3D Printing Technology in Automotive Industry 2022-2030:

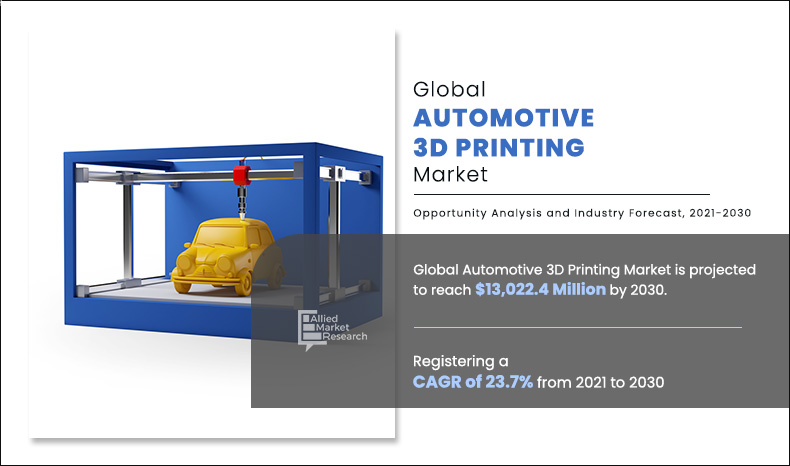

The global automotive 3D printing market was valued $1,664.0 million in 2020, and is projected to reach $13,022.4 million in 2030, registering a CAGR of 23.7%.

3D printing, also referred to as additive manufacturing, comprises printing layer by layer from a 3D CAD model. 3D printing aids in reduction of lead time as well as cost for prototyping and manufacturing complex parts. 3D printing is used in the automotive sector for applications such as design & concept of communication, prototyping validation, preproduction sampling & tooling, and customization of parts. The materials utilized for automotive 3D printing includes several types of polymers, metals, ceramics, and others. The selection of printing material depends on traits expected from printed object.

Growth in need to reduce vehicle weight, production cost & development time, increase in use of 3D printing for quick prototyping & development of complex parts, and greater demand for customized automotive parts drive the growth of the market. However, high initial cost and lack of expertise & skilled labor is expected to hamper the growth of the market. Furthermore, increased investments in R&D and technological advancements are expected to offer growth opportunities during the forecast period.

The automotive 3D printing market is segmented on the basis of component, application, propulsion, and region. By component, it is fragmented into technology, material, and services. The technology segment is further divided into material extrusion, powder bed fusion, vat photopolymerization, material jetting, direct energy deposition, and binder jetting. The material segment is further categorized into polymers, metals, and others. Based on application, the market is classified into prototyping, tooling, jigs & fixtures, end-use parts, and others. The propulsion segment is divided into ICE vehicles, electric vehicles. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the automotive 3D printing market report include 3D Systems Corporation, Autodesk, Inc., Desktop Metal, Inc., EOS Gmbh, General Electric Company, Hoganas AB, Materialise NV, Stratasys, Ltd., Ultimaker BV and Voxeljet AG.

By Component

Technology is projected as the most lucrative segment

Growth in need to reduce vehicle weight, production cost, and development time

Traditionally, several automotive components were manufactured from iron and steel alloys, both of which are strong however heavy materials. However, advancements in manufacturing technologies have enabled automotive manufacturers to replace these metal components with new set of materials such as aluminum, carbon fiber, and other composites. These lightweight materials reduce weight of vehicle, which in turn results in improved fuel efficiency of vehicles. Moreover, additive manufacturing or 3D printing aids in manufacturing of automotive parts by reducing lead time, associated cost of printing, and development time. For instance, Bugatti has included some 3D printed parts in its ‘Divo Supercar’ to reduce total weight of car. Bugatti has printed fin rear lights which makes new model lighter than previous model of car.

Increase in use of 3D printing for quick prototyping & development of complex parts

3D printing aids in manufacturing of automotive parts at a faster pace. Car manufacturers are focused on achieving high performance standards such as better fuel efficiency, connectivity, and aerodynamics through prototyping to reduce production time and cost. 3D printing is increasingly being used for development of complex parts. Over the past years, Ford has 3D printed over 500,000 parts to save costs and working hours. Moreover, introduction of electric vehicle and autonomous cars has created demand for smaller, more complex structures that drives the growth of automotive 3D printing.

