The global automotive acoustic material market size was valued at $3.6 billion in 2021, and is projected to reach $6.6 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031.

Acoustic materials are a variety of foams, fabrics, and metals used to quiet workplaces, homes, automobiles, and so forth to increase the comfort and safety of their inhabitants by reducing noise generated both inside and outside of those spaces. Automotive acoustic material deals with the study of mechanical waves in gases, liquids, and solids, including vibration, sound, ultrasound, and infrasound. The broad field of automotive acoustic includes mechanical waves and vibrations' production, transmission, and reception. Automotive acoustic materials aim to enhance the passenger's riding experience.

Currently, automobile industry has undergone significant changes in the recent past and had a huge impact on the world’s economy in past decades. The research for a better yet robust design is still on and vehicle manufacturers are still exploring novel ways to design car interiors. For instance, in November 2021, Autoneum announced a new felt-based technology Flexi-Loft, which due to a unique blend of recycled cotton and functional fibers, reduces product weight and allows for accurate adaptation even to complex shapes. Autoneum is already using Flexi-Loft worldwide as an insulator for various carpets, inner dashes, and other acoustic components based on its Prime-Light technology.

As automotive acoustic materials provide the interior appearance and minimize noise, vibration, and harshness (NVH) in the cabin, the expansion of the premium cars is likely to fuel the demand for automotive acoustic materials globally. According to the China Automobile Dealers Association, the country's luxury car dealers sold 277,000 vehicles in April 2020, an 11.1% increase over April 2019. Furthermore, luxury auto carmaker Bentley noted a record year in 2021 as its global sales increased by 31% on the back of solid demand for luxury vehicles. Such luxury vehicles are almost an obligatory status symbol of safety & are primarily equipped with advanced acoustic materials to improve the riding experience for the passenger.

Moreover, manufacturers' attention to providing exceptional color finishes for the interior and exterior appearance of cars is expected to contribute to market growth. For instance, in September 2022, BASF SE expanded its business for electrophoretic dip coating at its headquarters in Münster-Hiltrup, Germany. The center will mainly be used for the CathoGuard 800 e-coat technology, which has already been applied to more than 100 million vehicles worldwide. Also, growth and expansion of manufacturing sector and rising technological advancements in the manufacturing technology will also foster the market growth. For instance, in October 2021, Daimler opened its new “Daimler R&D Tech Center China” officially in Beijing. With a total investment of CNY 1.1 billion, the R&D tech center has a gross floor area of 55,000 m². The test building is home to seven testing facilities, including an eDrive lab, a charging lab, a volatile organic compounds (VOC) lab, a chassis lab, a noise, vibration, and harshness (NVH) lab, an engine lab, and an environmental lab.

The factors such as the rising penetration of luxury vehicles, increasing demand for enhanced comfort & safety features in vehicles, and stringent government regulations for economic assistance and vehicle noise supplement the growth of the automotive acoustic material market. However, volatile prices of raw materials and decline in vehicle sales are the factors expected to hamper the growth of the market. In addition, rise in trend of vehicle customization coupled with increase in disposable income and increase in demand for electric and hybrid vehicles creates market opportunities for the key players operating in the market.

