Audiology Devices Market Research, 2031

The global audiology devices market size was valued at $7.2 billion in 2021, and is projected to reach $13.1 billion by 2031, growing at a CAGR of 6.5% from 2022 to 2031. Hearing loss affects a relatively large percentage of people above 65 of age. Hearing loss is more likely in elderly people due to alterations in the neurological route from the brain to the ear. Audiology devices are used to detect and treat hearing loss or abnormalities. Audiology devices are commonly referred to as hearing aids and are used to monitor and study hearing issues in people. Globally, age-related hearing loss or impairment is a big concern.

Due to the advent of affordable, wearable hearing aids, the popularity of audiology equipment is anticipated to rise. The market for audiology devices is also anticipated to be driven by expanding technological developments and the older population's adoption of cutting-edge equipment. Nowadays, hearing aids have sensor devices that make them simpler to use. Additionally, there are numerous businesses producing wireless hearing aids, which are becoming more and more popular on the market for audiology devices.

The audiology devices are extremely expensive and thus not many people are able to afford such devices. Also, in most part of developing countries, the technology has not yet penetrated and thus, most people in the area are not well aware about the availability of such devices which can treat their hearing loss issues. Such factors are likely to restrain the audiology devices market size in the predicted time period.

According to technological advancement, the audiology devices market is anticipated to expand rapidly between 2022 and 2030. Bluetooth devices are becoming more popular because of their improved features, even though their vintage predecessors are still readily available. They are inconspicuous, easy to use, digital, and small but durable. The market expansion during the forecast period is mostly attributable to advanced technologies and the introduction of the Bluetooth 5.0 series, which is increasing demand for Bluetooth hearing devices. Artificial intelligence is also transforming the hearing aid sector (AI). All these factors are projected to create several growth opportunities for the key players operating in the market.

The key players profiled in this report include Demant A/S, GN Store Nord A/S, Sonova, Starkey Laboratories, Inc., MED-EL Medical Electronics, Cochlear Ltd., WS Audiology A/S, MAICO Diagnostics GmbH, Ltd., Oticon Medical, and INVENTIS srl.

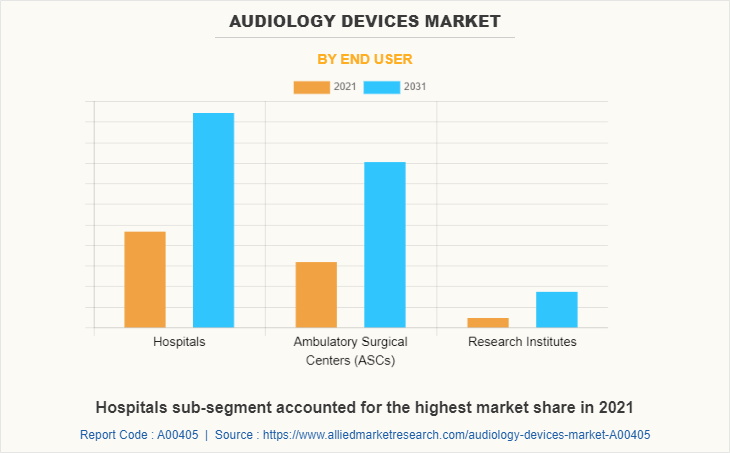

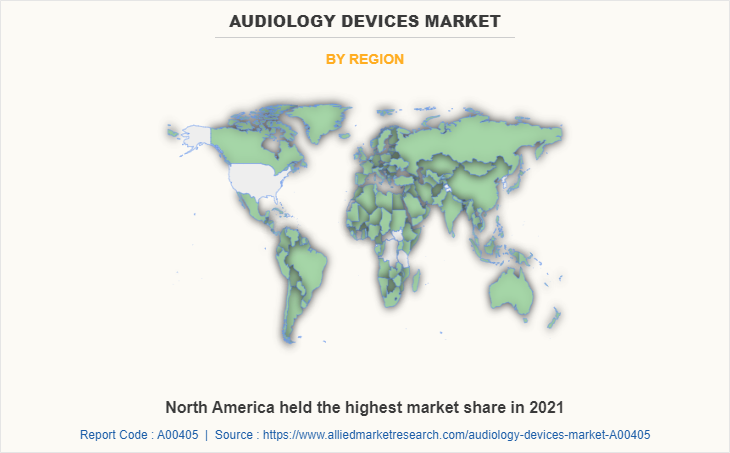

The audiology devices market is segmented on the basis of technology, product, sales channel, age group, end user, and region. By product, the market is divided into cochlear implants, hearing aids, and others. By sales channel, the market is classified into retail sales, government purchases, and e-commerce. By age group, the market is sub-segment into pediatric and adult. By end user, the market is classified into hospitals, ambulatory surgical centers (ASCs), and research institutes. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global audiology devices market is segmented into Technology, Product, Sales channel, Age Group and End User.

