Automotive Dealer Management System Market Insights, 2032

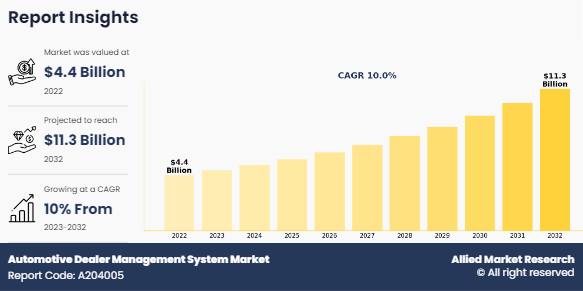

The global automotive dealer management system market size was valued at $4.4 billion in 2022, and is projected to reach $11.3 billion by 2032, growing at a CAGR of 10% from 2023 to 2032.

The growth of automotive dealership management system share is driven by surge in demand for cloud-based automotive dealer management system, increase sales of automobiles globally, and integration of artificial intelligence (AI) and machine learning (ML) capabilities. However, high cost and increase in security concerns hinder the growth of the market. On the contrary, factors such as rise in trend of remote working culture in the automobile sector and utilizing automotive dealer management system data for decision-making are anticipated to create lucrative growth opportunities for the market growth.

Automotive dealership management is a solution designed to efficiently run business operations. These solutions are designed to simplify the complex ecology of dealership operations while improving the client experience. They can be used for different types of applications, including sales, service, inventory management, customer relation management, insurance, financing and accounting.

Key Takeaways

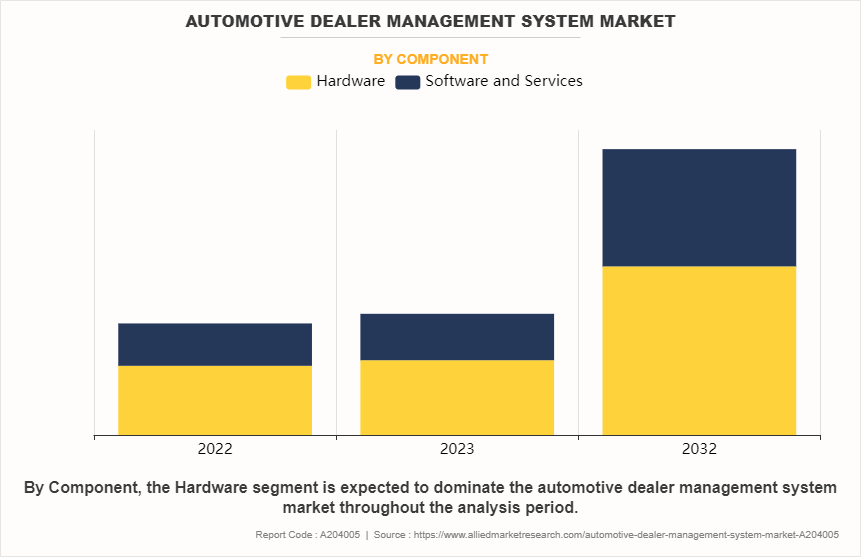

- By component, the software & service segment is anticipated to exhibit significant growth in the market in the near future.

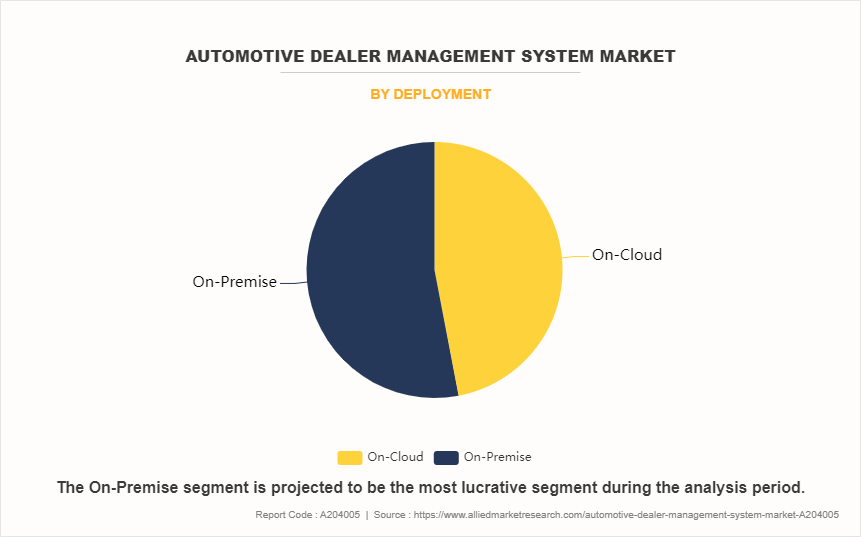

- By deployment, the on-cloud segment is anticipated to exhibit significant growth in the market in the near future.

