Automotive Bumper Market Research, 2032

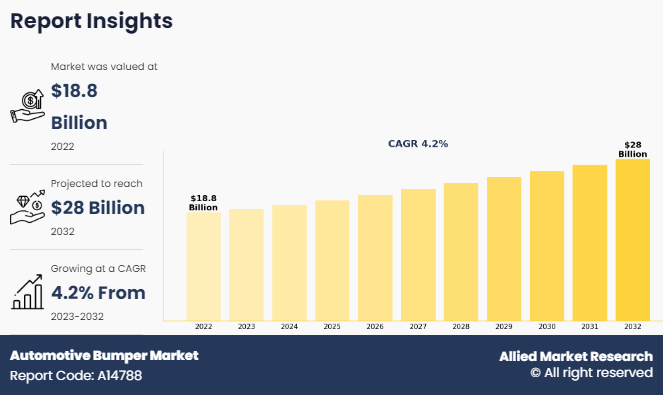

The global automotive bumper market size was valued at $18.8 billion in 2022, and is projected to reach $28 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Report Key Highlighters:

The automotive bumper market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The automotive bumper market share is highly fragmented, into several players including TOYODA GOSEI Co., Ltd., FORVIA Faurecia, TOYOTA BOSHOKU CORPORATION, SMP Deutschland GmbH, Flex-N-Gate Corporation, Plastic Omnium, MONTAPLAST GmbH, WARN International Ltd, NTF GROUP, and KIRCHHOFF Group. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A bumper is a structure that is connected to or integrated with the front & rear ends of the vehicle, and it plays an important role in absorbing the impact during collisions. The bumpers cannot reduce the effect of impact at high speeds but they can reduce the injury caused to the pedestrians struck by the cars. The bumpers protect the hood, fuel, exhaust, and cooling system. Apart from the safety feature, the automotive bumper is also used for the attractive look of vehicles.

Initially, bumpers were made out of rigid metal bars, and the construction was not very reliable, they were majorly used for aesthetic enhancement of the vehicles. In recent years due to numerous developments, and improvements in metal & technologies, as well as focus on protecting vehicle components have improved safety and modified the bumper's design and functionality. The increase in material advancements and integration of composite material is driving the demand for automotive bumpers.

The growth of the automotive bumper market is driven by increase in sales of automobiles globally, increase in customer demand for advanced safety features, and strengthening safety regulations. However, fluctuations in the price of raw materials and increasing trend towards EV are anticipated to hinder the market growth rate during the automotive bumper market forecast. Furthermore, technological advancement and use of composite materials and growing trend towards lightweight components are anticipated to offer lucrative growth opportunity.

Government bodies around the world are implementing strengthening norms in the automobile industry to safeguard passengers and pedestrians from road accidents. According to data from the World Health Organization, road traffic death incidents accounted for 1.19 million in 2021. The death ratio due to vehicle accidents is growing globally hence, governments and regulatory bodies are taking strengthening measures to reduce road fatalities and increasing vehicle safety standards. In 2021, the World Health Organization also announced its Action for Road Safety target, which aims towards a 50% reduction in road accidents by the year 2030. Thus, the strengthening of vehicle regulatory standards around the world is anticipated to witness strong growth in the automotive bumper market during the forecast period.

Key Developments in the Automotive Bumper Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position

On December 21, 2023 TOYODA GOSEI Co., Ltd. announced they have increased the production capacity of its Toyoda Gosei Irapuato Mexico, S.A. de C.V. The company aims to strengthen its automotive exterior part production in the North America region. The company will majorly focus on fulfilling‐¯the increasing demand for large painted product, such as rear spoilers and bumper peripheral components. The company has also invested in expanding its manufacturing facility and new equipment installation.

On August 1, 2022 Plastic Omnium announced they are planning to buy Hella’s 33 percent stake in the HBPO joint venture, which makes front-end modules for automobiles. The acquisition will strengthen Plastic Omnium position in segment such as front-end modules including lighting, bumpers, grilles, radar and other driving assistance sensors, and radiators.

