Automotive Ancillaries' Products Market Research: 2032

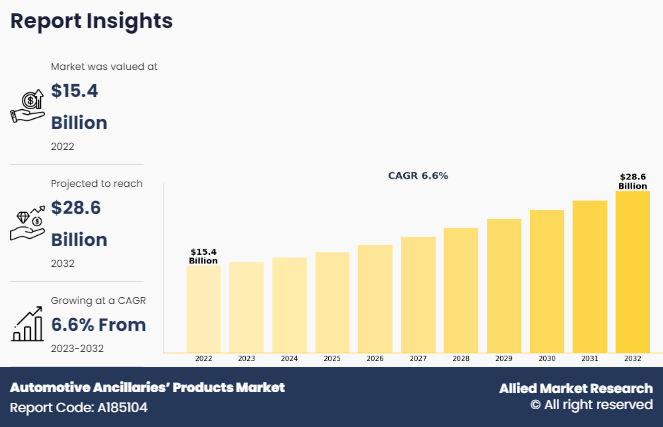

The global automotive ancillaries’ products market size was valued at $15,380 million in 2022 and is projected to reach $28,583 million by 2032, registering a CAGR of 6.6% from 2023 to 2032.

Report Key Highlighters:

- The automotive ancillaries’ products market size covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive ancillaries’ products market share is highly fragmented, into several players including Robert Bosch GmbH, Uno Minda, Continental AG, NIPPON, Duncan Engineering Ltd, ZF Friedrichshafen AG, DENSO CORPORATION, Magna International Inc, AISIN CORPORATION, and Lear Corporation. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

The automotive ancillaries’ products refer to the sector within the automotive industry that is majorly indulged in the production and supply of various automotive components, parts, and related accessories that are used in the repair, maintenance, and aesthetic enhancement of vehicles. Automotive ancillaries’ products are an essential component of the automobile industry as they allow enhanced functioning, safety, and performance of a vehicle. Ancillaries’ products include engine parts, braking systems, electrical systems, safety features, interior components, and communication solutions.

The global automotive ancillaries’ products market growth is driven by an increase in global automobile sales, surge in popularity of vehicle electrification & hybridization, and an increase in trend toward weight reduction in automobiles. However, factors such as fluctuation in the price of raw materials and stringent regulatory compliance are anticipated to hinder market growth during the forecast period. Furthermore, increase in R&D in autonomous & connected vehicle technology and increase in demand for sustainable & eco-friendly solutions are anticipated to provide lucrative market growth opportunity.

The rise in sales of automobiles across the globe is anticipated to be the major driving factor for the growth of the automotive ancillaries’ product market. As the demand for new vehicles grows, there is increased demand for automotive ancillaries’ products for the manufacturing and regular maintenance of vehicles. Similarly, as modern vehicles are equipped with novel technologies such as electric drive trains, ADAS, infotainment systems, and other modern connectivity solutions, they require regular maintenance, thus creating increased need for the replacement of automotive ancillaries’ products market.

The primary reason for that boosts automobile sale is increase in demand for automobiles in the developing nations particularly in China, India, Bangladesh, Brazil, and Mexico. These countries have seen a strong economic boom and rapid urbanization in recent years, resulting in a rise in disposable income among consumers and surge demand for passenger vehicles. Consumers are increasingly shifting from traditional internal combustion engine automobiles to alternative fuel vehicles as the price of petroleum has increased and governments have implemented laws on vehicle emission. This resulted in an increase in sales of electric, hybrid, and alternative fuel vehicles such as hydrogen fuel vehicles, biodiesel vehicles, and compressed natural gas (CNG) vehicles. Automobile sale is anticipated to continue to witness strong growth rate during the forecast period, thus driving the automotive ancillaries’ products market opportunity.

Key Developments in the Automotive Ancillaries’ Products Market

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On August 17, 2023, Uno Minda commissioned two new manufacturing facilities in Haryana, India. The new manufacturing facilities look after the manufacturing of ancillaries’ products for electric vehicles. The new manufacturing facility is expected to majorly manufacture on-board chargers, off-board chargers, motor control units, DC-DC converters, and battery management systems for electric 2 and 3-wheelers.

