ATM Security Market Research, 2032

The global ATM security market was valued at $13.7 billion in 2022, and is projected to reach $32.4 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

ATM (Automated Teller Machine) security refers to the measures and protocols in place to safeguard ATMs and their financial transactions from various threats and risks, including theft, fraud, and unauthorized access. Further, ATMs use various methods to authenticate the identity of the cardholder, such as PINs (Personal Identification Numbers), biometric authentication, and chip-based card technology. These methods help ensure that only authorized users can access their accounts. Furthermore, ATMs are equipped with sensors to detect any attempts at tampering or unauthorized access. These sensors can trigger alarms or shut down the machine if tampering is detected.

The rise in ATM-related fraud, including card skimming, cash trapping, and malware attacks, is driving the ATM security market growth. In addition, increasing regulatory compliances for the ATM deployment is benefiting the growth of ATM security market. Further, the demand for automated teller machine (ATM) security and safety devices is further anticipated to propel the growth of ATM security market.

However, high deployment costs and legacy systems are limiting the expansion of ATM security market. On the contrary, opportunity to access unexplored markets and the availability of industry professionals are expected to create lucrative opportunities for the ATM security market in upcoming years. Moreover, ATM security providers are exploring the use of advanced technologies to enhance the security, transparency, and efficiency of ATM transactions. This is expected to fuel the growth of ATM security market in upcoming years.

The report focuses on growth prospects, restraints, and trends of the ATM security market forecast. The study provides Porter‐™s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the ATM security market outlook.

The ATM security market is segmented into Offering, ATM Type, Application and End User.

Segment Review

The ATM security market is segmented into offering, ATM type, application, end user and region. On the basis of offering, it is categorized into software and service. By ATM type, the market is segmented into onsite ATM and offsite ATM. Based on application, the market is divided into fraud detection, security management, anti-skimming, and others. On the basis of end user, it is classified into banks and financial institutions and independent ATM operators. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

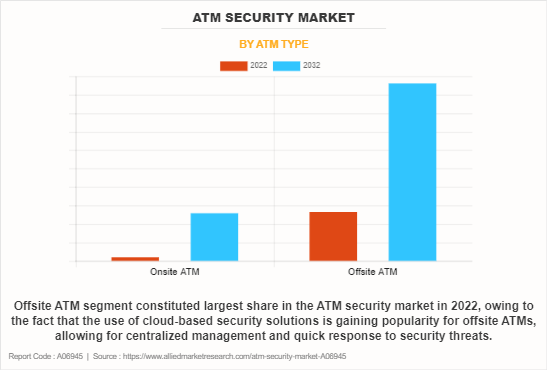

By ATM type, the offsite ATM segment acquired a major size of ATM security market in 2022. The is attributed to the fact that offsite ATMs are increasingly supporting contactless payment methods such as NFC (Near Field Communication) and mobile wallets, providing users with more secure and convenient options for transactions.

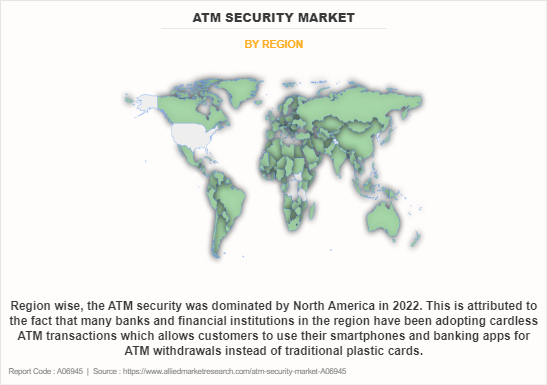

By region, the North America dominated the ATM security market in 2022. This is attributed to the fact that many banks and financial institutions in the region have been adopting cardless ATM transactions which allows customers to use their smartphones and banking apps for ATM withdrawals instead of traditional plastic cards. Furthermore, in both the U.S. and Canada, ATM security also involves physical measures like tamper-evident components, alarm systems, and surveillance cameras to deter vandalism and skimming devices.

