Automotive Advertising Market Insights, 2032

The global automotive advertising market size was valued at USD 18.5 billion in 2022 and is projected to reach USD 48.0 billion by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

Report Key Highlighters:

- The automotive advertising market study covers 22 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the automotive advertising market share are Adpearance, Inc., CMB Automotive Marketing Limited, Force Marketing, Google LLC by Alphabet Inc., HigherVisibility, Microsoft Corporation, Meta Platforms, Inc., Omnicom Group Inc., Social Media 55, and Visarc. These companies have adopted strategies such as product launches, product development, and others to improve their market positioning

Automotive advertising is defined as a sector within the advertising industry that particularly focuses on promoting the products and services related to automobiles. This includes advertising campaigns for car manufacturers, dealerships, aftermarket products, automotive services, and associated industries such as financing and insurance. This market includes a range of channels and mediums through which automotive companies advertise, such as radio, television, print media, digital platforms, social media, and traditional media such as billboards. Advertising in this sector often focuses on features, performance, safety, technology, and lifestyle related to automobiles to attract a large potential customer base. It primarily aims to create awareness, generate interest, and eventually drive sales of automobiles, automotive parts, accessories, services, and related products.

Surge in social media influence & digital marketing for automotive advertising, along with the rise in number of automotive advertising agencies drive the growth of the automotive advertising market demand. In addition, the increase in awareness about particular models and focused brand awareness are expected to fuel the growth of automotive advertising market. However, the high cost of innovative and attractive advertisements, coupled with the huge market competition among automotive advertisers is projected to limit the growth of this market. Conversely, the rising adoption of AI tools for an automotive marketing strategy is anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

The global automotive advertising market analyis is further growing due to the increasing focus of automotive advertisers to leverage data analytics and personalization efforts. With these enhancements, automotive advertisers are more likely to analyze consumer behavior, preferences, and buying patterns that help automotive brands deliver products and accessories in accordance with customer needs, thereby improving customer engagement and conversion rates.

Moreover, the ongoing digital transformation initiatives to enhance the advertiser's reachability across the wider target audience and track the performance of advertising campaigns effectively are driving market players to develop advertising solutions with advanced technical capabilities. According to Cox Automotive, around 82% of consumers are using online sources for vehicle research prior to making a purchase decision. In response to this, automotive brands initiated improved access to digital channels, which offer accurate targeting capabilities and measurable results among advertisers. Hence, these factors are contributing to the growth of the automotive advertising market across the globe.

