Automation and Controls Market Research, 2030

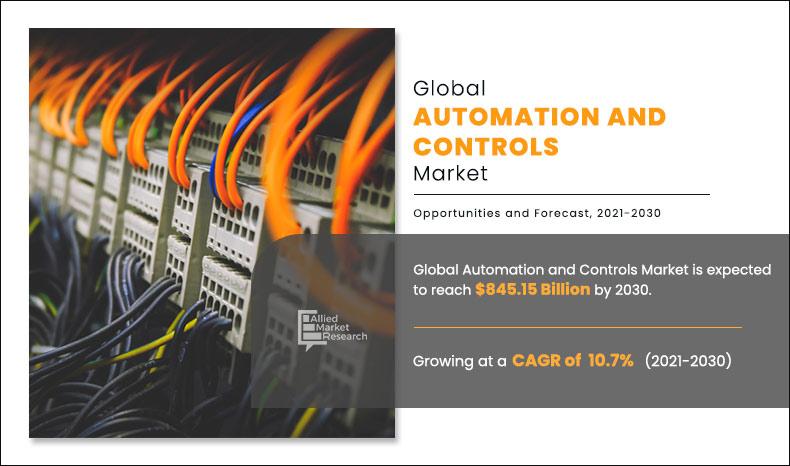

The global automation and controls market size was valued at $329.62 billion in 2020 and is projected to reach $845.15 billion by 2030, registering a CAGR of 10.7% from 2021 to 2030.

Automation and control are advanced aspects of modern manufacturing and utility supply chains that are meant to control and monitor industrial operations to reduce human interference. Further, motion control systems in the manufacturing sector is designed with a primary focus to design and develop automation in the manufacturing process. In addition, a wide range of process variables, such as pressure, distance, flow, temperature, and liquid levels, can be detected simultaneously in real-time in industrial automatic control. In addition, the industrial control systems in automation are an essential part of the automation system used to ensure the process variables follow the set points.

Through Industry Internet of Things technology, the Industry 4.0 solutions connect, control, and monitor an industrial network of applications such as machines, robots, gadgets, devices, and other cloud computing solutions in real-time.

Furthermore, the increased use of edge computing and artificial intelligence-based automation solutions is anticipated to propel automation and controls market growth during the forecast period.

The automation and controls market share is expected to witness notable growth during the forecast period, owing to a surge in demand for industrial automation in manufacturing sectors. Furthermore, government regulations in support to industrial automation have driven the growth of the market. Moreover, the rise in organizations focused on worker safety is expected to propel the growth of the automation and controls market.

By Product

SCADA segment influence the market in 2020, and expected to follow the same in future.

However, the high implementation cost associated with the installation restrains the market growth. On the contrary, growth in industrial robotics paired with the adoption of Industry 4.0 across various industries are expected to provide lucrative opportunities for the growth of the automation and controls market during the forecast period.

By Application

Safety & Security segment hold domination position in 2020.

Segment Overview

The global automation and controls market is segmented into product, application, end-user, and region. Based on product, the market is bifurcated into PLC, SCADA, PAC, DDCS, HMI, and MES. The SCADA segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period. The application segment covered in the study includes lighting, HVAC, safety & security, and others. The safety & security segment was the highest revenue contributor in 2020 and is anticipated to garner significant market share during the forecast period. By end use, the market is categorized into residential, commercial (hospitality, enterprise, and retail), and industrial (oil & gas, mining & metals, automotive & transportation, manufacturing, electrical & electronics, aerospace & defense, and others). The industrial segment acquired the largest share in 2020 and is expected to grow at a high CAGR from 2021 to 2030.

Region-wise, the automation and controls market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and rest of the Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Europe, specifically Germany, remains a significant participant in the global Automation and Controls market. Major organizations and government institutions in the country are intensely putting resources into the technology.

By End Use

Industrial segment generated the highest revenue in 2020.

