Automobile Antenna Market Research, 2033

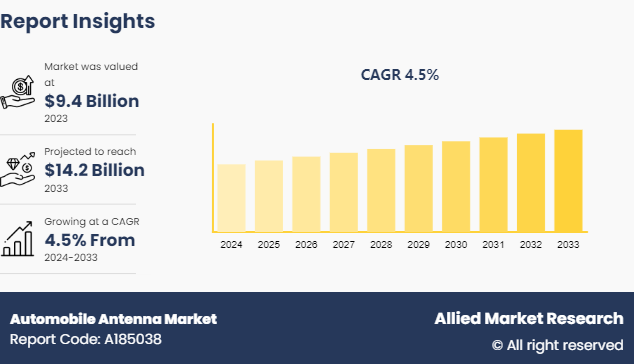

The global automobile antenna market was valued at $9.4 billion in 2023, and is projected to reach $14.2 Billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033.

Market Introduction and Definition

The automobile antenna market refers to the industry involved in the production, distribution, and sale of antennas specifically designed for vehicles. These antennas are crucial components of automotive communication systems, providing reception for radio, GPS, satellite, and other wireless signals. The market encompasses a wide range of antenna types, including traditional whip antennas, shark fin antennas, embedded antennas, and more. These antennas serve various purposes, such as radio broadcasting, navigation, satellite communication, and connectivity for infotainment systems.

Factors influencing the automobile antenna industry include advancements in technology, such as the integration of antennas for emerging communication standards such as 5G, as well as trends in automotive design that prioritize aesthetics and aerodynamics. In addition, the increasing adoption of electric vehicles and autonomous driving technologies may also impact the demand for antennas with specific performance requirements.

Key Takeaways

The automobile antennas market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automobile antenna industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

December 2023, LG's unveiling of a transparent automotive antenna at CES 2024 signifies a groundbreaking development in automotive antenna technology. This innovative antenna is designed to be integrated seamlessly into vehicle windows or surfaces, offering several advantages over traditional antennas. By leveraging transparent materials and advanced engineering, LG aims to address the demand for antennas that blend seamlessly with vehicle aesthetics while maintaining optimal performance.

In September 2023, Chelton launched its new tactical vehicle antennas with novel detachable interface which allows for easy removal and replacement of the antenna, providing a modular solution that enhances flexibility and adaptability in tactical vehicle operations. This modularity enables rapid reconfiguration of the antenna system to meet changing mission requirements or to accommodate different communication protocols and frequencies.

Key Market Dynamics

The rise in demand for connectivity is a significant driver of the automobile antenna market. With the increase in integration of advanced infotainment systems, navigation systems, and telematics in vehicles, there's a rise in demand for antennas that can support various connectivity options such as GPS, Wi-Fi, Bluetooth, and cellular networks. Furthermore, rise in adoption of autonomous and electric vehicles, and technological advancement have driven the demand for the automobile antenna market size.

However, lack of infrastructure for smart automotive antennas has hampered the growth of the automobile antenna market share. Smart automotive antennas require robust infrastructure to support connectivity standards such as 5G, which enable advanced features such as vehicle-to-vehicle (V2V) communication, vehicle-to-infrastructure (V2I) communication, and high-speed internet access. Without adequate infrastructure, the full potential of these antennas cannot be realized, limiting their adoption. Moreover, cost constraint and regulatory challenges are major factors that hamper the growth of the automobile antenna market size. On the contrary, widescale technological advances in the automotive antenna market create ample opportunities. Advancements in materials science, such as metamaterials and nanotechnology, enable the development of antennas with smaller form factors, higher efficiency, and broader bandwidth. These innovative designs open opportunities for antenna manufacturers to create compact, high-performance antennas suitable for integration into various vehicle models.

