The global automotive adaptive front lighting market was valued at $1.5 billion in 2021, and is projected to reach $4.2 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031.

The automotive adaptive front lighting adapts the vehicle lights to suit the light, road and weather conditions to increase perceptual safety and relieves driver stress. In addition, the adaptive headlamps are the intelligent headlamps that can automatically adjust to suit the driving situation. Active curve lights pivot the headlamps into the bend, improving road illumination. Moreover, the automotive adaptive front lighting allows the drivers as well as pedestrians to analyze the vehicle's direction of travel, size, position, and speed at low visibility area, which reduces the probability of road accidents. Automotive adaptive front lighting has several benefits over ordinary lighting system including the improved reliability & visibility, optimum energy-efficiency, better operational efficiency, and having the upright aesthetics. Currently, they are installed mostly in premium and high-end vehicles due to their relatively high acquisition cost.

Factors, such as adoption of Advanced Driver Assistance System (ADAS) and rise in concern toward road safety supplements the growth of the global automotive adaptive front lighting market. Moreover, high cost & configuration complexity accompanied with unorganized aftermarket services in developing regions hamper the growth of the market. However, factors, such as increase integration of advanced technology in vehicle and surge in adoption of autonomous vehicles, create ample opportunities for the growth of the global market during the forecast period.