- On January 13, 2023, Robert Bosch GmbH announced its plan to invest $1 billion in component manufacturing of electric vehicles in China. The company plans to build a new manufacturing facility and research and development center in Suzhou City. The company also plans to increase its production of electric drive systems for commercial vehicles, including electric motors and power electronic control units, in China; the investment in a new manufacturing facility is anticipated to boost the company's presence in the Asia-Pacific region.

- On July 10, 2023, ZF Friedrichshafen AG showcased its next gen of electric powertrains for OEM. The new product range includes all-electric central drives, axle drives, and other related components, which are particularly developed for light, medium, and heavy-duty trucks and trailers. The new integrated, modular e-driveline systems ensure noiseless and emission-free vehicle operation.

Segmental Analysis

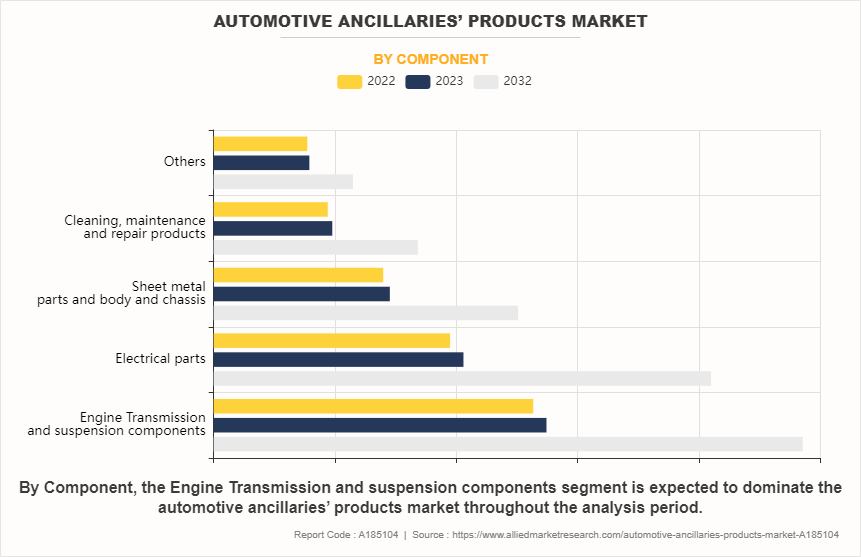

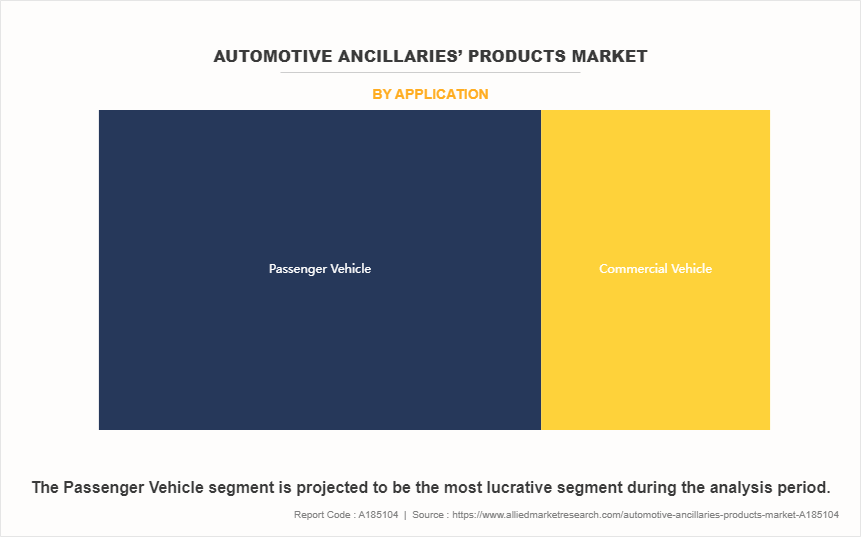

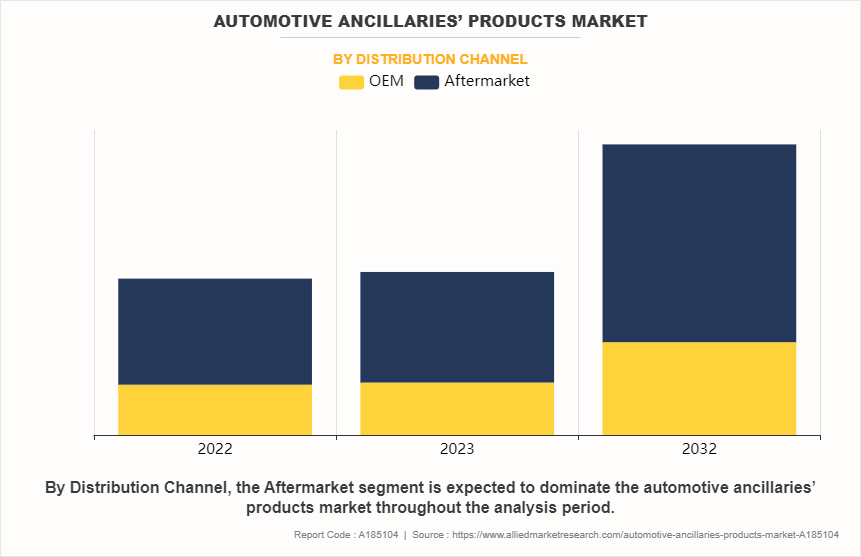

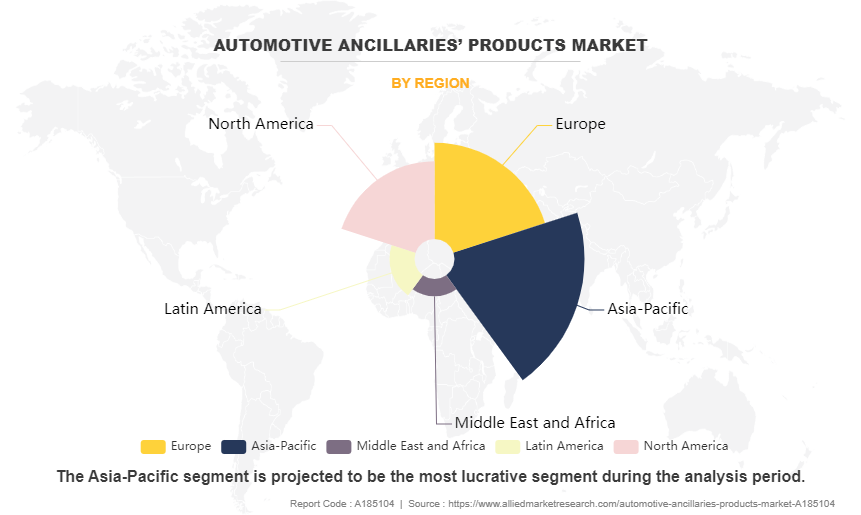

The automotive ancillaries’ products market analysis is segmented on the basis of component, application and distribution channel, and region. On the basis of component, the market is divided into engine transmission & suspension components, electrical parts, sheet metal parts & body and chassis, cleaning, maintenance & repair products, and others. On the basis of application, the market is fragmented into commercial vehicles and passenger vehicles. On the basis of distribution channel, the market is segregated into OEM and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

By Component