Top Impacting Factors

Significant factors that impact the growth of the global automation and controls industry include a surge in demand for AI-based chatbot solutions and an increase in demand for artificial intelligence-powered customer support services. However, the absence of knowledge about conversational artificial intelligence-powered solutions is acting as a prime barrier to early adoption, which hampers the growth of the market. On the contrary, the rise in the deployment of omnichannel methods coupled with growth in client engagement through social media platforms is expected to offer potential growth opportunities for the automation and controls market during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major automation and controls market players such as ABB Group, Bosch Rexroth AG, Emerson Electric Co., Fanuc Corporation, General Electric Company, Honeywell International Inc., KUK AG, Rockwell Automation, Schneider Electric SE, and Siemens AG are provided in this report. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration, to enhance their market penetration.

By Region

Europe segment garner significant market share in 2020.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the automation and controls market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall automation and controls market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current automation and controls market forecast is quantitatively analyzed from 2021 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart display.

- The report includes the market share of key vendors and automation and controls market trends.

Automation and Controls Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By end use |

|

| By Region |

|

| Key Market Players | SIEMENS AG, Emerson Electric Co., KuKa AG, Honeywell International Inc., ABB Group, Fanuc Corporation, Bosch Rexroth AG, Rockwell Automation, Schneider Electric, General Electric Co. |

Analyst Review

Automation & controls technology is a set of industrial system specifically designed control and monitor processes automatically so that human interventions can be minimized. Further, automation & controls technology can ensure high-quality production by preventing faculty batches due to human errors. In addition, rise in demand for artificial intelligence-based robotics solutions across manufacturing and industrial sector sure to Industry 4.0 initiative is expected to offer profitable opportunities for the automation and controls market,

The global automation & controls market is highly competitive, owing to the strong presence of existing vendors. Automation & controls vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Rise in demand for Internet of Things solutions across industrial and commercial sector globally is driving the need for next generation to enhance automation & controls solutions. Moreover, prime economics, such as the U.S., China, Germany, and Japan, plan to developing and deploying next-generation automation & controls solutions across various sectors such as automotive, manufacturing, healthcare, and hospitality. For instance, according to a report by the International Federation of Robotics (IFR) over 310,700 industrial robots are operating in various factories in the U.S. U.S. is the largest industrial robot user in North America with a share of 84% of the region’s total installations, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed geographical regions, North America exhibits the highest adoption of automation & controls and has been experiencing massive expansion of the market. On the other hand, Asia-Pacific is expected to grow at a faster pace, predicting lucrative growth due to emerging countries such as China, Japan, and South Korea investing in these technologies. Regions such as Middle East and Africa are expected to offer in new opportunities for the growth of the automation & controls market in the future.

Globally, various key players and government agencies are investing in automation & controls to make them compatible with various industrial platforms. For instance, On August 17, 2021, the Volkswagen, a leading automaker announced their plan to launch a digital transformation in its manufacturing base in the US and Mexico, aiming to get to 2025 with a 30 percent increase in productivity. In addition, on October 25, 2021, French President Emmanuel Macron announced on Monday an investment package worth $ 929 million in industrial robotics. All these developments across automation & controls showcase lucrative growth opportunities for the market growth.

The key players profiled in the report include ABB Group, Bosch Rexroth AG, Emerson Electric Co., Fanuc Corporation, General Electric Company, Honeywell International Inc., KUK AG, Rockwell Automation, Schneider Electric SE, Siemens AG are provided in this report.

The automation and controls market is estimated to grow at a CAGR of 10.7% from 2021 to 2030.

The automation and controls market is projected to reach $845.15 billion by 2030.

To get the latest version of sample report

The increased use of edge computing and artificial intelligence-based automation solutions is anticipated to propel.

The key players profiled in the report include ABB Group, Bosch Rexroth AG, Emerson Electric Co., Fanuc Corporation, General Electric Company, and many more.

On the basis of top growing big corporations, we select top 10 players.

The automation and controls market is segmented on the basis of product, application, end use, and region.

The key growth strategies of automation and controls market players include product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration.

Lighting segment would grow at a highest CAGR of 12.5% during the forecast period.

Europe region will dominate the market by the end of 2030.

Loading Table Of Content...