Auto Finance Market Overview

The global auto finance market was valued at $1.9 trillion in 2021, and is projected to reach $5.6 trillion by 2031, growing at a CAGR of 11.5% from 2022 to 2031. Rising vehicle sales, urbanization, increasing consumer demand for mobility, digital lending platforms, favorable interest rates, and financial institutions’ expansion into emerging markets are contributing to the growth of the market.

Market Dynamics & Insights

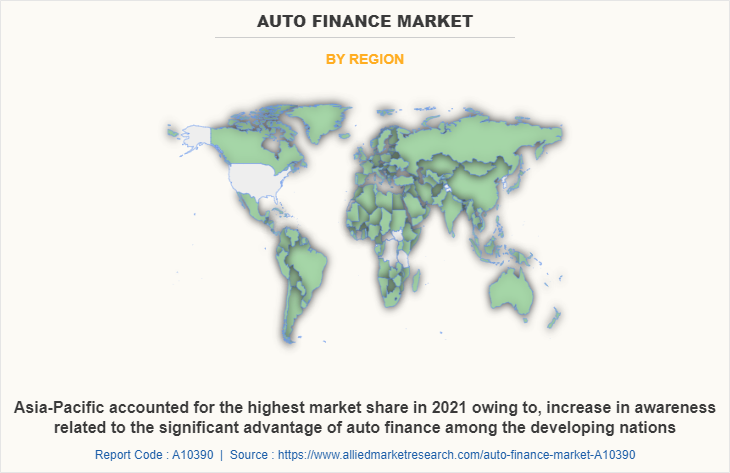

- The auto finance industry in Asia-Pacific held the largest share of 41% in 2021.

- By vehicle type, the passenger vehicle segment dominated the market, accounting for the revenue share of 71% in 2021.

- By purpose, the loan segment dominated the market, accounting for the revenue share of 76% in 2021.

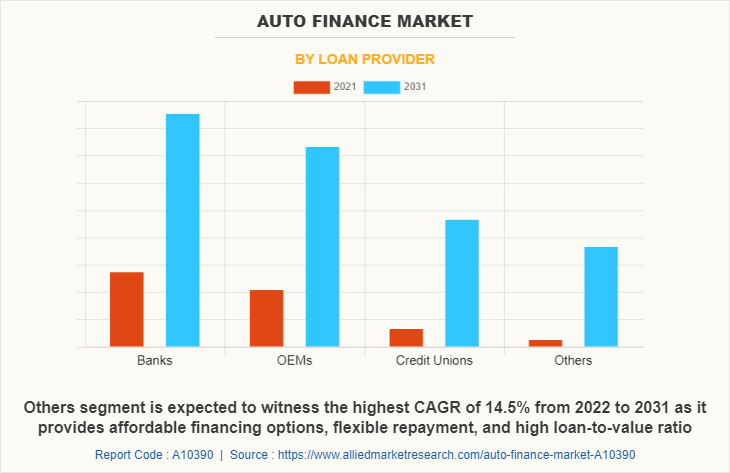

- By loan provider, the banks segment dominated the market, accounting for the revenue share of 39% in 2021.

Market Size & Future Outlook

- 2021 Market Size: $1.9 Trillion

- 2031 Projected Market Size: $5.6 Trillion

- CAGR (2022-2031): 11.5%

- Asia-Pacific: dominated the market in 2021

- LAMEA: Fastest growing market

What is Meant by Auto Finance

Auto finance market is the process where buyers can obtain financing or borrow money through a contractual agreement bank, credit union, or an automotive company or dealer where the purchase is being made. In addition, the lender generates revenue through charging interest on the amount borrowed. Furthermore, another option for automotive financing is a cash sale, which is when the buyer pays for the entire purchase in cash. When a buyer chooses this option for automotive financing it is most likely to avoid interest rates.

