Automotive LiDAR Sensors Market Overview, 2031

The global automotive lidar sensors market was valued at $793.2 million in 2021, and is projected to reach $11.7 billion by 2031, growing at a CAGR of 31.7% from 2022 to 2031. Light Detection and Ranging (LiDAR) sensors is remote sensing technique used to estimate distance and detect objects. Automotive LiDAR scanners are autonomous vehicle sensors necessary for the innovation of autonomous cars. Additionally, LiDAR sensors, which provide a high-resolution 3D image of their surroundings, are an important component of autonomous vehicles. LiDAR enables autonomous vehicles to "see" by generating and measuring millions of data points in real-time, resulting in a detailed map of the vehicle's constantly changing surroundings for safe navigation.

Due to the rise in popularity of autonomous vehicles, which need automotive LiDAR sensors for safety and accident avoidance, the market for these sensors is increasing at a rapid rate. In addition, an increase in innovations by market players, such as the incorporation of sensor technology in LiDAR point clouds through feature extraction and clustering to sense the hurdles more effectively, are anticipated to reveal lucrative opportunities for the automotive LiDAR sensors market growth over the course of the estimated period. However, it is expected that the industry would face challenges in the coming years due to the poor performance of automotive LiDAR sensors in adverse weather conditions, such as wet and foggy weather.

The automotive industry is working tirelessly to build autonomous and semi-autonomous vehicles, and as a result, demand for LiDAR technology is expected to skyrocket in the upcoming years. The use of LiDAR in self-driving vehicles has enabled them to gather enough data about their surroundings to allow the onboard computer to assume control and replace the driver. Levels 1, 2, and 3 of autonomous vehicles are currently on the market whereas levels 4 and 5 are currently undergoing testing and development and is expected to be available in the future years.

The industry players of automotive LiDAR sensors are investing a lot of effort on the research and development of smart and unique strategies to sustain their growth in the automotive lidar sensors market. These strategies include product development and joint ventures. For instance, in January 2021 Infineon Technologies AG announced the release of a new generation of their AURIXTM microcontroller family. (MCU). The TC4x series promotes eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and low-cost artificial intelligence (AI) applications.

