Automotive Driveline Market Overview

The global automotive driveline market was valued at USD 257.4 billion in 2021, and is projected to reach USD 545.8 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

The factors such as rise in automobile production, innovations and technological advancements in chassis systems, and increase in the sales of electric vehicles (EVs) supplement the growth of the automotive driveline market. However, fluctuating prices of raw material and decreasing vehicle ownership owing to increasing shared mobility are the factors expected to hamper the growth of the market. In addition, rocketing infrastructural developments in EV manufacturing and enhancement of all-wheel drive for future vehicles and increasing technology creates market opportunities for the key players operating in the automotive driveline market.

In addition, the adoption of light and aerodynamic quality of the drivelines improves the fuel efficiency of the vehicle and enhances the quality of the vehicle design. For instance, in June 2022, ZF Friedrichshafen AG launched its seven-speed automatic transmission at the Interschutz trade fair in Hanover. The new driveline allowed for a smooth operation with less weight and reduced fuel consumption along with various other optimizations, resulting in better performance and lower costs.

Introduction

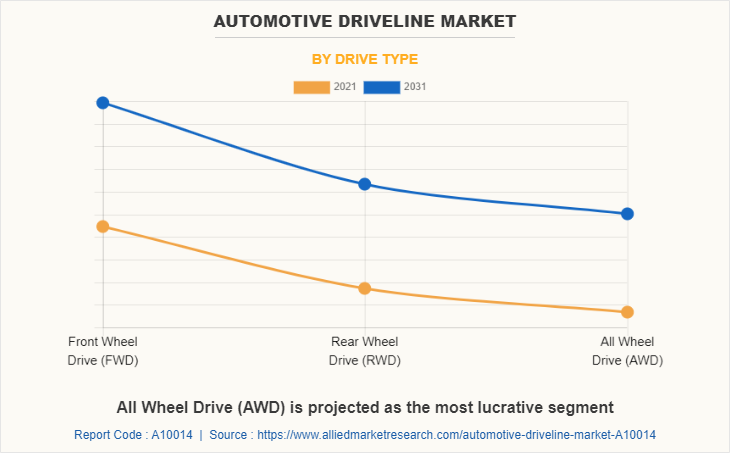

Driveline, also known as drivetrain, is the set of components of the automotive powertrain that lies between the transmission and differential. It generally includes everything in the chain from the engine to the drive wheels through a series of universal joints that transmit torque & rotation and deliver power to the wheels. Moreover, the automotive driveline connects to the wheel by enabling the vehicle to move. As the engine starts running, the vehicle’s driveline transfers power through the transmission to the drive wheel, which can be rear-wheel, front-wheel, or all-wheels. Modern passenger & commercial vehicles have the all-wheel drive installed with a significant focus on economic mileage. For instance, German manufacturers, such as Audi, Mercedes Benz, BMW, and many others, continue their penetration of AWD.