The emergence of online automotive finance applications and increasing the vehicle prices is boosting the growth of the global auto finance market. In addition, the adoption of digital technologies for automotive financing is positively impacts growth of the auto finance market. However, high competition and market saturation and the emergence of rideshare services and the surge in debts from various borrowers is hampering the auto finance market growth. On the contrary, the enactment of technologies in existing product lines and the untapped potential of emerging economies is expected to offer remunerative auto finance market opportunity for expansion during the auto finance market forecast. The auto finance report highlights a growing demand for vehicle loans as consumers seek more affordable options to purchase new and used cars, reflecting the overall expansion of the market.

The Auto Finance Market is Segmented into Vehicle Age, Vehicle Type, Purpose and Loan Provider

Auto Finance Market Segment Review

The Auto finance market outlook is segmented on the basis of by type, loan provider, purpose, vehicle type, and region. On the basis of type, the market is categorized into direct financing and indirect financing. On the basis of loan provider, the market is fragmented into bank financial institutions, OEMs, credit unions, and others. On the basis of purpose, the market is bifurcated into loan, and leasing. By vehicle type, it is classified into commercial vehicles and passenger vehicles. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of loan provider, the bank financial institution segment holds the highest auto finance market size increasingly adopting digital automotive finance in order to meet the changing customer needs across the globe. However, the OEMs segment is expected to grow at the highest rate during the forecast period as it provide better after-sales services due to the availability of identical automobile parts, like that of the vehicle financed, for repair or the replacement.

Region-wise, the auto finance market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to presence of a large number of automotive finance service providers in the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to growing number of favourable government initiatives in economies, such as India, Japan, and China, to promote growth in the automotive industry and maintain consumer interest.

The key players that operate in the auto finance industry are Ally Financials Inc., Bank of America, Capital One Financial Corporation, Chase Auto Finance, Ford Motor Company, General Motors Financial Company, Inc., Mercedes-Benz Mobility, Novuna, Toyota Financial Services and Volkswagen Finance Private Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

Auto finance is a web-based environment that boosts business communication and business-decision making. In addition, financial services institutions are implementing digital solutions at a faster pace to remain competitive. Moreover, advance technologies like block chain, AI, digital payment systems, and online mobile banking system, are the most prominent technologies used by financial industries today to provide the best auto loan services to clients. The number of people willing to take these services is growing steadily since last few years, as disposable income is rising in developing countries such as India, China, Brazil, Mexico, and Indonesia. For instance, according to research conducted by PWC in 2021, 91% of auto dealers believe a strong digital presence is critical to their overall sales strategy, yet 83% do not have a dedicated digital strategy. Auto finance worldwide is experiencing growth due to increasing global car sales and the rise of emerging markets, where financing solutions are becoming more accessible to a larger consumer base. A variety of auto finance options, such as leasing, loans, and hire-purchase agreements, are gaining popularity, allowing consumers to choose flexible payment methods that suit their financial situations.

Moreover, going digital can solve many challenges and deliver real benefits for both parties. Customers can make purchases that meet their needs and can walk away highly satisfied that they found the ideal vehicle at the best price and loan rate. Not only does this lead to higher revenues for the dealer, but they also improve internal efficiencies. In this example, “going digital” helps foster, maintain, and grow the relationship between the dealer and their customers. Furthermore, new advances in digital and cloud technology have created valuable new innovations and trends in auto financing. For example, powerful end-to-end auto lending software like Earnix—using next-generation technologies such as advanced data analytics, machine learning, and artificial intelligence—now enable auto dealers to manage all aspects of their lending program. Auto finance companies are seeing increased competition, driving innovation in loan terms, customer service, and digital lending platforms to attract more borrowers.

Key Benefits

Auto finance provides list of features and benefits. All the banks offer a different set of features and benefits that makes auto loan unique. In addition, being a secured loan, auto loans are generally subject to lower rates of interest as compared to other financing options such as personal loans, home loans, or other secured loans. Furthermore, auto loans are offered against the car as that wish to buy it thus involves lenient eligibility criteria and minimal documentation. This enables lenders to process the loan faster. With the availability of auto loans, individuals are not required to shell out savings or wait for long to buy vehicle. Moreover, banks offer auto loans for a tenure of up to a maximum of 7 years. So, that clients can have flexibility to choose the tenure as per convenience.