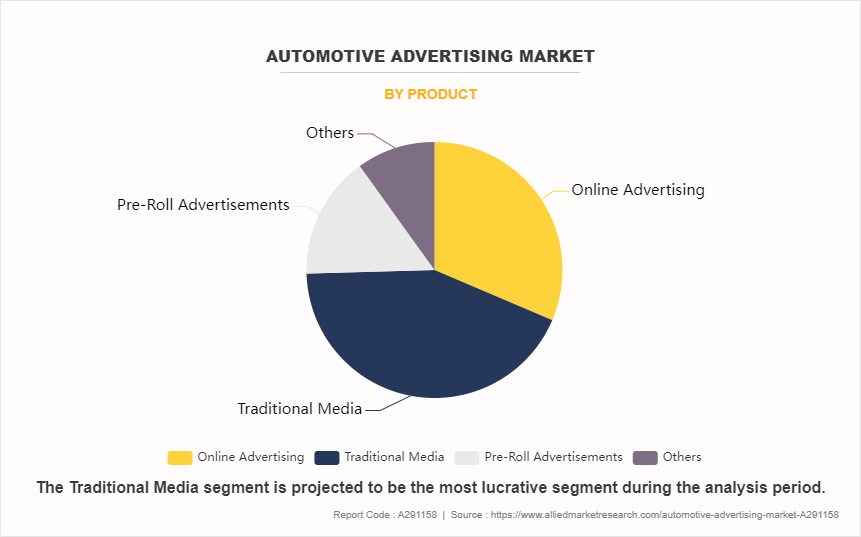

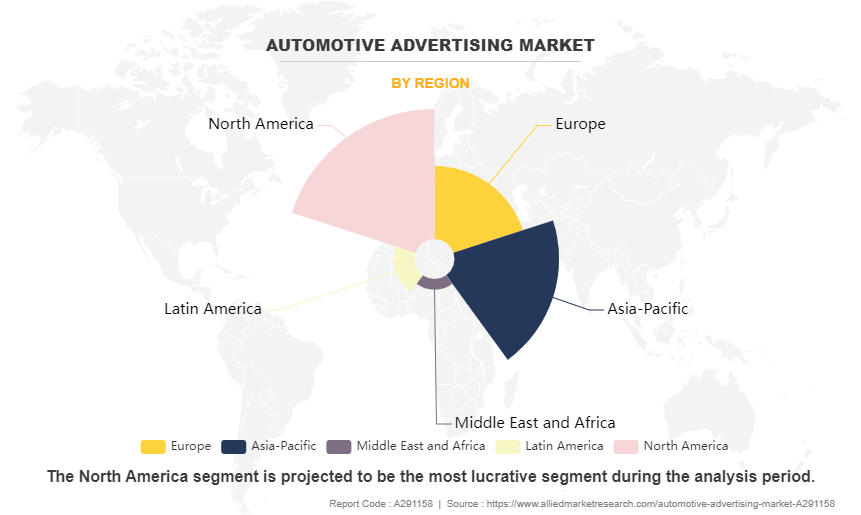

The automotive advertising market is segmented into type, product, end user, and region. Depending on the type, it is categorized into location-independent advertising and location-based advertising. By product, it is divided into online advertising, traditional media, pre-roll advertisements, and others. By end user, it is fragmented into automotive groups, automotive dealerships, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Region-wise, the automotive advertising market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the rising consumer preference for personal mobility and a lifestyle centered around automotive convenience, along with the high rate of digital ad spending by automakers in this region. Moreover, the rise in viewership of OTT video platforms, including digital TV, has improved the spending power of automakers in online advertisements, which fuels the growth outlook of the market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the growing digital markets in Central and Southern Asia, along with the rise in advertising campaigns focusing on convenient, sustainable, and cost-effective alternatives to traditional car ownership across the Asia-Pacific region.

Recent Developments in the Automotive Advertising Industry

- In January 2023, Force Marketing launched Audience IQ, a full-scale customer data platform (CDP), that help auto dealer groups to enhance their customer‐™s experience and increase marketing effectiveness and advertising return on investment.

- In March 2022, Google introduced its new automated vehicle ads that allow auto advertisers to raise their overall vehicle inventory to potential customers on Google.com. This format contains an image of the vehicle, model, price, miles and the advertisers name.

Growing Social Media Influence and Digital Marketing for Automotive Advertising

In the current fast-paced digital landscape, the automotive sector has experienced a profound impact on the transformation in its approach to advertising. Conventional methods are predominantly used in a way to provide more interactive and dynamic experiences, with social media influence and digital marketing taking center stage. According the CarGuru, an automotive research and shopping website, it is anticipated that social media is used by almost 71% of car buyers to assist them in the buying process. The most used social media channels when consumers seek to buy a car are YouTube (41%) and Facebook (37%), followed by Instagram (21%) and Twitter (13%). These trends have been accompanied by the increasing dependence of customers on online platforms for information, recommendations, and purchasing decisions, which play a pivotal role in unparalleled reach and customer engagement opportunities.

Moreover, people rely heavily on a range of social channels for obtaining product information, for example, TikTok emerged as a new engaging search engine, especially among Gen Z. Social media campaigns provide them lucrative opportunities to browse and finalize the purchase of automotive vehicles and related components. In addition, digital marketing emerged as a game-changer in the automotive advertising landscape, providing real-time analytics, precision targeting, and personalized messaging. From captivating visuals to immersive experiences, automotive brands are leveraging a range of techniques to capture the wider attention of their target audience. These aforementioned factors are expected to fuel the widespread adoption of the automotive advertising market, especially in emerging economies.

Rise in Number of Automotive Advertising Agencies

The automotive industry has long been a cornerstone of global commerce, and with the emergence of digitalization, its advertising landscape has endured a remarkable transformation. Further, there has been a significant increase in the number of automotive advertising agencies in recent years, depicting the industry's recognition of the immense opportunities driven by digital platforms and consumer-centric marketing strategies. In fact, as 2024 begins, the industry is expected to experience a considerable shift in business models due to the increasing rate of the electrification process and expansion of connection technology.

This promotes the interest of automotive marketing agencies to put a greater focus on the customer experience to facilitate automotive brands in offering better support services and attract a wide pool of clients, gaining more recognition and media coverage. This often preserves a competitive edge in the market. For instance, Amra & Elma is putting an increased focus on automotive advertising that facilitates car manufacturers in expanding their digital footprint, maximizing the return on investment. This factor is likely to impact the development of the automotive advertising market trends worldwide.

High Cost of Innovative and Attractive Advertisements

In the fiercely competitive landscape of automotive advertising, where capturing consumers' attention is paramount, the pursuit of innovative and attractive advertisements often comes with a substantial price tag. The prime reason behind its high cost is the creative excellence that drives the vision and skills to transform concepts into captivating visuals and narratives. Moreover, securing the services of top-tier talent, such as directors, designers, and photographers, entails considerable fees commensurate with their expertise and reputation, adding to the overall expense of advertisement production. These factors are projected to limit the development of the automotive advertising market.

Furthermore, in the current era of technological innovation, the integration of cutting-edge technologies, such as augmented reality and virtual reality, into advertisements needs a significant investment in both equipment and expertise, contributing to intensified production costs. These aforementioned factors have been acting as a hindrance to the growth of the automotive online advertising market.