Segmental Analysis

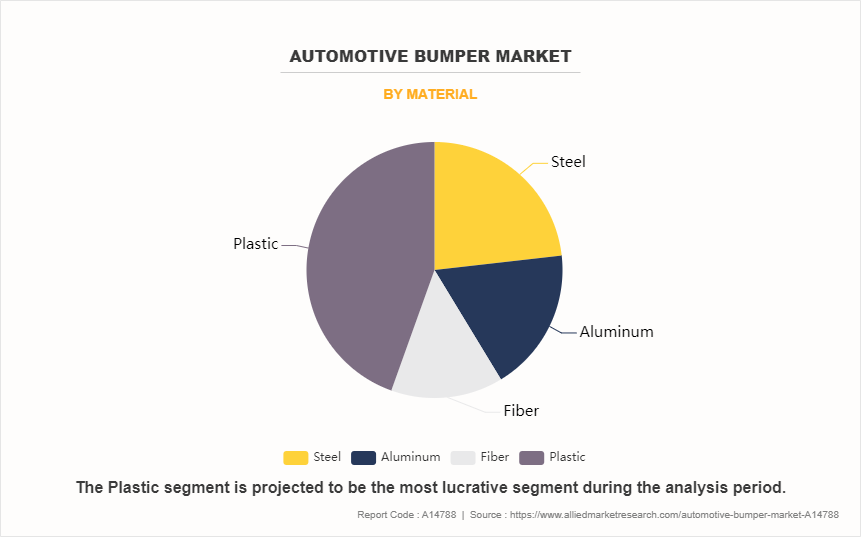

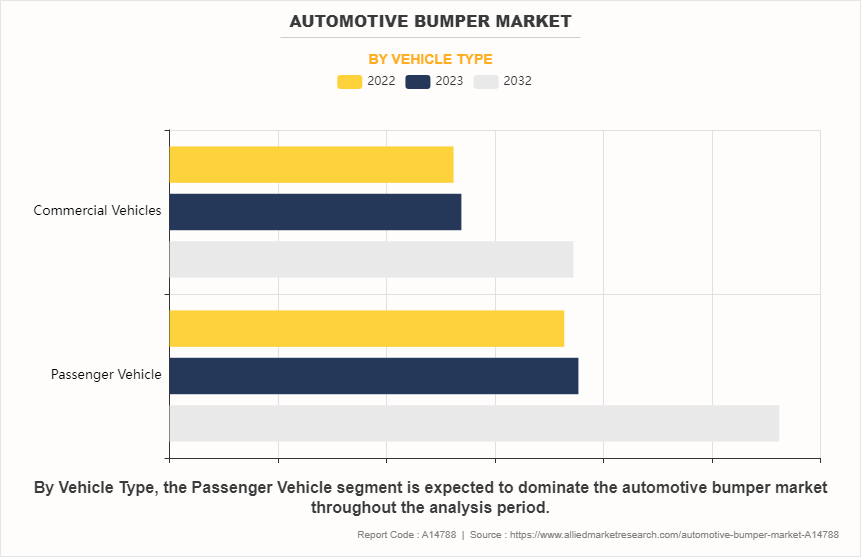

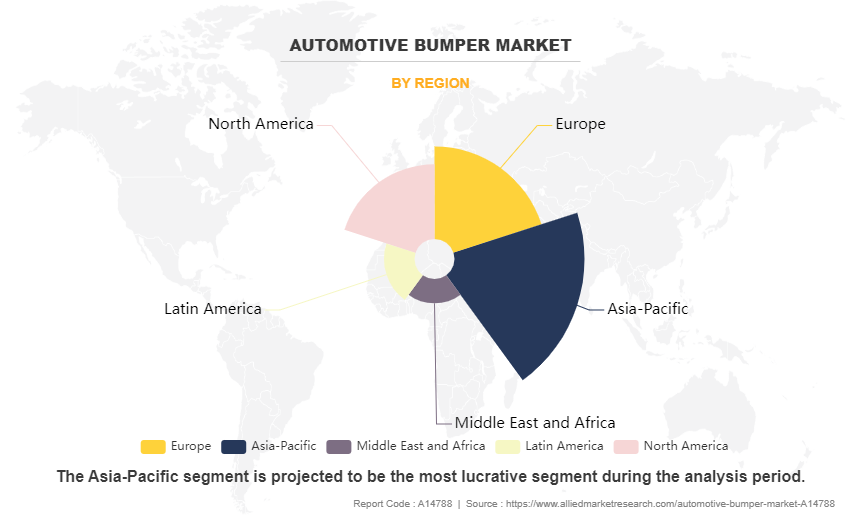

The global automotive bumper market size is analyzed on the basis of type, material and vehicle type. On the basis of type, the market is segmented into standard bumper, deep drop bumper, roll plan bumper, step bumper, and tube bumper. Based on material, the market is analyzed into steel, aluminum, fiber and plastic. By vehicle type, the market is segmented into passenger vehicle and commercial vehicle. Region wise, the market is analyzed into North America, Europe, Asia-Pacific, and Latin America and Middle East and Africa.

By Type

On the basis of type, the global automotive bumper market has been segregated into standard bumper, deep drop bumper, roll plan bumper, step bumper, and tube bumper. The standard bumper accounted for the largest market share in 2022 and is anticipated to maintain its dominance throughout the forecast period owing to its simple design and easy integration with different vehicle models. However, the tube bumper segment is anticipated to witness the strongest growth rate due to their simple and compact design. Similarly tube bumpers are also extensively used in SUV and offroad vehicles to provide maximum protection during off-road adventures and in harsh environments.

By Material

By material type, the global automotive bumper market has been segmented into steel, aluminum, fiber, and plastic. The plastic segment accounted for the largest market share in 2022, owing to plastic bumpers being easy to manufacture, repair, and install in various vehicle models, making them a popular choice among automobile manufacturers. In addition, the growing trend towards reducing overall vehicle weight is driving the demand for plastic bumpers.

