Automated Algo Trading Market Research, 2031

The global automated algo trading market size was valued at $13.5 billion in 2021, and is projected to reach $35 billion by 2031, growing at a CAGR of 10.1% from 2022 to 2031.

Automated algo trading is a form of automation, which uses computer program to execute a defined set of instructions or rules that include the buying or selling of an asset in regard to the varying market data. The defined sets of instructions or rules are based on timing, quantity, price, or any mathematical model. It offers several benefits to market participants such as it executes trades at the best possible prices, offers simultaneous automated checks on multiple market conditions, trades timed correctly and instantly; and reduces transaction costs due to lack of human intervention.

Factors such as rise in demand for reliable, fast, and effective order execution, emergence of favorable government regulations, and the need for market surveillance primarily drive the growth of the global automated algo trading market. In addition, rise in demand for reducing the transaction costs fuels the demand for automated algo trading market. However, insufficient risk valuation capabilities are expected to hamper the market growth to some extent. On the contrary, emergence of AI and algorithms in the financial services is expected to provide lucrative opportunities for the market growth during the forecast period. In addition, rise in demand for cloud-based solutions is anticipated to be opportunistic for the market growth during the forecast period.

Segment Review

The automated algo trading market is segmented on the basis of component, deployment mode, enterprise size, application, trading type, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. Based on application, the automated algo trading market is segmented into trade execution, statistical arbitrage, liquidity detection, and others. The trade execution segment is further bifurcated into market maker, Over-the-Counter (OTC) market maker, and Electronic Communications Network (ECN). The market maker is further divided into agency trade and principal trades. Based on trading type, the automated algo trading market is segmented into stock markets, FOREX, ETF, bonds, cryptocurrencies, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

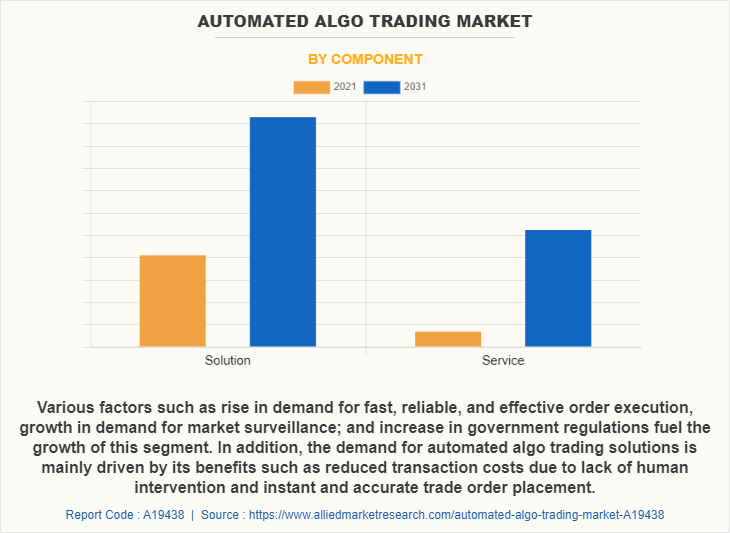

By component, the solution segment attained the highest growth in 2021. This was attributed to various factors such as rise in demand for fast, reliable, and effective order execution, growth in demand for market surveillance; and increase in government regulations that fuel the growth of this segment. In addition, the demand for automated algo trading solutions is mainly driven by their benefits such as reduced transaction costs due to lack of human intervention and instant and accurate trade order placement.

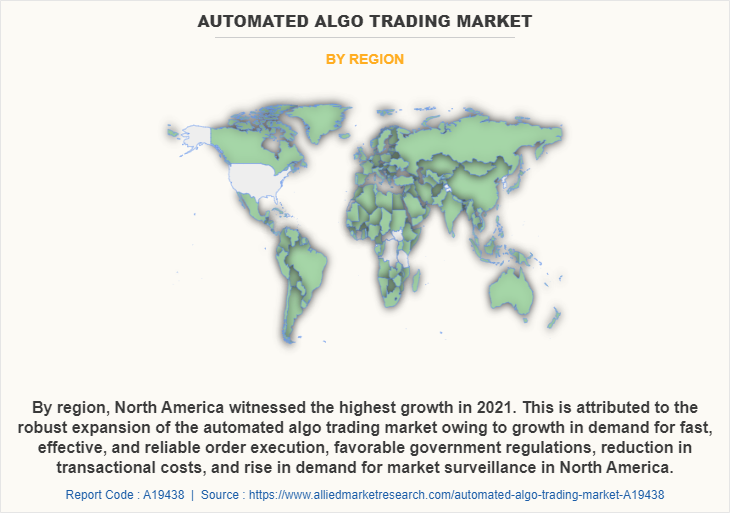

By region, North America witnessed the highest growth in 2021. This is attributed to the robust expansion of the automated algo trading market owing to growth in demand for fast, effective, and reliable order execution, favorable government regulations, reduction in transactional costs, and rise in demand for market surveillance in North America.

The report focuses on growth prospects, restraints, and trends of the automated algo trading market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the automated algo trading industry.

The report analyzes the profiles of key players operating in the automated algo trading industry such as 63MOONS, AlgoTrader, Argo Software Engineering, Ava Trade Markets Ltd., India Algo, InfoReach, Inc., LEHNER INVESTMENTS, MetaQuotes Ltd, NinjaTrader, QuantConnect, Software AG, Symphony, Tethys Technology, VIRTU Financial Inc., Tata Consultancy Services Limited, Next Algo, and Myalgomate Technologies LLP. These players have adopted various strategies to increase their market penetration and strengthen their position in the automated algo trading market.