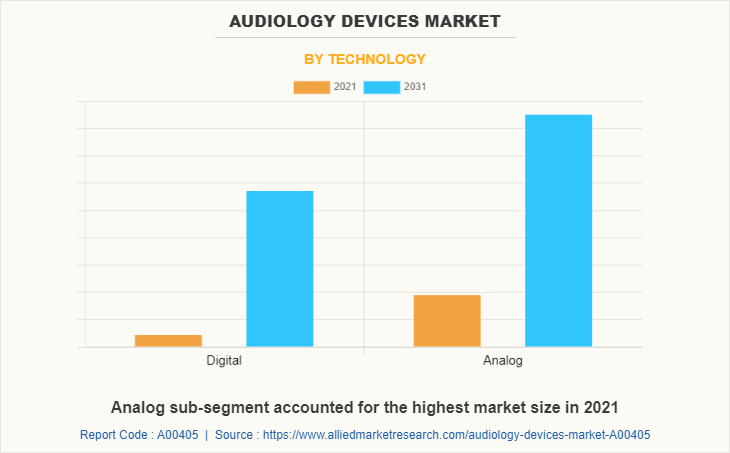

By technology, the analog sub-segment dominated the market in 2021. Analog hearing aids function by amplifying all sounds, including speech and background noise, by boosting the loudness of continuous sound waves. They generate sound using an electrical signal that is continuously changing, much like a microphone and speaker connected in series. Better analogue hearing aids use automatic gain control to compress the sound. This keeps quieter sounds audible while reducing the level of stronger noises. Some hearing aids also feature programmable settings, which let you adjust them based on how loud or quiet the surroundings. Such features of analog audiology devices market is expected to drive the market share in the forecast time period.

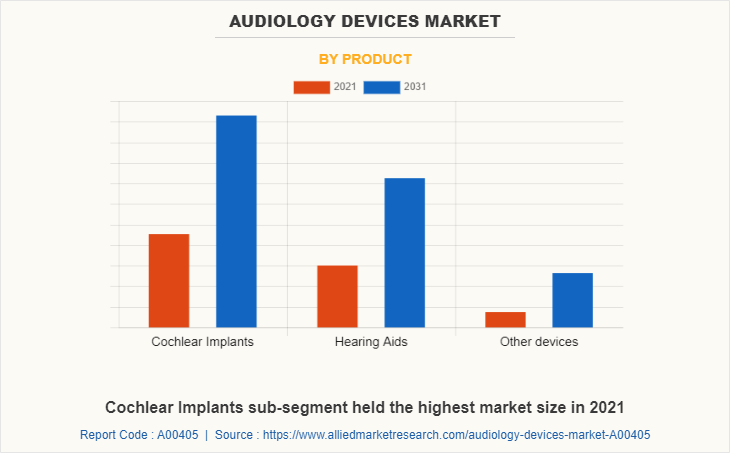

By product, the cochlear implants sub-segment dominated the market in 2021. Hearing aids are essentially just amplifiers, unlike cochlear implants, which often directly stimulate the auditory nerve. The cochlear implants capture outside noise, amplify it, and then transmit it to the ear canal. A cochlear implant can at least partially restore hearing in cases of severe hearing loss, especially when there has been catastrophic ear structure damage. Users of cochlear implants often report being better able to distinguish between various pitches and frequencies of sound when compared to hearing aid users. Such advantages of cochlear implants are expected to boost the market growth in the forecast time period.

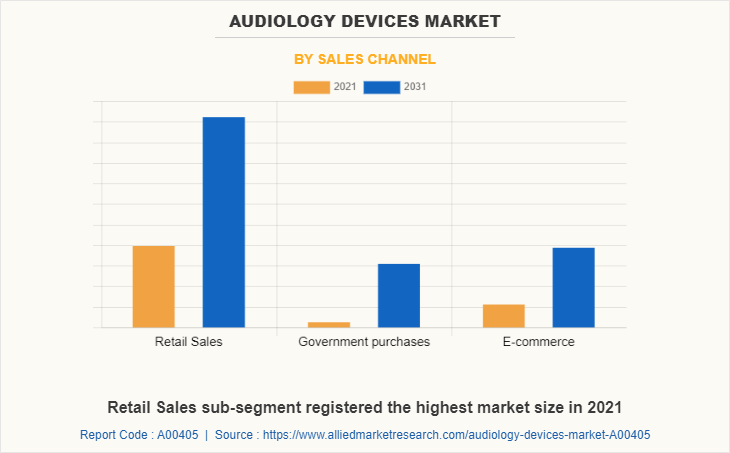

By sales channel, the retail sales sub-segment dominated the global audiology devices market share in 2021. Numerous companies offer hearing aids at affordable prices online or in physical stores, including Costco and Wal-Mart (who employ audiologists). Also, at retail stores, the patient can physically explore various possible options for choosing perfect hearing aid for himself. This factor is projected to drive the growth of the sub-segment during the forecast period.

