Automatic Boarding Gates Market Research, 2032

The Global Automatic Boarding Gates Market was valued at $85.1 million in 2023, and is projected to reach $132.8 million by 2032, growing at a CAGR of 5.1% from 2024 to 2032.

[INFOIMAGE]

Market Introduction and Definition

Automatic boarding gates are advanced security systems installed at airport boarding areas to streamline passenger processing and enhance security. These gates utilize various technologies such as biometric identification, facial recognition, and QR code scanning to verify passengers' identities and boarding passes automatically. By automating the boarding process, these gates reduce the need for manual checks by security personnel, thereby expediting passenger flow and minimizing wait times.

Key benefits of automatic boarding gates include improved operational efficiency, enhanced security, and a better passenger experience. They provide real-time data to operators about passenger movements, allowing for more effective monitoring and management of boarding procedures. Additionally, these gates help in complying with stringent security regulations by accurately profiling and screening passengers to prevent unauthorized access and potential security threats.

Key Takeaways

The automatic boarding gates market oveview study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automatic boarding gates industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Automatic Boarding Gates Market Dynamics

The automatic boarding gates market growth is driven by factors such as the increasing adoption of contactless technologies, enhanced security requirements, and the need for efficient passenger flow management. The growing demand for automation in airports and public transport hubs, coupled with advancements in biometric and AI technologies, further fuels market growth. However, high initial investment costs and technical challenges, such as ensuring system reliability and integration with existing infrastructure, act as significant restraints. In addition, privacy concerns related to biometric data use pose challenges for widespread adoption.

Future opportunities in the market include expanding the use of automatic gates to other sectors, such as sports stadiums and bus stations, and leveraging AI and machine learning for enhanced security and operational efficiency. As urbanization and air travel demand continue to rise, the market is poised for substantial growth, driven by the need for improved passenger experience and safety measures.

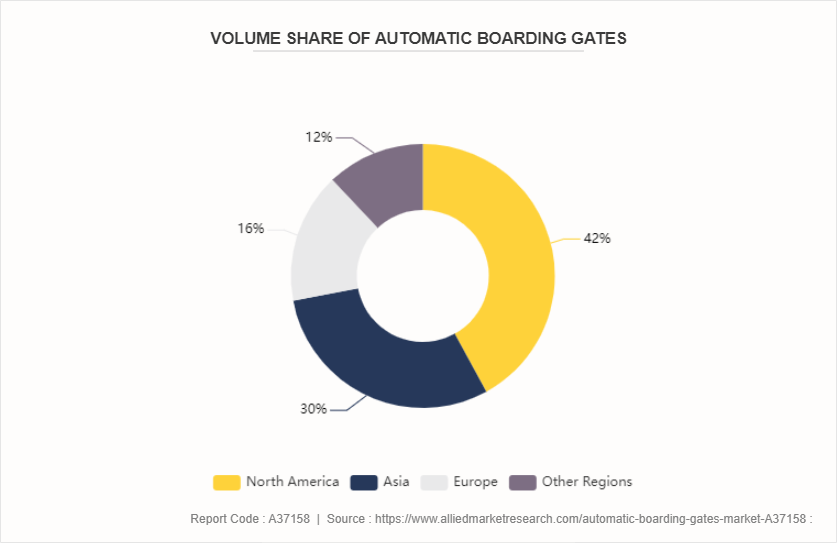

Volume Analysis of Global Automatic Boarding Gates Market

The deployment of over 3, 600 automated border control gates highlights a significant global trend towards enhancing border security and efficiency. North America's share of over 42% indicates a robust adoption of these technologies, likely driven by stringent border control policies and high air traffic volume. Asia's 30% share reflects its growing investment in modernizing travel infrastructure, catering to increasing passenger numbers. Europe's slightly over 16% share suggests a more measured adoption pace, potentially influenced by varying regulatory frameworks and logistical considerations. Overall, the distribution underscores a global shift towards automated solutions in border management, aimed at improving security and passenger experience.

Automatic Boarding Gates Market Segmentation

The automatic boarding gates market forecast is segmented into type, technology, end user, and region. On the basis of type, the market is divided into single unit gates and multiple unit gates. As per technology, the market is classified into biometrics, bar code reader, electronic ticketing, computer vision, RFID, others (boarding pass reader, document reader) . On the basis of end user, the market is classified into airports, railways, bus terminals and sports stadiums.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Automatic Boarding Gates Market Segment Outlook

Based on type, the multiple unit gates held the highest market share in 2023, accounting for three-fifths of automatic boarding gates market size. Multiple unit gates are designed to handle a larger volume of passengers simultaneously, making them more suitable for high-traffic areas such as major international airports. This increased capacity and efficiency drive their higher adoption rates, contributing to their dominance in the market.

Based on technology, the biometric technology segment held the highest market share in 2023, accounting for nearly half of the automatic boarding gates market share. Biometric systems, including facial recognition, iris scanning, and fingerprint recognition, are increasingly adopted due to their ability to enhance security and streamline passenger processing.

Based on end user, the airports segment held the highest market share in 2023, accounting for nearly three-fourths of the automatic boarding gates market share. This dominance is driven by the high passenger volumes and stringent security requirements at airports, which make the adoption of automated boarding gates highly beneficial for efficiency and safety.