Segment Overview

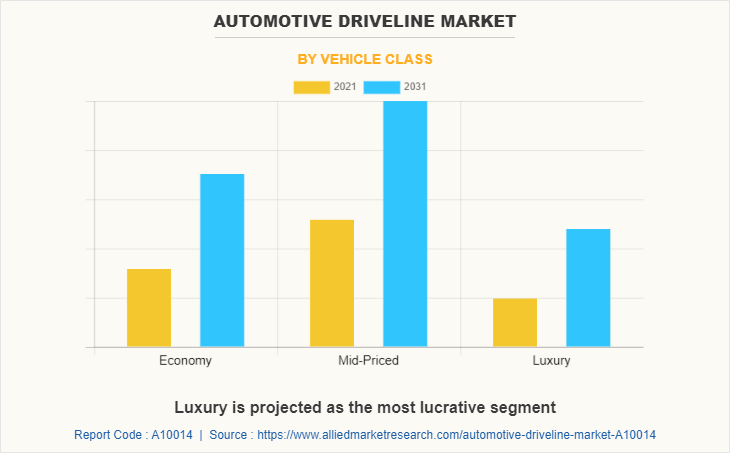

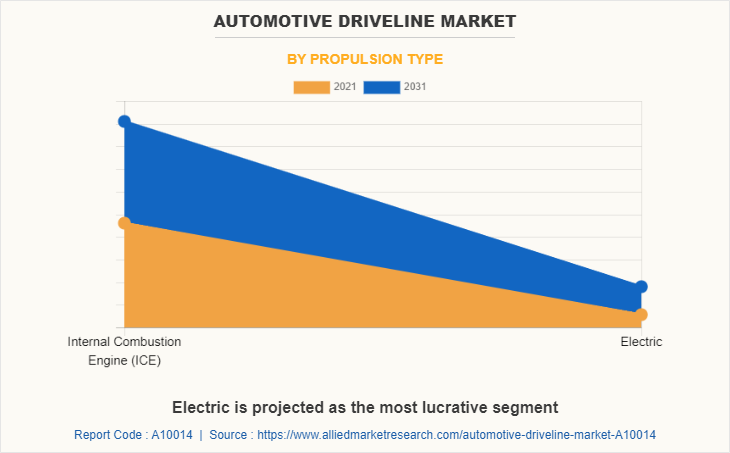

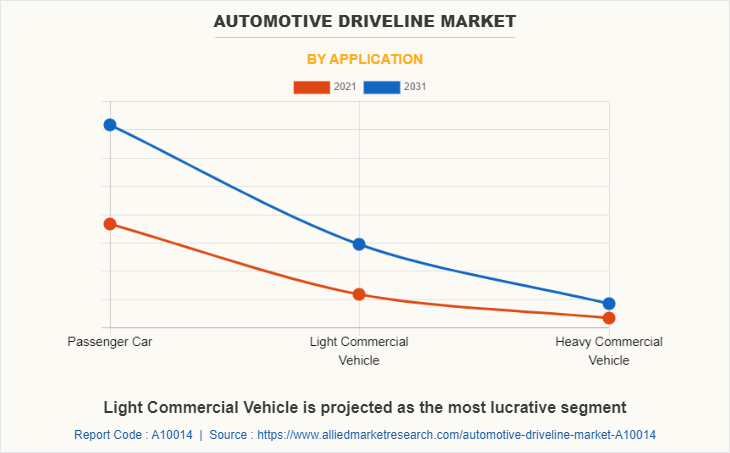

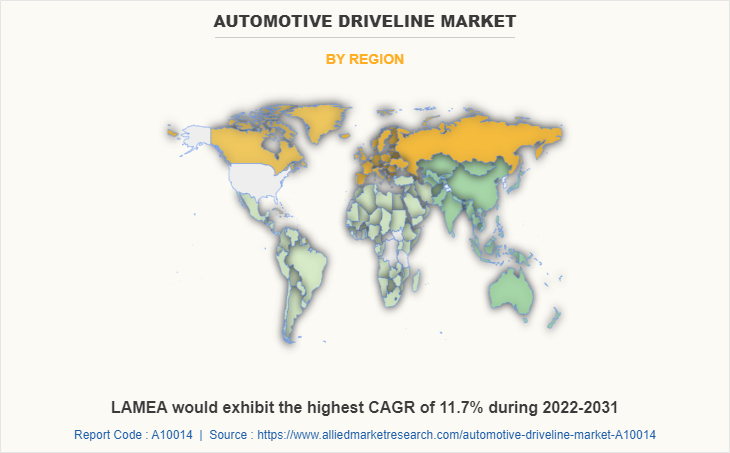

The automotive driveline market is segmented into drive type, vehicle class, propulsion type, application, and region. By drive type, the market is divided into front wheel drive (FWD), rear wheel drive (RWD), all wheel drive (AWD). By vehicle class, it is fragmented into economy, mid-priced, and luxury. By propulsion type, it is categorized into internal combustion engine (ICE) and electric. By application, it is further classified into passenger car, light commercial vehicle, and heavy commercial vehicle. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Players

The leading players operating in the automotive driveline market are BorgWarner Inc, Continental AG, DENSO Corporation, Ford Motor Company, GKN Automotive Limited, Hitachi Ltd, Mahindra & Mahindra Ltd, Marelli Holdings Co., Ltd, Melrose industries PLC, MSL Driveline Systems Limited, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Valeo, Volkswagen AG, Xlerate Driveline India Ltd., and ZF Friedrichshafen AG.