Segment Overview

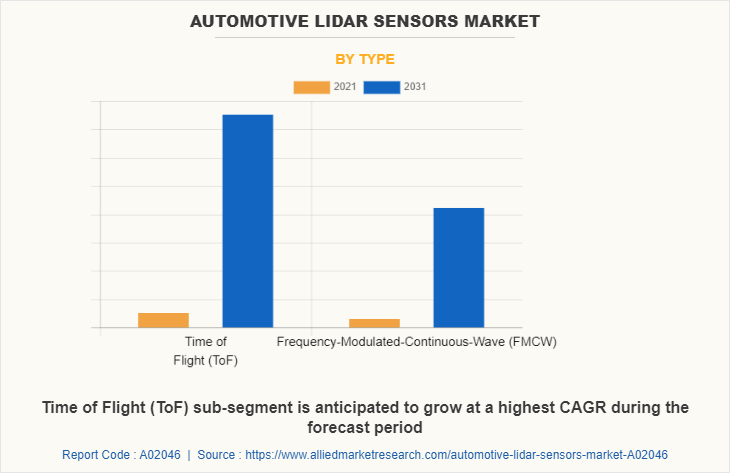

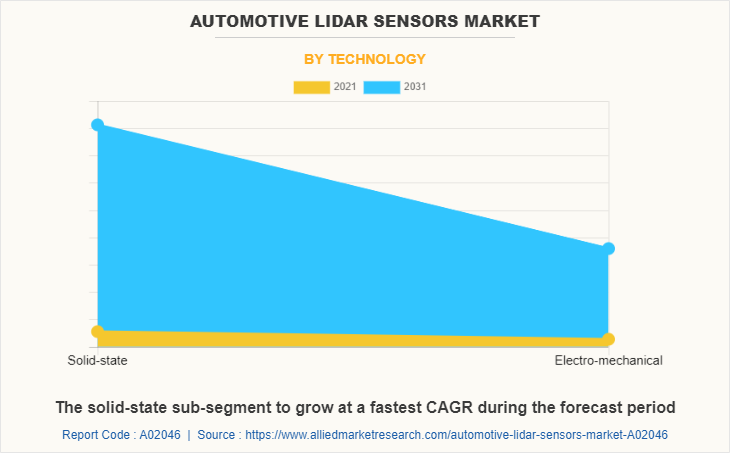

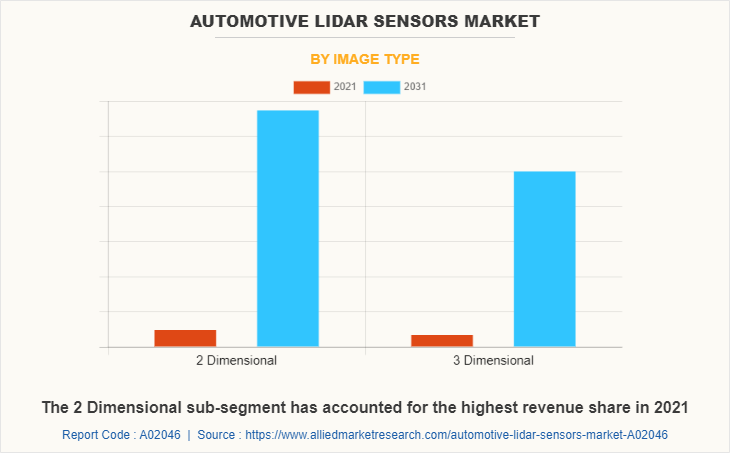

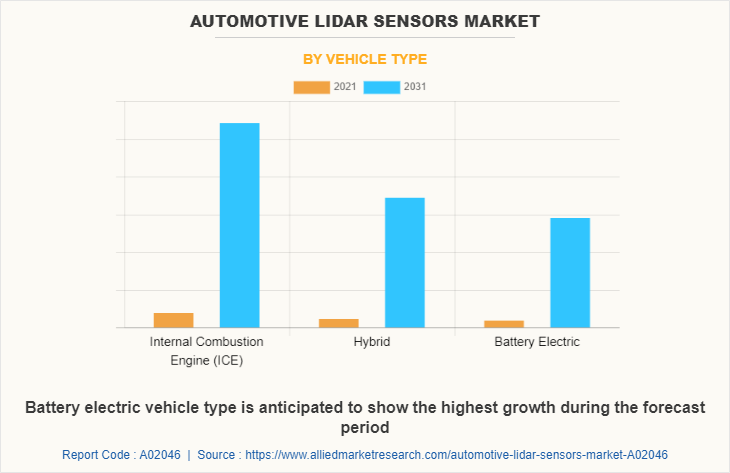

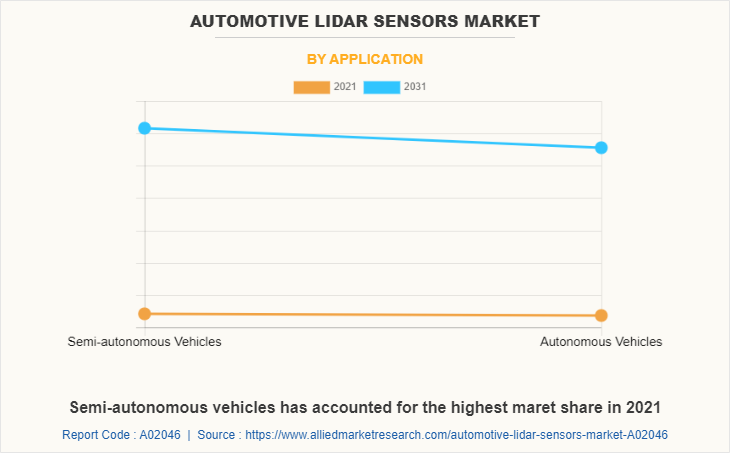

The global automotive LiDAR sensors market is segmented on the basis of type, technology, image type, and vehicle type. On the basis of type, the market is classified into Time of Flight (ToF) and frequency-modulated-continuous-wave (FMCW)). By technology, the automotive lidar sensors market is classified into solid-state and electro-mechanical. By image type, it is classified into 2 dimensional and 3 dimensional. On the basis of vehicle type, the market is classified into internal combustion engine (ICE) and hybrid battery electric. By application, semi-autonomous vehicles, and autonomous vehicles. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the Time of Flight (ToF) sub-segment dominated the market in 2021. An active form of 3D imaging and scanning technology is Time of Flight. In comparison to the other two 3D imaging approaches, structured light and stereo vision, ToF is faster, more dependable, and energy-efficient. Given its affordability, ToF technology is expected to see a rise in demand for 3D imaging and scanning applications. These are predicted to be the major factors affecting the automotive LiDAR sensors market size during the forecast period.

By technology, solid-state sub-segment dominated the automotive lidar sensors market in 2021. Solid-state LiDAR sensors are ideal for the automotive industry because they conserve space, are almost unnoticeable, and provide an elegant and robust solution. A solid state of LiDAR sensor is typically illuminated by a single laser beam, and the 3D data that is returned is captured by a ToF sensor array. These solid-state sensors are more affordable and reliable than traditional scanning LiDAR sensors since they have few to no moving parts. These are predicted to be the major factors affecting the automotive LiDAR sensors market share during the forecast period.

