Automotive Aluminum Wheel Market Overview

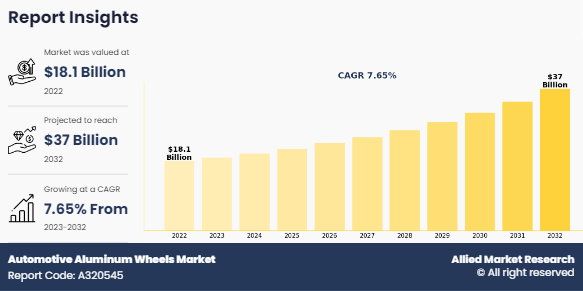

The global automotive aluminum wheels market size was valued at USD 18.1 billion in 2022, and is projected to reach USD 37 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. The automotive aluminum wheel market is driven by increase in vehicle production and sales, increase in demand for enhanced visual appeal in automobiles and increase in trend towards weight reduction. However, factor such as volatility in raw materials price and high cost hinder the market growth. Furthermore, factors such as technological advancement and increase in demand for aftermarket products are anticipated to offer lucrative market growth opportunities.

Key Market Trends & Insights

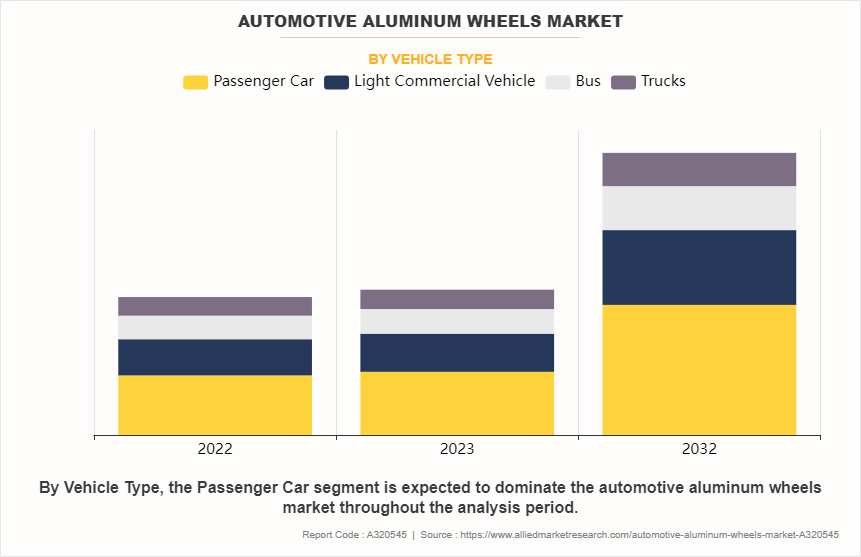

- Passenger cars are expected to drive significant growth in the automotive aluminum wheel market.

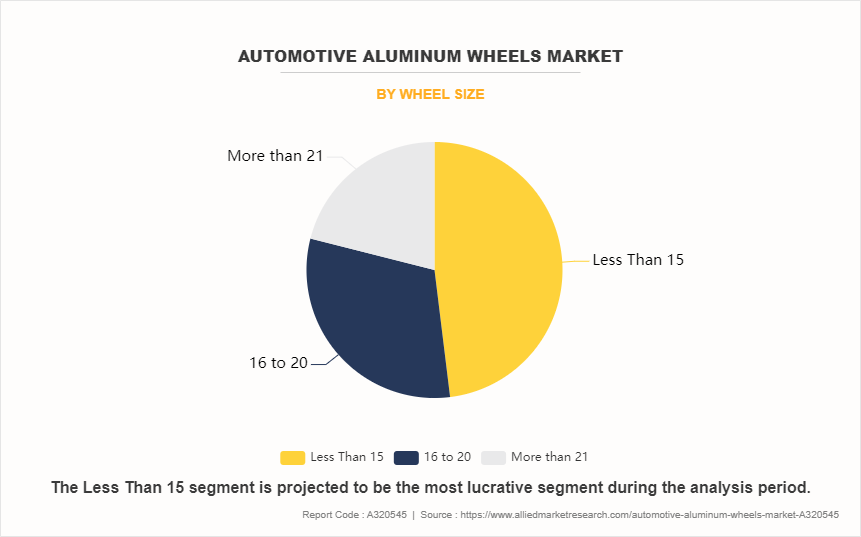

- Wheels under 15 inches are projected to witness notable growth in demand.

