Automotive Auxiliary Lamps Market Research, 2032

The global automotive auxiliary lamps market size was valued at $7.3 billion in 2022, and is projected to reach $11.1 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032.

Market Introduction and Definition

Automotive auxiliary lamp is an additional lighting device installed in vehicles to supplement the primary lighting system. These lamps serve various purposes, enhancing visibility and safety in different driving conditions. They help to significantly improve visibility in low-light conditions and adverse weather. Moreover, while driving at night, auxiliary lamps provide additional lighting to the vehicle that complements the main headlights, ensuring better illumination of the road ahead. This is attributed to the fact that auxiliary lamps are specifically modified to work in extreme weather conditions such as fog, rain, and snow, providing a clearer view of the road when standard headlights might struggle.

Key Takeaways

The automotive auxiliary lamps market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Automotive auxiliary lamps industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

On February 6, 2023, Lazer Lamps Ltd. became an employee ownership trust (EOT) business; this move is anticipated to make employees more involved and engaged with the future success of the company. Moreover, the company moved to a new high-tech manufacturing facility in Harlow with considerably more capacity for both production and warehousing compared to the previous manufacturing facility.

On October 5, 2023, ICHIKOH INDUSTRIES, LTD. showcased Intelligent vehicle lighting for electrical and automated driving of the new era Under the theme of “Lighting Everywhere” in the Japan mobility show. The new lighting concept portrays the latest styling trends and gives the vehicle an advanced and modern impression. The lighting solutions help to improve the visibility of drivers and optimize the viewing ability.

On January 11, 2022, J.W. Speaker Corporation and UK Automotive Products announced a partnership. The partnership aims to provide UKAP customers with access to J.W. Speaker’s wide range of LED lighting solutions. The agreement will provide lighting solutions for custom vehicle modification, commercial vehicles, cars, and motorcycles.

On 30 January 2019, Ring Automotive, a 40-year-old company offering products in the automotive aftermarket segment in the UK and Europe, announced an agreement to sell its operations to OSRAM GmbH. The collaboration aims to develop and increase both the company's global operation, development of product range, and service to a vast pool of customers and increase their research and development offering for the automotive aftermarket product range.

?????Key Market Dynamics

The global automotive auxiliary lamps market growth is driven by increase un vehicle production and sales, surge in aftermarket demand, and rise in penetration of electric vehicles. However, high replacement and maintenance costs and stringent automotive industry regulations restrain the development of the market. In addition, advancements in connected vehicle technology and automotive lighting technology are expected to provide automotive auxiliary lamps market opportunity during the forecast period.

In recent years, there has been growing aftermarket demand for automotive auxiliary lamps due to increase in off-road activities. Auxiliary lamps such as floodlights, spotlights, and front fog lamps are extensively being used in outdoor recreational vehicles. Aftermarket automotive auxiliary lamps provide better visibility in harsh and challenging environments than standard headlamps, especially in foggy, rainy, and night driving environments. Moreover, aftermarket automotive auxiliary lamps provide more customizable options to the user and enhance the visual appeal of the vehicle. Likewise, aftermarket auxiliary lamps are more energy-efficient, durable, and powerful compared to traditional OEM-fitted automotive lamps.

Furthermore, with increasing penetration of connected vehicle technology, the market demand for automotive auxiliary lamps is anticipated to grow. Connected and autonomous vehicles often utilize adaptive lighting systems for improving the performance of the navigation systems and other external sensors. Moreover, these vehicles are integrated with energy management systems. Auxiliary lamps integrated with these systems can automatically adjust their power consumption based on real-time data, further helping in energy savings.

Market Segmentation

The automotive auxiliary lamps industry is segmented into type, application, vehicle type, and region. On the basis of type, the market is fragmented into auxiliary high beams, front fog lamps, cornering lamps, and spotlights. Depending on application, it is segregated into OEM and aftermarket. By vehicle type, it is segmented into passenger vehicles and commercial vehicles. Region wise, the market is analyzed in North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North American market for automotive auxiliary lamps is well-established and mature, with the U.S. and Canada being the key contributors. The major factors driving the growth in these markets are advancements in the automotive industry and the growing preferences of people for pickup trucks. Surge in demand for pick-up trucks and rise in recreational activities such as off-roading are fueling the demand for the automotive auxiliary lamps market.

According to data published by the International Trade Administration in November 2023, Mexico is the world’s seventh largest passenger vehicle manufacturer, producing?3.5 million vehicles annually. Moreover, the country is the world’s fifth largest manufacturer of heavy-duty vehicles for cargo; the country has a presence of 14 manufacturing and assembling facilities for buses, trucks, and tractor trucks. Mexico is the largest export market for U.S. automotive parts and the fourth largest producer of automotive parts worldwide, generating $107 billion in annual revenues. The Mexico automotive industry is dependent on five major sub-sectors, including original equipment parts, aftermarket parts, electric and hybrid vehicle parts, specialty equipment, and remanufactured products. The automotive industry in Mexico has seen strong growth in recent years and is anticipated to maintain its dominance in the global market. The growing automotive industry is creating ample opportunity for the automotive auxiliary lamp manufacturers in the region.