Top Impacting Factors

Rise in Demand for Reliable, Fast, and Effective Order Execution

Automated algo trading is rapidly being used by big brokerage houses as well as institutional investors to cut down on costs associated with trading. This is attributed to the fact that automated algo trading system enables easier and faster execution of orders, making it attractive for exchanges. In addition, it enables the investors and traders to quickly book profits off small changes in price. Hence, rise in demand for effective trade drives the automated algo trading market growth, as it enables the user to quickly execute trades.

Insufficient Risk Valuation Capabilities

Automated trading algorithm may face a significant amount of risk intraday. However, without the adequate amount of controls the losses can accumulate and spread rapidly. Investment firms need to be able to automatically block or cancel orders where they risk compromising the firm’s own risk management thresholds. In addition, algorithmic high frequency trading (HFT) has a number of risks, the biggest of which is its potential to amplify systemic risk. However, automated algo trading solutions have insufficient risk valuation capabilities, which may hamper growth of the market to some extent during the automated algo trading market forecast period.

Emergence of AI and Algorithms in the Financial Services

Rise in number of financial services companies drives the adoption of AI and machine learning to capitalize on the data from digitally driven channels. It is being used by several companies that operate in areas such as banking, insurance, and asset management. This has led to the emerging trend of data-driven investments during the last decade. This in turn fueled the demand for high-frequency trading or automated algo trading. Such AI-driven trading systems analyze massive amounts of data much quicker than people would do it. Thus, AI and algorithms in the financial services is opportunistic for the market growth during the forecast period, as it enables innovation in the automated algo trading market outlook.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automated algo trading market analysis from 2021 to 2031 to identify the prevailing automated algo trading market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automated algo trading market share segmentation assists to determine the prevailing market opportunities.

- The report includes the analysis of the regional as well as global automated algo trading market trends, key players, market segments, application areas, and market growth strategies.

Automated Algo Trading Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Trading Type |

|

| By Region |

|

| Key Market Players | LEHNER INVESTMENTS, NinjaTrader, AlgoTrader, India Algo, VIRTU Financial Inc., QuantConnect, Next Algo, Tata Consultancy Services Limited, Symphony, Ava Trade Markets Ltd., Argo Software Engineering, Software AG, InfoReach, Inc., Tethys Technology, MetaQuotes Ltd, 63MOONS, Myalgomate Technologies LLP |

Analyst Review

The automated algo trading market is going through enormous transformation and growth. Automated algo trading has become the emerging technology for financial institutions to gain an edge over other market participants. There is very less possibility that the traders are profitable; however, automated algo trading has improved such odds through better strategy testing, design, and execution; thus, increasing the profitability. More number of investors have adopted automated algo trading technology to bring superior efficiency to financial markets. Moreover, most of the investors and regulators are inclining toward algorithmic as well as high-frequency trading (HFT). Over the past few years, HFT has become the most pervasive use of the automated algo trading technology, especially among large financial institutions. HFT enables the large volumes of shares to be bought and sold automatically at very high speeds. HFT is anticipated to continuously grow and become the dominant form of automated algo trading in the upcoming years. This is attributed to its huge popularity among big insurers, banks, and hedge funds, owing to its ability to place large volumes of orders at high speed across different markets based on a number of automated algo trading strategies.

COVID-19 pandemic has significantly fueled the growth rate of the automated algo trading market, owing to increase in shift toward automated algo trading. For instance, the Reserve Bank of Australia, in its recent publication stated that the COVID-19 pandemic may have only furthered the industry's shift toward electronic trading. Furthermore, the automated algo trading market is competitive and comprises number of regional and global vendors competing based on factors such as cost of solutions, reliability, and support services. The growth of the market is impacted by rapid advances in the electronic trading offerings, whereas the vendor performance is impacted by COVID-19 conditions and industry development. Moreover, vendors operating in the market offer advanced automated algo trading products and services to improve the experience of traders using an automated algo trading platform.

Some of the key players profiled in the report include 63MOONS, AlgoTrader, Argo Software Engineering, Ava Trade Markets Ltd., India Algo, InfoReach, Inc., LEHNER INVESTMENTS, MetaQuotes Ltd, NinjaTrader, QuantConnect, Software AG, Symphony, Tethys Technology, VIRTU Financial Inc., Tata Consultancy Services Limited, Next Algo, and Myalgomate Technologies LLP. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Rise in demand for reliable, fast, and effective order execution, emergence of favorable government regulations, and the need for market surveillance are some of the major trends in the global automated algo trading market.

The global automated algo trading market size was valued at $13,540.66 million in 2021, and is projected to reach $34,971.39 million by 2031, growing at a CAGR of 10.1% from 2022 to 2031.

Rise in demand for reducing the transaction costs fuels the demand for automated algo trading market.

63MOONS, AlgoTrader, Argo Software Engineering, Ava Trade Markets Ltd., India Algo, InfoReach, Inc. are the leading players in automated algo trading market

The automated algo trading market is segmented on the basis of component, deployment mode, enterprise size, application, trading type, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. Based on application, the automated algo trading market is segmented into trade execution, statistical arbitrage, liquidity detection, and others. The trade execution segment is further bifurcated into market maker, Over-the-Counter (OTC) market maker, and Electronic Communications Network (ECN). The market maker is further divided into agency trade and principal trades. Based on trading type, the automated algo trading market is segmented into stock markets, FOREX, ETF, bonds, cryptocurrencies, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...