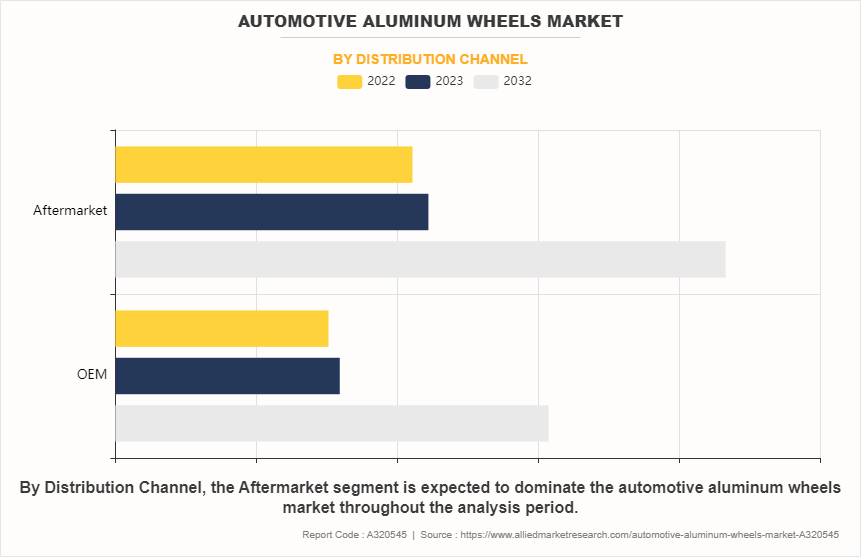

- Aftermarket channels are anticipated to record the highest CAGR in the forecast period.

- Electric vehicles are set to register the fastest growth by propulsion type.

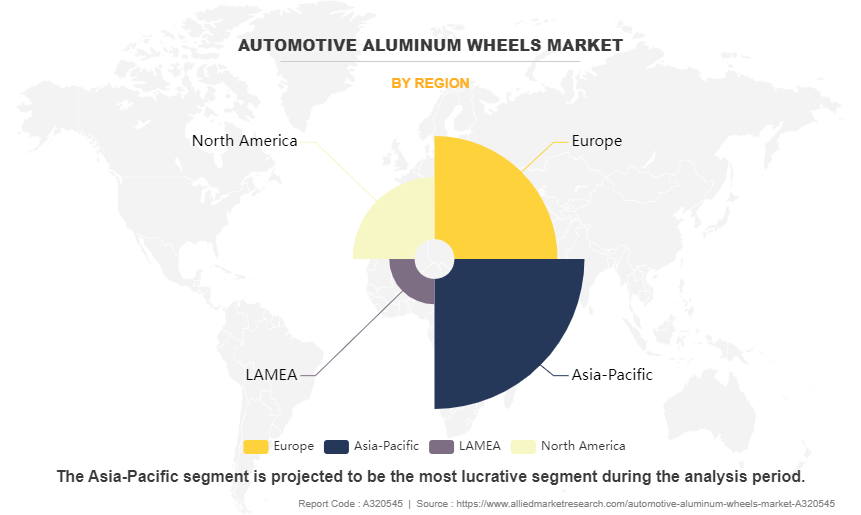

- Asia-Pacific is projected to achieve the highest CAGR regionally.

Market Size & Forecast

- 2032 Projected Market Size: USD 37 billion

- 2022 Market Size: USD 18.1 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 7.7%

Introduction

Automotive aluminum wheels are made majorly of aluminum metal and mixture of alloys and are around 30-40% lighter in weight as compared to steel wheels. Due to their lower weight, these wheels are used in cars for lowering fuel consumption, reducing tire wear, and enhancing riding comfort. In addition, aluminum wheels also offer other benefits such as enhancing aesthetic appeal of the wheel, better heat dissipation, corrosion resistance, and overall reduced weight.