Top Impacting Factors

Rise in automobile production

The automotive industry is racing toward a new world with growing sustainability, changing consumer behavior, encompassing electric vehicles, connected cars, mobility fleet sharing, and improving lifestyles. Developing countries such as India, China, and Brazil are the most promising countries for the automotive sector. For instance, India became the fourth largest automobile industry in the world with an increase in sales of 9.5% year-on-year to 4.2 million units. This rise in automobile production in the developing nations automatically leads to increased production of automotive driveline systems in the vehicle. Moreover, according to European Automobile Manufactures’ Association (ACEA), in June 2021, passenger car registrations in the European Union increased by 10% compared to last year's same month owing to their hybrid nature & increased fuel efficiency. Therefore, an increase in automobile production is anticipated to boost the growth of the automotive driveline market.

Increase in the sales of electric vehicles (EVs)

Electric vehicles (EVs) are experiencing a rise in popularity over the past few years as the technology has matured & costs have declined, and support for clean transportation has promoted awareness, increased charging opportunities, and facilitated EV adoption. Although, innovations in driveline technologies have made EVs more competitive than conventional ICE vehicles by providing increased range in a single charge. Furthermore, growing vehicle emission concerns and depletion of non-renewable energy resources have attracted the attention of several governments to invest in electric vehicles. For instance, in August 2021, Schaeffler AG bought in further development in its electric axle by introducing the 800-volt power electronics and thermal management system. These improvements increased the efficiency of the electric drive, which further increased the effective range of electric vehicles.

According to European Environment Agency, in 2020, electric car registrations surged, accounting for 11% of newly registered passenger cars in which battery electric vehicles (BEVs) accounted for 6% of total new car registrations, while plug-in hybrid electric vehicles (PHEVs) represented 5%. Also, the production and sales of electric vehicles globally have been proliferating, owing to positive regulatory environments, such as subsidies and tax exemptions for both the industry and consumers in the European and Asia-Pacific regions. Hence, the increasing adoption of EVs around the world is expected to drive the market growth of the automotive driveline market in the forecast period.

Fluctuating prices of raw material

The raw material used for the manufacturing of automotive driveline mainly consists of carbon steel, aluminum alloys, and others. Some regions of the world experience an increase in the cost of metals used in driveline systems. For instance, there is a rise in the cost of metals such as aluminum, carbon, and others due to the reformed European Emissions Trading Scheme. This hinders the adoption of these metals as raw materials for the production of driveline systems. Also, the customers who prefer to upgrade to an advanced driveline assistance system need an additional $2000-$3000 based on additional components. Thus, fluctuating price of raw materials used in driveline systems restrains the growth of the automotive driveline market.

Enhancement of all-wheel drive for future vehicles and increasing technology

The rising developments in all-wheel drive (AWD) for upcoming passenger cars and SUVs are driving the market's growth. The critical shift in consumer demand will eventually impact the driveline business offered by different OEMs. North America, China, and European countries have seen significant volume uplifts for the models built with all-wheel drives. For instance, German manufacturers, such as Audi, Mercedes Benz, BMW, and many others, continue their penetration of AWD. Audi official has stated that the Audi Quattro model is driven by all-wheel drive every second. Additionally, the potential arrival of AWD EVs from manufacturers like Land Rover, Chevrolet (Volt), and the next fourth-generation Toyota Prius, which is anticipated to hit the automotive driveline market in the upcoming years, will present chances for the EV driveline industry.

