Audio IC Market Outlook – 2027

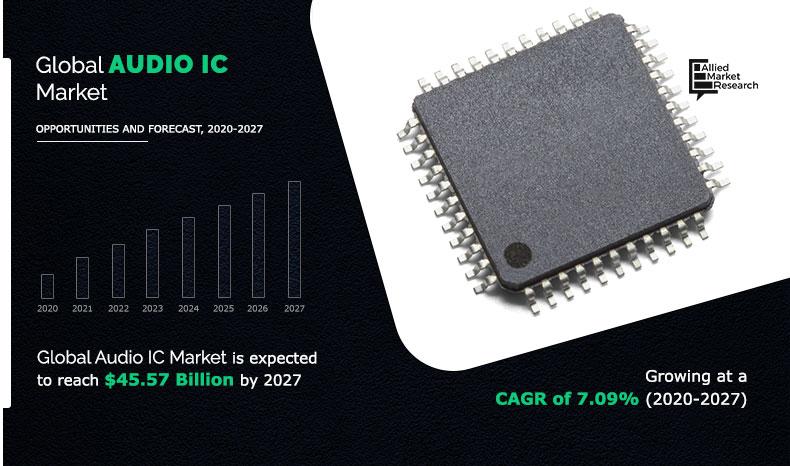

The global audio IC market size was valued at $27.72 billion in 2019 and is projected to reach $45.57 billion by 2027, registering a CAGR of 7.09% from 2020 to 2027.

Asia-Pacific was the highest revenue contributor, accounting for $10.06 Billion in 2019, and is estimated to reach $17.68 Billion by 2027, with a CAGR of 8.0%. Audio IC is an electronic chip, which is used as an audio processor, MEMS microphone, audio amplifier, and subsystem. Various types of audio ICs include audio amplifiers, audio converters, audio DSPs, and audio processors.

Audio amplifier ICs are used in sound systems such as home audio systems, musical instruments, loudspeakers, and sound reinforcement. The purpose of an amplifier is to increase vibrations to the maximum extent of signals without affecting frequency or any wavelength and to help improve the efficiency of a system. In addition, a digital sound processor (DSP) is a specialized microprocessor chip widely used in audio signal processing, telecommunications, digital image processing, radar, sonar and speech recognition systems, and consumer electronic devices such as mobile phones, disk drives, and high-definition television (HDTV) products.

The increase in the adoption of consumer electronics devices and the development of new energy-efficient audio devices with enhanced user experience drives the growth of the audio IC market. In addition, the rise in the adoption of wireless and smart infrastructure and the surge in demand for Hi-Fi audio in commercial events fuel the growth of the market. However, the increase in demand for the audio system on chip (SoC) and technical faults and issues associated with the integration of audio devices is a major restraint for the global audio IC industry. In addition, rise in demand for on-board media entertainment systems and the development of VR technology is expected to create opportunities for the audio IC market.

By Type

Audio Codec segment is projected to be the most lucrative segment

Segment Overview

The global audio IC market is segmented based on IC type, application, and region. By IC type, the market is segmented into audio amplifiers, audio DSP, audio codecs, and microphone IC. The application segment is divided into computers & tablets, phones, headphones, home entertainment systems, automotive, smart home & IoT devices, and wearables. Region-wise, the audio IC market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Application

Mobile Phone segment will dominate the market throughout the forecast period

Asia-Pacific is expected to develop at the highest growth rate during the forecast period. This is attributed to the rise in the adoption of consumer electronics, the rise in disposable income of consumers across developing countries in the region, and extensive technological advancements. In Asia-Pacific, China and India remain significant participants in the global audio IC market, owing to the surge in the manufacturing capacity of consumer electronics in these countries.

Leading audio IC manufacturers such as STMicroelectronics, NXP Semiconductors, and Infineon are focusing their investments on technologically advanced and cost-effective products. For instance, in March 2020, STMicroelectronics launched a new FDA901 class-D audio amplifier IC, with a semiconductor design that integrates the audio design expertise of Alps Alpine Co., Ltd., a major Japanese manufacturer of information communication equipment and car audio equipment.

By Geography

Asia-Pacific region will dominate the market with a highest CAGR of 8.0% during 2020 - 2027

This amplifier is aimed to contribute to the creation of high-fidelity and multi-function car audio systems. Some of the key players in the industry are Cirrus, Maxim, ROHM, NXP Semiconductors, ADI, STMicroelectronics, and Infineon. These companies aim for business expansion through mergers & acquisitions, partnerships, and product launches to prevent new entrants from capturing/entering the market.