Market Dynamics

The automotive aluminum wheels market share is segmented on the basis of vehicle type, wheel size, distribution channel, propulsion type, and region. By vehicle type, the market is divided into passenger car, light commercial vehicle, bus, and trucks. On the basis of wheel size, the global market is divided into less than 15, 16 to 20, and more than 21. By distribution channel, the market is segmented into OEM and aftermarket. On the basis of propulsion type, the market is segmented into ICE and electric. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Currently the market demand for automotive aluminum wheel is increasing, particularly in the developing regions such as China, India, and others due to rise in population, which has resulted in increased demand for vehicles. Companies operating in this industry are adopting various innovative techniques such as mergers and acquisition activities, to strengthen their business position in the competitive matrix.

Automobiles tend to become heavier as the safety features are improved. Automotive weight reduction is regarded as one of the most effective means for decreasing fuel consumption in any vehicle. Large OEM and aftermarket wheel manufacturers are making significant investments towards reducing the weight of car wheels. as reduced weight improves overall vehicle dynamics, fuel efficiency, and performance. Moreover, with the growing popularity of hybrid and electric cars (EVs), manufacturers are now focusing on improving battery performance and boosting overall vehicle range. Lighter wheels require less energy to move the car forward, allowing for increased driving range in electric cars. To reduce weight, manufacturers are experimenting with combing different metals to produce wheels.

For instance, aluminum and its alloys are regarded as the ideal lightweight material for automobiles and related components since it can reduce the overall weight of the component by up to 50% without sacrificing on safety. Therefore, rise in demand for low-weight vehicle components coupled with inclination toward luxury and comfortable automobiles supports the demand for automotive aluminum wheel and acts as a major driver for the market.

Which are the Top Automotive Aluminum Wheels companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Automotive Aluminum Wheels industry.

- Status Wheels

- ENKEI Wheels (India) Limited

- Wheel Pros

- Accuride Corporation

- CITIC LIMITED

- BBS Kraftfahrzeugtechnik AG

- OTTO FUCHS KG

- Ronal Group

- Wanfeng Group Co., Ltd.

- BBS Japan Co., Ltd.

- SuperAlloy Industrial Co., Ltd.

- Maxion Wheels

- Uno Minda

- Fuel Off-Road Wheels

- MHT Luxury Wheels

- ALCOA Wheels

- Zhejiang Hongxin Technology Co., Ltd.

- UNIWHEELS AG

What are the Recent Developments in the Automotive Aluminum Wheels Market

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

On June 2023, CITIC LIMITED opened its first plant in Mexico that provides high-quality aluminum wheels for prestigious automotive brands. The plant, located in the Santa María Industrial Park, in Ramos Arizpe, represents an important investment of 100 million dollars in its first phase and is expected to generate more than 1,200 direct and indirect jobs.

On September 2023, Maxion Wheels developed latest light vehicle wheel innovation technology, Maxion BIONIC. It is developed by teams in Brazil, Mexico, the U.S., and Germany. Maxion BIONIC answers the growing demand from OEMs for affordable, stylish, and sustainable wheel solutions, especially for light vehicle programs where wheel load is increasing.

On September 2022, Maxion Wheels partnered with Inci Holding to start new truck steel wheels plant in Turkey by investing $150 million. These two companies plan to build a plant to offer forged aluminum Commercial Vehicle (CV) wheels beginning in 2024.

On November 2022, Ronal Group launched R70-blue, carbon neutral recycled aluminum wheel to reduce greenhouse gas emissions from both the aluminum production and the wheel manufacturing process. It is manufactured using recycled aluminum, which significantly reduces the need for virgin materials and minimizes the environmental footprint associated with traditional manufacturing processes.

On April 2021, Wheel Pros launched ForceForm, a new line of Made-in-America cast wheels. The ForceForm wheels are built using modern casting technology, maximizing the efficiency of available tooling & production processes, and designed to exceed Department of Transportation structural requirements.

