Automotive Ac Valves Market Research, 2034

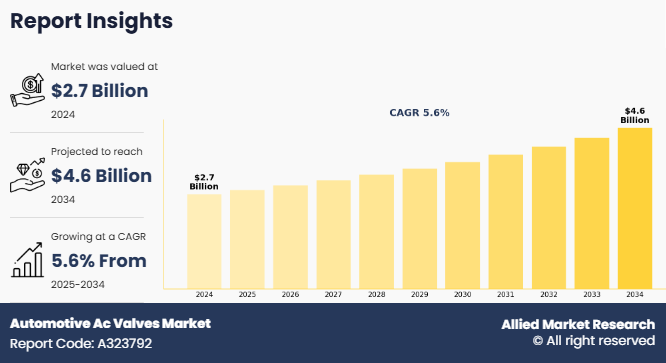

The global automotive Ac valves market size was valued at $2.7 billion in 2024, and is projected to reach $4.6 billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

Report Key Highlighters:

- The automotive Ac valves market size covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The Automotive Ac Valves Market Share is highly fragmented, into several players including DENSO Corporation, Valeo SA, Mahle GmbH, Hanon Systems, Delphi Technologies, Eberspächer Group, NRF B.V., Nissens Automotive A/S , Rheinmetall AG, and Raicam Industrie S.r.l. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Automotive AC valve is an essential part of the vehicle’s climate control system which is responsible for managing refrigerant flow and optimally balance pressure throughout the AC circuit. These valves enable the proper function of key components by regulating how much refrigerant enters evaporator, where heat absorption occurs. AC valves ensure the refrigerant is delivered at the correct pressure and volume. They help in maintaining cooling efficiency, prevent system overload, and support consistent passenger comfort across different operating environments.

The global automotive Ac valves market trends is driven by increase in vehicle production, surge in demand for passenger vehicles in developing countries, and integration of lightweight materials in manufacturing automotive valves. Likewise, growth in emission regulation, and technological advancement in automotive valves offers lucrative market growth opportunity. However, shift toward electric vehicles with alternative cooling technologies, and high cost and fluctuation in price of raw material hinders the growth of the market to some extent.

In recent years, the rise in global vehicle production has significantly contributed to the surge in demand for automotive AC valves, as these components are essential for regulating refrigerant flow within vehicle climate control systems. Moreover, with the growing consumer expectations for comfort, and the integration of air conditioning systems in all types of vehicles from compact passenger cars to commercial trucks has become standard, thus driving the market demand. According to data from the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached approximately 93.5 million units in 2023. The growth in automobile manufacturing directly influences the demand for critical AC system components such as expansion valves and control valves. In addition, the rise in shift toward electric vehicles (EVs) has further fueled the market for automotive AC valves. EVs rely heavily on advanced thermal management systems not only for cabin cooling but also to maintain optimal battery performance.

Moreover, automobile manufacturers are integrating lightweight materials in the manufacturing of automotive AC valves in order to decrease their weight and increase their overall performance. Traditionally, automotive valves were manufactured by heavy and durable materials such as steel and cast iron. However, with surge in demand for performance components, manufacturers are utilising alloys, silicon and other composite materials in the manufacturing of automotive AC valves.

For instance, manufacturers are utilizing lightweight materials such as low carbon steel alloys, stainless steel, titanium, and nickel-chromium-iron alloys. In recent years, silicon chromium steels are increasingly used to make inlet valves as they provide strength as well as are more durable for use in high-temperature environment. Ceramic valves are also used in modern automobiles. However, their usage is limited to supercars and luxury vehicles as they are 50 times more expensive as compared to steel valves.

To tackle the demand for efficient and lightweight automotive AC valves, companies are collaboratively working toward the development of automotive AC valves for instance, On March 2024, Anhui Changsheng Electromechanical Technology Co., Ltd., a leading Chinese manufacturer in automotive air conditioning components, introduced a new line of lightweight automotive compressor valves specifically designed for small cars and vans. The new AC valves utilize advanced materials and innovative design techniques. These valves achieve significant weight reduction without compromising performance. The lightweight design contributes to improved fuel efficiency and aligns with the industry's ongoing efforts to reduce vehicle emissions and enhance overall sustainability. Such advancements drives the market for automotive Ac valves market growth.

