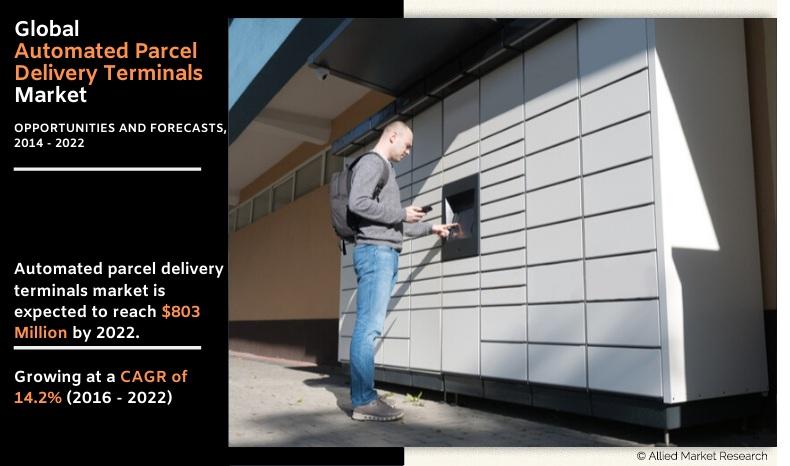

Automated Parcel Delivery Terminals Market Outlook-2022

Global automated parcel delivery terminals market size is projected to reach $803 million by 2022, growing at a CAGR of 14.2% from 2016 to 2022. Automated parcel delivery terminals or parcel kiosks/automated lockers are standalone units that are installed in populous places including shopping malls, walkways, grocery outlets, and railway stations. These terminals enable the parcel recipient to receive and/or return their orders 24/7 as per their convenience.

The automated parcel delivery terminals market offers promising opportunities to the industry. Europe has witnessed the highest adoption of these terminals, followed by Asia-Pacific, North America, and LAMEA. In addition, many market players including Smartbox Ecommerce Solutions Pvt. Ltd., ByBox Holdings Ltd., Neopost group, and others have adopted innovative techniques to provide advanced and pioneering offerings.

The global automated parcel delivery terminals market is primarily driven by the booming e-commerce business & internet penetration. Further, growth in cross-border deliveries and decline in operating costs largely support the market growth. However, the market witnesses hindrance in its overall growth potential from factors such as susceptibility to burglary, emergence of other competitive delivery technologies, and need for a large installation space for deployment. Growth in emerging economies such as China and India is highly opportunistic for the market.

Some of the significant players in the automated parcel delivery terminals market that are profiled in the report are Smartbox Ecommerce Solutions Pvt. Ltd., ByBox Holdings Ltd., Neopost group, Winnsen Industry Co., Ltd., InPost S.A., TZ Ltd., ENGY Company, LL OPTIC (Loginpost), Cleveron Ltd., and Keba AG.

The automated parcel delivery terminals market is segmented on the basis of deployment type, end user, and geography. Indoor and outdoor terminals are the deployment types analyzed in the report. In 2015, indoor terminal segment accounted for the maximum revenue share among the deployment types of market. Further, the various end users included are retail, shipping & logistics, government organizations, and others (educational institutions, large enterprises). The retail sector dominated the global market in 2015 owing to the massive growth in the e-retail sector.

Geographically, the global automated parcel delivery terminals market is segmented into North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region. The European region dominates the global market.

Top Impacting Factors in Automated Parcel Delivery Terminals Market

According to the impact analysis of the various factors impacting the global automated parcel delivery terminals market, booming e-commerce business & internet penetration and growth in emerging economies are projected to have a positive influence on the market during the forecast period. In addition, growth in cross-border deliveries is expected to boost the market growth. However, the impact of factors such as susceptibility to burglary and need for large installation space for deployment are expected to diminish over the forecast period. The following illustration determines the impact of factors on the market growth.

Booming E-commerce Business and Internet Penetration

The e-commerce industry is growing at a significant rate of around 20% per year and is projected to outpace the growth of the brick-and-mortar industry over the forecast period. The growth in e-commerce has led to direct access of the manufacturers to customers. In addition, manufacturers have engaged into strategic tie-ups with key e-commerce players for increased automated parcel delivery terminals market share and growth rate. Furthermore, the increasing rate of internet penetration across the globe has supported the automated parcel delivery terminals market growth to a considerable extent.