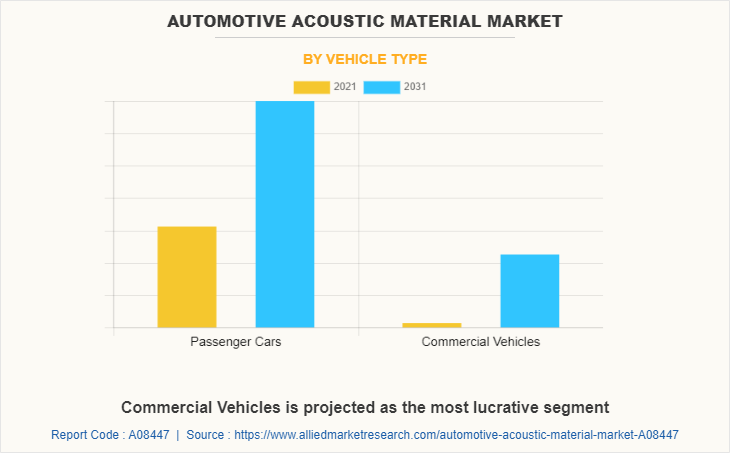

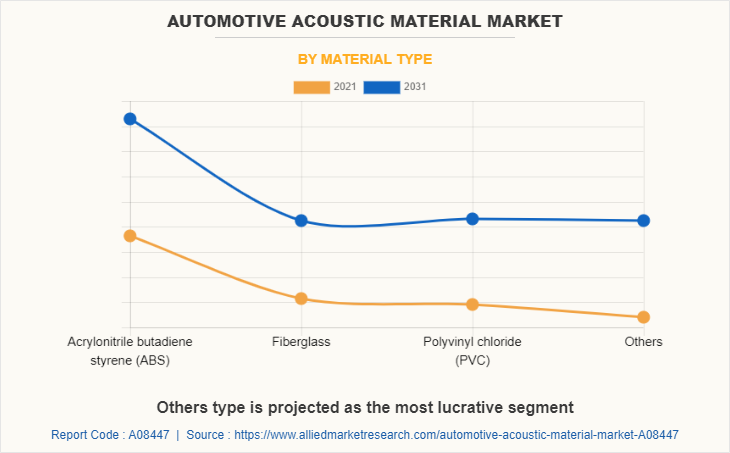

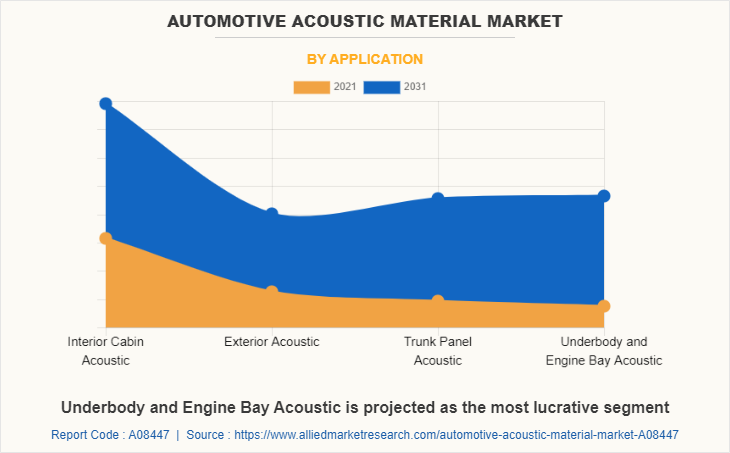

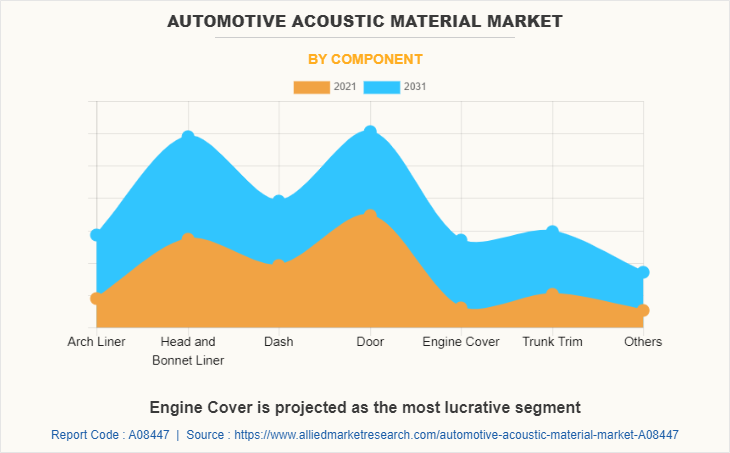

The global automotive acoustic material market is segmented on the basis of material type, application, component, vehicle type, and region. By material type, the market is divided into acrylonitrile butadiene styrene (ABS), fiberglass, polyvinyl chloride (PVC), and others. By application, it is fragmented into interior cabin acoustics, exterior acoustics, trunk panel acoustics, and underbody & engine bay acoustic. By component, it is categorized into arch liner, head & bonnet liner, dash, door, engine cover, trunk trim, and others. By vehicle type, it is categorized into passenger cars and commercial vehicles. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the automotive acoustic material market are 3M Acoustics, BASF SE, Covestro, Freudenberg Group, Henkel Adhesive Technologies, Huntsman, Lyondellbasell, Sika, Sumitomo Riko, and Toray Industries.

Rising penetration of luxury vehicles

Luxury vehicles provide a high level of comfort and safety features. In addition, major luxury car manufacturers are launching electric variants of their vehicles due to growing environmental concerns and increasing fuel prices. Premium carmakers, such as Audi, Mercedes-Benz, BMW, Lexus, and Volvo, have always maintained positive growth in the Chinese luxury car market. According to the China Automobile Dealers Association, the country's luxury car dealers sold 277,000 vehicles in April 2020, an 11.1% increase over April 2019. Furthermore, luxury auto carmaker Bentley noted a record year in 2021 as its global sales increased by 31% on the back of solid demand for luxury vehicles. Such luxury vehicles are almost an obligatory status symbol of safety & are primarily equipped with advanced acoustic materials to improve the riding experience for the passenger. In September 2021, BASF SE launched a new flame-retardant Ultramid® grade (PA66) that expands the portfolio of color-stable, tailor-made engineering plastics for electric cars. The newly developed material combines color stability (available in orange RAL 2003) and mechanical strength in an innovative way and is thus able to meet the technical requirements the market demands.

Increasing demand for enhanced comfort & safety features in vehicles