By Vehicle Type

On the basis of vehicle type, the global automotive bumper industry has been segregated into passenger vehicles and commercial vehicles. The passenger vehicle segment accounted for the largest market share and is expected to show the strongest growth rate due to increasing disposable income among consumers in the developing economy and a growing inclination towards personally owned vehicles. Furthermore, rapid urbanization across the globe with a growing population in cities has resulted in consumers spending more on owning a passenger vehicle for daily commute. Moreover, with the growth in electric and hybrid vehicle e-technology, the demand for the passenger vehicle segment is anticipated to continue to grow in the coming years.

By Region

Based on region, the global market is analyzed into North America, Europe, Asia-Pacific, and Latin America and Middle East and Africa. The Asia-Pacific region accounted for the largest market share in 2022 and is predicted to witness the strongest growth rate during the forecast period. In Asia-Pacific, the higher adoption rates of smart mobility solution such as EV and hybrid vehicle due to increase in disposable income and growing urbanization is creating demand for automotive bumpers. The growing government regulations towards decreasing vehicle emission, increase in fuel prices, and rise in trend toward adopting non-fossil fuel-based vehicles is creating more demand for automobiles. The growing vehicle sales in developing countries such as India, China, and Indonesia is creating lucrative opportunities for the automotive bumper market in this region. Moreover, various technological advancements related to the automotive sector because of government initiatives, and rising investment in R&D, further propel the market growth.

Market Dynamics

Increase in Sales of Automobiles Globally

In recent years, there has been an increase in sales of automobiles around the world, especially in developing economies, especially in China, India, Brazil, Indonesia, and Mexico, due to a growing preference towards personally owned vehicles, increase in disposable income among people, and a rise in urbanization.

Similarly, in recent years, there has been a growing emphasis on electric and alternative fuel vehicles. For instance, according to data published by the International Energy Agency in 2022, the sales of EVs were close to 10 million. As per the data, in 2022, EV share accounted for 14% of all automobiles sold in the same year. Majorly, the sales of EV and alternative fuel vehicles such as EVs, Hydrogen Fuel vehicles, Biodiesel vehicles, Compressed Natural Gas (CNG) Vehicles, and others are growing in China, Europe, and the U.S. The increased shift of consumer focus from traditional ICE vehicles towards other fuel types vehicles is due to the increase in the price of petroleum and stringent government regulations towards vehicle emissions. The rise in sales of automobiles are anticipated to continue in the coming years, thus the growth of automobile sales are anticipated to drive the market growth.

Fluctuation in the Price of Raw Materials

The production costs of automobile bumpers are significantly affected by fluctuations in the price of raw materials such as plastic, aluminum, and steel. These raw materials are crucial for the production of automotive bumpers. Due to the depletion of mineral reserves and a declining quantity of metals accessible from ores, there is a shortage in production of iron and aluminum, which increases the overall production costs of automotive bumpers. Additionally, the global demand for plastic, iron, and aluminum is exceeding the overall raw material supply rates, creating a shortage that is potentially leading to the fluctuation in its price.

For instance, in recent years, the prices for raw materials, primarily aluminum, has grown immensely due to supply chain disruption during the COVID-19 pandemic and the impact of the Russia-Ukraine war. Aluminum is the third most traded metal, and its major manufacturers are China, Russia, Canada, and UAE. The shortage and fluctuation in the prices of this raw material are anticipated to hinder the automotive bumper market growth during the forecast period.

Growing Trend Towards Lightweight Components

There has been an increasing trend toward the use of lightweight components in automobiles, due to their ability to significantly reduce vehicle weight and thereby enhance safety, fuel economy, and emissions. For an average vehicle, about 80% of the vehicle weight consists of the body, chassis, motor, and other external components. Majority of the automobile manufacturers are concentrating on these parts in order to reduce total weight.

According to studies by the U.S. Department of Energy, a 10% reduction in vehicle weight can lead to a 6-8% reduction in fuel consumption and a 5-6% reduction in emission volume. Automobile bumper manufacturers are focusing on manufacturing of lightweight vehicle components including automotive bumpers. Thus, the growing trend towards the use of light components in automobiles is anticipated to provide lucrative growth opportunities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive bumper market analysis from 2022 to 2032 to identify the prevailing automotive bumper market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive bumper market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive bumper market trends, key players, market segments, application areas, and market growth strategies.

Automotive Bumper Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Material |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | WARN International Ltd, montaplast gmbh, Plastic Omnium, KIRCHHOFF Group, Toyoda Gosei Co., Ltd., SMP Deutschland GmbH, TOYOTA BOSHOKU CORPORATION, NTF GROUP HOLDING, Flex-N-Gate Corporation, FORVIA Faurecia |

Utilization of composite material in manufacturing of automotive bumper is the upcoming trend in the industry.

Passenger vehicle is the leading application of automotive bumper market.

Asia-Pacific is the largest regional market for automotive bumper.

The automotive bumper market was valued at $18.7 billion in 2022.

TOYODA GOSEI Co., Ltd., TOYOTA BOSHOKU CORPORATION, and FORVIA Faurecia are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...