The key players operating in the global ATM security market include Fujitsu Ltd., NCR Corporation, Euronet USA, LLC, Hitachi, Ltd., Diebold Nixdorf, Incorporated, GRGBanking, Oki Electric Industry Co., Ltd., Hyosung TNS Inc., Triton, and LD Systems. These players have adopted various strategies to increase their market penetration and strengthen their position in the ATM security market.

Market Trends and Landscape

Increase in product launches to enhance ATM security and adoption of the advanced technologies are some of the trends flourishing the growth of ATM security market. For instance, in September 2023, Hitachi Payment Services, a subsidiary of Japan-based Hitachi Ltd., announced the launch of India's first-ever UPI-ATM as a White Label ATM (WLA) named Hitachi Money Spot UPI ATM, with the National Payments Corporation of India (NPCI). The ATM offered cardless cash withdrawals, eliminating the need for physical cards. This UPI-ATM allowed users to withdraw cash from multiple accounts using the united payments interface (UPI) app.

Furthermore, increasing partnerships in the market by key players is expected to boost the growth of ATM security market during the forecast period. For instance, in July 2023, Diebold Nixdorf, a world leader in automating, digitizing and transforming the banking and retail industry, announced that Red Link, the operator of the largest ATM network in Argentina, has migrated 90% of its network to DN Series. The transition to DN Series has allowed Red Link and its more than 40 partner banks to improve the consumer experience with additional functionalities, such as fingerprint and facial recognition, and increase efficiencies by remotely optimizing and automating processes.

The ATM security market has undergone significant changes due to the far-reaching effects of the COVID-19 pandemic. One primary consequence was the accelerated adoption of contactless payment methods, diminishing the reliance on both cash transactions and ATMs. This shift in consumer behavior prompted financial institutions to reevaluate their ATM networks and place greater emphasis on improving security measures to protect the remaining cash-dispensing points. Further, the pandemic brought to light vulnerabilities within the ATM infrastructure, resulting in an increased focus on enhancing security features to counter emerging threats such as card skimming and cyberattacks. Financial institutions responded by investing in advanced technologies such as biometric authentication, sophisticated anti-skimming solutions, and upgraded encryption protocols to ensure the security of customer transactions. Furthermore, the necessity for remote monitoring and management of ATMs became more pronounced during lockdowns and social distancing measures, intensifying the demand for robust security systems. Thus, these factors overall had a moderate impact on ATM security market.

Recent Partnerships in ATM Security Market

In July 2023, Red Link partnered with Diebold Nixdorf, to Migrate the Entire ATM Network to DN Series. The transition to the DN Series has allowed Red Link and its more than 40 partner banks to improve the consumer experience with additional functionalities.

In October 2020, Euronet USA, LLC, partnered with Connected Processing Services, LLC of Dallas, Texas (Connected). Connected will utilize Euronet's REN Foundation software to provide a superior level of transaction processing services to its customers.

Recent product launches in ATM Security Market

In September 2023, Hitachi Payment Services launched UPI-ATM as a White Label ATM (WLA) in association with the National Payments Corporation of India (NPCI), offering secure, card-less cash withdrawals.

In August 2023, Diebold Nixdorf launched two new models as part of its DN Series family, the DN Series 600V teller cash recycler system for in-branch use, and the DN Series 430V, an outdoor walk-up cash recycler.

Top Impacting Factors

Increase in the ATM Fraud Incidents

The continuous evolution of techniques used by criminals to commit ATM fraud, such as card skimming, card trapping, and malware attacks, has driven the demand for advanced security solutions. Criminals attach skimming devices to ATM card readers to capture card data and PINs when users insert their cards. These stolen card details are then used to create counterfeit cards or for online transactions. Further, criminals use devices to block cash dispensing mechanisms, causing the security service ATM to retain the user's cash. The criminal retrieves the trapped cash once the user leaves. However, consumers are increasingly aware of the risks associated with ATM transactions and demand secure banking experiences. Financial institutions invest in security to maintain customer trust and loyalty. For instance, in February 2021, ACI Worldwide, a leading global provider of real-time digital payment software and solutions, announced a partnership with Auriga, a market leader for omni-channel banking and payment systems. The companies launched a next-generation ATM and self-service banking platform aimed at improving the omni-channel banking experience for consumers globally. This provided banks with the next-generation self-service banking that merged physical and digital channels in a highly secure, modernized technology platform. Thus, increase in the ATM fraud incidents is fueling the growth of ATM security market.

