Automated Liquid Handling Market Research, 2030

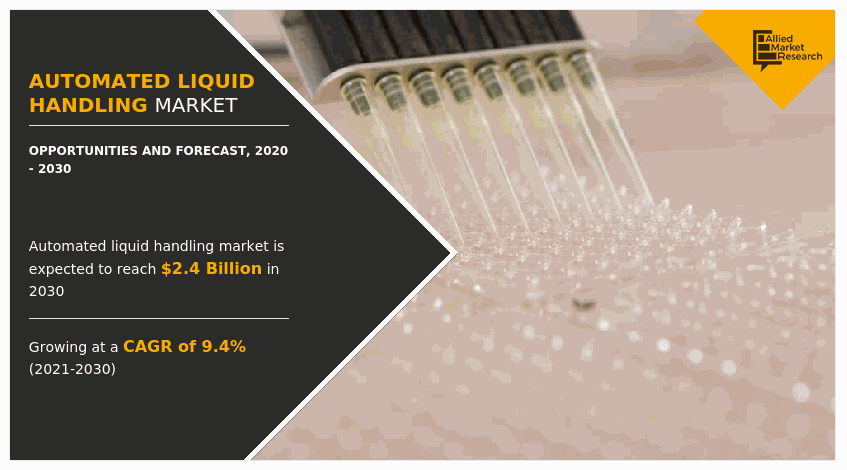

The global automated liquid handling market was valued at $960.98 million in 2020, and is projected to reach $2,385.91 million by 2030, growing at a CAGR of 9.4% from 2021 to 2030. Automated liquid handling (ALH) systems are equipment that are precisely programmed to handle liquids and deliver accurate and reproducible results without any complexity in clinical and research settings. Efficient and accurate liquid handling techniques play important role in clinical and research laboratories. Automated liquid handling systems can be optimized for use in techniques, including ELISA, time-resolved fluorescence, nucleic acid preparation, PCR setup, next-generation sequencing for genomic research, TLC spotting, SPE, and liquid– liquid extraction. Automated liquid handling instruments have various advantages like it enables simplified sample preparation with consistent high accuracy and allows labs to free up manual labor and run more samples while maintaining reproducibility. It helps to address sample preparation needs for proteins, metabolites, as well as genomics and NGS applications, reducing set up times and protocol development.

The automated liquid handling market growth is driven by rise in adoption of ALH, rise in adoption of ALH in emerging countries, technological advancements in ALH systems, and surge in demand for miniature process equipment. Moreover, the advantages of ALH systems over manual pipetting such as improved efficiency, enhanced safety also contributes in the growth of the market. However, rise in higher costs of ALH instruments is expected to hinder the market growth. Conversely, untapped potential of emerging markets offers automated liquid handling market opportunity.

Coronavirus (COVID-19) was discovered in late December, 2019, in Hubei province of Wuhan city in China. The disease is caused by a virus, namely, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans. Testing for COVID-19 has been an ongoing bottleneck in the fight against COVID-19. With growth in need to process specimens faster with greater accuracy, interest in automated liquid handlers and robotics that can handle the workload has been increasing rapidly. Overall, the impact of COVID-19 on the automated liquid handling industry was recorded to be fairly positive. This was attributed to increase in customizations of automated liquid handling systems by different automated liquid handling suppliers specifically for work related to coronavirus. For instance, in April 2020, Hamilton Company and Zymo Research Corporation announced that they have collaborated and launched MagEx STARlet assay-ready workstation with Quick-DNA/RNA Viral MagBead Kit protocol to extract pure DNA/RNA from the novel coronavirus, SARS-CoV-2. The jointly developed automated solution offers significant advantages compared to manual processing of samples via traditional time-consuming methods such as spin columns.