Furthermore, auto loans have the flexibility to choose the mode of payment to repay auto loan. Clients can choose to pay through post-dated cheque or use the auto-debit facility where equated monthly installments (EMIs) will be automatically deducted from bank account. Furthermore, the old methods of the auto financing industry were highly complicated and time consuming for a typical customer. It is used to take several days to process the application manually. However, due to digitalization and advancement in technologies now the same process is take only a few minutes. Therefore, customers can easily avail of quick & hassle-free transactions.

Government Regulations

All well-governed financial industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields. Organizations are adopting financial consulting software to supports the clients in financial matters in the field of property and real-estate management. For instance, The Australian Prudential Regulation Authority (APRA) is an independent statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. In addition, it recognizes the momentum towards cloud computing, APRA has called on regulated entities to implement a thoughtful cloud-adoption strategy with effective governance, thorough risk assessment, and regular assurance processes.

Furthermore, to help regulated entities assess cloud providers and services more effectively and guide them through the regulatory issues of outsourcing to the cloud. In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data that are involved in their operations. For instance, on June 5, 2020, Japan enacted a new set of amendments to its data-privacy law, the Act on the Protection of Personal Information (APPI) Individuals can sue for damages relating to the loss of privacy, which may end up having the biggest financial repercussions for businesses. For instance, the European Government adopted the new General Data Protection Regulation (GDPR). The act seeks to regulate the collection, storage, and processing of information about individuals. The key aim of GDPR is to protect critical data of financial and banking sectors of the European nation).

Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent big data regulations, which comprise privacy, government regulatory environment, and intellectual property protection. For instance, the technology risk management established in Singapore encouraged multiple organizations in the country to adopt financial consulting software for business advisory and protect from cyber risk.

What are the Report Coverage & Deliverables

Provider Type Insights

The banks segment led the auto finance market revenue in 2022. The banks segment growth can be attributed to the fast-processing features with the necessity for least documentation, in addition to the high-reliability features. Earlier, banks are used to finance only around 70.0% to 80.0% of the total vehicle price. However, currently, these banks are offering 100% finance for the vehicle such as car credit solutions, owing to which customers are showing more interest in purchasing a new car, over a used car. The banks are increasingly adopting digital automotive finance in order to meet the changing customer needs across the globe.

Finance Type Insights

The direct segment dominated the auto finance market revenue in 2022. Consumers are focusing on determining the automotive financing source, which effectively meets their requirements. Consumers directly apply for car loans at the credit union, banks, and other lending companies. Moreover, the customers have complete control over the lending process as this process doesn’t include any third-party salesperson or dealer. In the direct loan process, the consumer requires a large amount of time to choose a suitable lender as compared to the indirect loan process.

Purpose Type Insights

The loan segment led the auto finance market revenue in 2022. Loans have been a standard process of purchasing an automobile by most of the global population. As the credit environment started to advance, leasing and finance companies had extra funding sources to make accessible to the consumers. Moreover, banks and credit unions are targeting customers with low-interest rate loans. The automotive loan companies offer customers services such as a wide network of dealerships, dedicated customers support, and 24/7 access to loan accounts. These offered services enable the lending companies to enhance their customer's experience.

Vehicle Type Insights

The passenger vehicles segment led the auto finance market revenue, in 2022. The segment growth can be attributed to the increasing need for mobility due to the increased distances between work, home, education, leisure, and shopping facilities this also helps to increase vehicle financing. The automotive industry is growing due to the constant change in customer needs. The need for innovations in safety systems, infotainment systems, advanced driver-assistance systems, telematics, autonomous vehicles, and in-dash controls is increasing, especially in passenger vehicles.

Regional Insights

The European region dominated the auto finance market revenue in 2022. The regional market growth can be attributed to the presence of a large number of automotive finance service providers in the region. Numerous market players are focusing on offering their services through mobile and online channels. This initiative is giving these players an edge over traditional players. At the same time, the growing demand for electric vehicles in the region is also driving the market growth within the region.

