Automotive Carbon Fiber Market Insights, 2032

The global automotive carbon fiber market size was valued at USD 24.13 billion in 2022, and is projected to reach USD 64.05 billion by 2032, growing at a CAGR of 11.16% from 2023 to 2032.

Report Key Highlighters:

- The automotive carbon fiber market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive carbon fiber market share is highly fragmented, into several players including DowAksa Advanced Composite Material Industries Limited, Mitsubishi Chemical Corporation, Toray Industries, Inc., Nippon Graphite Fiber Co., Ltd., Hyosung Advanced Materials, Hexcel Corporation, Teijin Limited, Formosa Plastics Corporation, SGL Carbon, Solvay S.A, among others. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Carbon fiber is a material made of strong, thin carbon crystalline filaments, which are basically long chains of carbon atoms bound together. The fibers are employed in numerous processes to produce superior structural materials since they are incredibly light, robust, and stiff.

Carbon fibers are widely used in the automobile sector for making automotive components. This is attributed to the fact that aluminum-based carbon fiber possesses high strength to weight ratio and helps in increasing efficiency of vehicles.

Rise in production of lightweight vehicles across the globe fuels the demand for carbon fibers in the automotive sector. This is attributed to the fact that vehicles built using materials with low weight and high strength deliver higher mileage and enhance fuel efficiency.

The automotive carbon fiber market growth is driven by several factors, including surge in adoption of carbon fiber in automobiles, stringent government regulations on emission norms.

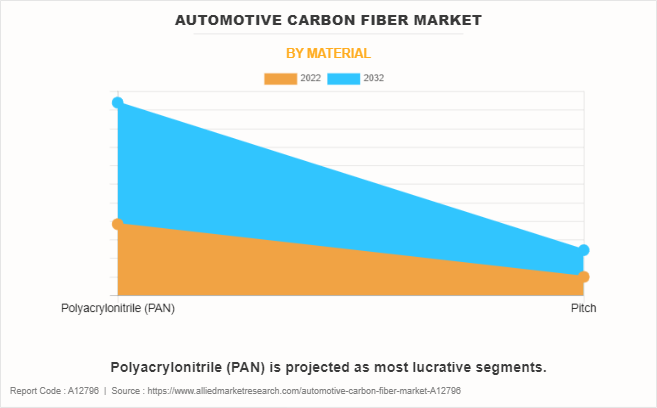

The production of carbon fiber involves several steps. Initially, precursor materials, such as polyacrylonitrile (PAN) fibers or pitch fibers, are subjected to high temperatures in an oxygen-free environment to carbonize them. This process eliminates non-carbon elements and aligns the carbon atoms into tightly bonded structures.

The automotive industry increasingly uses carbon fiber to reduce vehicle weight and improve fuel efficiency. Carbon fiber components help to enhance performance, safety, and overall design aesthetics in high-end sports cars and electric vehicles. This factor is anticipated to drive the market during the forecast period.

The market for automotive carbon fibers is driven by several factors, including surge in adoption of carbon fiber in automobiles, stringent government regulations on emission norms. However, the high cost of carbon fibers hampers the market growth. In addition, growth in sales of zero emission vehicles presents significant opportunities for market expansion.