On the basis of component, the global automotive ancillaries’ products market is segregated into engine transmission & suspension components, electrical parts, sheet metal parts & body and chassis, cleaning, maintenance & repair products, and others. The engine transmission and suspension component segment accounted for the largest market share in 2022, as these components are a crucial part of overall vehicle safety and functionality. Likewise, these components consist of several moving parts, such as pistons, crankshafts, valves, and others, which are most prone to wear and tear and thus require regular maintenance and replacement.

By Application

By application, the global automotive ancillaries’ products market is divided into commercial vehicles and passenger vehicles. The passenger vehicle segment accounted for the largest market share in 2022, due to an increase in disposable income among consumers in the developing economy and surge in inclination toward personally owned vehicles. Furthermore, rapid urbanization across the globe with a growing population in cities has resulted in consumers spending more on owning a passenger vehicle for daily commute. Moreover, with the growth in electric and hybrid vehicle e technology, the demand for the passenger vehicle segment is anticipated to continue to grow in the coming years.

By Distribution Channel

On the basis of the distribution channel, the automotive ancillaries’ products market has been segregated into OEM and Aftermarket. The aftermarket segment accounted for the largest market share in 2022 due to the widespread availability of aftermarket products at lower prices in the market. Similarly, aftermarket products offer more customization options and are designed to enhance the aesthetic and overall performance of a vehicle.