What are the Top Impacting Factors in Auto Finance Market

The Emergence of Online Automotive Finance Applications

Online loan services have emerged as the most disruptive technology in industry. In addition, the mobile and web-based platforms allow easy viewing, comparison, and applying for loan services. The increasing vehicle prices are propelling the demand for auto finance services. Furthermore, demand for auto finance is relatively saturated in developed countries, developing countries are anticipated to emerge as the lucrative target market for financing companies. Moreover, customers in various countries have more faith in bank for such loans instead of financial companies. For instance, in India, the majority of auto loans are taken from nationalized banks and private banks mainly due to low interest rates & services. Therefore, the rising automotive sales will directly lead to auto finance market growth.

Increasing the Vehicle Prices

The inflation in commodity prices globally has compelled automotive manufacturing companies to increase vehicle prices in the last few years. The auto financeindustry is expected to see new opportunities for international investment as well as new types of alternatives to invest in. In addition, the increasing demand from developing nations, high government taxes, and stringent policies further boosting the growth of the market. For instance, in 2020 kia Motors increased the vehicle prices by USD 400 to USD 500 in the Indian market. However, having disposable income in these countries is also growing customers opt for vehicle loan to fulfill financial needs for purchasing the cars, which in turn is driving the growth of the auto finance market.

What are the Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global auto finance market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global auto finance market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The auto finance market analysis from 2022 to 2031 is provided to determine the market potential.

Auto Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.6 trillion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Vehicle Age |

|

| By Vehicle Type |

|

| By Purpose |

|

| By Loan Provider |

|

| By Region |

|

| Key Market Players | Capital One Financial Corporation, General Motors Financial Company, Inc., Toyota Financial Services, Bank of America Corporation, Volkswagen Finance Private Limited, Ford Motor Company, JPMorgan Chase & Co., Mercedes-Benz Mobility, Ally Financials Inc., Novuna |

Analyst Review

Auto finance services aim to provide funds to customers who are willing to purchase or lease a car. In addition, technology advancement has also created demand for the auto finance sector significantly in the last few years. Furthermore, technologies such as block chain, digital payment systems, and online/mobile banking system are the most prominent technologies used by financial institutions to provide the best financial services to client.

The global auto finance market is expected to register high growth due to rapid centralization and digitization of business processes to streamline all operations into a single platform are expected to drive industry growth. Thus, increase in adoption of auto finance, owing to its security is one of the most significant factors driving the growth of the market. With surge in demand for auto finance, various companies have established alliances to increase their capabilities. For instance, in March 2022, Santander Consumer USA Inc partnered with AutoFi Inc, a leading e-commerce platform for automotive sales and financing, to develop SC's end-to-end digital car buying experience. Santander US has also invested in the capital raise announced today by AutoFi, strengthening the Santander and AutoFi relationship and aligning long-term interests.

In addition, with further growth in investment across the world and the rise in demand for auto finance, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in March 2022, Solera Holdings, LLC the global leader in vehicle lifecycle management launched a financing solution that will enable franchise and independent dealers to provide competitive-rate auto loans to the full spectrum of used car buyers.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, November 2021, Cars.com acquired automotive FinTech platform CreditIQ to enable instant financing for consumers, dealers and lenders, and will build additional revenue streams for Cars.com

The auto finance market is estimated to grow at a CAGR of 11.5% from 2022 to 2031.

The auto finance market is projected to reach $ 3,610.19 million by 2031.

The emergence of online automotive finance applications and increasing the vehicle prices is boosting the growth of the global auto finance market. In addition, the adoption of digital technologies for automotive financing is positively impacts growth of the auto finance market.

The key players profiled in the report include Ally Financials Inc., Bank of America, Capital One Financial Corporation, Chase Auto Finance, Ford Motor Company, General Motors Financial Company, Inc., Mercedes-Benz Mobility, Novuna, Toyota Financial Services and Volkswagen Finance Private Limited.

The key growth strategies of auto finance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...