Automotive Door Panel Market Statistics - 2025

The global automotive door panel market size is expected to reach $34,158.6 million by 2025, from $24,115.1 million in 2017, growing at a CAGR of 4.4% from 2018 to 2025.

Automotive door panel is a vital component in a vehicle as it allows entry/exit access to the vehicle. Apart from this primary function, door panels are also responsible for the protection of the driver as well as the passengers present inside the vehicle. Moreover, door panels also give a stylish look to the vehicle, as they have the ability to integrate various interior parts, which are mounted on door trim. Such door panels differ from one manufacturer to another and from car model to model. Further, door panels are considered as one of the crucial components in vehicles as they provide reliable side protection, ergonomic comfort, and convenience coupled with attractive and soft-touch surfaces. They are usually made up of steel, aluminum, or mixed material.

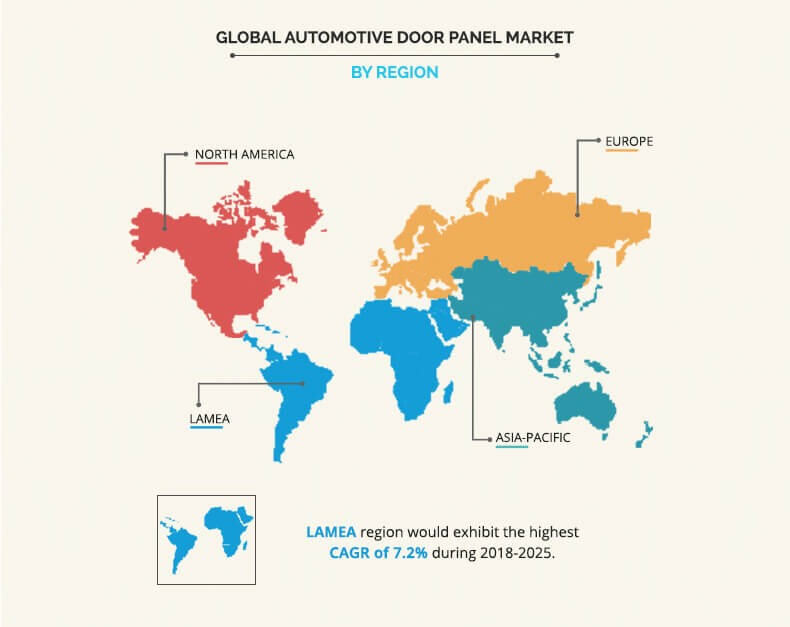

The global automotive door panel market is segmented into mode of operation, vehicle type, distribution channel, and region. Based on mode of transportation, it is categorized into front-hinged doors, rear-hinged doors, scissor door, Gullwing doors, and sliding door. Based on vehicle type, it is divided into passenger cars, LCV, and HCV. Further, passenger cars are classified into economical cars and premium cars. OEM and aftermarket are the two distribution channels considered under the study. Based on region, the automotive door panel market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

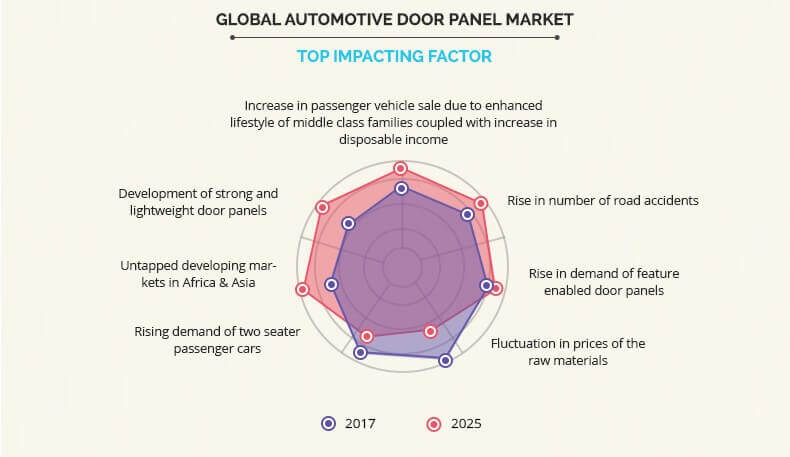

Top Impacting Factors

Increase in sale of passenger vehicles due to enhanced lifestyle of middle-class families coupled with surge in disposable income, rise in number of road accidents, and increase in demand for feature-enabled door panels impact the growth of the automotive door panel market. In addition, fluctuation in prices of the raw materials, rise in demand for two seater passenger cars, untapped developing markets in Africa & Asia, and development of strong and lightweight door panels also affect the growth of the global automotive door panel market. These factors are anticipated to either drive or hamper the market growth.