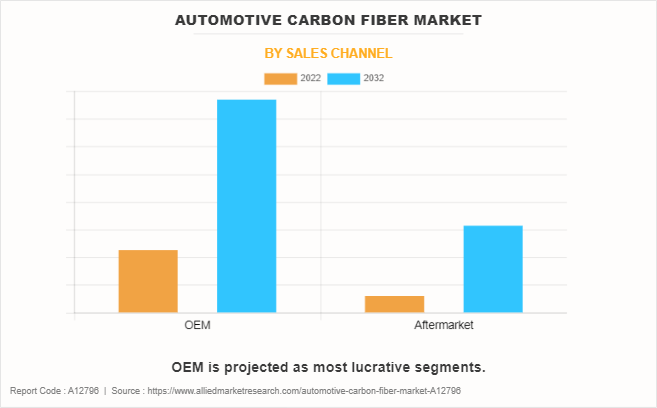

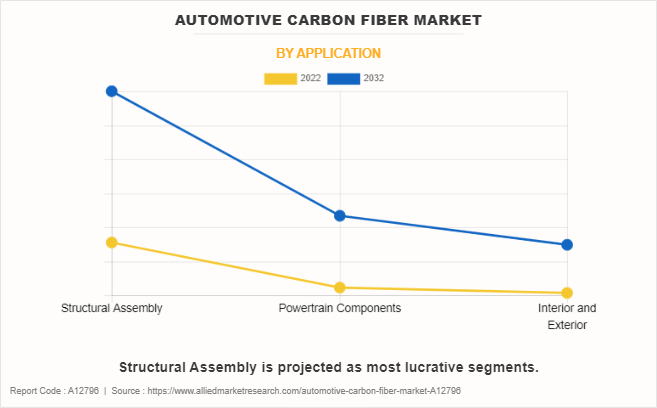

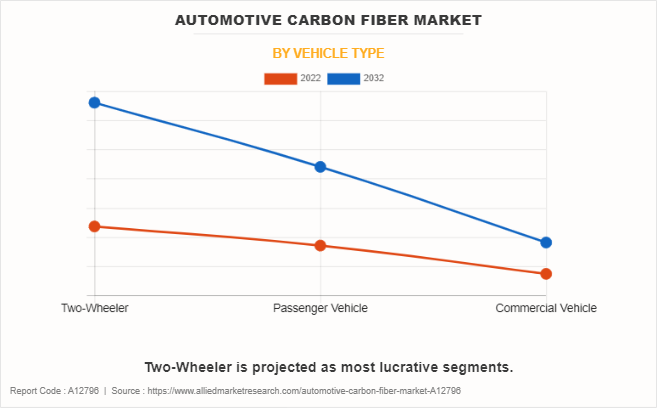

The automotive carbon fiber market is segmented into material, vehicle type, application, sales channel and region. On the basis of material, the market is classified into Polyacrylonitrile (PAN) and Pitch. On the basis of vehicle type, it is categorized into two-wheelers, passenger vehicle and commercial vehicle. By application, the market is divided into structural assembly, powertrain component, interior and exterior. On the basis of sales channel, the market is segmented into OEM and aftermarket. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automotive carbon fiber market in Asian countries has witnessed significant growth and is poised to offer compelling opportunities in the coming years. Rapid industrialization and a growing logistics industry in the Asia-Pacific region are driving up demand for automotive carbon fibers. Industrial growth has also led to an increase in freight transportation, necessitating more of these vehicle types.

Key Developments

The leading companies are adopting strategies such as product launch, acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In March 2023, SGL Carbon launched carbon fiber named SIGRAFIL C T50-4.9/235 and the new SIGRAFIL C T50-4.9/235 possess exceptional elongation (2.0%) and strength (4.9 GPa) standards. This carbon fiber is widely used in automotive applications.

- In October 2023, TORAY INDUSTRIES, INC. expanded by introducing its new production facility in Gumi, North Gyeongsang Province. This production facility will produce carbon fibers for car body parts.

Surge in adoption of carbon fiber in automobiles

Carbon fiber is extremely lightweight and robust material which makes it an ideal for production of automotive parts. Vehicle components made of carbon fiber have a high impact energy absorption capacity ultimately improving the vehicle safety when applied appropriately. In addition, owing to their lightweight design, vehicles use less gasoline, which lowers their carbon footprint and emissions. The usage of electric cars also increases the efficiency and range, making them a greener alternative to conventional gasoline-powered automobiles. Moreover, BMW’s use of carbon fiber in its i3 model has considerably reduced the car’s weight, Audi is also using carbon fiber to produce the rear wall of the space frame for its A8 sedan. Since it takes lesser energy to accelerate a lighter object than a heavier one, lightweight materials offer great potential for increasing vehicle efficiency and fuel economy. Thus, driving the growth of the market.