Parcels Susceptible to Burglary

Indoor terminals are connected to in-house security that prevents the terminals from burglars. However, the parcels within the outdoor terminal are more prone to burglary as compared to the indoor terminals. There is an increased risk for unethical access of the outdoor terminals, specifically at odd hours. This could potentially harm the terminal and cause an expensive damage to the equipment. According to a statistics on burglary, UK witnesses burglary every 40 seconds. Apart from burglary, identity theft is one of the fastest growing crimes particularly in the U.S., Canada, and the UK. Hence, susceptibility to burglary is one of the major restraints impacting the global automated parcel delivery terminals market.

Growth in Emerging Economies

The dominance of automated parcel delivery terminals in the European market and in countries such as Australia, Japan, and Singapore has elevated the growth avenue for the global market. However, the increasing adoption of automated parcel delivery terminals amongst logistics companies, retailers, and government organizations in emerging countries such as China, India, African countries, and other economies is a major opportunity for the market growth. Moreover, new entrants from the emerging economies are probable to mark their presence in the near future.

Covid-19 Impacts on Automated Parcel Delivery Terminals Market-

Several automated parcel delivery terminal manufacturers across the globe have halted their production activities due to disrupted supply chain amid lockdown due to Covid-19 pandemic.

The growth of automated parcel delivery terminal market is expected to decline during the Covid-19 pandemic due to restriction on cross border mobility among the states amid lockdown owing to which the parcels are not likely to be delivered to their recipients.

Key Benefits for Automated Parcel Delivery Terminals Market:

This study provides the analytical depiction of the global automated parcel delivery terminals market along with the trends and future estimations to depict the imminent investment pockets.

The overall market potential is determined to understand the profitable trends to gain stronger coverage in the market.

The report presents information regarding key drivers, restraints, and opportunities along with detailed impact analyses.

Quantitative analysis of the market for the period of 2014-2022 is provided to determine its financial competency.

Porters five forces analysis of the industry illustrates the potency of buyers and suppliers in the automated parcel delivery terminals industry.

Automated Parcel Delivery Terminals Market Report Highlights

| Aspects | Details |

| By Deployment Type |

|

| By End User |

|

| By Geography |

|

| Key Market Players | TZ LTD., KEBA AG, SMARTBOX ECOMMERCE SOLUTIONS PVT. LTD., INPOST S.A., WINNSEN INDUSTRY CO., LTD., BYBOX HOLDINGS LTD., NEOPOST GROUP, ENGY COMPANY, LL OPTIC (LOGINPOST), CLEVERON LTD. |

Analyst Review

Several industries such as retail, shipping & logistics, and others have inclined towards the adoption of automated parcel delivery terminals. This is undertaken in order to reap the benefits of the automated terminals such as reduced human intervention, 24X7 access, reduced operational costs, and operability on national holidays & under severe weather conditions. Further, the growth in e-commerce industry has created a major growth avenue for the global automated parcel delivery terminals market.

Automated parcel delivery terminals are increasingly deployed in Europe, followed by Asia-Pacific, North America, and LAMEA. The early adoption of automated parcel delivery terminals among European retailers, shipping & logistics companies, and government organizations is a key parameter leading to the dominance of the European automated parcel delivery terminals market.

The global automated parcel delivery terminals market has witnessed immense growth in the recent years owing to varied factors, such as growth in cross-border deliveries, booming e-commerce business & internet penetration, and decline in operating costs. In addition, the growth in emerging economies such as India has further propelled the automated parcel delivery terminals market growth.

Smartbox Ecommerce Solutions Pvt. Ltd., ByBox Holdings Ltd., Neopost group, Winnsen Industry Co., Ltd., InPost S.A., TZ Ltd., ENGY Company, LL OPTIC (Loginpost), Cleveron Ltd., and Keba AG are some of the leading market players that occupy a prominent market share in the automated parcel delivery terminals industry.

Loading Table Of Content...