The automated liquid handling market is segmented on the basis of type, modality, procedure, end user, and region. On the basis of type, the market is divided into standalone, individual benchtop workstation, multi-instrument system, and others. By modality, it is bifurcated into fixed tips and disposable tips. By procedure, it is segmented into PCR-set-up, serial dilution, high-throughput screening, cell culture, whole genome amplification, plate reformatting, array printing, and others. On the basis of end user, it is classified into biotechnology & pharmaceutical companies, contract research organizations, and academic & government research institutes. Region wise, the market has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

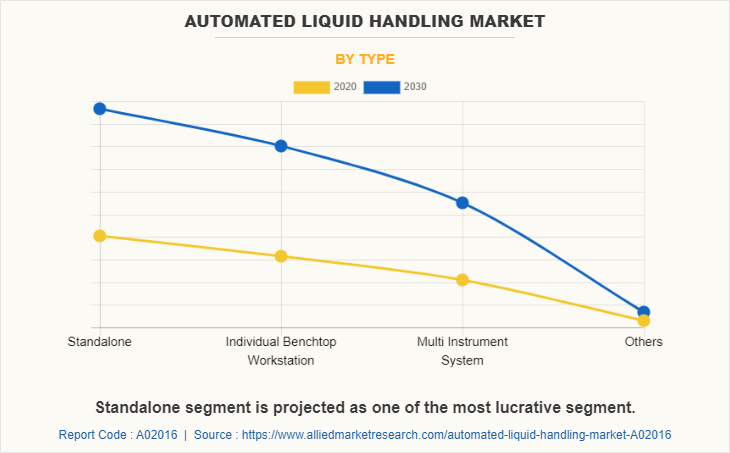

Type segment review

By type, the global automated liquid handling market is classified into standalone, individual benchtop workstation, multi-instrument system, and others. Standalone segment was the major contributor to the automated liquid handling market size in 2020, and is anticipated to remain dominant during the automated liquid handling market forecast period due to lower cost and higher usage among different research and clinical settings. However, the multi-instrument ALH system segment is expected to show fastest market growth during the forecast period, owing to rise in adoption of technologically advanced multi-instrument ALH.

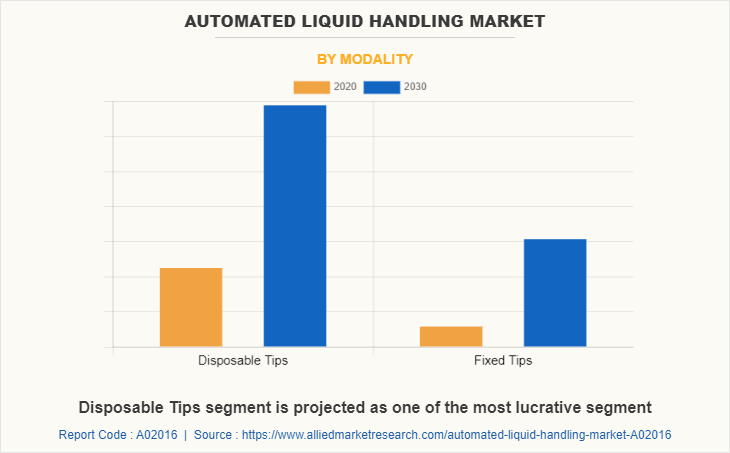

Modality segment review

By modality, the global automated liquid handling market is classified into fixed tips and disposable tips. Disposable tips segment was the major contributor to the global automated liquid handling market size in 2020, and is anticipated to remain dominant during the forecast period due to rise in adoption of technologically advanced ALH instruments with disposable tips.

