Automated Manual Transmission Market Research, 2034

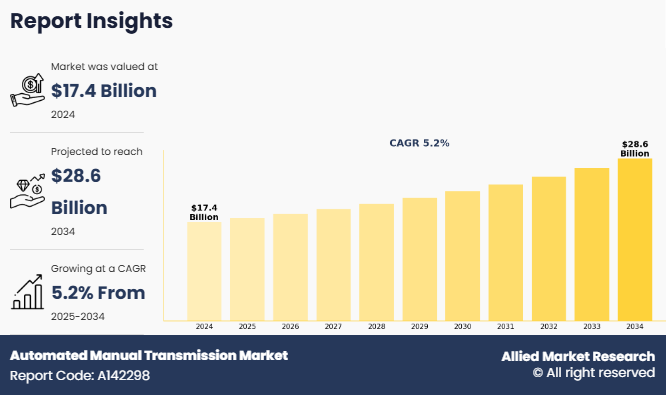

The global automated manual transmission market size was valued at $17.4 billion in 2024, and is projected to reach $28.6 billion by 2034, growing at a CAGR of 5.2% from 2025 to 2034.

Report Key Highlighters:

- The automated manual transmission market growth study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the automated manual transmission market size.

- The automated manual transmission market forecast is highly fragmented, into several players including ZF Friedrichshafen AG, Aisin Corporation, Eaton Corporation, BorgWarner Inc., Hyundai Transys, AB Volvo, Detroit Diesel Corporation, Shaanxi Fast Auto Drive Group Co., Ltd, Mack Trucks, and Magna International Inc. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An automated manual transmission is a type of transmission system that combines the mechanical components of a traditional manual gearbox with an automatic shifting mechanism. However, in automated manual transmission, the clutch operation and gear shifting are controlled electronically by a transmission control unit using actuators and sensors. This setup eliminates the need for a clutch pedal and manual gear lever, allowing for a more affordable, fuel-efficient, and low-maintenance automatic driving experience. Automotive manual transmission are especially popular in entry-level and compact vehicles due to their cost-effectiveness compared to fully automatic transmissions like CVTs or torque converters.

The demand for automated manual transmission market is driven by increased focus on fuel efficiency & reduced emissions, ease of driving in congested areas, and growing adoption in commercial fleet and taxies. However, lag in gear shifts and growing competition from electric vehicle hinder the growth of the market to some extent. On the contrary, factors such as increase in adoption in military and utility vehicles, and growth in adoption from the aftermarket segment especially in aging vehicle fleets offer lucrative market growth opportunities.

Growing focus of consumers for increasing fuel efficiency & reducing emissions is one of the major factor driving the growth of the automated manual transmission industry. As fuel prices around the world continue to grow and governments are enforcing stricter emission standards, which resulted in automobile manufacturers to develop drivetrains that are both cost-effective and environmentally friendly. Automated manual transmissions offer a clear advantage in this situation, as they offer the mechanical efficiency of a regular manual gearbox but automate the gear shifting process, thus helping the engine run more efficiently and smoothly. This leads to better fuel economy compared to traditional automatic transmissions like torque converters or dual-clutch systems, which are often more complicated and require more fuel. Moreover, automated manual transmission have lower carbon emissions as compared to manual transmission, making them a smart option in price-sensitive markets. Additionally, as more and more countries are pushing towards sustainable and greener transportation, the demand for automated manual transmission market are anticipated to continue to grow.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On January 2025 Eaton Corporation announced they have expanded their aftermarket portfolio to include Endurant automated manual transmission parts. The new offering expands the existing AMT portfolio of products for Daimler DT12 and Volvo I-Shift transmissions for the North America market. This expanded offering includes genuine remanufactured units, gears, shafts, kits, electronics and components needed to remanufacture or repair the Endurant HD transmission. The company will distribute these parts only to independent aftermarket customers.

- September 2024, ZF Friedrichshafen AG and Foton Motor entered into strategic partnership for the development of hybrid transmission for commercial vehicles for China market. The companies are collaboratively working for the development of new hybrid automated manual transmission system TraXon 2 Hybrid for heavy-duty trucks, while the joint venture will look after manufacturing of the hybrid transmission. The new system can significantly reduce carbon emissions while retaining many of the advantages of traditional ICE technologies.