Vehicle Production and Sales Statistics of Global Automobile Antenna Market

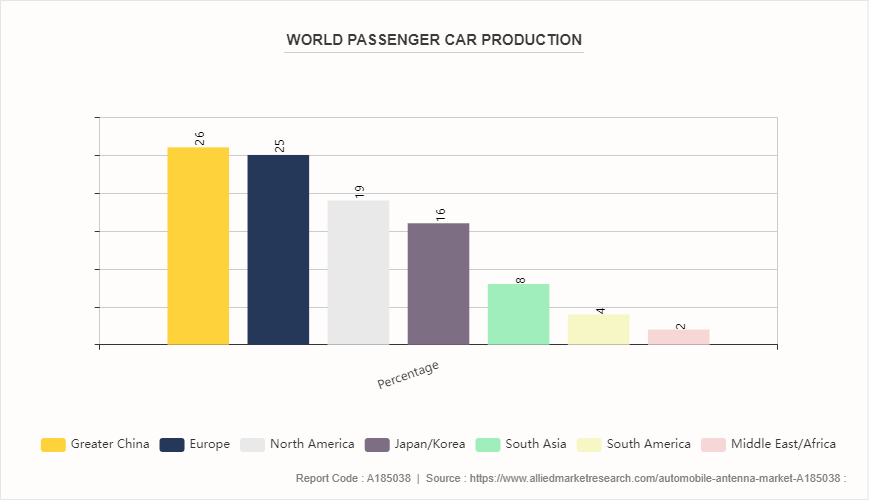

The global automobile antenna market's performance closely aligns with trends in vehicle production and sales worldwide. As vehicle manufacturers introduce new models and upgrade existing ones to integrate advanced connectivity features, the demand for automotive antennas rises. The potential size of the antenna market is indicated by vehicle production data, which also serves as an indicator for the state of the sector. Moreover, sales figures reflect consumer adoption of vehicles equipped with advanced infotainment systems, navigation technology, and connectivity features, all of which rely on robust antenna systems. A surge in vehicle sales often translates to increased demand for antennas, particularly as consumers seek seamless connectivity experiences. Therefore, vehicle production and sales statistics serve as crucial indicators for assessing the growth trajectory and opportunities within the global automobile antenna market industry.

The production and sales statistics of vehicles play a pivotal role in shaping the dynamics of the global automobile antenna market growth. The production volume of vehicles directly influences the demand for automotive antennas since each vehicle typically requires one or more antennas to facilitate communication, navigation, and connectivity features. As vehicle manufacturers introduce new models or upgrade existing ones to incorporate advanced technologies such as infotainment systems, telematics, and autonomous driving capabilities, the demand for antennas that support these features increases correspondingly.

Market Segmentation

The automobile antenna market is segmented into antenna type, location, vehicle type, sales channel, antenna technology, and region. On the basis of antenna type, the market is divided into on-glass antenna, shark fin antenna, monopole antenna, and others. As per location, the market is segregated into front windshield, backlit, sidelit, sunroof, roof module, and others. On the basis of vehicle type, the market is bifurcated into passenger vehicles, and commercial vehicles. On the basis of sales channel, the market is bifurcated into OEM, and aftermarket. By antenna technology, the market is divided into broadcasting antenna, communication antenna, and intelligent antenna. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, particularly the U.S., is known for its early adoption of advanced automotive technologies. The region has a robust automotive industry with a strong focus on innovation and technological advancements. As a result, vehicles in North America are often equipped with sophisticated infotainment systems, telematics, and connectivity features, all of which rely on high-quality antenna systems. North America has one of the highest vehicle ownership rates globally, with a large portion of the population relying on personal vehicles for transportation. This high level of vehicle ownership creates a significant market for automotive antennas, as each vehicle requires antennas for various purposes such as AM/FM radio reception, GPS navigation, satellite radio, and wireless communication.