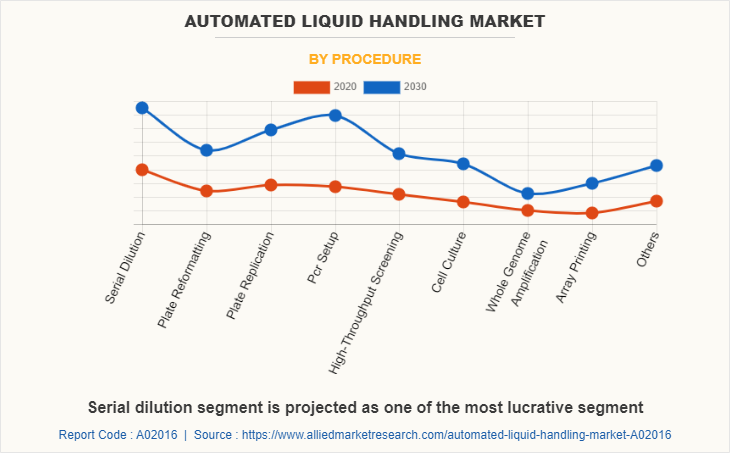

Procedure segment review

By procedure, the global automated liquid handling market is classified into PCR-set-up, serial dilution, high-throughput screening, cell culture, whole genome amplification, plate reformatting, array printing, and other. Serial dilution segment was the major automated liquid handling market share in 2020, and is anticipated to remain dominant during the forecast period due to increase in adoption of ALH within laboratories for serial dilution. However, array printing is expected to show significant market growth during the forecast period.

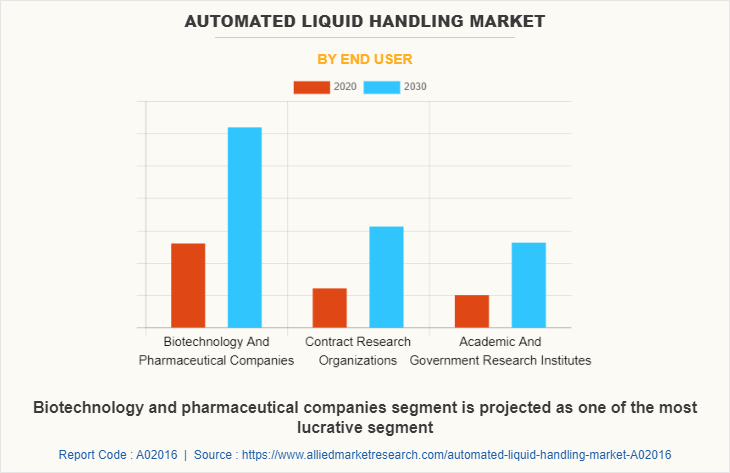

End user segment review

By end user, the global automated liquid handling market is classified into biotechnology & pharmaceutical companies, contract research organizations, and academic & government research institutes. Biotechnology & pharmaceutical companies segment was the major contributor to the global market in 2020, and is anticipated to remain dominant during the forecast period due to increase in the use and application of ALH systems to carry out high throughput screening in the biotechnology and pharmaceutical industry.

Region Segment Review

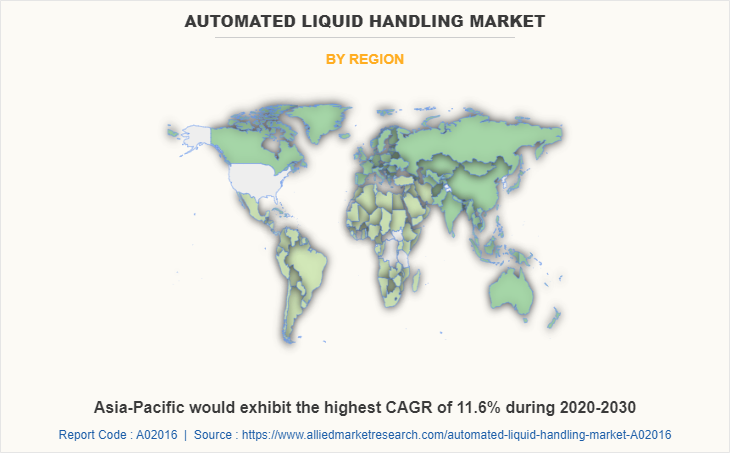

North America generated highest revenue in 2020, and is anticipated to dominate the global ALH market. This was attributed to rise in adoption of ALH system, wide availability of advanced ALH, large presence of pharmaceutical and biotech companies and R&D laboratories, and large presence of trained professionals. However, Asia-Pacific is expected to witness highest growth rate of automated liquid handling market share during the forecast period, attributable to rise in awareness related to ALH systems, developing R&D sector, and developing infrastructure of research and clinical settings.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automated liquid handling market analysis from 2020 to 2030 to identify the prevailing automated liquid handling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automated liquid handling market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automated liquid handling market trends, key players, market segments, application areas, and market growth strategies.