Increase in passenger vehicle sale due to enhanced lifestyle of middle-class families coupled with increase in disposable income

In 2017, new passenger vehicle registrations increased in Europe, Russia, Japan, Brazil, India, and China, though it was sharply down in the U.S. In July 2017, the U.S. was the only major car market in the world with light vehicle sales down 7%. The Indian and Russian car markets expanded rapidly with double-digit growth, while the recovery in Brazil continued but at a more moderate pace. New passenger vehicle registrations in Japan increased for the ninth consecutive month. Moreover, in Europe and China car sales was stronger, but the UK recorded the fourth consecutive month of weaker car sales. Thus, the overall increase in registration of passenger vehicles drives the growth of the automotive door panel market. In addition, although luxury vehicles are more expensive than conventional vehicles, luxury vehicles are an obligatory status symbol for well-to-do individuals. Around 28,500 of luxury vehicles were sold in 2016. Around 15.9% rise was recorded in the sale of luxury vehicles from 2015 to 2016. Furthermore, the demand for luxury vehicles was particularly fueled by China, owing to improved standard of living and rise in disposable income of the population. Thus, all these factors together are boosting the demand for the automotive door panel market.

Rise in number of road accidents

The number of road accidents and mishaps is increasing at higher rate. As being the cheapest way of transportation there is considerable rise in the number of operating vehicles on roads, which is the major factor for increase in road accident. It has been seen in the recent past that huge number of road accidents is from developing countries such as India, China, Indonesia and Brazil among others. Rise in road accidents drives various car manufacturers to install different active and passive safety systems and thereby preventing road mishaps. Thus, car manufacturers are required to provide smart and crashworthy vehicles in order to curb the fatality on roads in developing countries where automobile safety regulations are more lenient than those in developed countries. Moreover, it has been noticed that 80% road traffic accidents occur in middle income countries such as Russia, Mexico, China, Thailand and India among others, which comprises 72% population but only 52% registered vehicles. Thus, rise in number of road accidents create an additional demand for the replacement of door panels of the vehicle involved in the accident. This, in turn drives the global automotive door panel market.

Untapped developing markets in Africa and Asia

The developing nations of Asia-Pacific and Africa offer numerous growth opportunities. There is a rise in the demand for passenger vehicles in this region that is anticipated to increase during the forecast period. This has facilitated many automotive vehicle manufacturers to set up manufacturing plants in Africa and Asia to cater to the local demand and leverage low manufacturing costs for exporting vehicles and parts. For instance, in September 2017, Chinese car-maker BAIC opened an automotive assembly plant in South Africa that is expected to build 50,000 vehicles a year by 2022. In addition, in January 2017, Volkswagen South Africa began production at its Kenyan facility in Thika. This, provides an opportunity for vehicle manufacturers in the African market, which in turn is expected to create lucrative opportunities for the automotive door panel market expansion.

Key Benefits of Automotive Door Panel Market Study:

- This study comprises analytical depiction of the global automotive door panel market with current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable automotive door panel market trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current market is quantitatively analyzed from 2017 to 2025 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the automotive door panel industry.

Automotive Door Panel Market Report Highlights

| Aspects | Details |

| By Mode Of Operation |

|

| By Vehicle Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | KASAI KOGYO CO., LTD., YANFENG AUTOMOTIVE INTERIORS, TS TECH CO.,LTD., IAC GROUP, BROSE FAHRZEUGTEILE GMBH & CO., TOYOTA BOSHOKU CORPORATION, HAYASHI TELEMPU CORPORATION, DRAXLMAIER GROUP, SAMVARDHANA MOTHERSON GROUP (REYDEL AUTOMOTIVE FRANCE SAS), GRUPO ANTOLIN |

Analyst Review

The automotive door panel market holds high potential for the automotive industry owing to its importance in a vehicle. At present, there is an increase in demand for the automotive door panels from developing countries such as China, India, and others. Companies in this industry adopt various innovative techniques to provide customers with advanced and innovative product offerings.

Increase in passenger vehicle sale due to enhanced lifestyle of middle class families coupled with rise in disposable income, and surge in number of road accidents make way for the growth of the market. In addition, rise in demand for feature enabled door panels also contribute to the market growth. However, fluctuation in prices of the raw materials, and rise in demand for two seater passenger cars impedes the growth of the market. In the near future, untapped developing markets in Africa & Asia, and development of strong and lightweight door panels is expected to create lucrative opportunities for the key players operating in the market.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period (2018-2025) followed by Europe, North America, and LAMEA. However, LAMEA is expected to grow at a higher growth rate, predicting a lucrative market growth for automotive door panels owing to the expected increase in vehicle sale.

Grupo Antolin, Brose, Draexlmaier Group, HAYASHI TELEMPU CORPORATION, IAC Group, TS TECH, Kasai Kogyo, Reydel Automotive France SAS, TOYOTA BOSHOKU CORPORATION, and Yanfeng are the key market players that occupy a significant revenue share in the automotive door panel market.

Loading Table Of Content...