Segmental Review

The automotive aluminum wheels market is classified on the basis of vehicle type, wheel size, distribution channel, propulsion type, and region. By vehicle type, the market is divided into passenger car, light commercial vehicle, bus, and trucks. On the basis of wheel size, the global market is divided into less than 15, 16 to 20, and more than 21. By distribution channel, the market is segmented into OEM and aftermarket. On the basis of propulsion type, the market is segmented into ICE and electric. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Vehicle Type

On the basis of vehicle type, the passenger car segment accounted for the largest market share in 2022, due to rise in population in developing nations, such as China and India, creates lucrative opportunities for the penetration of electric and hybrid passenger car and assists in the automotive aluminum wheels market growth. In addition, factors such as rise in disposable income in countries, such as India and China, and stringent rules and regulations to promote adoption of electric vehicles are projected to increase the demand for automotive aluminum wheels in passenger vehicles, which in turn is projected to contribute toward the growth of the market.

By Wheel Size

Based on wheel size the less than 15 segment accounted for the largest market share in 2022, due to their high adoption in the passenger vehicle segment. Moreover, this segment is the lightest in weight as compared to other wheel types. This allows the vehicle suspension to respond more quickly, which enhances handling, cornering, improving¯overall maneuverability, increased fuel efficiency, and better handling on the vehicle.

By Distribution Channel

On the basis of distribution channel, the aftermarket segment accounted for the largest market share in 2022, owning to companies operating as an aftermarket player offer a wide range of products options in the market at a relatively lower price, which helps companies to generate revenue. In addition, customers also prefer buying products from aftermarket players as they are cheaper.

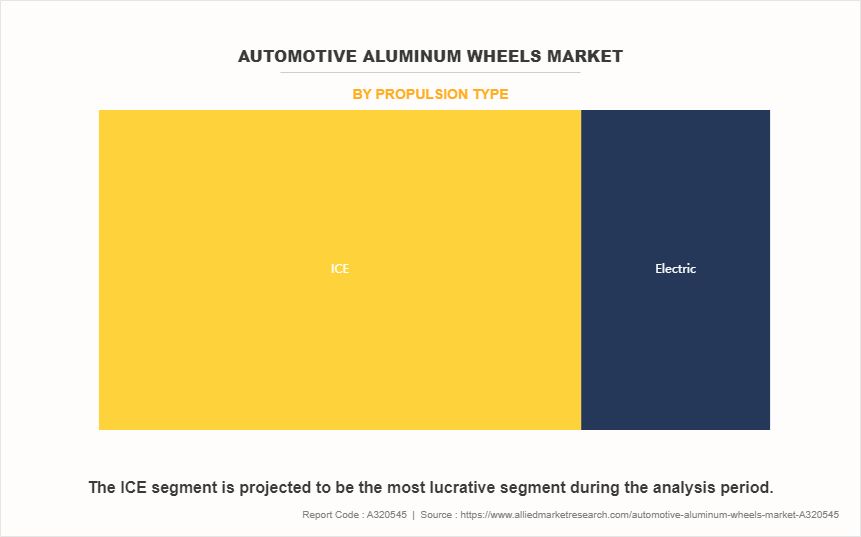

By Propulsion Type

Based on propulsion type, the ICE segment accounted for the largest market share due to affordability of the ICE vehicle, moreover, in major developing regions, there is lack of EV charging infrastructure. Customers are therefore more likely to choose internal combustion engines (ICEs). ICEs are mostly utilized in commercial vehicles and are going to continue to dominate the market for few years.

By Region

On the basis of region the Asia-Pacific region accounted for the largest market share in 2022, owning to significant rise in income levels and increase in urbanization in emerging countries of Asia-Pacific are driving the demand for automotive aluminum wheels. In addition, strengthening regulation related to vehicle emission, and subsidies and incentive scheme for hybrid & electric vehicles are helping in the market growth. Passenger electric vehicles are gaining popularity among consumers, which will further boost the demand for automotive aluminum wheels trends.

What are the Top Impacting Factors

Key Market Driver

Increase in Vehicle Production and Sales

In recent years, there has been increase in production and sales of automobile. The major factors driving the sales of the automobiles include increase in technological advancement in the EV and hybrid vehicle technology, increase in disposable income among consumer, and growing demand for automobiles from the emerging markets such as China, India, Brazil, Indonesia, Mexico, and others. Rise in urbanization along with increase in population is boosting the demand for vehicles among consumers.