Segmental analysis

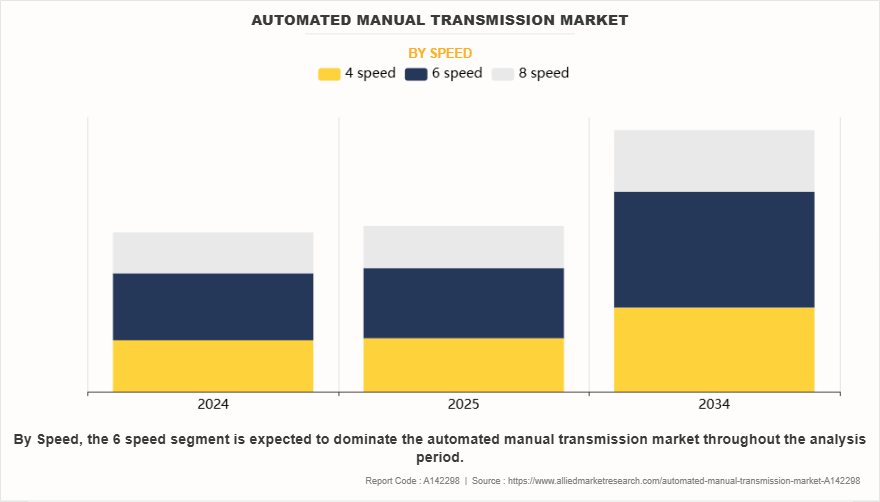

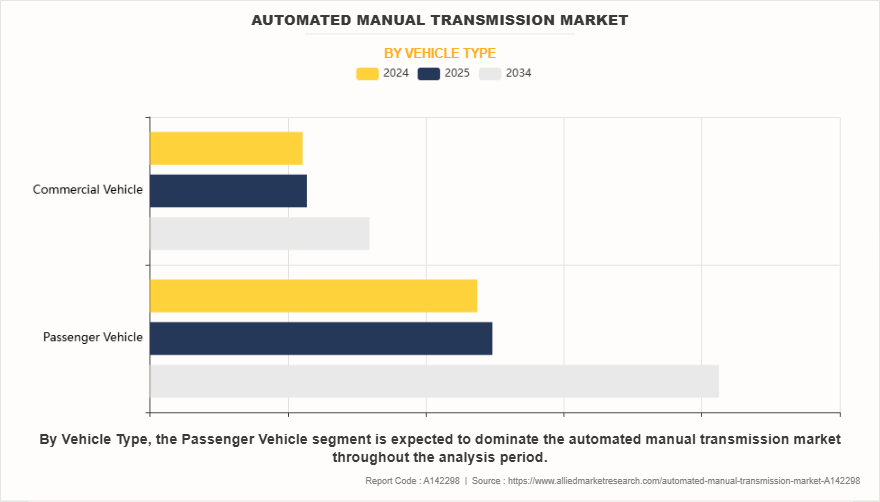

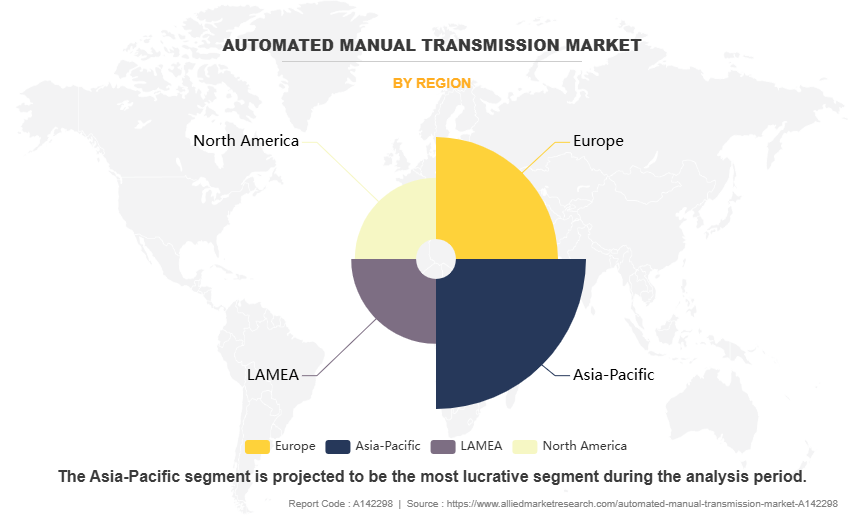

The global automated manual transmission market share is segmented into speed, vehicle type and region. Based on speed, the global market is segregated into 4 speed, 6 speed and 8 speed. On the basis of vehicle type, the market is analyzed into passenger vehicle and commercial vehicle. Region wise, the global market is analyzed into North America, Europe, Asia-Pacific, and LAMEA.

By Speed

By speed, the automated manual transmission market insights is categorized into 4 speed, 6 speed and 8 speed. The 6 speed. segment dominated the automated manual transmission market in 2024.due to their ideal balance between performance, fuel economy, and low manufacturing cost. 6 speed transmission offers better gear ratio coverage compared to 4-speed gearboxes, allowing for smoother acceleration and improved highway fuel efficiency. Additionally, many passenger cars and light commercial vehicles rely on 6-speed gearboxes for their versatility and durability.