Asia-Pacific is experiencing rapid economic growth, leading to an expansion of the middle class and increased disposable income. This has fueled the demand for automobiles across the region, driving the need for automotive antennas. Asia-Pacific is a hub for automotive manufacturing, with countries such as China, Japan, South Korea, and India being major contributors to global vehicle production. The region's burgeoning automotive industry generates substantial demand for automotive antennas to equip vehicles with connectivity and communication features.

In March 2023, USI's planned acquisition to enhance automotive antenna capability signifies a strategic move to strengthen its position in the automotive electronics market. By acquiring a company specializing in automotive antennas or relevant technology, USI aims to expand its product portfolio and technological capabilities in this sector.

In December 2023, LG's unveiling of a transparent automotive antenna at CES 2024 signified a groundbreaking development in automotive antenna technology. This innovative antenna is designed to be integrated seamlessly into vehicle windows or surfaces, offering several advantages over traditional antennas. By leveraging transparent materials and advanced engineering, LG aims to address the demand for antennas that blend seamlessly with vehicle aesthetics while maintaining optimal performance.

In September 2023, Chelton launched its new tactical vehicle antennas with novel detachable interface which allows for easy removal and replacement of the antenna, providing a modular solution that enhances flexibility and adaptability in tactical vehicle operations. This modularity enables rapid reconfiguration of the antenna system to meet changing mission requirements or to accommodate different communication protocols and frequencies.

In December 2022, Syntronic developed a state-of-the-art test system for a market-leading vehicle antenna manufacturer renowned for its cutting-edge expertise in antennas designed for connected and self-driving vehicles.

Competitive Landscape

The report analyzes the profiles of key players operating in the automobile antenna market such as Laird Connectivity, Harada Industry Co., Ltd., Kathrein SE, TE Connectivity, Hirschmann Car Communication, Yokowo Co., Ltd., Amphenol Corporation, Fiamm, Schaffner Holding AG, and Shenzhen Sunway Communication Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the automobile antenna market opportunity.

Industry Trends

In December 2021, Molex acquired the core technology portfolio and IP rights of Keyssa Inc. to cater to the rise in demand for high-speed, broad-to-broad contactless connectivity.

In September 2021, Ace Technologies Corp. announced a fully automated production line for shark fin antennas at its Nom Dong Campus in South Korea.

In September 2021, TE connectivity signed a definitive agreement to acquire the antenna business of laird connectivity.

In March 2021, Kathrein Solutions introduced a new item, the RRU 1400 reader, which was added to the IoT line-up of the business. The RRU 1400 makes it simple to employ IoT applications that require great performance and reliability.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automobile antenna market segments, current trends, estimations, and dynamics of the automobile antenna market analysis from 2022 to 2032 to identify the prevailing automobile antenna market forecast.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automobile antenna Market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automobile antenna market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automobile antenna market trends, key players, market segments, application areas, and market growth strategies.

Automobile Antenna Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.2 Billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 488 |

| By Antenna Type |

|

| By Location |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Kathrein SE, Laird Connectivity Corporation., Shenzhen Sunway Communication Co., Ltd, hirschmann car communication gmbh, Harada Industry Co., Ltd., Schaffner Holding AG, TE Connectivity, Amphenol Corporation., fiamm, Yokowo Co., Ltd. |

Upcoming trends in the automobile antenna market include the integration of advanced multi-band and smart antennas, increased use of 5G and connected car technologies, and the development of compact, high-performance antennas to support autonomous driving and enhanced infotainment systems.

The leading application of the automobile antenna market is for vehicle communication systems, including GPS navigation, radio, and cellular connectivity.

North America is the largest regional market fin the Automobile Antenna Market

$14.2 billion is the estimated industry size of the Automobile Antenna Market

Laird Connectivity, Harada Industry Co., Ltd., Kathrein SE, TE Connectivity, Hirschmann Car Communication, Yokowo Co., Ltd., Amphenol Corporation, Fiamm, Schaffner Holding AG, and Shenzhen Sunway Communication Co., Ltd.

Loading Table Of Content...