The passenger’s comfort in the automobile is a significant concern for automobile manufacturers. Car acoustics is slowly gaining popularity as a quality factor in current automobiles, and automakers are expressing a lot of interest in it. Since they are used in numerous components such as the engine cover, dash insulator, and other regularly vibrating components when driving, the aftermarket for automotive acoustic materials is expanding. For instance, in September 2022, BASF SE expanded its business for electrophoretic dip coating at its headquarters in Münster-Hiltrup, Germany. The center will mainly be used for the CathoGuard 800 e-coat technology, which has already been applied to more than 100 million vehicles worldwide. Thus, the manufacturing industry's growth and expansion and the rapid progress of manufacturing technologies are supporting the market expansion and is expected to drive the automotive acoustic material industry.

Volatile prices of raw materials

Various raw materials, such as acrylonitrile, ethylene, rubber, polyurethane, fiberglass, and others, are used to manufacture automotive acoustic components and accessories. The tariff on import of leathers & foams is adversely affecting many players in the market. Moreover, the crude derivatives, such as nylon and polyester are used as raw materials in the manufacture of multiple automotive acoustics. The pricing of these raw materials has a significant impact on the overall price of the component. These materials are traded on community exchange and owing to global economic ups and downs in the market, prices of these materials fluctuate occasionally. Therefore, an increase in prices of these raw materials negatively affects the automotive acoustic material vendors. Owing to all the aforementioned factors, the rise in prices of raw materials is expected to hamper the growth of the automotive acoustic material market during the forecast period.

Rise in trend of vehicle customization coupled with increase in disposable income

Globally, the disposable income of individuals has been increasing considerably. For instance, according to the Organization for Economic Co-operation and Development (OECD) statistics, the disposable income in OECD countries witness a growth of 1.7% in 2021. In addition, according to the China government, China’s per capita disposable income observed an increase of 8.1% in 2021. In addition, increase in trend of vehicle customization has been witnessed, owing to rise in disposable income as car owners are more conscious about the looks and aesthetics of the car. For instance, in November 2021, Autoneum announced a new felt-based technology Flexi-Loft, which due to a unique blend of recycled cotton and functional fibres, reduces product weight and allows for accurate adaptation even to complex shapes. Autoneum is using Flexi-Loft worldwide as an insulator for various carpets, inner dashes, and other acoustic components of automobiles based on its prime-light technology. This, in turn, is expected to create a lucrative opportunity for the growth of the automotive acoustic material market.