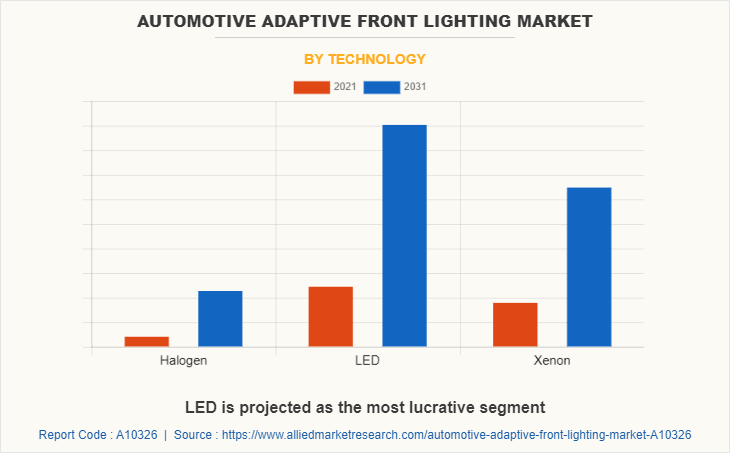

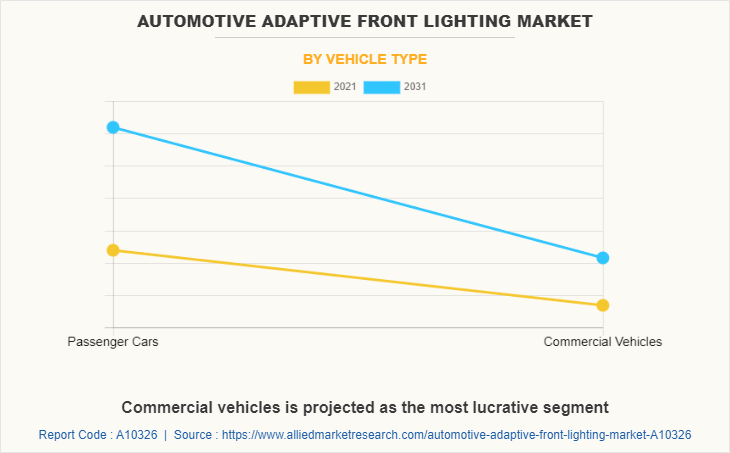

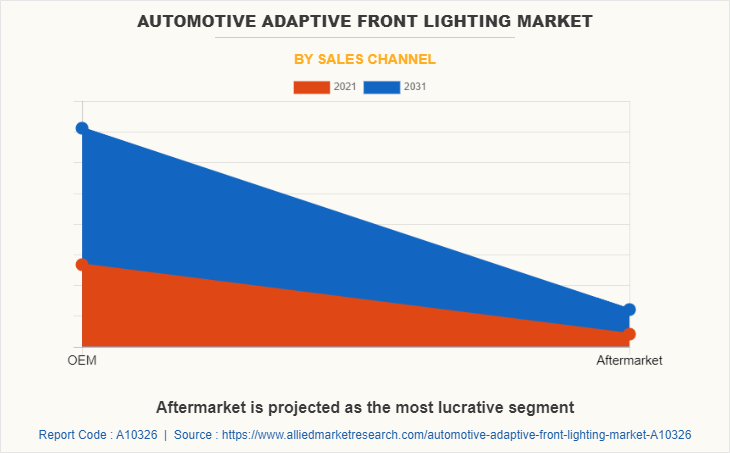

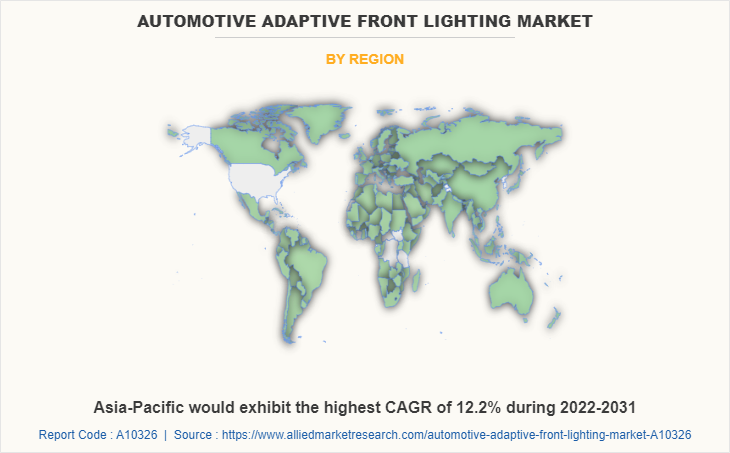

The global automotive adaptive front lighting market has been segmented into technology, vehicle type, sales channel, and region. By technology, the global market is divided into halogen, LED, and Xenon. By vehicle type, it is bifurcated into passenger vehicle and commercial vehicle. By sales channel, the global market is segmented as OEM and aftermarket. By region, the global market has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players analyzed in the automotive adaptive front lighting market include Continental AG, DE Amertek Corporation, Hella KGaA Hueck & Co., Hyundai Mobis Co., Ltd., Johnson Electric Holdings Limited, J.W. Speaker Corporation, Marelli Holdings Co., Ltd., Robert Bosch GmbH, Stanley Electric Co., Ltd. and Valeo.

Adoption of Advanced Driver Assistance System

Automotive adaptive front lighting is a part of advanced driver assistance system which changes the vehicle lighting pattern during a drive on a turning road to compensate for the road curvature and enhance the night visibility. In addition, in bad weather conditions, the intelligent lighting of ADAS plays a vital role as it provides enhanced visibility while driving in bad visibility conditions. Moreover, factors such as adoption autonomous and semi-autonomous vehicles, high demand for safety features, and increased requirement for comfort drive the growth of advanced driver assistance system that directly compliments the growth of automotive adaptive front lighting market.

Rise in concern toward road safety

The demand for safety features along with adaptive front lighting has increased due to surge in number of road accidents around the world. Vehicles with adaptive and intelligent lightings can detect threats on the path; thereby, allowing the vehicle driver to take appropriate required actions. Rise in concern regarding road accidents globally, fuels the demand for better safety features in vehicles eventually leading to incorporation of intelligent lighting systems, which supports the growth of the market. Intelligent lights are primarily installed to enhance the visibility in curve roads and improve the vehicles conspicuity in critical conditions. Further, as per World Health Organization’s published data in June 2021, nearly 1.3 million people die in road traffic accidents each year that comprises a significant portion owing to improper lighting system in vehicle. These factors boost the demand for adaptive and intelligent lighting system in vehicles. Therefore, increase in concern toward road safety drives the growth of the automotive adaptive front lighting market.

