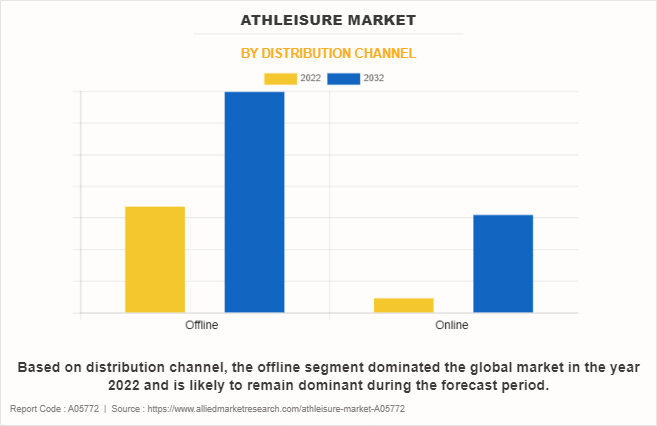

The athleisure market is divided by gender, product type, distribution channel, and region. By gender, the market is divided into male and female. By product type, the market is divided into sneaker, joggers, leggings, hoodies, and others. According to the distribution channel, the market is divided into offline and online.

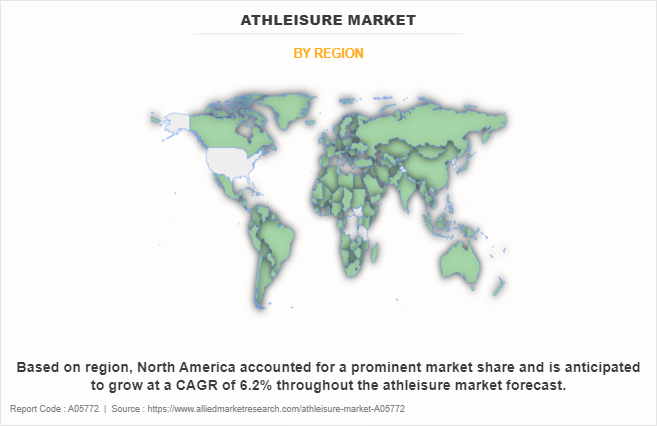

By region, the market is divided into North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, United Arab Emirates, South Africa, and the Rest of LAMEA).

By Gender

Since its introduction, athleisure articles of clothing has been a tremendously successful trend. These apparel choices are now considered acceptable for an extensive range of occasions. Men are inclined to dress in clothes that are both aesthetically pleasing and comfortable for them. Such needs are met by the characteristics and product options of athletic wear.

Some athleisure clothing items, such bomber jackets, casual pants, crew-neck sweaters, polo shirts, and others, have gained more popularity in recent years among men. Thus, the distinct combination of both fashion and functionality seen in athleisure is one of the major elements influencing male consumers' desire for the product.

Female population is very conscious about the overall looks and appearance when it comes to wearing any kind of apparels. In a social setting, women always embrace their active and healthy lifestyle. They look for clothing and footwear that are both comfortable and stylish as a consequence. Most of the producers in the global athleisure market have been working to develop items that meet the needs of the female population in light of this trend.

For instance, Puma, one of the major competitors in the global athleisure industry, has been offering a range of hoodies created exclusively for ladies. These hoodies are made of soft cotton material and are cleverly designed with contemporary colors. As a result, the strategic decision made by manufacturers to develop athleisure items specifically for women fuels female consumers' interest in the athleisure sector.

By Product Type

Sneakers segment domianted the global athleisure market in the year 2022 and is likely to remain diminant during the athleisure market forecast period. Canvas sneakerswith soles made of rubber are suited for a variety of outdoor activities. Sneakers have recently become recognized as casual shoes that are utilized by the target market due to the growing trend and demand for athleisure items.

Customers, and millennials in particular, have been quite picky about the footwear they have recently been wearing. They like attractive, longer-lasting performance footwear over other types. As a result, the increased need for performance footwear prompts the target market to seek a variety of sneakers. The initial purpose of joggers was to be used for jogging. They are comfy and light. They have a tapered leg and an athletic look.

Most joggers feature an elasticized waistband with a drawstring or elastic at the ankles, making them considerably more trendy. Joggers have risen in popularity among the target audience as a result of the athleisure and sports luxe fashion trends. Males in particular have had joggers made just for them.

Manufacturers have been expanding their product offerings in the sector that has been meeting the needs of the customers as joggers have become more popular in daily life. Skin-tight clothing such as leggings can help hide the waist and legs. They are footless, substantially thicker, and occasionally worn as pants. The materials used to create and design leggings include spandex, Lycra, nylon, cotton, and polyester. Although both men's and women's versions of these types of clothing are available, the female market favors them more.

Leggings come in a variety of styles on the market. These include lounge leggings, higher waists, metallic, neon, and perforated leggings, among others, that are 7/8 in length. Right now, 7/8-length leggings are becoming more and more popular with the target market.

A hooded sweatshirt or jacket falls under the category of hoodies in athleisure. Before athleisure clothing entered the scene, hoodies had already begun to acquire popularity. Since there are many different types of hoodies on the market, including baja hoodies, zip-up hoodies, fur hoodies, over-the-head hoodies, polo hoodies, skull hoodies, slim-fit hoodies, and others, target buyers nowadays take a holistic approach when purchasing hoodies for themselves. Hoodie demand has increased, thus producers are planning to improve their current goods by including new features.

