Automotive Body Sealing System Market Research, 2033

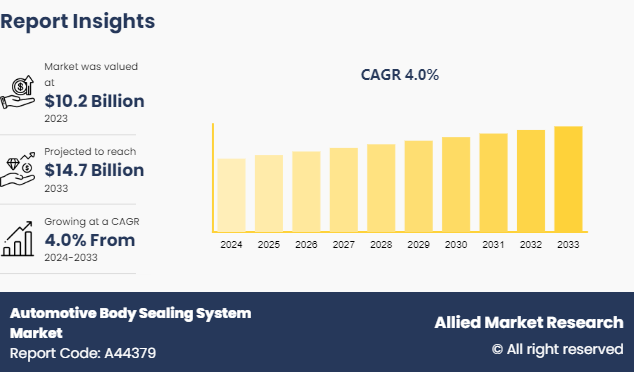

The global automotive body sealing system market size was valued at $10.2 billion in 2023, and is projected to reach $14.7 billion by 2033, growing at a CAGR of 4% from 2024 to 2033.

Market Introduction and Definition

The automotive body sealing system market encompasses the manufacturing and distribution of components designed to prevent water, air, dust, and noise from entering vehicle interiors. These systems include weatherstrips, seals, and gaskets used around doors, windows, trunks, and hoods. The market is driven by the growing demand for enhanced vehicle performance, comfort, and safety, alongside increasing automotive production and sales globally. Innovations in material technology, such as the use of advanced rubber and plastic composites, are propelling market growth.

In addition, the rising adoption of electric vehicles and stringent environmental regulations are influencing the development of more efficient and eco-friendly sealing solutions. Key players in this market focus on research and development to create durable, high-performance products that meet evolving industry standards and consumer expectations.

Key Takeaways

The automotive body sealing systems market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive body sealing systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In May 2024, KRAIBURG TPE launched its latest EPDM adhesion compounds tailored for automotive sealing and exterior applications, catering to global market demands with a strong emphasis on Europe, North, South, and Central America. These compounds represent a significant advancement in material technology, offering superior adhesion, durability, and processability crucial for challenging automotive environments.

In April 2023, Freudenberg Sealing Technologies, the world's leading provider of sealing solutions, has launched a crucial product innovation for the automotive industry: an impermeable rectangular busbar overmild that seals reliably and helps prevent damage to an electric vehicle’s power electronics. The solution also reduces assembly complexity by combining the busbars, seal, and guide in one complete package that is ready for installation on the vehicle assembly line.

Key Market Dynamics

The rise in adoption of electric vehicles presents a significant driver for the automotive body sealing system market share. EVs require specialized sealing solutions to protect sensitive electronic components, ensure water-tightness, and maintain overall vehicle efficiency. As the EV market expands, the demand for innovative sealing systems tailored for electric vehicles is expected to surge. Furthermore, the rise in automotive production, and technological advancement in vehicle manufacturing processes have driven the demand for the automotive body sealing system market size.

However, complexity of automotive design hampers the growth of the automotive body sealing system market forecast. Modern automotive designs are becoming increasingly complex, incorporating advanced features such as panoramic sunroofs, electric doors, and integrated electronic systems. The complexity of vehicle designs poses challenges for designing and implementing effective sealing solutions, as manufacturers must ensure compatibility with diverse vehicle architectures while meeting stringent performance requirements. Moreover, intense market competition, and fluctuating raw material price are major factors that hamper the growth of the automotive body sealing system market trends.

On the contrary, rise in focus of sustainability presents a significant and lucrative opportunity for the automotive body sealing system market growth. The automotive industry's growing emphasis on sustainability presents opportunities for manufacturers to develop eco-friendly sealing solutions. By leveraging recyclable materials, reducing waste generation during production, and implementing energy-efficient manufacturing processes, companies can align with the industry's sustainability goals and capitalize on emerging market trends.

Supply Chain Dynamics for the Automotive Body Sealing Systems Market

Technological advancements in vehicle components for the automotive body sealing system industry have been driven by several factors, including the need for improved performance, durability, efficiency, and safety. Manufacturers are constantly researching and developing new materials for automotive seals to enhance their performance and longevity. This includes the use of synthetic rubber compounds, thermoplastic elastomers (TPE) , and silicone-based materials that offer better resistance to temperature extremes, UV exposure, and chemical degradation. Furthermore, modern vehicles often feature integrated sealing systems that combine multiple components into a single assembly. These systems not only simplify manufacturing and assembly processes but also improve overall sealing effectiveness and reduce the risk of leaks.

With the rise of smart and connected vehicles, there's increasing interest in incorporating sensors and electronic components into sealing systems. Smart seals can detect changes in pressure, temperature, and other environmental factors, allowing for real-time monitoring and predictive maintenance. In addition, researchers are exploring the use of self-healing materials in automotive seals to repair small cracks or damages automatically. These materials can prolong the lifespan of seals and reduce the need for frequent replacements.

Automotive seals play a crucial role in reducing noise, vibration, and harshness levels inside the vehicle cabin. Advancements in seal design and materials help minimize NVH, leading to a quieter and more comfortable driving experience. Moreover, innovations in manufacturing techniques, such as injection molding, extrusion, and die-cutting, have led to higher precision and consistency in producing automotive seals. This results in better seal quality and tighter tolerances, which are essential for effective sealing performance.