By Region

By region, the Asia-Pacific region held the highest market share in terms of revenue in 2022 and is expected to witness the strongest growth rate during the forecast period owing to the higher adoption rates of smart mobility solutions such as EV and hybrid vehicle due to increase in disposable income. Moreover, the region has witnessed an increase in sales of passenger vehicles, due to increasing disposable income among consumers and a growing inclination toward personally owned vehicles. Furthermore, rapid urbanization in the Asia-Pacific region and a growing population in the countries have resulted in consumers spending more on owning a passenger vehicle for the daily commute, thus driving the demand for automotive ancillaries’ products. Furthermore, many technological advances in the automotive sector as a result of government efforts, as well as increased R&D expenditure, help in driving the automotive ancillaries’ products market trends.

Market Dynamics

Increasing Trend Toward Weight Reduction in Automobiles

The demand for lightweight automobiles has grown due to an increase in demand for fuel-efficient and enhanced vehicle performance. Lighter vehicles require less fuel to propel, thus improving their overall performance and handling. As the demand for lightweight vehicles is increasing, automotive ancillaries products manufacturers are focusing on using lightweight materials, such as high-strength steel, aluminum, magnesium, carbon fiber, and alloys, in the manufacturing of components to reduce overall vehicle weight. The demand for weight reduction is particularly high in the electric vehicle segment as it directly helps reduce power demand and increase vehicle range. The demand for weight reduction is anticipated to continue during the forecast period thus helping in the growth of automotive ancillaries' products market.

Fluctuation in the price of Raw Materials

The fluctuation in the price of raw materials significantly hampers the growth of the automotive ancillaries' products market. Raw materials are essential in the manufacturing of automotive ancillaries' products, such as engine transmission, suspension components, electrical parts, sheet metal parts, and body & chassis. The fluctuation in the price of raw materials increases the overall production cost of vehicles, thus hampering market growth. For instance, due to the Russia-Ukraine war, the prices of raw steel increased significantly impacted the ancillaries' products market particularly in the central Europe region. Russia and Ukraine produced around 5-7% of the global steel, however, the war resulted in suspension of operation of 90% steel manufacturing facilities in Ukraine. For instance, Azovstal and Illich Steel facilities, in Mariupol, which accounted for about 41% of Ukrainian steel production, completely halted its production as it was destroyed. Similarly, major countries enacted sanctions on Russian companies, resulting in the decline in the import of steel from Russia and increasing the price of steel. Thus, the fluctuation in the price of raw materials is anticipated to significantly impact the automotive ancillaries' products market forecast.

Increase in Demand for Sustainable and Eco-friendly Solutions

In recent years, there has been a strong focus on environmentally friendly and sustainable mobility solutions. The growth-shifting trend away from traditional internal combustion engine vehicles is due to the rise in price of petroleum and the strengthening of government norms toward the use of ICE vehicles. Despite the rising price of gasoline, major countries around the world have experienced a stable price of electricity; this has led to a growing inclination of consumers toward EVs. Especially in countries that rely majorly on fuel imports, there has been an increased shifting trend toward the use of electric and alternative fuel vehicles. Moreover, as there is continuous ongoing technological advancement in electric vehicle technology, such as the development of EV charging infrastructure, increasing range of EVs, and reduced vehicles cost, consumers have witnessed EVs as an alternative option to ICE vehicles. Thus, the growing trend toward adoption of EV and other alternative fuel vehicles is expected to foster the growth of the automotive ancillaries’ products market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive ancillaries’ products market analysis from 2022 to 2032 to identify the prevailing automotive ancillaries’ products market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive ancillaries’ products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive ancillaries’ products market trends, key players, market segments, application areas, and market growth strategies.

Automotive Ancillaries’ Products Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28.6 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Distribution Channel |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Continental AG, Duncan Engineering Ltd, Lear Corporation, DENSO CORPORATION, AISIN CORPORATION, Nippon, Uno Minda, Magna International Inc, ZF Friedrichshafen AG, Robert Bosch GmbH |

Utilization of lightweight material for manufacturing is the upcoming trend in the automotive ancillaries’ products market.

Passenger vehicles are the leading application of automotive ancillaries’ products.

Asia-Pacific is the largest market for automotive ancillaries’ products.

The automotive ancillaries’ products industry was valued at $15,380 million in 2022.

Robert Bosch GmbH, Uno Minda, Continental AG and ZF Friedrichshafen AG are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...