Automotive Electronic Control Unit (ECU) Market Research, 2035

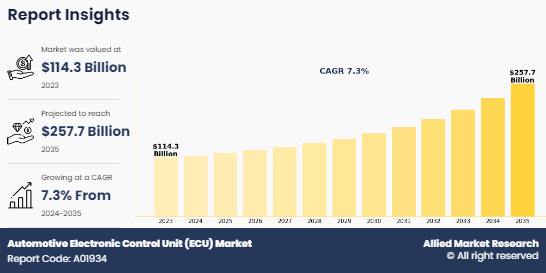

The global automotive electronic control unit market size was valued at USD 114.3 billion in 2023, and is projected to reach USD 257.7 billion by 2035, growing at a CAGR of 7.3% from 2024 to 2035. Rising adoption of ADAS technologies and increasing integration of IoT-enabled smart features in vehicles are fueling demand for advanced automotive ECUs.

Key Market Trends

- Powertrain ECUs dominate due to their critical role in engine, transmission, and EV power management.

- Passenger cars lead the market, driven by high demand for safety, comfort, infotainment, and connectivity features.

- Conventional vehicles hold dominance, supported by ongoing ICE production and established infrastructure.

- 32-bit ECUs remain industry standard, balancing performance, cost-efficiency, and advanced functionality.

- Central/domain ECUs dominate as automakers shift toward streamlined, software-defined vehicle architectures.

- Asia-Pacific leads the market, backed by strong manufacturing, EV adoption, and supportive government policies.

Market Size & Forecast

- 2035 Projected Market Size: USD 257.7 billion

- 2023 Market Size: USD 114.3 billion

- Compound Annual Growth Rate (CAGR) (2024-2035): 7.3%

Introduction

An automotive electronic control unit (ECU) is a computerized part used in cars that monitors and regulates a number of systems by obtaining real-time data from sensors positioned all over the car. These sensors take measurements on things like speed, temperature, and engine timing. Utilizing embedded software with algorithms specific to each system it oversees, the ECU processes this data. The ECU uses this processed data to generate output signals that are then translated into physical commands by a number of system actuators, which allow the vehicle's various components to be adjusted as necessary.

What are the Recent Developments in the Automotive Eelectronic Control Unit (ECU) Market

August 2024: Aptiv expanded its Indian subsidiary (situated in Chennai) to nearly 220,000 square feet to produce fully integrated, software-defined cockpit solutions. The plant began producing advanced cockpit control systems, radars, cameras, and next-gen electronic control units (ECU) for India and global markets, enhancing safety and user experience features.

April 2024: Marelli Holdings Co., Ltd collaborated with Infineon company to showcase its latest zone control unit (Zone). It is advanced electronic control unit, and it is placed in specific zones of the vehicle to manage various functions, consolidating electronic control units (ECUs) from multiple domains ‐“ including lighting, body, audio, power distribution, propulsion, thermal management, chassis control, and vehicle diagnostics.

August 2023: Continental AG partnered with Amazon Web Services to create a new cloud-based, virtual Electronic Control Unit Creator for automotive software developers. The vECU creator is part of the Continental Automotive Edge framework and runs on AWS' cloud service, allowing developers to access it from anywhere.

September 2022: Marelli Holdings Co., Ltd opened Technical R&D Center in Bangalore, Southern India, for boosting the innovation capability, particularly in software engineering. Through this newly opened center, it mainly focusses on Software for Cockpit DCU (Domain Control Units), Digital Clusters, Powertrain, and Electric Powertrain products.

March 2021: Hitachi Astemo, Ltd. developed Dynamic Planning, a highly precise vehicle trajectory planning technology for Autonomous Driving Electronic Control Unit. The technology uses an algorithm to control unpleasant sway and acceleration in Level 3 vehicles and promotes a comfortable driving experience.

What are the Top Impacting Factors

Key Market Driver

Rise in Demand for Advanced Driver Assistance Systems

The rise in demand for advanced driver assistance systems (ADAS) is significantly driving the growth of the automotive electronic control unit industry. As vehicles incorporate more sophisticated ADAS technologies, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, the need for advanced ECUs that can manage and integrate these complex systems has surged. ECUs are crucial for processing data from various sensors and executing the algorithms necessary for ADAS functionalities, ensuring vehicle safety and enhancing driver convenience.

For instance, in January 2023, ZF launched next-generation Smart Camera 6, advancing urban and highway automated driving and safety systems, alongside its comprehensive suite of multi-sensor environmental monitoring solutions, including Image Processing Modules for 3D surround view and Interior Monitoring Systems, enhancing scalability and functionality for ADAS and automated driving systems.

In addition, the rise in demand for ADAS not only stimulates the need for high-performance ECUs but also accelerates innovation within the market, as manufacturers seek to develop more advanced, reliable, and versatile control units. The trend toward increased automation and safety features in vehicles directly translates into higher demand for ECUs, highlighting their critical role in supporting the next generation of automotive technologies and contributing to the overall expansion of the automotive electronic control unit market share. Therefore, rise in demand for advanced driver assistance systems is driving the demand for the automotive electronic control unit market growth.