Increase in ATM deployments

The expansion of banking and financial services, especially in emerging markets, leads to a higher number of ATM installations. As the ATM infrastructure grows, so does the need for security solutions to protect these machines. While digital and mobile payments are growing, cash remains an essential part of the global economy. Ensuring the security of ATM cash withdrawals and deposits remains critical. Further, the adoption of biometric authentication methods, such as fingerprint recognition and facial recognition, is on the rise to enhance ATM security. Biometrics provides a higher level of security and convenience for users. Furthermore, contactless technologies, including NFC (Near Field Communication) and mobile wallets, are being integrated into ATMs to facilitate touchless transactions and reduce the risk of germ transmission, especially in the wake of the COVID-19 pandemic. Thus, increasing ATM deployments is boosting the growth of the market.

Increase in Consumer Demand for ATM Security

Consumers are increasingly concerned about card skimming, where criminals install devices to capture card data. They demand ATMs equipped with advanced card readers that have anti-skimming technology. Further, consumers want to receive real-time alerts on their mobile devices or through SMS/email notifications if there are suspicious activities on their accounts or if their cards are used at ATMs in unfamiliar locations. Furthermore, Financial institutions are increasingly expected to communicate openly and transparently with consumers about security measures, best practices, and any security breaches that may impact their accounts. Moreover, the rise of contactless transactions and the use of mobile apps for ATM access have gained popularity due to their perceived security advantages. Thus, the increasing consumer demand for ATM security is propelling the growth of ATM security industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ATM security market analysis from 2022 to 2032 to identify the prevailing ATM security market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ATM security market size segmentation assists to determine the prevailing ATM security market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ATM security market trends, key players, market segments, application areas, and market growth strategies.

ATM Security Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 32.4 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 270 |

| By Offering |

|

| By ATM Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Fujitsu Limited, LD Systems, Diebold Nixdorf, Incorporated., Hitachi, Ltd., Euronet USA, LLC, Oki Electric Industry Co., Ltd., GRGBanking, Triton, Hyosung TNS Inc., NCR Corporation |

Analyst Review

The ATM security market is witnessing dynamic trends to counter evolving threats. Biometric authentication methods, including fingerprint recognition and facial scanning, are on the rise, boosting user security. Further, encryption and advanced network security measures protect data against cyberattacks. Anti-skimming technologies are constantly evolving to combat card skimmers. Furthermore, robust physical security enhancements, such as anti-ram features and secure cash dispensing mechanisms, are being integrated to deter physical attacks. Real-time monitoring, remote management, and ATM network isolation are becoming standard practices. Moreover, as criminals innovate, the ATM security market continues to adapt with advanced solutions to safeguard these crucial financial assets and transactions.

The key market players are adopting strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in August 2020, TDM Security, a Dutch ATM specialist that provides hardware, technologies and software solutions had agreed a partnership with Deloitte. TMD Security aimed at accelerating the growth of its services. Together, the two companies would help banks and ATM deployers to gain insight in the annual operational cost savings and benefits from replacing their existing way of working (mostly using physical keys and manual processes) with a key-less ATM and Branch Access Management solution.

Moreover, some of the key players profiled in the report are Fujitsu Ltd., NCR Corporation, Euronet USA, LLC, Hitachi, Ltd., Diebold Nixdorf, Incorporated, GRGBanking, Oki Electric Industry Co., Ltd., Hyosung TNS Inc., Triton, LD Systems. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The ATM security market is estimated to grow at a CAGR of 9.2% from 2023 to 2032.

The ATM security market is projected to reach $32.42 billion by 2032.

Increase in the ATM fraud incidents, increase in ATM deployments, and increase in consumer demand for ATM security majorly contribute toward the growth of the market.

The key players profiled in the report include ATM security market analysis includes top companies operating in the market such as Fujitsu Ltd., NCR Corporation, Euronet USA, LLC, Hitachi, Ltd., Diebold Nixdorf, Incorporated, GRGBanking, Oki Electric Industry Co., Ltd., Hyosung TNS Inc., Triton, and LD Systems.

The key growth strategies of ATM security players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...