One of the major participants in the global athleisure industry, Nike, has developed a hoodie that has Dri-fit technology. The others area of the global athleisure market is taking into consideration some of the most important clothing items, including layering tanks, sports bras, moisture-wicking socks, and others. Since they are active and engage in a variety of physical activities including sports, yoga, the gym, running, and others, baby boomers and millennials have been embracing these types of clothing more and more. As a result, they want to live a fit and healthy lifestyle in a group setting. The sports bra is the product type with the highest degree of demand.

By Distribution Channel

The offline store section is taking into consideration some of the most important brick and mortar establishments, such as hypermarket/supermarkets, specialty shops, and franchisee stores. These shops provide a wide range of possibilities in clothing and shoes, supporting both the branded and private-label markets. Customers always like to sample athletic wear before making a purchase, and offline businesses provide such needs.

Additionally, these offline shop types launch a number of significant promotional and marketing initiatives, including customer loyalty programs, discounts, seasonal specials, and others. The prevalence of the internet has significantly increased during the past ten years, particularly in North America, Europe, and Asia-Pacific. Nowadays, consumers rely on the internet to learn new things, and they find online buying to be the most convenient. As a result, the majority of significant manufacturers have gone online and developed their own web stores.

By Region

Customers in North America are more active and participate in a greater variety of sports and fitness activities, which has increased demand for sportswear that is versatile enough to be used outside of the gym and in daily life. Fashion and function are being used in athletic wear designs to advance them. Along with workout enthusiasts, this has attracted clients who are fashion-conscious and interested in clothing that is both attractive and functional.

Influential individuals, well-known individuals, and social media influencers have all made substantial contributions to the marketing of athleisure as a stylish and alluring trend. Parks, exercise facilities, and recreational amenities have expanded as a result of rising urbanization in European towns. Urban living has increased the popularity of activewear for both daily wear and exercise.

Consumers in Europe are known for having growing worries about the sustainability and ethical standards of fashion. As a result, athletic wear companies with a focus on ethical production methods and eco-friendly materials have grown in popularity. Europe is home to some of the most well-known fashion capitals in the world, including Paris, Milan, and London. Thanks to the influence of these trendy towns and their residents, athleisure has gained widespread acceptance as a fashion trend.

The rising emphasis on health and fitness in the Asia-Pacific area has raised demand for athletic and athleisure apparel. As people embrace active lifestyles and become more conscious of their health, the popularity of athleisure clothes is increasing. As urbanization in the Asia-Pacific region continues to rise, more people are living in large cities with busy schedules. Athletic clothing's comfort and versatility match well with the demands of urban living. The growth of the middle class in various Asia-Pacific countries has made more money available.

Customers are keen to spend money on stylish and warm athleisure apparel as a result. In many LAMEA countries, urbanization has resulted in a change in lifestyle as more people look for comfortable, practical athleisure wear. As numerous LAMEA countries' economies continue to rise, the middle class and disposable income have expanded.

Customers can now afford to purchase athletic and athleisure thanks to their increasing purchasing power. The varying weather in LAMEA may have an effect on the demand for specific types of athleisure wear. Lightweight, breathable fabrics may be preferred in hot, humid conditions, whereas warmer, more insulating textiles may be preferred in cooler temperatures.

Some of the major players analyzed in this report are Adidas AG, ASICS Corporation, Columbia Sportswear Company, PVH Corp., Puma SE, VF Corporation, The Gap, Inc., Nike, Inc., Under Armour, Inc., and Lululemon Athletica Inc.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the athleisure market analysis from 2022 to 2032 to identify the prevailing athleisure market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the athleisure market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global athleisure market trends, key players, market segments, application areas, and market growth strategies.

Athleisure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.2 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Gender |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | VF Corporation, PVH Corp., Under Armour, Inc., ASICS Corporation, Columbia Sportswear Company, Puma SE, The Gap, Inc., lululemon athletica inc, Adidas AG, Nike, Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the rise in health and wellness trend around the globe, is one of the key factors in driving the demand for global athleisure market.

With the rise in demand for various athleisure products incurring from the target segments, companies have been initiating several key mergers and acquisition in the view of generating revenue from the athleisure segment. For instance, in 2018, JD Sports announced the acquisition of US retailer Finish Line for US$558 million. Finish Line is one the largest retailers of premium multi-branded athletic footwear, apparel, and accessories in the U.S. Apart from merger and acquisition, companies have been also strategizing on expanding the operations to cater to the surging demand for athleisure products. For instance, High-end athleisure company Hylete has agreed to acquire rival Graced by grit in an all-stock transaction.

The rise in rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs as online platforms are one of the easiest ways to create awareness about the specifications and features of the athleisure products among the target customers.

The global athleisure market size was valued at $2 billion in 2022, and is projected to reach $3.2 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

The global athleisure market to grow at a CAGR of 5.2% from 2023 to 2032.

Some of the major players analyzed in this report are Adidas AG, ASICS Corporation, Columbia Sportswear Company, PVH Corp., Puma SE, VF Corporation, The Gap, Inc., Nike, Inc., Under Armour, Inc., and Lululemon Athletica Inc.

According to region, North America held the largest share of the market in terms of revenue in 2022.

The rise in trend of health and wellness is one of the key influential factors that has been driving the value sales athleisure market growth.

Loading Table Of Content...

Loading Research Methodology...