Rising Adoption of AI Tools for an Automotive Marketing Strategy

The rapid technological advancement and evolving consumer behaviors & preferences, the automotive sector is likely to witness a profound shift in marketing strategies. One of the most notable developments is the widespread adoption of artificial intelligence (AI) tools to revolutionize automotive brands engage with their wide target audience and drive business growth amidst fierce market competition. Traditional marketing approaches are still relevant and are being augmented and, in numerous cases, these approaches are complemented by the transformative AI capabilities.

For instance, TARS is a cutting-edge platform that delivers a versatile chatbot solution with considerable potential for automotive marketing. Similarly, Adobe Photoshop‐™s Generative Fill, DALL-E, MidJourney, and StabilityAI, are some of the latest examples of AI tools that assist in enhancing sales performance through superior visual representation. Thus, the presence of a large number of AI tools makes automotive marketing easier and offers improved customer engagement opportunities, which in turn drives the growth of the automotive advertising industry during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive advertising market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Automotive Advertising Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 48 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Product |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Visarc, Meta Platforms, Inc., HigherVisibility, Omnicom Group Inc., Microsoft Corporation, Adpearance, Inc., Google LLC by Alphabet Inc., CMB Automotive Marketing Limited, Social Media 55, Force Marketing |

Analyst Review

According to the leading CXOs, the automotive advertising market is expected to witness significant growth globally, due to the rising government initiatives to promote automotive manufacturing, electric vehicles (EVs), and clean energy drive advertising efforts. The ongoing trend of automotive advertising through digital channels, such as social media platforms, and online marketplaces to reach and engage consumers, particularly younger demographics, has further fueled the growth outlook of the automotive advertising market. The market growth is accompanied by numerous developments carried out by top advertising service providers, such as Meta Platforms, Inc., Microsoft Corporation, Google Corporation, and CMB Automotive Marketing Limited, which has led to the growth of the market.

With larger requirements for automotive advertising, service providers introduced various strategies, such as product launch and development, partnership, acquisition, collaboration, and business expansion, to strengthen their market position capabilities. Among these, product launch is a leading strategy used by prominent players such as Google and Microsoft Corporation. For instance, in March 2022, Google launched automated vehicle ads for all U.S. advertisers that enable auto advertisers to promote their overall vehicle inventory to potential customers on Google.com. This format often includes an image of the vehicle, make, model, price, miles, and the advertiser’s name. However, it is not likely to allow advertisers to promote vehicle accessories, parts, tires, or services.

Similarly, in August 2022, Microsoft Corporation introduced Automotive Ads, Audience Network expansion, and seven other updates across the U.S. and global markets. The new Automotive Ads are specified ad formats that are unique to the auto industry. The new ad format is expected to display a snap of the vehicle for sale, the year, and model, condition, dealer website, price, and a brief description. Such novel developments and innovations are projected to pave the market demand for automotive advertising.

The key factors that drive the growth of the market are increase in penetration of social media & digital marketing for automotive advertising, surge in number of automotive advertising agencies, rise in awareness of particular models, and focused brand awareness. However, the high cost of innovative advertising is the factor likely to hinder market growth. Furthermore, the increase in adoption of AI tools for an automotive marketing strategy is expected to give remarkable growth opportunities to key players operating in the automotive advertising market.

Among the analyzed regions, Asia-Pacific is expected to account for the highest CAGR in the global market throughout the forecast period, followed by North America and Europe. This growth rate is driven by robust economic growth, increasing vehicle ownership rates, and changes in consumer preferences, owing to rapid urbanization and the increase in the middle-class population. In addition, countries such as China, Japan, and India are projected to witness significant demand for automotive advertising in the future, owing to the increase in demand for vehicles. This is likely to boost the Asia-Pacific market for automotive advertising.

The automotive advertising market is segmented into type, product, end user, and region. Depending on type, it is categorized into location-independent advertising and location-based advertising. On the basis of product, it is divided into online advertising, traditional media, pre-roll advertisements, and others. By end user, it is fragmented into automotive groups, automotive dealerships, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

The global automotive advertising market size was esteemed at $18,453.60 million in 2022 and is estimated to reach $48,004.58 million by 2032, exhibiting a CAGR of 10.2% from 2023 to 2032.

The key players in the automotive advertising market are Adpearance, Inc., CMB Automotive Marketing Limited, Force Marketing, Google LLC by Alphabet Inc., HigherVisibility, Microsoft Corporation, Meta Platforms, Inc., Omnicom Group Inc., Social Media 55, and Visarc.

Surge in social media influence & digital marketing for automotive advertising, along with the rise in number of automotive advertising agencies drive the growth of the market. In addition, the increase in awareness about particular models and focused brand awareness are expected to fuel the growth of automotive advertising market.

Online advertising is expected to be the leading product of automotive advertising market.

Region-wise, the automotive advertising market was dominated by North America in 2022 and is expected to retain its position during the forecast period.

Loading Table Of Content...

Loading Research Methodology...