In addition, with the growing prices of fuel, consumers are shifting their focus towards hybrid vehicles as hybrid vehicles deliver 20% - 35% more fuel economy as compared to traditional gasoline-powered vehicles. Moreover, governments globally are implementing stricter emission norms on traditional ICE vehicle, to reduce tapeline emission and greenhouse gases from vehicle. Governments are also encouraging the adoption of green mobility solution such as EV and hybrid vehicles. Thus, rise in inclination of customers towards EV and hybrid vehicle technology is resulting in increased production of vehicles. This trend is expected to be the main driver for the growth of the automotive aluminum wheels market during the forecast period.

Increased in Demand for Enhanced Visual Appeal in Automobiles

There is increase in demand for automotive aluminum wheels for enhancing aesthetic appeal in passenger and commercial vehicles. Aluminum wheels give more customization possibilities than standard steel wheels since aluminum wheels can be built with different designs, elaborate patterns, and distinctive finishes. Aluminum wheels are lighter in weight as compared to steel wheels. They can be bended in different forms and casted in different designs.

Aluminum wheels also have a greater resistance to rust and corrosion owing to their nature, which makes them durable and functional in adverse weather conditions such as high moisture areas. As aluminum wheels enhance vehicle performance, reduce weight, and enhance aesthetics, they are extensively used by original equipment manufacturers in mid and higher range vehicles.

Restraints

Volatility in Raw Material Price

In recent years, the prices for raw materials, primarily aluminum, has grown immensely due to supply chain disruption during the COVID-19 pandemic and the impact of the Russia-Ukraine war. Aluminum is the third most traded metal and its major manufacturers are China, Russia, Canada, and UAE. China utilizes over half of global raw aluminum production. As the price for raw aluminum increased, the automotive aluminum wheel manufacturers in China increased the price of aluminum wheels.

Similarly, many developed economies depend heavily on metal exports. With the shortage in aluminum, they are focusing more on metal recycling to meet their raw material demand. With increase in global aluminum price and supply chain constraints, manufacturers in Europe and U.S are facing severe shortage of aluminum, further increasing the overall prices of wheels. Thus, volatility in the price of raw materials is anticipated to hinder the market growth during the forecast period.

Opportunity

Technological Advancement

The automotive industry is shifting its focus towards lightweight materials to reduce overall vehicle weight, increase efficiency, and performance. Automobile aluminum wheel manufacturers are increasingly focusing on technological advancement in wheels to reduce weight and make them more durable. For instance, BBS developed ‘Air Inside Technology’ wheels. These wheels set have hollow chambers construction, inspired by nature and reduce the overall rotational mass while significantly enhancing the wheels' stability and load-bearing capability. For example, in the inner center and outer shoulder of the wheel, the weight is drastically reduced by several kilograms. The company performance line range of wheels are extensively used by major OEM manufacturers such as BMW, Audi, Mercedes and Porsche.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive aluminum wheels market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Automotive Aluminum Wheels Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 37 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 364 |

| By Vehicle Type |

|

| By Wheel Size |

|

| By Distribution Channel |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | SuperAlloy Industrial Co., Ltd.., Status Wheels, Uno Minda, Accuride Corporation, BBS Kraftfahrzeugtechnik AG, Fuel Off-Road Wheels, CITIC LIMITED, ENKEI Wheels (India) Limited, Maxion Wheels, UNIWHEELS AG, Ronal Group, MHT Luxury Wheels, Zhejiang Hongxin Technology Co., Ltd., BBS Japan Co., Ltd., Wheel Pros, OTTO FUCHS KG, ALCOA WHEELS, Wanfeng Group Co., Ltd. |

Reduction in wheels are the upcoming trend in the automotive aluminum wheels market.

Passenger cars are the major application of automotive aluminum wheels.

Asia-Pacific is the largest regional market for automotive aluminum wheels.

The automotive aluminum wheel market was valued at $18.09 billion in 2022.

Accuride Corporation, ALCOA WHEELS, CITIC LIMITED, Ronal Group, and Uno Minda are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...