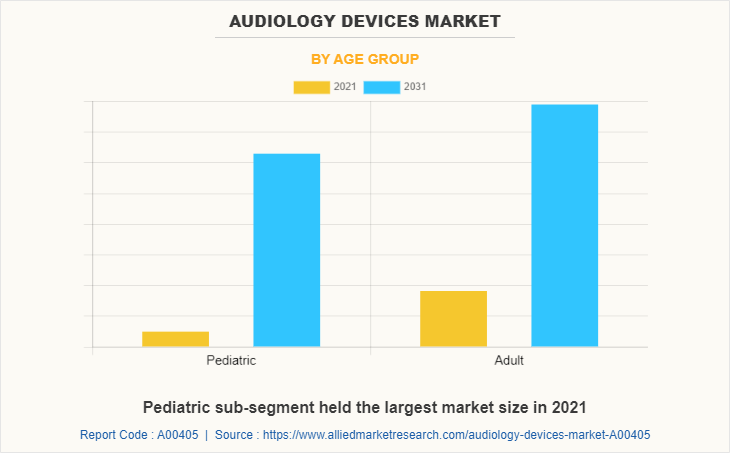

By age group, the adult sub-segment dominated the market in 2021. The main factors influencing the segment growth are the rising elderly population and awareness of the various hearing implants and gadgets. As the geriatric population is increasing at a high rate, across the globe, the cases of hearing impairment are also increasing. As a result, the demand for effective hearing aid or audiology devices has increased considerably which has boosted the market growth, significantly.

By end user, the hospitals sub-segment dominated the market in 2021. Hospitals act as a perfect place for patients to visit and get a proper treatment for their hearing impairment issues. Hospitals are technically equipped with advanced technologies which can greatly benefit the patients. Also, availability of experienced healthcare professionals and skilled technicians further add on to the market growth.

By region, North America dominated the global market in 2021 and is projected to be the fastest-growing region during the forecast period. The growth of audiology systems, an increase in the number of audiologists, and the production of computerized implants by existing suppliers all assist the development of the regional market. Also, growing geriatric population and association of hearing issues with growing age is likely to propel market growth in the forecast time period.

Impact of COVID-19 on the Global Audiology Devices Industry

- The COVID-19 pandemic had a substantial effect on the audiology devices market. The crisis caused supply chains, logistics, and production to experience a major setback. In addition, healthcare facilities were instructed to give priority to individuals who had the Sars-Cov-2 virus, which decreased the amount of people who screened for hearing loss

- Due to the possibility of cross-infections in enclosed settings, the COVID-19 pandemic had forced the cessation of numerous routine audiology services

- One of the key actions taken during this was the suspension of a large number of elective procedures and outpatient visits, which decreased the demand for audiology devices in the market. This was due to the suspension of a large number of surgeries across various medical specialties during the initial lockdown period, which temporarily restrained market growth

Highlights of the Report

- The report provides an exclusive and comprehensive analysis of the global audiology devices market trends along with the audiology devices market forecast

- The report elucidates the audiology devices market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building

- The report entailing the audiology devices market analysis maps the qualitative sway of various industry factors on market segments as well as geographies

- The data in this report aims on market dynamics, trends, and developments affecting the audiology devices market growth

Audiology Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13.1 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Technology |

|

| By Product |

|

| By Sales channel |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Demant A/S, Cochlear Ltd., INVENTIS srl, GN Store Nord A/S, maico diagnostics gmbh, oticon medical, MED-EL Medical Electronics, WS Audiology A/S, Starkey Laboratories, Inc., Sonova |

Analyst Review

The audiology devices market is growing significantly due to the increase in popularity of cochlear implants, behind-the-ear, in-the-ear, in-canal, and receiver-in-the-ear hearing devices by both adults and children. Innovative technological developments in hearing aids are crucial to increasing market demand. However, the market growth is expected to be restrained owing to high prices of hearing aids and lack of availability of skilled technicians at healthcare facilities to operate such devices for patients. The audiology devices market is expected to grow at a fast pace in future owing to various strategic developments by medical devices companies. Numerous product launches by manufacturers are likely to drive the market growth in the future.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by 2031, followed by Asia-Pacific, Europe, and LAMEA. The increase of audiologists, improvements to audiology systems, and the production of computerized implants by established vendors all contribute to the growth of the U.S. market.

Rising technology breakthroughs, such as the use of AI and machine learning, as well as innovations in audiology devices are the latest trends in the market.

Increasing government activities to improve awareness about hearing screening among infants and older people are major market drivers anticipated to generate excellent opportunities in the market.

North America is the largest regional market for audiology devices.

Audiology devices is estimated to reach $13,093.8 million by 2031.

Demant A/S, GN Store Nord A/S, Sonova, and Starkey Laboratories, Inc. are the top companies to hold the highest market share in the audiology devices market.

Loading Table Of Content...