Key Developments in The Automotive Ac Valves Market Forecast

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On May 1, 2025 Hanon Systems was acquired by Hankook & Company Group. This strategic move is expected to help in financial backing, and to strengthen Hanon’s leadership in global automotive thermal management, particularly in the fast-evolving EV and hybrid vehicle sectors.

Segmental Analysis

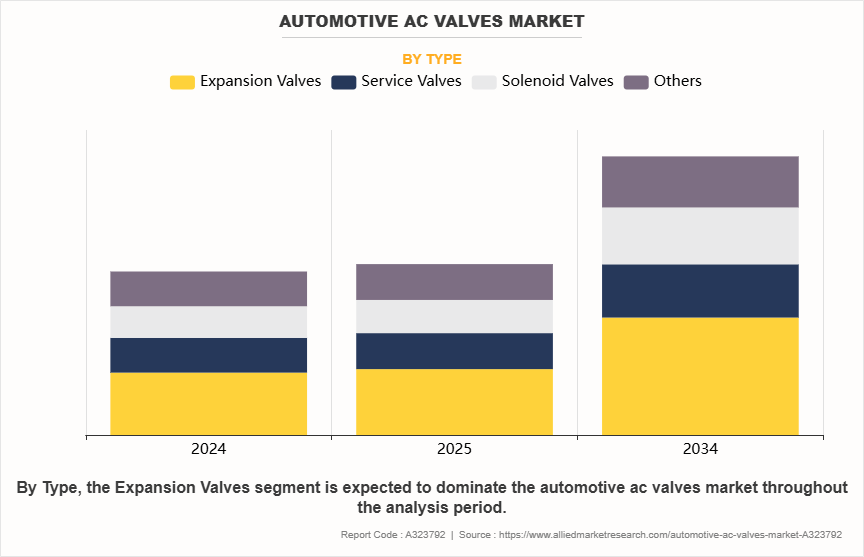

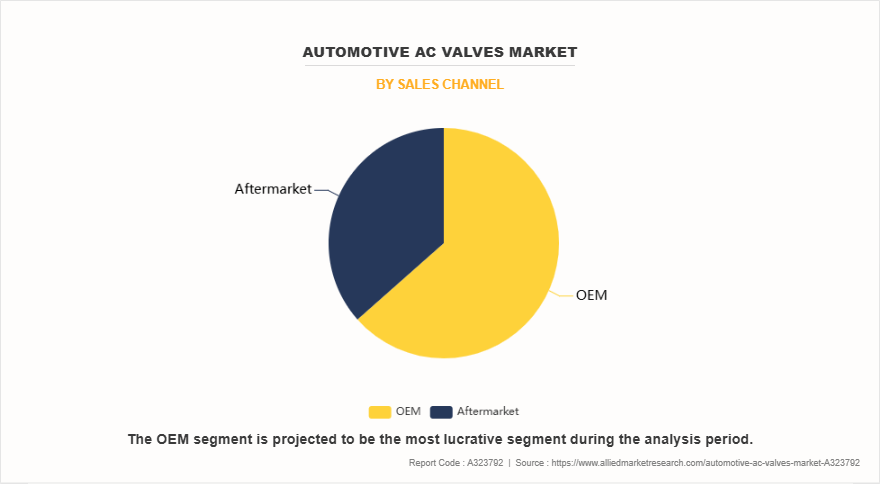

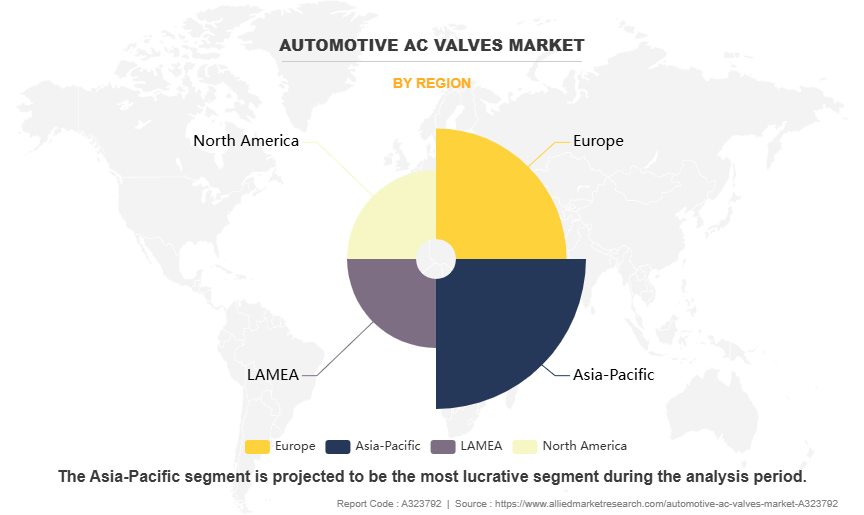

The automotive Ac valves market share segmented into type, vehicle type, sales channel, and region. On the basis of type, the market is classified into expansion valve, service valve, solenoid valve, and others. By vehicle type, the market is segregated into passenger vehicle and commercial vehicle. On the basis of sales channel, the market is bifurcated into OEM and aftermarket. By region, the market is analysed into North America, Europe, Asia-Pacific and LAMEA.

By Type

By Type, the automotive Ac valves market insights is categorized into expansion valves, service valves, solenoid valves, and others. The expansion valves dominated the global market share in 2023, owing to increase use of expansion valves in vehicles