Rising emphasis from cities and governments on sustainable transportation solutions has driven the growth of electric and hybrid vehicles. This is an aim to mitigate carbon emissions and enhance air quality in a concerted effort to address environmental concerns. For instance, according to International Energy Agency (IEA), global electric car sales exceeded 10 million units in 2022, indicating 35% increase in 2023, reaching a total of 14 million units. This remarkable surge in sales signifies a substantial rise in electric cars' market share with 4%. These factors projected to a surge in deployment of carbon fiber due to their lightweight and strength.

Stringent government regulations on emission norms

There are stringent government regulations incorporated for emission norms in vehicles. For instance, in 2023, India is set to introduce updated emission standards for vehicles, with the government implementing more rigorous BS6 norms, also recognized as Real Driving Emissions (RDE) norms. The revised regulations mandate car manufacturers to display real-time emissions data for their vehicles. Carbon fiber composites provide more sustainable transportation solutions with lower carbon emissions due to which vehicles are manufactured using carbon fibers.

With the growing environmental concerns, governments and environmental agencies across the world are enacting stringent emission norms and laws to reduce vehicle emission. In April 2023, the European Parliament and the Council passed Regulation (EU) 2023/851, which modifies Regulation (EU) 2019/631 to enhance the CO2 emission performance standards for new passenger cars and new light commercial vehicles, aligning with the heightened climate ambition of the European Union. The regulations set by the government are aiming to reduce the greenhouse gases. Carbon dioxide is one of the major greenhouse gas due to which the carbon fibers are used for vehicle parts production impacting the market growth positively.

High cost of carbon fiber along with non-biodegradability

Carbon fibers need tons of energy for its production, which further increases their cost relative to steel or aluminum. The cost of carbon fibers is directly related to the cost and yield of the precursor and the cost of conversion from which it is derived. Polyacrylonitrile (PAN) is actually based on carbon fiber, with a conversion efficiency of just 50%.

Moreover, carbon fibers are non-biodegradable and will not decompose in the landfill, unlike other metals and non-metals. Carbon fiber recycling is very difficult and requires a lot of resources. Thus, long-lasting carbon fiber scraps have a poor environmental impact and serve as a limiting factor in the development of the demand for automotive carbon fibers market.

Growth in sales of zero emission vehicle

Increase in global concerns regarding the negative effect of climate change along with alarming pollution levels recorded in major cities have created a significant demand for electric vehicles. This involves the use of electric vehicles that do not use gas and are more economical than conventional vehicles. Carbon fibers are widely used to manufacture parts of the electric vehicles such as clutch plates, breaks, and other parts as it saves energy reduces emissions.

The demand for fuel-efficient vehicles has increased recently, owing to the rise in the price of petrol and diesel. This is due to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from oil reserves. Thus, these factors give rise to the need for advanced fuel-efficient technologies, leading to a surge in demand for carbon fiber for vehicle parts production.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive carbon fiber market analysis from 2022 to 2032 to identify prevailing the market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Automotive Carbon Fiber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 64.1 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 311 |

| By Sales Channel |

|

| By Application |

|

| By Material |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | SGL Carbon, Solvay S.A., Nippon Graphite Fiber Co., Ltd., TEIJIN LIMITED., HYOSUNG ADVANCED MATERIALS, Hexcel Corporation, TORAY INDUSTRIES, INC., DowAksa Advanced Composites Holdings BV, Formosa Plastics Corporation, Mitsubishi Chemical Corporation |

Polyacrylonitrile (PAN) is the upcoming trends of Automotive Carbon Fiber Market in the world.

Structural Assembly is the leading application of Automotive Carbon Fiber Market.

Europe is the largest regional market for Automotive Carbon Fiber.

$24 billion is the estimated industry size of Automotive Carbon Fiber.

Mitshubishi Chemical Corporation is the top companies to hold the market share in Automotive Carbon Fiber.

Loading Table Of Content...

Loading Research Methodology...