By Application

End-use parts is projected as the most lucrative segment

Greater demand for customized automotive parts

Numeric control manufacturing processes are best suited for mass production, which make customization of automotive parts expensive. However, 3D printing can be utilized effectively to produce customized automotive parts. 3D printing can customize parts as per customer preference. Different automobile manufacturers utilize 3D printing for serial part production & personal customization. For instance, Volkswagen is utilizing HP Metal Jet 3D printer for producing mass customized vehicles.

COVID-19 Impact Analysis

The COVID-19 crisis has created uncertainty in the automotive 3D printing market, massive slowdown of supply chain, falling business confidence, and increased panic among the customer segments. Governments of different regions have announced total lockdown and temporary shutdown of industries, thereby adversely affecting the overall production and sales.

By Propulsion

Electric vehicles is projected as the most lucrative segment

Automotive markets experienced weak demand in Europe and Asia resulting in weak printer shipments. Most 3D printing companies shifted their focus on services to assist in printing of medical equipment during the pandemic. However, some automotive manufacturers adopted additive manufacturing to overcome supply chain issues, and offer localized & decentralized production. Several market players adopted in-house 3D printing for on-demand production of tools, jigs, and fixtures.

Surge in sale of electric vehicles during the pandemic is expected to increase the demand for automotive 3D printing. 3D printing offers greater level of customization in manufacturing of electric vehicles with lighter parts to extend battery life, greater material options, improved thermal capabilities, and superior value in low-volume production with quicker speed to market.

By Region

Asia-Pacific would exhibit the highest CAGR of 25.9% during 2021-2030.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the global automotive 3D printing market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall automotive 3D printing market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global automotive 3D printing market with a detailed impact analysis.

- The current automotive 3D printing market is quantitatively analyzed from 2020 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive 3D Printing Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Propulsion |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Growth of the automotive 3D printing market is driven by rise in need for lightweight & fuel efficient vehicles. There has been increased focus on reducing weight of vehicles, production costs, and development time. The leading players in the market have developed customized automotive parts and solutions to cater to the customers’ growing needs. For instance, German engineering design studio EDAG created 3D printed car “Light Cocoon” using SLM 3D printing technology, which is a combination of 3D printing with generative design inspired by nature. The car is covered with stretchy fabric that is extremely lightweight, only 19 grams per square meter.

The increase in demand for automotive 3D printing from Europe and Asia-Pacific is expected to supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different regions. Several developments have been carried out by key players operating in the automotive 3D printing industry. In February 2021, 3D Systems introduced next generation “High Speed Fusion” 3D printing system for automotive market applications. In April 2021, Materialise NV opened a new Metal Competence center for 3D printing in Germany.

The global automotive 3D printing market is expected to reach $13,022.4 million in 2030 from 1,664.0 million in 2020

Some prominent market players in the 3D printing industry include 3D Systems Corporation, Autodesk, Inc., Desktop Metal, Inc., General Electric Company, Hoganas AB, Materialise NV, Stratasys, Ltd., Ultimaker BV and Voxeljet AG

The sample/company profiles for global automotive 3D printing market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

3D printing is expected to be adopted in the automotive industry at a significant pace. Growth in need to reduce vehicle weight, production cost & development time, increase in use of 3D printing for quick prototyping & development of complex parts, and greater demand for customized automotive parts are some factors expected to drive the demand in the future

Additive manufacturing or 3D printing aids in manufacturing of automotive parts by reducing lead time, associated cost of printing, and development time. Car manufacturers are focused on achieving high performance standards such as better fuel efficiency, connectivity, and aerodynamics through use of 3D printing

The company profiles of the top market players of automotive 3D printing market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the automotive 3D printing market.

Increased investments in R&D and technological advancements are expected to offer growth opportunities during the forecast period.

In February 2021, 3D Systems introduced next generation “High Speed Fusion” 3D printing system for Automotive market applications.

Some upcoming trends include use of 3D printing for customization of parts, advancements in manufacturing technologies, use of light weight materials, and adoption of 3D printing for development of electric and autonomous vehicles.

Some major automotive companies using 3D printing technology include BMW, Ford, Volvo, General Motors, and Porsche

Loading Table Of Content...