By Vehicle Type

By vehicle type, the automated manual transmission market opportunity is categorized into passenger vehicle and commercial vehicle. The passenger vehicle segment dominated the automated manual transmission market in 2024. as it offers cost-efficiency, convenience, and enhanced fuel economy. Automated manual transmissions provide the benefits of automatic transmission but at a lower cost, making them an attractive option in economy and entry-level vehicles. Moreover, in developing regions such as in India and Southeast Asia, AMTs offer a better solution by providing easier driving without the higher cost of conventional automatics.

By Region

By region the global automated manual transmission market is categorized into North America, Europe, Asia-Pacific, Europe and LAMEA. The Asia-Pacific region dominated the automated manual transmission market in 2024, owing to driven by the need for fuel efficiency, ease of driving in congested urban environments, and cost-effectiveness compared to traditional automatic transmissions. AMT offers better fuel efficiency when compared to manual transmission, making it an attractive option for both entry-level and mid-range vehicles. Likewise, rising urbanization, increasing disposable income, and the growing popularity of compact cars are also fueling the market demand.

Ease of driving in congested area

Automated manual transmission offers significant ease of driving in congested areas by eliminating the constant need for clutch engagement and manual gear shifting. This is especially beneficial in cities around the world with heavy traffic, such as Los Angeles, London, São Paulo, or Bangkok, where average driving speeds can drop below 15–20 km/h during peak hours. In such conditions, frequent stop and clutch movement can make driving a manual car physically tiring. Automated manual transmissions automate the clutch and gear-shifting movements, thus allowing drivers to simply operate the brake and accelerator pedals dramatically reducing fatigue during long haul commutes.

For instance, in cities like São Paulo, a daily commuter may experience over 150 gear changes in a single hour of rush-hour traffic. Automated manual transmission helps in automatically shifting gear, thus easing the burden on the driver. Vehicles equipped with AMT also often feature a creep mode, where car moves slowly forward when the brake is released, which is ideal in slow moving traffic, or while parking. Globally, the adoption of AMT technology in popular urban cities is growing. To tackle the growing demand for AMT, automakers are increasingly offering car variants equipped with automated manual transmission such as the Dacia Sandero in Europe and Suzuki Swift in Asia-Pacific markets which are witnessing high sales growth. The growing demand for convenience, affordability, and fuel efficiency will continue to drive the demand for automated manual transmission during the forecast period.

Growing adoption in commercial fleet and taxis

Businesses involved in ride-hailing, delivery, taxi services, or public transport, demand reliable, fuel efficient, and ease of operation from vehicles. Automated manual transmissions offer a better alternative when compared to traditional transmission. In urban centers such as New York, London, and Singapore, more and more taxi and fleet operators are opting for vehicles with automated manual transmission gearboxes to help reduce driver fatigue and provide a smoother, more comfortable ride for passengers. In comparison to manual gearboxes, automated systems do gear shifting automatically, resulting in less driving efforts especially during long haul routes or in heavy traffic.

For instance, online taxis platforms such as Uber and Bolt are opting for AMT equipped cars specifically to avoid the constant strain of clutch and improve vehicle life. Similarly, in emerging economies across Latin America and Southeast Asia, logistics companies and food delivery service providers are increasingly using AMT-equipped vehicles in their fleets as AMT vehicles are easier to train for new drivers, and also help reduce operating errors, and boost overall fuel efficiency. Moreover, automated transmissions reduce the wear and tear due to poor manual shifting, thus helping in long-term savings for fleet operators. Furthermore, rapid urban growth and a surge in demand for ride-hailing and last-mile delivery services will continue to drive the market for automated manual transmission industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automated manual transmission market analysis from 2024 to 2034 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automated manual transmission market trends, key players, market segments, application areas, and market growth strategies.

Automated Manual Transmission Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 28.6 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By Speed |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Magna International Inc., Shaanxi Fast Auto Drive Group Co., Ltd, AB Volvo, AISIN CORPORATION, Mack Trucks, Hyundai Transys, Detroit Diesel Corporation, BorgWarner Inc., ZF Friedrichshafen AG, Eaton Corporation PLC |

Increased adoption in commercial vehicles are the upcoming trends in the automated manual transmission industry.

The 6 speed segment is the leading segment of the automated manual transmission market.

Asia-Pacific is the largest regional market for automated manual transmissions market.

The automated manual transmission market was valued at $17.4 billion in 2024 and is estimated to reach $28.5 billion by 2034, exhibiting a CAGR of 5.2% from 2025 to 2034.

ZF Friedrichshafen AG, Aisin Corporation, Eaton Corporation, BorgWarner Inc., Hyundai Transys are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...