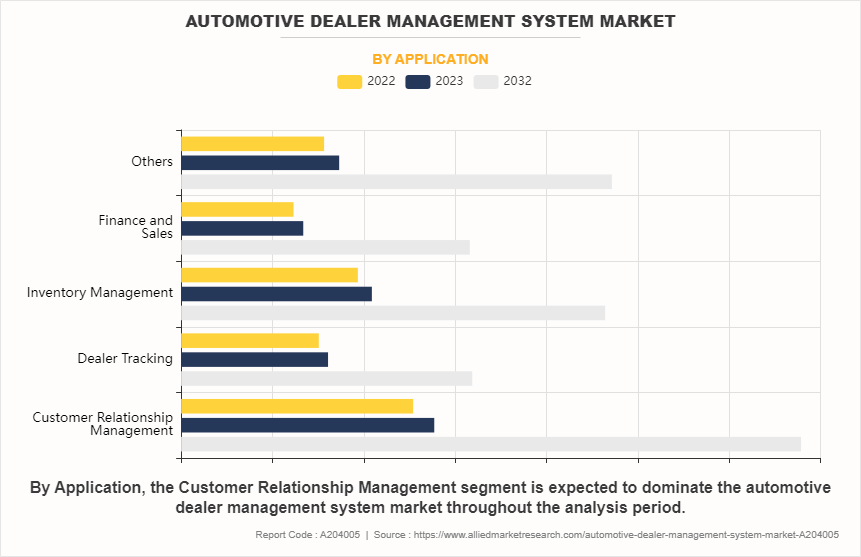

- By application, the others segment is anticipated to exhibit significant growth in the automotive dealer management system trends in the near future.

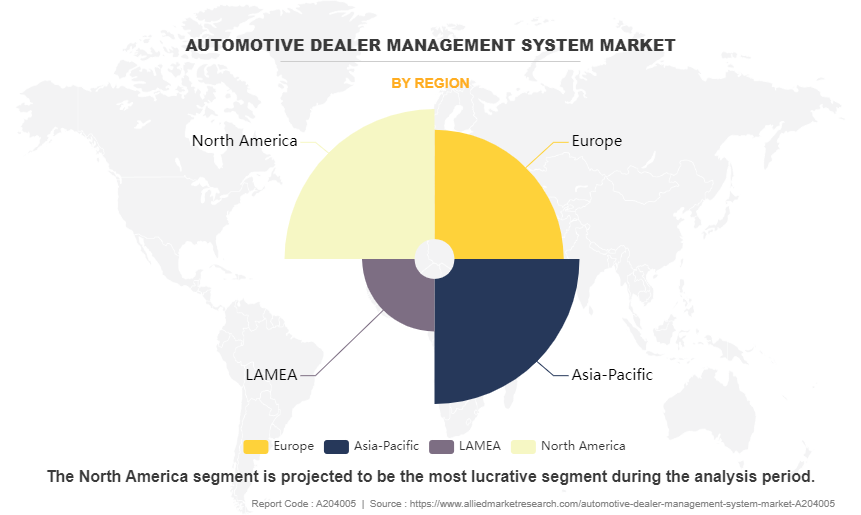

- By region, Asia-Pacific is anticipated to register the highest CAGR during the forecast period.

The global automotive dealer management system market is segmented into component, deployment, application, and region. Depending on component, the global market is classified into hardware, and software, and services. On the basis of deployment, it is bifurcated into on-cloud and on-premise. By application, it is segregated into customer relationship management, dealer tracking, inventory management, finance & sales, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The market is witnessing increasing demand for cloud-based automotive dealer management system as it help businesses to operate more effectively than on-premises solutions. Cloud-based system further enable the client to easily scale up their operation while reducing upfront cost, which is needed for on-premise solutions. Moreover, a cloud-based automotive dealer management system helps in effectively managing collaboration between different company departments and other dealerships. Cloud-based system utilizes real-time data transfer, which helps in better managing various aspect of businesses and offer more efficient service to the client.