Regional/Country Market Outlook

The European automatic boarding gates market is driven by stringent security regulations, technological advancements, and the presence of major industry players. Key countries leading this market include Germany, France, and the UK. For instance, Germany's Frankfurt Airport and France's Charles de Gaulle Airport have implemented advanced biometric boarding gates to enhance passenger flow and security. Companies like Gunnebo, Boon Edam, and Materna IPS are prominent suppliers in the region. Gunnebo offers solutions such as biometric and RFID-enabled gates that streamline the boarding process while ensuring high security standards. Boon Edam focuses on speed gates and turnstiles, catering to the needs of high-traffic areas like airports and train stations. Materna IPS specializes in self-service solutions, including automated boarding gates, enhancing the passenger experience through efficient and secure boarding processes. These advancements not only improve operational efficiency but also significantly enhance passenger convenience and safety, making Europe a leader in the adoption of automated boarding technologies.

In October 2023, Munich Airport and Dabico Airport Solutions Germany signed a letter of intent to develop fully automated passenger boarding bridges. They plan to start by determining the requirements for autonomous operation and then develop a pilot system for Munich Airport.

In June 2024, Sofia Airport in Bulgaria introduced a new automated boarding pass checking system at Terminal 2. This system includes the latest generation of IATA-compliant electronic gates and software for connecting to airport and airline systems. It is designed to reduce queues and increase security levels during the check-in process. The capacity is 10-12 passengers per gate per minute, and the system is particularly beneficial for people with reduced mobility.

As of May 2024, Singapore has implemented a new policy allowing all foreign nationals to use the automated lanes at Changi Airport without prior registration. This initiative is expected to cut immigration clearance times by approximately 40%.

Competitive Landscape

The major players operating in the automatic boarding gates market include SITA, Gunnebo AB, Boon Edam, Magnetic Autocontrol, NEC Corporation, Collins Aerospace (Raytheon Technologies Corporation) , Idemia, Kaba (Dormakaba Holding AG) , Vision-Box, IER Blue Solutions.

Other players include Emaratech, Saima Sicurezza, ZKTeco, Smiths Detection and others.

Recent Key Strategies and Developments

In May 2024, SITA, the global leader in technology solutions for the air transport industry, announced its acquisition of Materna IPS, a leader in passenger handling for airports and airlines. The acquisition will enhance SITA’s leadership in passenger processing and is part of a fast-growth strategy for the years ahead.

In February 2024, at the Passenger Terminal Expo 2024, Gunnebo launched a security solutions, including the BoardSec, an automated self-boarding eGate designed to accelerate the boarding process. This is alongside the ImmSec, which maximizes resources by efficiently verifying passengers at border control.

In November 2022, NEC developed a gateless access control system that combines their globally recognized face recognition technology with person re-identification technology. This system allows for fast and reliable entry control without the need for physical gates, which often causes congestion.

In February 2023, Bosch Rexroth AG inaugurated a cutting-edge Hydraulics Training Center aimed at catering to the technical education requirements within the fluid power industry. This advanced facility is designed to facilitate skills enhancement for newcomers and experienced professionals alike, addressing the diverse learning needs of individuals across various stages of their careers in the industry.

Industry Trends

In July 2023, Frankfurt Airport expanded its EasyPASS system to include registered third-country nationals. As of July 3rd, those holding a German residence permit and being older than 12 years can use the partially automated EasyPASS facilities for entry and exit. This expansion aims to reduce waiting times and streamline the process for all German residents.

In January 2023, Paris Charles De Gaulle Airport introduced a new Schengen border control system that allows American travelers with biometric passports to experience expedited entry and exit through France. This system is designed to make international travel less cumbersome and is also available to citizens from the UK, Canada, Japan, Australia, New Zealand, and South Korea, provided they are over 18 years old.

In October 2021, UK airports, including Heathrow, Gatwick, and Edinburgh, experienced delays due to faults with self-service passport gates. This issue occurred for the second time in weeks, causing significant queues and inconvenience for passengers.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automatic boarding gates market analysis from 2024 to 2032 to identify the prevailing automatic boarding gates market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automatic boarding gates market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automatic boarding gates market trends, key players, market segments, application areas, and market growth strategies.

Automatic Boarding Gates Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 132.8 Million |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Gunnebo AB, Collins Aerospace (Raytheon Technologies Corporation), IDEMIA, SITA, Vision-Box, IER Blue Solutions, NEC Corporation, Magnetic Autocontrol, Boon Edam, Kaba (Dormakaba Holding AG) |

integration of advanced biometric technologies and growing demand for contactless and touchless solutions are the upcoming trends of Automatic Boarding Gates Market in the globe.

The leading application of the automatic boarding gates market is airport passenger boarding.

The largest regional market for automatic boarding gates is Asia-Pacific.

The automatic boarding gates market was valued at $85.12 million in 2023.

SITA, Gunnebo AB, Boon Edam, Magnetic Autocontrol, NEC Corporation, Collins Aerospace (Raytheon Technologies Corporation), Idemia, Kaba (Dormakaba Holding AG), Vision-Box, IER Blue Solutions are the top companies to hold the market share in Automatic Boarding Gates.

Loading Table Of Content...