High cost & configuration complexity

The increase in need for operational efficiency, enhancement in overall safety, and greater visibility are expected to fuel the demand for intelligent headlamps. However, the intelligent headlamps are connected with steering of vehicle that allows it to automatically adjust according the driving situation and helps to avoid dazzling oncoming drivers. This eventually increases the cost of intelligent headlamps to be used in automobiles. For instance, the average cost of intelligent headlamp is observed to be around $948.9. Therefore, the automotive adaptive front lighting market is anticipated to experience a decline during the forecast period.

Unorganized aftermarket services

Intelligent lighting is primarily offered in premium vehicles due to its high cost. In addition, the intelligent lights are very complex to install due to which unorganized aftermarket services centers face difficulty in incorporation of intelligent headlights. Moreover, improper incorporation of intelligent lights can impact overall functionality of vehicle lighting system. Further, any incorporations from unorganized aftermarket service center hampers the warranty of the vehicle. Therefore, the unorganized aftermarket services limit the growth of the automotive adaptive front lighting market during the forecast period.

Surge in adoption of autonomous vehicles

Intelligent lighting system is an important component in autonomous vehicles that follow the curve of the road and give a more solidified and lit up field of vision. The continuous developments in the area of autonomous vehicle by leading companies drive the growth of the autonomous vehicles market. In addition, factors such as technology advancement, rise in congestion in urban areas, consumer acceptance, and policy & legislation fuel the demand for autonomous vehicles and create opportunities for automotive adaptive front lighting market.

The automotive adaptive front lighting market is segmented into Technology, Vehicle Type and Sales Channel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive adaptive front lighting market analysis from 2021 to 2031 to identify the prevailing automotive adaptive front lighting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive adaptive front lighting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive adaptive front lighting market trends, key players, market segments, application areas, and market growth strategies.

Automotive Adaptive Front Lighting Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | STANLEY ELECTRIC CO., LTD., ROBERT BOSCH GMBH, JOHNSON ELECTRIC HOLDINGS LIMITED, DE AMERTEK CORPORATION, CONTINENTAL AG, HELLA GmbH & Co. KGaA, J.W. Speaker Corporation, HYUNDAI MOBIS CO., LTD., VALEO, MARELLI HOLDINGS CO., LTD. |

Analyst Review

The automotive adaptive front lighting market is expected to witness significant growth, owing to adoption of intelligent lighting system in modern vehicles to provide greater visibility. Numerous developments have been carried out by companies, such as Hyundai Mobis Co., Ltd., Valeo, and others, which have supplemented the growth of the automotive adaptive front lighting market.

The demand for vehicles equipped with advanced technology has increased. This has led the vehicle manufacturers to develop and install latest components in the upcoming vehicle models. For instance, companies, such as Hyundai Mobis Developed the advanced adaptive driving beam linked to advanced driver assistance system. The newly developed adaptive lighting system prevents the glare on the driver of the car in front by blocking only the light beaming on the car in front while enabling driving with high beams on all the time.

Moreover, automobile manufacturers across the globe are focusing toward manufacturing the vehicles equipped with advanced technologies such as advanced driver assistance system, adaptive lighting system, intelligent ambient lighting and various other systems, which ensure safety and increase comfort while driving. This is expected to increase the demand for automotive adaptive front lighting. Thus, increase in demand for advanced technology in vehicle create opportunities for the automotive adaptive front lighting market.

The market in Asia-Pacific is projected to report a significant growth, which is attributed to rise in demand for luxury vehicles, adoption of autonomous and semi-autonomous vehicles, and advancements in technology.

The global automotive adaptive front lighting market was valued at $1,524.0 million in 2021 and is projected to reach $4,157.9 million in 2031, registering a CAGR of 10.7%.

Some upcoming trends include greater adoption in commercial vehicles, and technological advancements associated with LED lights.

The largest region is Europe.

The leading application is passenger cars.

Some leading companies in the market include Continental AG, DE Amertek Corporation, Hella KGaA Hueck & Co., Hyundai Mobis Co., Ltd., Johnson Electric Holdings Limited, J.W. Speaker Corporation, Marelli Holdings Co., Ltd., Robert Bosch GmbH, Stanley Electric Co., Ltd. and Valeo.

Loading Table Of Content...