For instance, in December 2022, Tata Motors announced that it has moved all of its dealer management system (DMS) to Oracle Cloud Infrastructure (OCI). The dealer management DMS has 60,000 users and supports Tata Motors pre-sales, sales, and after-sales market engagements across all categories, notably passenger and commercial vehicles. With the upgrade of its DMS, the organization can better monitor sales performance and increase communication throughout its entire dealer network.

Competitive Analysis

Some of the major companies that operate in the global automotive dealer management system industry are Wipro, Oracle, CDK Global LLC, Dealertrack, Inc., Elva DMS, Quorum Information Technologies Inc., Irium Software, Autosoft Inc., GaragePlug Inc., and The Reynolds and Reynolds Company.

Overview of the United States Automotive Dealer Management System Industry

The automobile industry in the United States has evolved as one of the largest in the world. 14.5 million light vehicles were sold in the United States in 2020. Overall, the United States automobile industry is the world’s second-largest both in terms of vehicle sales and production. The country also has the presence of some of the global manufacturers such as General Motors, Ford, and Chrysler. The automobile industry is responsible for approx. 3% of the country's GDP. Moreover, the U.S automobile companies are globally known for their strong funding in research and development and innovative product offerings. The United States exports its manufactured automobiles to more than 200 markets around the globe. The U.S manufacturers have a global reach; they sell their automobiles to this market through direct sales or through partnerships. The use of automotive dealership management helps companies operating in the U.S to efficiently optimize their operations and enhance customer experiences. Furthermore, with the growth of electric mobility companies such as Tesla, Inc. global sales are anticipated to grow further, thus creating an increased demand for automotive dealer management system.

Key Developments in Automobile Dealer Management Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In July 2023, CDK Global announced that it is officially certified as a DMS supplier for BMW Group Canada, including BMW and MINI retailers in the country. The dealer management system will provide merchants access to financial statement transfers, stock replenishment, and other vital factors. The company's recent certification strengthens its position in the automotive sector. , allowing them to better serve their customers.

- On June 28, 2023, Quorum Information Technologies Inc. acquired VINN Automotive Technologies Ltd. The integration of both the companies will enable to increase and develop their product range and offer innovative solution for the automotive industry. The acquisition will also help in increasing its presence by providing full services to automobile dealerships

- On July 13, 2023, Autosoft Inc. expanded its DMS Go platform with Sales and Customer Management Pro (SCM Pro). In the new update, the company centralized the lead management system with external communication tools, contact templates, unified customer histories, and a dedicated leads email address for automated processing of customer management operation and to optimize the overall dealer and customer experiences.

Segmental Analysis

The global automotive dealer management system market is bifurcated into component, deployment, application, and region. Depending on component, the global market share is classified into hardware, software, and services. On the basis of deployment, it is bifurcated into on-cloud and on-premise. By application, it is segregated into customer relationship management, dealer tracking, inventory management, finance & sales, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

Depending on component, the hardware segment accounted for the largest market share in 2022. As the system is becoming more advanced and complex, it is being integrated with novel technologies such as data analytics, artificial intelligence (AI), and machine learning to sustain the processing hardware that are extensively used in automotive dealer management system. Furthermore, modern automotive dealership heavily rely on DMS software to manage various aspects of their operations, including sales, inventory management, customer relationship management (CRM), finance & accounting, service & repair, and parts management. There has been growing demand for software to streamline workflow processes in automotive dealerships and improve overall efficiency.. Thus, the growing importance of software in automotive dealership management systems is anticipated to drive the growth of the segment in the near future.

By Deployment

On the basis of deployment, the on-cloud segment is anticipated to witness strong growth rate during forecast period owing to on-cloud deployment enabling companies in cost saving. Also, firms can pay for the services on subscription and pay-per-use basis. These allow companies to significantly lower their expenses.

By Application

By application, the customer relationship management segment accounted for the largest market share in 2022. Owning to CRM being an essential element in handling sales data, customer relationship management allows business to analyze customer behavior, preferences, and purchasing patterns. This allows companies to provide more personalized sales and marketing tactics, which eventually help boost client loyalty and satisfaction.