The companies are also developing a brand-new integrated driveline system for high-tech automobiles. Many manufacturers have developed tech-savvy goods due to the shrinking engine capacity with a significant focus on economic mileage. Therefore, developing all-wheel drive for future vehicles and increasing technology from companies of electric and fuel cell commercial vehicles with high torque and improved acceleration, traction, and towing capabilities are expected to create lucrative opportunities for automotive driveline key players in the forecast period.

Key Benefits For Stakeholders

This study presents analytical depiction of the global automotive driveline market analysis along with current trends and future estimations to depict imminent investment pockets.

The overall automotive driveline market opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to the key drivers, restraints, and opportunities of the global automotive driveline market with a detailed impact analysis.

The current automotive driveline market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive Driveline Market Report Highlights

| Aspects | Details |

| By Vehicle Class |

|

| By Drive Type |

|

| By Propulsion Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Toyota Motor Corporation, Schaeffler AG, Marelli Holdings Co., Ltd, Volkswagen AG, Hitachi Ltd, GKN Ltd, MSL driveline systems limited, BorgWarner, Robert Bosch GmbH, Melrose industries plc, Mahindra & Mahindra Ltd, Continental AG, ZF Friedrichshafen AG, Ford Motor Company, Valeo, Xlerate Driveline India Ltd., DENSO Corporation |

Analyst Review

This section provides the opinions of various top-level CXOs in the global automotive driveline market. Hence, based on the interviews of various top-level CXOs of leading companies, the increase in technological improvements in the automotive segments and the rise in production of automobiles across all segments of vehicles drive the growth of the automotive driveline market. Additionally, due to emission reduction, the growing demand for electric vehicles across different countries is another factor boosting the market growth. For instance, according to European Environment Agency, in 2020, electric car registrations surged, accounting for 11% of newly registered passenger cars in which battery electric vehicles (BEVs) accounted for 6% of total new car registrations, while plug-in hybrid electric vehicles (PHEVs) represented 5%.

Moreover, rising expenditure capacities of consumers, especially in the developing economies, along with the electrification of driveline components, are anticipated to drive the market further. For instance, in November 2020, Valeo introduced its fully integrated compact electric driveline system in India. This technology helped electrification small mobility vehicles at an affordable cost, further accelerating its growth in the e-mobility segment. In addition, the growing utilization of the light-weighted driveshaft to enhance fuel efficiency and performance imposes a positive outlook on the automotive driveline market. In November 2020, The Aisin Group’s electric drive module “eAxle” has been used in the LEXUS UX300e, the brand’s first commercial electric vehicle. The “eAxle” is a lightweight and compact permanent magnet type synchronous motor designed specifically for electric vehicles, with high output and efficiency.

The market growth is supplemented by factors such as rise in automobile production, innovations and technological advancements in chassis systems, and increase in the sales of electric vehicles (EVs) supplement the growth of the automotive driveline market. However, fluctuating prices of raw material and decreasing vehicle ownership owing to increasing shared mobility are the factors expected to hamper the growth of the automotive driveline market. In addition, rocketing infrastructural developments in EV manufacturing and enhancement of all-wheel drive for future vehicles and increasing technology creates market opportunities for the key players operating in the automotive driveline market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to increasing consumer preference for comfort driving experience and rising import & luxury sales in the region.

Introduction of all wheel drive (AWD) in vehicles are the upcoming trends of Automotive Driveline Market in the world

Introduction of electric propulsion vehicles are the leading application of Automotive Driveline Market

Asia-Pacific is the largest regional market for Automotive Driveline

The global automotive driveline market was valued at $257.4 billion in 2021, and is projected to reach $545.76 billion by 2031, registering a CAGR of 7.7% from 2022 to 2031.

The leading players operating in the automotive driveline market are BorgWarner Inc., Continental AG, DENSO Corporation, Ford Motor Company, GKN Automotive Limited, Hitachi Ltd, Mahindra & Mahindra Ltd, Marelli Holdings Co., Ltd, Melrose industries PLC, MSL Driveline Systems Limited, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Valeo, Volkswagen AG, Xlerate Driveline India Ltd., and ZF Friedrichshafen AG.

Loading Table Of Content...