Automotive AC Compressor Market Statistics: 2031

The global automotive AC compressor market size was valued at $8.1 billion in 2021 and is projected to reach $11.8 billion by 2031, growing at a CAGR of 4% from 2022 to 2031.

An automotive AC compressor is used to remove the heat-laden vapor refrigerant from the evaporator of the automotive AC compressor. The market is anticipated to expand significantly in the future years, owing to the rapid rise in vehicle production as well as the increase in the installation of superior comfort accessories for affordable vehicles. Additionally, rising automotive production and a surge in the use of vehicle air conditioning systems in emerging markets will boost automotive AC compressors market growth.

Refrigeration gases are powerful greenhouse gases (in liquid form), and their leakage has a significant negative influence on the climate and the environment as a whole. As refrigerants are essential for compressor operation, governments of various countries across the world have legislated rules to decrease the pollution generated by these refrigerants. Strict enforcement of these laws is anticipated to stymie the expansion of the automotive AC compressors industry.

The lack of capacity in passenger cars is one factor affecting the installation of air conditioning systems in automobiles. Therefore, several original equipment manufacturers (OEMs) are working to build lighter, more efficient, and smaller car air conditioning systems. The characteristics of original equipment manufacturers' automotive AC compressors also help to reduce vehicle vibration and noise levels. . Therefore, advancements in compressor design, which result in lower size and power consumption, are a prominent trend witnessed in the global automotive AC compressor market.

The key players profiled in the automotive AC compressor market report include Behr Hella Service GmbH, Calsonic Kansei Corporation, Continental AG, Hanon Systems, Keihin Corporation, Michigan Automotive Compressor, Inc., SANDEN Subros Limited, MAHLE Group, and BorgWarner Inc.