By Region

Region wise, North America held the largest market share in 2022, owing to the region's high rate of adoption of advanced technology. However, Asia-Pacific is anticipated to dominate the market share during the forecast period. In recent years, there has been increasing trend of consumers toward more fuel-efficient vehicles in the region and thus is anticipated to drive the demand for EVs and hybrid cars. Similarly, governments in the region are supporting the adoption of fuel-efficient vehicles by providing tax benefits and subsidies toward the purchase of new vehicles. This has resulted in increased sales of automobiles and thus will create more demand for automotive dealership management systems.

Market Dynamics

Increase in Sales of Automobiles Globally

In earlier decades, the sales of personally owned vehicles especially passenger cars have increased significantly. The increase in automobiles sales is due to growing consumers preference toward personally owned vehicles and technological advancement in the automotive industry. Moreover, with the advent of electric and alternative fuel vehicles, the demand for automobiles is anticipated to grow significantly. The major reason for the increased car ownership is due to increase in disposable income among consumers in developing economies and changing lifestyle preferences.

During 2021-2022, decline was witnessed in global vehicle sales and a disturbance in the supply chain. Similarly, with rise in the cost of raw materials, such as steel and semiconductors used in automobiles, the cost of vehicles increased simultaneously, thereby decreasing the sales. . However, by 2023, vehicle sales witnessed positive growth; for instance, in 2023, China alone accounted for nearly 60% of all the global EV sales. In addition, many Chinese manufacturers such as BYD, SAIC-GM Wuling, Chery, Changan, Geely, Hozon Auto, and Xpeng are increasing their EV production for domestic and international markets. These companies are focusing on development of EV technology and reducing price of overall vehicle, which will help in increasing sales in global markets, thus driving the demand for automotive dealer management system.

Utilizing Automotive Dealer Management System Data for Decision-making

The automotive dealership management systems can provide crucial insights related to sales figures, customer information, and other key data sources. Leveraging automotive dealership management system data can provide valuable insights on valuable insights for the automotive dealerships. This data can be used for strategic decision-making for various departments and increase business intelligence and enhance business operators. There has been an increase in leveraging this data to identify customer buying patterns, analyze market demand, and understand emerging trends in the industry.

High System Cost of Automotive Dealer Management

Automotive dealer management system plays an essential role in automobile dealership. It is vital for optimal inventory management, handling sales, and other essential functions. Automotive dealer management system utilizes real-time data and analytics. However, these systems are complex and often require high maintenance and setup costs. Similarly, different automotive dealerships demand tailor-made solution for their needs, customizing, and integrating dealer management system with program to fit individual dealership needs, required connecting the system with third-party apps, which, in turn, rises security concerns and hinders the market growth.

Increased Remote Working Culture in the Automobile Sector

In recent years, the shift toward remote working culture in the automobile industry has notably contributed toward the market growth. Remote working has resulted in automotive manufacturer and distributors in cost saving. Furthermore, remote collaboration solutions have accelerated communication and decision-making processes, leading to enhanced efficiency and productivity among teams working from many different locations. However, during the COVID pandemic, almost 40% of people working in the EU were working remotely on a full-time basis; the remote and hybrid working culture is anticipated to continue in the coming years. Thus, increase in remote working in the automobile industry will create lucrative growth opportunities for market growth.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive dealer management system market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Automotive Dealer Management System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.3 billion |

| Growth Rate | CAGR of 10% |

| Forecast period | 2022 - 2032 |

| Report Pages | 208 |

| By Component |

|

| By Deployment |

|

| By Application |

|

| By Region |

|

| Key Market Players | CDK Global LLC, Irium Software, Quorum Information Technologies Inc., Autosoft Inc, Dealertrack, Inc., GaragePlug Inc, Elva DMS, Wipro, The Reynolds and Reynolds Company, Oracle |

Integration of AI is the system are the upcoming trend in the industry.

Customer Relationship Management (CRM) is the upcoming trend in the industry.

North America is the largest region for Automotive Dealer Management System.

The automotive dealer management system market was valued at $4389.30 million in 2022.

Wipro, Oracle, CDK Global LLC, Dealertrack Inc., Elva DMS, and Autosoft Inc. are some of the largest companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...