furthermore growing production and the need for improved fuel efficiency & thermal management in modern vehicles. Electronic expansion valves, in particular, are becoming popular in electric and hybrid vehicles as they offer precise refrigerant control, which helps optimize energy use. Moreover, as more modern vehicles are designed to operate with new refrigerants such as the R-1234yf, the demand for and efficient expansion valves are further growing for use in passenger and commercial vehicles.

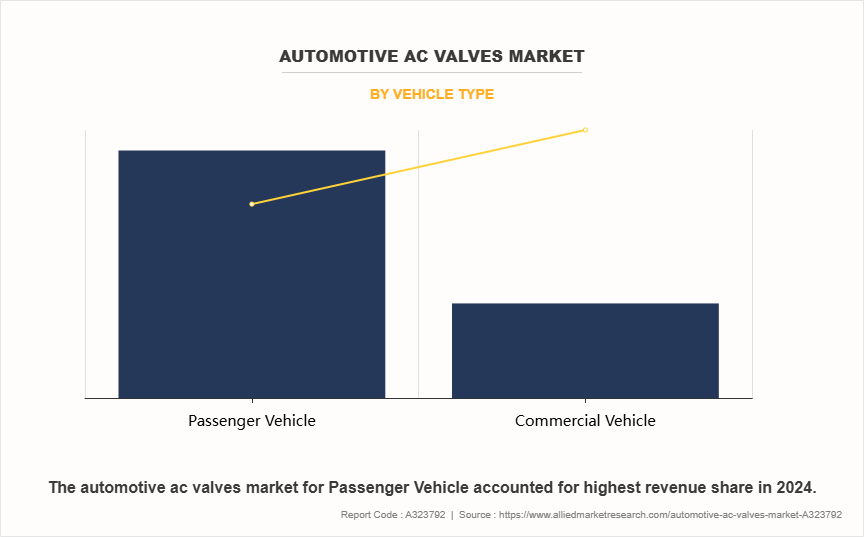

Vehicle Type

By vehicle type the global automotive Ac valves market demand is segmented into passenger vehicles and commercial vehicle. The passenger vehicle segment dominated the global market share in 2024, owing to rise in consumer preference for enhanced in-cabin comfort, even in entry-level models. Modern consumers are increasingly demanding air conditioning as a standard feature, automakers are equipping more cars with advanced climate control systems. Furthermore with the growing global car ownership especially in emerging markets and the rising production of electric and hybrid vehicles, which demand precise thermal management, are also contributing to the increased need for efficient and reliable AC valves.