Automated Liquid Handling Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Modality |

|

| By Procedure |

|

| By End User |

|

| By Region |

|

| Key Market Players | GILSON, INC., AGILENT TECHNOLOGIES, INC. (BIOTEK INSTRUMENTS, INC.), TECAN GROUP LTD., AURORA BIOMED INC, METTLER-TOLEDO INTERNATIONAL INC., DANAHER CORPORATION (BECKMAN COULTER INC.), HAMILTON COMPANY, PERKINELMER, INC., CORNING INCORPORATED, EPPENDORF AG |

Analyst Review

Automated liquid handling industry have streamlined research workflows to a great extent and have reduced manual effort required in liquid transfer operations. Manual pipetting can be prone to error and is not very reproducible. This creates additional bottlenecks in overall research experiment, when experiments are not satisfactorily reproduced. Therefore, different research laboratories globally are adopting ALH systems as they deliver error-free reproducible results. ALH systems comprise instruments and equipment that are used to handle liquids and execute different functions related to liquid transfer in a clinical and research environment.

The use of ALH systems has resulted in efficient high-throughput screening of chemical compounds. High-throughput screening is of utmost necessity in the pharmaceutical industry to execute drug discovery and development. Likewise, in research settings, routine laboratory procedures equipped with ALH through work-stations allow researchers to think deeply and unconventionally about their experiment outcomes. Furthermore, this also helps scientists and researchers design effective follow-up projects or develop alternative approaches and hypotheses for their investigations instead of repeatedly doing tedious tasks, especially pipetting.

The ALH market has gained momentum in research, innovation, and development sectors, owing to increase in productivity and profitability it offers, which reduces burden associated with manual liquid transfer operations. In addition, dearth of skilled professionals, technological advancements associated with ALH systems, and advantages of ALH systems over manual pipetting drive the market growth. High-end equipment; their continuous use, in terms of procedures such as plate reformatting, plate replication, high throughput screening array printing, and other procedures are carried out to a higher extent in the biotechnology & pharmaceutical industry, when compared to other end users. Employment of technologically advanced ALH systems is the highest in North America, owing to increase in adoption of this technology, followed by Europe and Asia-Pacific.

The total market value of automated liquid handling market is $2,385.91 million in 2030.

Top companies such as Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter Life Sciences), Corning Inc., Agilent Technologies, Inc. (Biotek Instruments, Inc.), PerkinElmer, Inc., Mettler-Toledo International Inc. held a high market position in 2020. These key players held a high market postion owing to the strong geographical foothold in different regions.

Standalone segment is the most influencing segment owing to the technological advancements associated with ALH systems, rise in adoption of ALH in pharmaceutical companies & R&D institutes.

The forcast period for automated liquid handling market is 2020 to 2030

The market value of automated liquid handling market in 2020 is $960.98 million.

The base year is 2020 in automated liquid handling market

The technological advancements associated with ALH systems, rise in adoption of ALH in pharmaceutical companies & R&D institutes, development of R&D infrastructure in emerging economies, and advantages of ALH systems over manual pipetting, key advantages such as rise in productivity, efficiency, and enhanced accuracy are the key trends in the automated liquid handling market report.

Asia-Pacific has the highest growth rate of 8.6% in the market which is growing due to presence of large patient population, strong presence of key players, ease of devices availability, well developed healthcare infrastructure, favorable reimbursement policies in healthcare system, higher number of research and development.

Yes, the automated liquid handling market companies are profiled in the report.

Yes, the automated liquid handling market report provides PORTER Analysis

Loading Table Of Content...