KEY BENEFITS FOR STAKEHOLDERS

- This study presents an analytical depiction of the global automotive acoustic material market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall automotive acoustic material market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global automotive acoustic material market with a detailed impact analysis.

- The current automotive acoustic material market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive Acoustic Material Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.6 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 315 |

| By Vehicle Type |

|

| By Material Type |

|

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | Toray Industries, Inc., Covestro AG, BASF SE, Henkel AG & Co. KGaA, Sumitomo Riko Company Limited, Lyondellbasell Industries Holdings B.V., sika, Huntsman International LLC, 3M, Freudenberg Group |

Analyst Review

The rising availability of mainly designed acoustic materials with dampening capabilities and the worldwide emphasis on reducing noise pollution is providing considerable potential opportunities for the industry. Similarly, the fast advancement of manufacturing technology and the rise & expansion of the manufacturing sector will boost market expansion. For instance, in November 2022, Covestro AG launched the advanced solutions for automotive interiors at the K 2022 plastics trade show. The company has developed the first material that is shrinkage-free and highly dimensionally stable, transparent, and heat-resistant. This material can be back-injected and back-lit to create textured and 3D shapes.

Automotive acoustics is slowly gaining popularity as a quality factor in current automobiles, and automakers are expressing a lot of interest in it. In addition, many OEMs are heavily investing in the R&D of the most cutting-edge acoustic material solutions for electric automobiles since EV powertrains have fewer moving parts and generate various sounds and vibrations. For instance, in May 2022, BASF SE launched its flame-retardant engineering plastics Ultramid® A3U44G6 DC OR for the eMobility market. The new grade meets all the criteria of color stability and heat aging resistance and thus also enables long-lasting color coding, which is safety-relevant in the sensitive area of high voltages. Since they are used in numerous components such as the engine cover, dash insulator, and other components that are regularly vibrated when the car is driving, the aftermarket for automotive acoustic materials is expected to expand. The ever-increasing demand for sports and luxury vehicles and the growing popularity of modified antique cars may open a large market for automotive acoustic materials.

Similarly, the rise in number of automotive players is now influencing the sound technologies in their vehicles for enhanced customer experience. Also, availability of a wide range of premium vehicles further triggers the market development which in turn stimulates the market demand for automotive acoustic materials. For instance, in March 2021, Teijin Limited announced that its polyester three-dimensional molded sound-absorbing material had been adopted for Toyota Motor Corporation's fuel cell vehicle (FCV) "Mirai." It will be used as a material to reduce noise when hydrogen and air chemically react in the FC stack, and the generated water is discharged from the FC stack or drainpipe outside the vehicle.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period, due to increasing demand for sports and luxury vehicles and the growing popularity of modified antique cars. Also, the growth in constant R&D spending by manufacturers to enhance noise-absorbing levels is driving the automotive acoustic materials market.

The automotive acoustic material market is estimated to reach $6,621.60 million by 2031, exhibiting a CAGR of 6.4% from 2022 to 2031.

3M Acoustics, BASF SE, Covestro, Freudenberg Group, Henkel Adhesive Technologies, Huntsman, Lyondellbasell, Sika, Sumitomo Riko, and Toray Industries are the top companies to hold the market share in automotive acoustic material.

Interior cabin acoustics is the leading application of automotive acoustic material market.

Asia-Pacific is the largest regional market for automotive acoustic material.

Rise in penetration of luxury vehicles, increase in demand for enhanced comfort & safety features in vehicles, and stringent government regulations for economic assistance and vehicle noise supplement are the upcoming trends of automotive acoustic material market in the world.

Loading Table Of Content...