Advancements in Automotive Electronics and Connectivity

Advancements in automotive electronics and connectivity are significantly driving the demand for the automotive electronic control unit industry. As vehicles increasingly incorporate cutting-edge electronic systems and connectivity features, such as advanced infotainment, telematics, and over-the-air updates, the role of ECUs becomes more crucial. These advancements require sophisticated ECUs to manage and integrate various functions, including data processing from sensors, communication between different vehicle systems, and interface with external networks. The rise of technologies such as Vehicle-to-Everything (V2X) communication and the shift towards software-defined vehicles further amplify the need for advanced ECUs that can handle complex tasks and ensure seamless operation.

For instance, in March 2022, Renesas Electronics Corporation, a leader in semiconductor solutions, collaborated with Honda in the realm of advanced driver-assistance systems (ADAS). Building on their prior partnership, which saw Honda implement Renesas' R-Car SoC and RH850 motor control unit (MCU) in the Honda SENSING Elite system for Level 3 automated driving in the Legend, Honda has once again chosen these technologies for the Honda SENSING 360 system. This next-generation system enhances omnidirectional safety and driver assistance.

Additionally, the growing focus on autonomous driving and Advanced Driver Assistance Systems (ADAS) necessitates high-performance ECUs to support real-time data processing and system integration. As automotive electronics and connectivity continue to evolve, the demand for innovative and reliable ECUs is expected to grow, driving automotive electronic control unit market share expansion and technological progress. Therefore, advancements in automotive electronics and connectivity is driving the demand for the automotive electronic control unit market.

Restraints

Complexity of Integration with Existing Vehicle Systems

The complexity of integrating advanced electronic control units (ECUs) with existing vehicle systems is hampering the growth in automotive electronic control unit market forecast. Modern vehicles consist of numerous interconnected systems, including powertrain, infotainment, safety, and communication networks, all of which need to work in agreement. As newer ECUs are developed to manage advanced features such as autonomous driving, ADAS, and connectivity, ensuring compatibility with legacy vehicle architectures becomes increasingly difficult. The process of retrofitting or upgrading ECUs into existing systems often requires extensive reengineering and testing to ensure seamless integration and operation, leading to higher development costs and longer deployment times.

Moreover, the wide variety of vehicle models and platforms further complicates integration efforts, as each platform may require specific configurations and adaptations. This complexity can slow down the adoption of new ECUs and discourage manufacturers from implementing them across their fleets. As a result, while the demand for more advanced ECUs grows due to technological advancements, the challenges associated with integrating these units into current vehicle ecosystems act as a restraint, limiting automotive electronic control unit market size growth and slowing the pace of innovation in automotive electronics. Therefore, complexity of integration with existing vehicle systems is hampering the demand for the automotive electronic control unit market.

Opportunity

Development of Next-Generation Automotive Electronics and Sensors

The development of next-generation automotive electronics and sensors presents a lucrative opportunity for the automotive ECU market. As vehicles increasingly incorporate advanced technologies, such as autonomous driving, vehicle-to-everything (V2X) communication, and sophisticated driver assistance systems, the demand for more capable and versatile ECUs rises significantly. These next-generation electronics and sensors require ECUs that can handle vast amounts of data, integrate multiple systems seamlessly, and provide real-time processing capabilities to ensure optimal vehicle performance and safety.

For instance, in August 2023, Elektrobit announced that its industry-leading software suite, designed for the development of automotive electronic control units (ECUs) based on the latest AUTOSAR standards, along with its Linux solution, had begun supporting NXP Semiconductors' new S32G3 vehicle network processor. The S32G3 series processors significantly enhanced processing power, memory capacity, and networking capabilities, while maintaining compatibility with the packaging pinout and software of the widely successful S32G2 series. This advancement aligned with the automotive industry's shift toward more consolidated domain and zonal architectures for software-defined vehicles, offering car manufacturers a powerful combination of hardware and software.

Furthermore, the push towards electrification and smart vehicles also drives the need for ECUs that can manage complex powertrain systems, advanced battery management, and energy-efficient operations. As these technologies continue to evolve, there is a growing demand for ECUs that not only support current functionalities but also anticipate future needs, such as enhanced connectivity, over-the-air updates, and increased automation.

In addition, the global focus on sustainability and reducing emissions is accelerating the development of electric vehicles (EVs), which rely heavily on sophisticated ECUs to manage everything from battery health to regenerative braking systems. This trend opens up significant opportunities for ECU manufacturers to innovate and develop products that cater to the specific needs of modern and future vehicles, positioning the ECU market for substantial growth. Therefore, development of next-generation automotive electronics and sensors is lucrative opportunity for the automotive electronic control unit market.