By image type, 2 dimensional sub-segment dominated the automotive lidar sensors marketin 2021. Increasing awareness about the benefits of using 2D LiDAR sensors in various sector such as security and surveillance, industrial automation, robotic technologies, and logistics is expected to drive market growth in future. LiDAR is a form of remote sensing that determines an object's distance by using a laser to illuminate the target and then examining the reflected light. This makes it possible for the sensor to determine the precise distances between objects. Only one laser beam is required for a 2D LiDAR sensor. It is fast processing and has fast acquisition system. These are predicted to be the major factors affecting the automotive LiDAR sensors industry growth during the forecast period.

By vehicle type, the internal combustion engine (ICE) sub-segment dominated the market share in 2021. The majority of ICEs are employed in mobile applications and serve as the main power source for automobiles, aircraft, and watercraft. Natural gas or petroleum-based fuels such as gasoline, diesel, or fuel oil are the most common sources of energy for ICEs. Compression ignition (CI) engines use biodiesel as a fuel, while spark ignition (SI) engines use bioethanol or ETBE (ethyl tert-butyl ether), which is made from bioethanol. These are predicted to be the major factors affecting the automotive LiDAR sensors market demand during the forecast period.

By application, semi-autonomous vehicles sub-segment dominated the market as fully autonomous vehicle may operate on its own without assistance from a person. On the other hand, in semi-autonomous vehicles, the driver still has primary control over driving while being assisted by a number of advanced driver assistance technologies.

By Region

North America region held the highest market share in 2021

By region, Asia-Pacific region is estimated to show the fastest growth during the forecast period. The demand for LiDAR sensors in countries, namely China and India, is growing rapidly. For instance, In July 2022 Baraja and Veoneer collaborated to commercialize Spectrum-Scan LiDAR technology. Following comprehensive testing, the automotive technology business decided to collaborate with Baraja due to its reliable technology and roadmap that makes it one of the smallest LiDAR for vehicle integration.

Competitive Analysis

The key players profiled in this report include Continental AG, Robert Bosch GmbH, First Sensor AG, Denso Corp, Hella KGaA Hueck & Co., Novariant, Inc., Laddartech, Quanergy Systems, Inc., Phantom Intelligence, and Velodyne LiDAR, Inc.

Key Benefit For Stakeholders

- The report provides an exclusive and comprehensive analysis of the global automotive LiDAR sensors market trends along with the automotive LiDAR sensors market forecast.

- The report elucidates the automotive LiDAR sensors market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the automotive LiDAR sensors market analysis maps the qualitative sway of various industry factors on market segments as well as geographies. The complete analysis of lidar for automotive market is provided in this study.

- The data in this report aims on market dynamics, trends, and developments affecting the automotive LiDAR sensors market growth.

Automotive LiDAR Sensors Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.7 billion |

| Growth Rate | CAGR of 31.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Type |

|

| By Technology |

|

| By Image Type |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Texas Instruments Incorporated, First Sensor AG, Continental AG, Hella KGaA Hueck & Co., Quanergy Systems, Inc., Velodyne LiDAR, Inc., Denso Corp, Robert Bosch GmbH, Novariant, Inc., LeddarTech |

Analyst Review

The ongoing demand for better sensors in the automotive sector, as well as an increase in administrative laws requiring such installations, is the key factor that is projected to drive the growth of the global automation LiDAR sensors market during the forecast period. In addition, the implementation of stringent government regulations toward vehicle safety owing to the use of automatic cars, which reduce the chance of accidents is expected to fuel growth of the market during the forecast period. However, high initial investments associated with LiDAR sensors are the key factors expected to hamper the market growth during the forecast period. On the contrary, the market for automotive LiDAR sensors is expected to increase quickly in the next years due to the rapid development of the renewable energy sector and the widespread usage of Sensor Fusion, a technology that detects impediments in LiDAR point clouds.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. The growth is majorly owing to the rapid increase in the adoption of both autonomous as well as semi-autonomous vehicles with highly advanced LiDAR sensors technology among people. This key factor is responsible for the leading positions of North America in the global automotive LiDAR sensors market.

Automotive LiDAR sensors is estimated to grow at a CAGR of 31.7% during the forecast period.

By 2030, the automotive LiDAR sensors market is estimated to reach $11.7 billion.

The leading players in the automotive LiDAR sensors market are Robert Bosch GmbH, Continental AG, and First Sensor AG.

LiDAR sensors for autonomous vehicles and their use in camera, parking assistance, adaptive cruise control, automotive braking system, and others is estimated to drive the LiDAR sensors market growth.

LiDAR sensors are widely used in automotive vehicles. For instance, autonomous car manufacturers, use LiDAR sensors to minimize the number of cameras in their vehicles.

Loading Table Of Content...