By Sales Channel

On the basis of sales channel the global automotive AC valves industry is segregated into OEM and Aftermarket. The OEM segment dominated the global market share in 2024, owing to the growing vehicle production, including electric and hybrid models. Automakers are focusing on integrating more efficient and compact HVAC systems into new vehicles to meet consumer expectations and regulatory requirements. As AC systems are becoming a standard feature even in low-cost and compact cars, the volume of AC valves required at the manufacturing level is rising significantly. Automakers are also preferring OEM based AC valves to enhance the performance and reliability of their climate control systems.

By Region

Based on region the global automotive AC valves industry is segregated into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the global market share in 2024, owing to factors such as increase in local vehicle production, rise in passenger car sales, and surge in demand for comfort features in vehicles. Asia-Pacific is one of the largest automotive manufacturing hubs globally. Asia-Pacific accounts for a major share of global vehicle production, with countries such as China, India, Japan, and South Korea, dominating the market share. The strong manufacturing automotive industry and growing automobile export drive the demand for automotive Ac valves market opportunity.

Growing Demand for Passenger Vehicles in Developing Countries

In recent years, there has been an increase in sales of passenger vehicles especially in in the developing region particularly in Asia-Pacific and Africa region. The growing sales of passenger vehicles are particularly driven by increase in economic activity in developing countries and growing disposable income among consumers. In countries such as China and India, the growing populations and rapidly urbanizing has led to increased demand for passenger vehicles. Moreover, the growing availability of affordable vehicles, coupled with government incentives for the purchase of electric and other sustainable fuel vehicles, has further accelerated passenger vehicle sales in these markets. Moreover, the availability of hybrid vehicles, plug-in hybrids, fully electric, hydrogen and other biofuels vehicles are further driving the demand for automotive AC valves. For instance, according to the data by SIAM society of Indian automobile manufactures, passenger vehicle sales in India in 2024 was around 5 million units and is growing at 8.4%. The demand for passenger vehicle is anticipated to continue in coming years, the strong sales of passenger vehicle segment is expected to drive the market for automotive AC valves during the forecast period.

Shift Towards Electric Vehicles With Alternative Cooling Technologies

The global shift toward electric vehicles (EVs) and the adoption of alternative cooling technologies hinder the growth of the automotive AC valve market to some extent. Unlike internal combustion engine vehicles, which rely heavily on conventional air conditioning systems with mechanical compressors and expansion valves, modern electric vehicle utilizes advanced, integrated thermal management systems. These systems utilize alternative technologies such as heat pumps, electronic expansion valves (EEVs), and centralized thermal control units that regulate both cabin temperature and battery cooling simultaneously. As a result, the demand for traditional mechanical AC valves is declining.

Moreover, several EV manufacturers are exploring refrigerant-free cooling methods or solid-state thermal systems, which further reduce reliance on conventional AC valve components. Furthermore, the share of electric vehicle is growing and is anticipated to account for 20% of all new car sales by 2025. This technological transition toward advanced cooling systems poses a long-term threat to the growth of the traditional automotive AC valve market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive AC valves market analysis from 2024 to 2034 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive AC valves market trends, key players, market segments, application areas, and market growth strategies.

Automotive Ac Valves Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 4.6 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 279 |

| By Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | DENSO CORPORATION, VALEO SA, MAHLE GmbH, NRF B.V., Rheinmetall AG, Raicam Industrie S.r.l, Nissens Automotive A/S, Delphi Technologies, Hanon Systems, Eberspächer Group |

Integration of lightweight materials in the manufacturing are the upcoming trends in the automotive AC valves industry.

The passenger vehicle segment is the leading segment of the automotive AC valves market.

Asia-Pacific is the largest regional market for automotive AC valves market.

The automotive AC valves market was valued at $2,680.4 million in 2024 and is estimated to reach $4,567.4 million by 2034, exhibiting a CAGR of 5.58% from 2025 to 2034.

DENSO Corporation, Valeo SA, Mahle GmbH, Hanon Systems, Delphi Technologies are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...