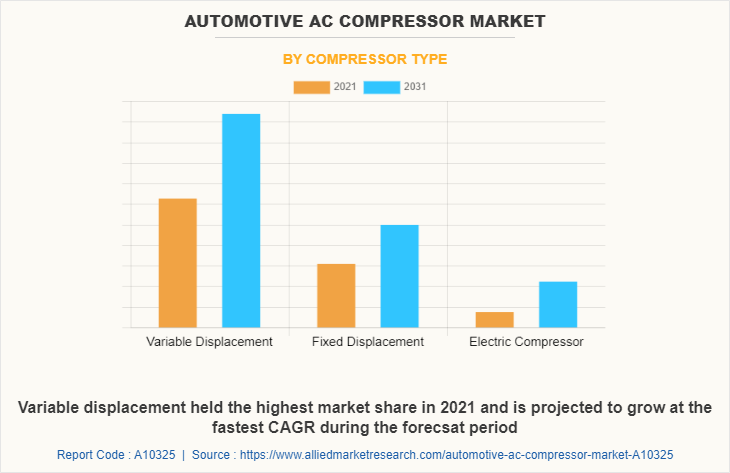

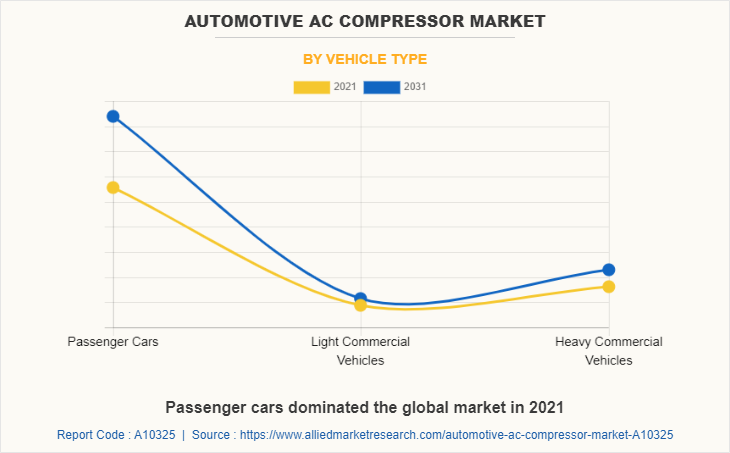

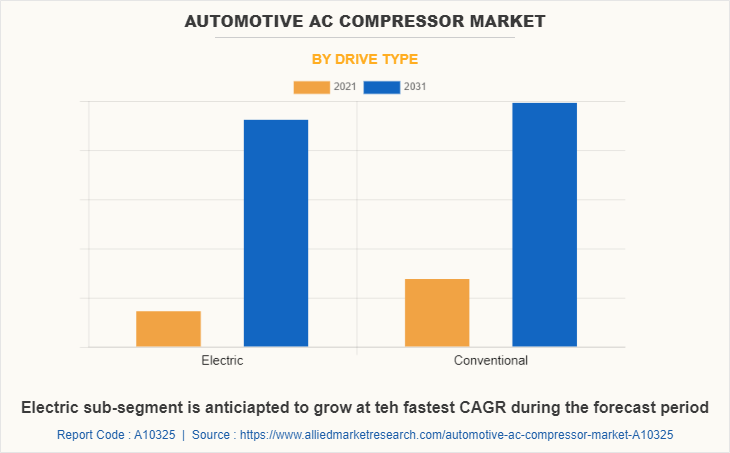

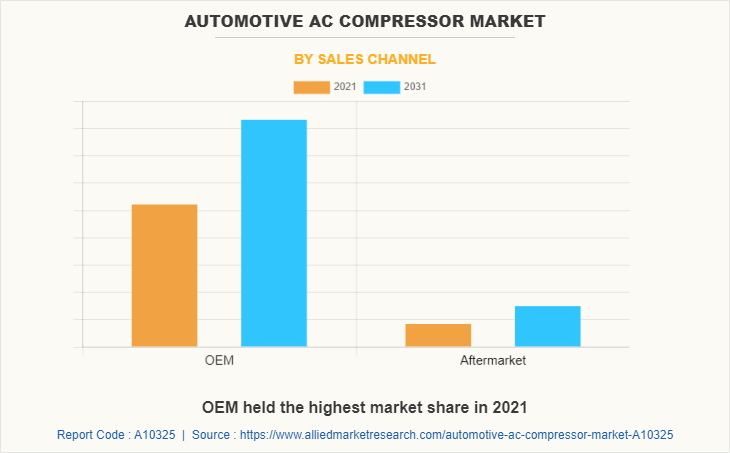

The global automotive AC compressor market is segmented on the basis of compressor type, vehicle type, drive type, sales channel, and region. By compressor type, the market is divided into variable displacement, fixed displacement, and electric compressor. By vehicle type, the market is classified into passenger cars, light commercial vehicles, and heavy commercial vehicles. By drive type, the market is divided into electric and conventional. By sales channel, the market is classified into OEM and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automotive AC compressor market is segmented into Compressor Type, Vehicle Type, Drive Type and Sales Channel.

By compressor type, the variable displacement sub-segment dominated the market share in 2021. These compressors are in high demand in Europe and North America as they give exceptional acceleration while producing less CO2 and consuming less energy than fixed displacement compressors. The compressor controls the amount of refrigerant released by adjusting the angle of the revolving swash plate. This smooth control is connected to engine and driving conditions that increase not only driving comfort but also vehicle environmental efficiency by lowering compressor energy consumption. Variable displacement compressors will benefit greatly from engine conserving resource techniques and high fuel efficiency rules in automobiles. These are predicted to be the major factors affecting the automotive AC compressor market size during the forecast period.

By vehicle type, the passenger cars sub-segment dominated the global automotive AC compressor market share in 2021. The growth of the passenger cars sub-segment can be attributed to the use of automotive AC compressors for manufacturing automotive components. Customers of passenger vehicles are more concerned with a vehicle's ride comfort and other amenities. Customers are ready to pay more for their comforts, and thus manufacturers have made air conditioning a standard feature in the majority of their car models to fulfill the customers’ demands. Such applications of automotive ac compressors in the automotive sector are bound to create a scope of growth for the sub-segment during the forecast period.

By drive type, the conventional sub-segment dominated the market in 2021. Through a handle that is attached to the typical sub-segment by a V-belt, the vehicle engine powers it directly. The increase in the production of conventional has raised the need for AC compressors. The usage of air conditioners in large commercial vehicles is rising, which is expected to increase the demand for air compressors.

By sales channel, the OEM sub-segment dominated the market in 2021. Developing nations are spending heavily in the manufacturing sector in original equipment manufacturers (OEM) to establish a strong export potential, which is leading to increasing automotive production. The growing number of working people who own vehicles is driving up demand for automotive AC compressors.