Top Impacting Factors

Prominent factors that impact the audio IC market growth include an increase in the adoption of consumer electronics devices and the development of new energy-efficient audio devices with enhanced user experience. In addition, the increase in the adoption of wireless and smart infrastructure and the surge in demand for Hi-Fi audio in commercial events fuel the growth of the market. However, the increase in demand for audio SoCs and technical faults and issues associated with the integration of audio devices is a major restraint for the global audio IC industry. Furthermore, the rise in demand for onboard media entertainment systems and the development of VR technology are expected to create opportunities for the global market.

Competitive Analysis

Competitive analysis and profiles of the major market players that dominate global audio IC market share such as Analog Devices Inc., Cirrus Logic, NXP Semiconductors, STMicroelectronics, Maxim Integrated, ROHM CO. LTD., Texas Instruments, ON Semiconductors, Toshiba Corporation, and Infineon. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

COVID-19 Impact Analysis

The overall effect of the COVID-19 outbreak is impacting the production process of several industries in the global market. As governments of different countries have already announced a total lockdown or temporary shutdown of industries, the overall production process has been adversely affected; which, hinders the overall audio IC market globally.

The COVID-19 pandemic is impacting the society and overall economy across the globe. The impact of this outbreak is growing day by day and is affecting the supply chain. The crisis is creating uncertainty in the stock market, falling business confidence, massive slowing of the supply chain, and increasing panic among customers.

Asian and European countries under lockdowns have suffered major losses of business and revenue, owing to the shutdown of manufacturing units in the region. Operations of production and manufacturing industries have been heavily impacted by the outbreak of the COVID-19 disease; thereby, leading to a slowdown in the growth of the audio IC market in 2020.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the global audio IC market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall audio IC market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current audio IC market forecast is quantitatively analyzed from 2019 to 2027 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the audio IC market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Audio IC Market Key Segments

By IC Type

- Audio Amplifier

- Audio DSP

- Audio Codecs

- Microphone IC

By Application

- Computer & Tablets

- Phones

- Headphones

- Home Entertainment Systems

- Automotive

- Smart Home & IoT devices

- Wearables

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Sweden

- France

- Germany

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players

- Analog Devices Inc.

- Cirrus Logic

- NXP Semiconductors

- STMicroelectronics

- Maxim Integrated

- ROHM CO. LTD.

- Texas Instruments

- ON Semiconductors

- Toshiba Corporation

- Infineon

Audio IC Market Report Highlights

| Aspects | Details |

| By IC TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | TEXAS INSTRUMENTS INCORPORATED, Cirrus Logic, Inc., ROHM CO., LTD., NXP Semiconductor, ON Semiconductor, TOSHIBA CORPORATION, Analog Devices, Inc. (ADI), STMICROELECTRONICS N.V., .Maxim Integrated, Infineon Technologies AG |

Analyst Review

The global audio IC market is highly competitive, owing to strong presence of existing vendors. Audio IC technology vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Audio IC market is expected to witness a significant growth with increase in adoption from various industries to improve operations efficiency and consumer experience across different regions. Technological advancements have augmented the overall product development within a wide range of industries. Consumer electronics, automotive, and commercial are some of the leading sectors that use audio IC to improve operation efficiency and enhance audio experience.

Asia-Pacific is projected to dominate the market during the forecast period, owing to growth in the consumer electronics industry. Countries in this region have an improved consumer electronics industry, with China manufacturing a massive number of mobile phones each year. Adoption of audio ICs in commercial and automotive sectors and cost-effectiveness of audio ICs drives growth of the audio IC market in this region.

The audio IC market provides numerous growth opportunities to players such Texas Instrument, Broadcom, Renesas Electronics, and NXP Semiconductors. Leading audio IC manufacturers such as STMicroelectronics, NXP Semiconductors, and Infineon, which are focusing their investments on technologically advanced and cost-effective products. For instance, in March 2020, STMicroelectronics launched its new FDA901 class-D audio amplifier IC, with a semiconductor design that integrates audio design expertise of Alps Alpine Co., Ltd., a major Japanese manufacturer of information communication equipment and car audio equipment. This amplifier is aimed to contribute in creation of high-fidelity and multi-function car audio systems.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Product launch, acquisition, collaboration, and partnership are expected to be the prominent strategies adopted by the market players. For instance, In February 2019, Cirrus Logic Inc., an American semiconductor supplier specialized in mixed-signal, analog, and audio DSP integrated circuits launched CS35L41, a low-power boosted smart audio amplifier IC.

Loading Table Of Content...