Market Segmentation

The automotive body sealing systems market is segmented into application, product, vehicle type and region. On the basis of application, the market is segmented into doors, windows, trunks, hoods, convertible roofs, and sunroofs. As per product, the market is divided into EPDM rubber seals, PVC seals, TPE seals, thermoset rubber seals, and Foam seals. As per vehicle type, the market is divided into passenger vehicle and commercial vehicle. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America is home to some of the world's largest automotive manufacturers, including General Motors, Ford, and Fiat Chrysler Automobiles (FCA) . These companies have a substantial demand for automotive body sealing system industry to equip their vehicles, contributing to the region's market share. Furthermore, North America has one of the highest vehicle ownership rates globally. The large number of vehicles on the roads in the region necessitates a steady demand for automotive components, including body sealing systems, for both OEM and aftermarket sales.

The automotive industry in North America is known for its focus on innovation and technological advancements. This includes the development of advanced sealing technologies to meet increasingly stringent safety, performance, and environmental standards. In addition, the North American automotive aftermarket is robust, with a large network of distributors, retailers, and service centers. This aftermarket demand for replacement parts, including body sealing systems, contributes significantly to the overall market share in the region.

The Asia-Pacific region, particularly countries like China, India, Japan, and South Korea, has experienced rapid economic growth over the past few decades. This growth has led to an expansion of the middle class and increased purchasing power, driving demand for automobiles and automotive components, including body sealing systems. In addition, Asia-Pacific is now the largest automotive manufacturing hub globally, with several leading automotive manufacturers establishing production facilities in the region. This growth in the automotive industry has created a significant demand for automotive components, including body sealing systems, to equip new vehicles.

Rising disposable incomes and urbanization in countries across Asia-Pacific have led to a surge in vehicle ownership rates. As more consumers purchase cars, there's a corresponding increase in the demand for replacement parts and aftermarket components, including body sealing systems. Moreover, automotive manufacturers and suppliers in Asia-Pacific are investing heavily in research and development to develop innovative and advanced sealing solutions. This focus on technological advancements helps meet the evolving needs of the automotive industry and enhances the competitiveness of Asia-Pacific in the global market.

In July 2023, Nissan's investment of up to $663 million in Renault's new electric vehicle unit signals a significant step forward in their restructured partnership, a development likely viewed positively, despite prolonged negotiations, which were reportedly delayed by concerns over protecting Nissan's intellectual property in future collaborations, as reported by Reuters.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive body sealing systems market such as Cooper Standard, CQLT Saar Gummi Technologies GmbH, Henniges Automotive, Hutchinson SA, Magna International Inc., Minth Group, Nishikawa Rubber Co., Ltd., SaarGummi Group, Sumitomo Riko Company Limited, and Toyoda Gosei Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive body sealing systems market.

Industry Trends

In May 2024, KRAIBURG TPE launched its latest EPDM adhesion compounds tailored for automotive sealing and exterior applications, catering to global market demands with a strong emphasis on Europe, North, South, and Central America. These compounds represent a significant advancement in material technology, offering superior adhesion, durability, and processability crucial for challenging automotive environments.

In April 2023, John Crane introduced a new sealing solution aimed at improving operational efficiency and sustainability. This advanced sealing technology is designed to extend the mean time between repairs (MTBR) for industrial equipment, meaning that machinery can operate longer without needing maintenance. This leads to reduced downtime and maintenance costs, enhancing overall productivity.

In April 2023, Freudenberg Sealing Technologies, the world's leading provider of sealing solutions, has launched a crucial product innovation for the automotive industry: an impermeable rectangular busbar overmild that seals reliably and helps prevent damage to an electric vehicle’s power electronics. The solution also reduces assembly complexity by combining the busbars, seal, and guide in one complete package that is ready for installation on the vehicle assembly line.?

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive body sealing systems market segments, current trends, estimations, and dynamics of the automotive body sealing systems market analysis from 2023 to 2033 to identify the prevailing automotive body sealing system market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive body sealing systems market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive body sealing systems market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive body sealing systems market trends, key players, market segments, application areas, and market growth strategies.

Automotive Body Sealing System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.7 Billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 465 |

| By Application |

|

| By Product Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | SaarGummi Group, Toyoda Gosei Co., Ltd., Minth Group Ltd., Nishikawa Rubber Co., Ltd., Sumitomo Riko Company Limited, cooper standard, CQLT Saar Gummi Technologies GmbH, Magna International Inc., Henniges Automotive Holdings, Inc., Hutchinson SA |

Upcoming trends in the global automotive body sealing system market include the development of lightweight and advanced sealing materials, increased integration of smart sealing systems with sensors, adoption of environmentally friendly and recyclable materials, enhanced aerodynamics for improved fuel efficiency, and growing demand for noise, vibration, and harshness (NVH) reduction solutions. The rise of electric and autonomous vehicles is driving innovations in sealing technologies.

Door is the leading application of automotive body sealing system market.

North America is the largest regional market for automotive body sealing system.

$14.7 billion is the estimated industry size of automotive body sealing system

Cooper Standard, CQLT Saar Gummi Technologies GmbH, Henniges Automotive, Hutchinson SA, Magna International Inc., Minth Group, Nishikawa Rubber Co., Ltd., SaarGummi Group, Sumitomo Riko Company Limited, and Toyoda Gosei Co., Ltd. are the top companies to hold the market share in automotive body sealing system

Loading Table Of Content...