By region, Asia-Pacific dominated the global market in 2021 and is projected to be the fastest-growing region during the forecast period. The automotive AC compressor demand in countries namely China and India is growing rapidly owing to the increase in production to meet both domestic and export demand for automobiles. These factors are expected to boost the Asia-Pacific automotive AC compressor market growth. The increase in this region is connected to a rise in the utilization of automotive AC compressors due to an increase in the number of automobiles on roadways in the United States and Canada.

Impact of COVID-19 on the Global Automotive AC Compressor Industry

COVID-19 has had a severe influence on several industries, including automotive, resulting in a significant drop in vehicle sales. As automotive AC compressors are widely employed in the automobile industry, there has been a major decrease in worldwide demand for automotive AC compressors.

China is the main producer of electric and raw material, but all industrial operations had been halted, majorly hampering the production of automotive AC compressor. However, as China was the epicenter of the coronavirus pandemic, its export was hindered, resulting in a drop in automobile AC compressors.

As a result of lockdowns, the automobile sector had a considerable drop in vehicle production and sales throughout the COVID-19 pandemic, impeding the economy's progress. Moreover, the overall requirement for AC compressors in the automobile sector has been substantially impacted by import-export restrictions, restricted borders, and supply chain delays caused by the COVID-19 pandemic.

The global economic recession has hampered the development of new automotive projects since the bulk of government funds have been transferred to the healthcare sector owing to the fast spread of the COVID-19 virus, which has had a significant influence on the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive AC compressor market analysis from 2021 to 2031 to identify the prevailing automotive AC compressor market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

An in-depth analysis of the automotive ac compressor market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global automotive AC compressor market trends, key players, market segments, application areas, and market growth strategies.

Automotive AC Compressor Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.8 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 342 |

| By Compressor Type |

|

| By Vehicle Type |

|

| By Drive Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Sanden Corporation, MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., VALEO, Hanon Systems, MAHLE GmbH, DENSO CORPORATION, Toyota Industries Corporation, Nissens, Subros, BorgWarner Inc. |

Analyst Review

The increase in production of vehicles across several countries is a significant factor driving the need for air conditioner compressor. Furthermore, as the demand for comfort and advanced features in vehicles has increased, the usage of air conditioning systems in four-wheelers has expanded.

However, the high cost of luxury vehicles may act as a small market restraint for automotive AC compressors. This is because expensive AC compressor are needed to operate the premium HVAC systems found in luxury vehicles. Automotive AC compressor systems operate at variable loads to keep passengers comfortable in a variety of temperature conditions. These factors are influencing the installation of automotive AC compressor systems in automobiles in passenger vehicles. Therefore, several original equipment manufacturers (OEMs) are working to build lighter, more efficient, and smaller air conditioning systems for automobiles. These factors are anticipated to contribute to lower levels of noise and vibration in autos. Therefore, advancements in compressor design, resulting in smaller size and power consumption, is a prominent opportunity witnessed in the global automotive AC compressor market.

Among the analyzed regions, Europe is expected to account for the highest revenue in the market by 2031, followed by Asia-Pacific, North America, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for leading position of Europe and Asia-Pacific in the global automotive ac compressor market.

The automotive AC compressor industry's key participants have a huge chance to provide innovative compact and efficient AC compressors at competitive pricing. The worldwide automotive AC compressor market is predicted to develop significantly during the forecast period, owing to technical improvements to deliver better goods at lower prices, as well as increase in installation of AC systems in vehicles.

The passenger cars sub-segment of the vehicle type acquired the maximum share of the global automotive AC compressor market in 2021.

The use of automotive AC compressor of environmentally friendly and fuel-efficient components in cars helped the variable displacement market generate sizable income. Variable displacement compressors have a lot of chances as a result of a fuel efficiency rules and engine efficiency techniques.

Europe will provide more business opportunities for the global automotive AC compressor market in the future.

Behr Hella Service GmbH, Calsonic Kansei Corporation, Continental AG, Hanon Systems, Keihin Corporation, Michigan Automotive Compressor, Inc., SANDEN Subros Limited, MAHLE Group, and BorgWarner Inc. are the leading market players active in the automotive AC compressor market.

The major growth strategies adopted by the automotive AC compressor market players are investment and agreement.

The automotive industry leaders are the major customers in the global automotive AC compressor market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global automotive AC compressor market from 2021 to 2030 to determine the prevailing opportunities.

Loading Table Of Content...