Competitive Landscape

The major players operating in the automotive auxiliary lamps market analysis include HELLA GmbH & Co. KGaA, LAMPA SpA, Suprajit Group, OSRAM GmbH., STANLEY ELECTRIC CO., LTD., ICHIKOH INDUSTRIES, LTD., Lazer Lamps Ltd., J.W. Speaker Corporation, Venta Global Ltd., and VALEO SA.

Other players in the automotive auxiliary lamps market size include KOITO MANUFACTURING CO., LTD., StrandsEurope, Koninklijke Philips N.V., Marelli Holdings Co., Ltd., Robert Bosch GmbH, General Electric Company, and Hyundai Mobis.

Parent Market Overview

The global automotive market is witnessing strong growth in terms of vehicle production and sales. The major factor contributing to the growth of the automotive industry is the growing preference of consumers toward EV and hybrid vehicles especially in Europe and North America. Moreover, rising income levels in Asia-Pacific and Africa has escalated the sales of automobiles, especially for the passenger car segment. According to data published by the International Energy Agency (IEA) , by 2030 almost 1 in 3 cars on the roads in China is set to be electric, and almost 1 in 5 in both the U.S. and the European Union. The agency also anticipated that global electric car sales will reach around 17 million units by the end of 2024 and will continue to witness strong growth till 2030.

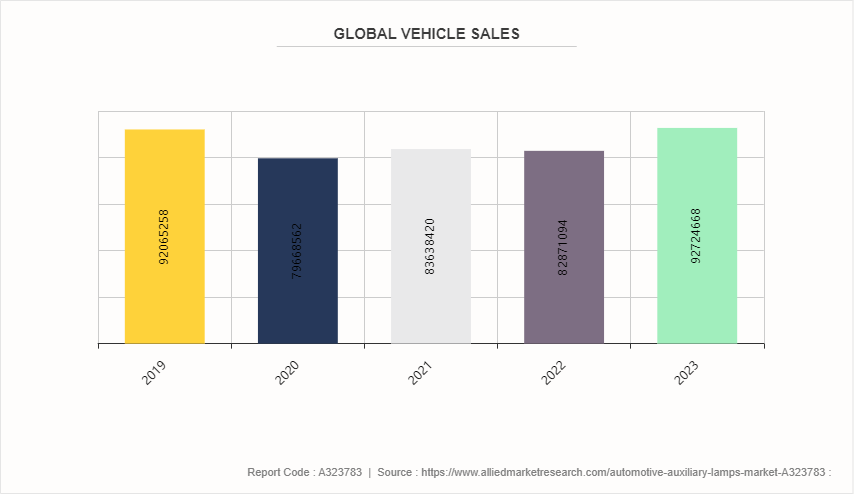

The below graph depicts the sales of the global passenger vehicle segment from 2019 to 2023. The sales greatly decreased in 2020 due to the COVID-19 pandemic. However, the sales are anticipated to continue to witness a positive growth rate till 2030.

Industry Trends

In July 2023, Toyota Motor Corporation, Japan’s renowned automaker, announced plans to establish an auto ancillary manufacturing facility in India. This move reflects the increasing importance of the company to developing markets such as India as a major manufacturing destination especially given global efforts at diversifying supply chains away from overreliance on China. Despite Suzuki’s dominance in India’s automobile space compared to Toyota whose presence was minimal; this possible expansion indicates its commitment towards capturing the fast-growing manufacturing ecosystem of India. Thus, this portrays that major OEM manufacturers are diversifying their production facility away from China, which is the current trend in the industry.

Key Sources Referred

International Organization of Motor Vehicle Manufacturers (OICA) ?

European Automobile Manufacturers Association (ACEA) ?

Automotive Component Manufacturers Association of India (ACMA) ?

Motor & Equipment Manufacturers Association (MEMA) ?

Truck and Engine Manufacturers Association (EMA) ?

Society of Automotive Engineers (SAE) ?

American Trucking Associations (ATA) ?

International Road Transport Union (IRU) ?

Key Benefits For Stakeholders

This report provides a quantitative analysis of the automotive auxiliary lamps market forecast, market segments, current trends, estimations, and dynamics of the market analysis from 2022 to 2032 to identify the prevailing opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive auxiliary lamps market trends, key players, market segments, application areas, and market growth strategies.

Automotive Auxiliary Lamps Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.1 Billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2023 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Suprajit Group, OSRAM GmbH., ICHIKOH INDUSTRIES,LTD., LAMPA SpA, J.W. Speaker Corporation, Lazer Lamps Ltd, HELLA GmbH & Co. KGaA, Venta Global Ltd, Stanley Electric Co., Ltd., VALEO SA |

Integration of lightweight material in the manufacturing process is the upcoming trend in the automotive auxiliary lamps market.

Off road is the major application for automotive auxiliary lamps market.

Asia-Pacific is the largest regional market for automotive auxiliary lamps market.

The automotive auxiliary lamp industry was valued at $7,320 million in 2022.

HELLA GmbH & Co. KGaA, LAMPA SpA, Suprajit Group, and OSRAM GmbH. are some of the major companies operating in the market.

Loading Table Of Content...