Segment Overview

The automotive electronic control unit market is segmented on the basis of technology, application, mode, ECU capacity, type, and region. On the basis of technology, the market is classified into powertrain, body, ADAS, infotainment, and chassis. On the basis of application, the market is bifurcated into passenger cars, commercial vehicle, and electric vehicles. On the basis of mode, the market is categorized into conventional, and autonomous. On the basis of ECU Capacity, the market is divided into 16 Bit, 32 Bit, and 64 Bit. On the basis of type, the market is divided into Smart Actuator or Edge Node, Central ECU or Domain ECU, Zonal ECU, and Others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America. and Middles East & Africa.

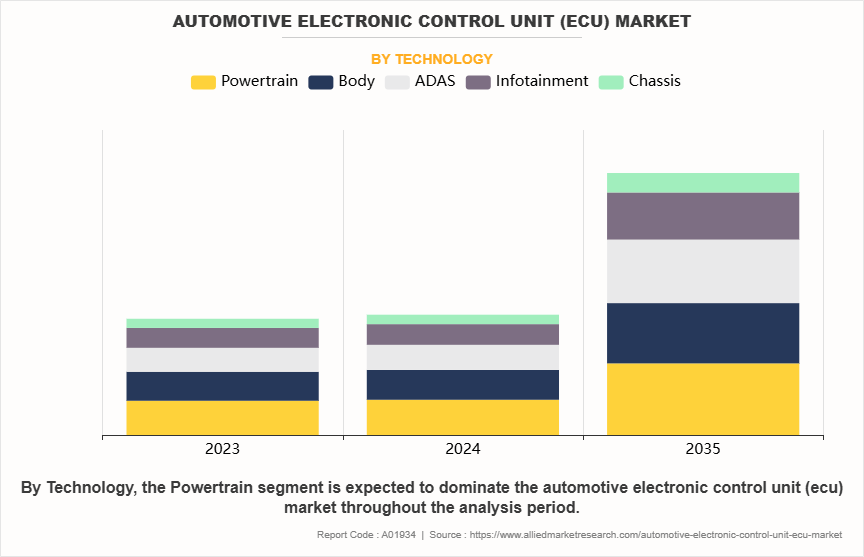

By Technology

On the basis of technology, the market is classified into powertrain, body, ADAS, infotainment, and chassis. The powertrain segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to its critical role in managing engine, transmission, and overall vehicle performance. With the rise of electrification, powertrain ECUs are becoming even more essential for controlling electric motors, battery systems, and energy optimization. Their importance in ensuring fuel efficiency and complying with stringent emission regulations further drives demand. As automakers prioritize electrification and hybrid technologies, powertrain ECUs are crucial for optimizing power delivery, making this segment a dominant force in the automotive ECU market.

By Application

On the basis of application, the market is bifurcated into passenger cars, commercial vehicle, and electric vehicles. The passenger cars segment dominated the global market in the year 2023 due to the widespread use of electronic systems that control a variety of functions, including safety, comfort, infotainment, and powertrain management. Passenger cars, which account for the largest portion of global vehicle production, require multiple ECUs to manage these features, especially with the growing adoption of advanced technologies such as ADAS, infotainment, and connectivity.

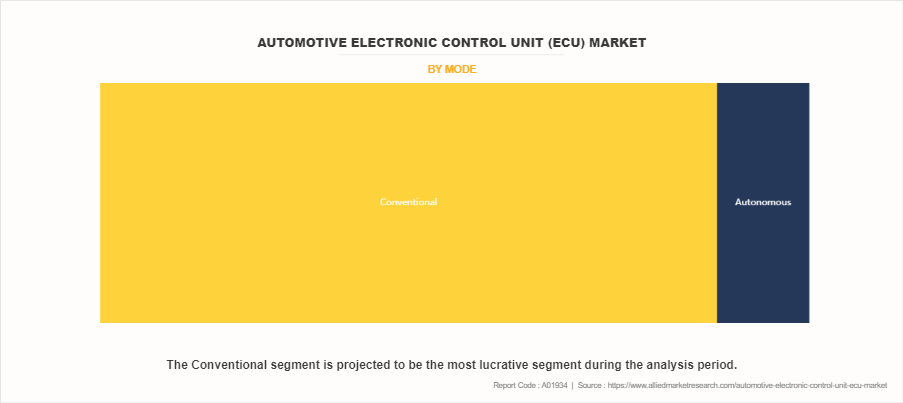

By Mode

On the basis of mode, the market is categorized into conventional, and autonomous. The conventional segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to the extensive global production and sales of internal combustion engine (ICE) vehicles. Conventional vehicles require multiple ECUs for managing various functions, such as engine control, emissions, and transmission systems, maintaining high demand for ECUs. Additionally, their established infrastructure, lower initial costs, and the gradual transition to electric vehicles keep conventional vehicles relevant in the market, further sustaining this segment's dominance.

By ECU Capacity

On the basis of ECU capacity, the market is categorized into 16 Bit, 32 Bit, and 64 Bit. The 32 Bit segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to its balance of performance and cost-efficiency. These ECUs are capable of handling complex functions, such as engine management, infotainment, and safety systems, making them suitable for most conventional and mid-range vehicle applications. The 32-bit architecture offers enough processing power to manage advanced vehicle functions like real-time data processing for ADAS, without the higher costs associated with 64-bit systems. As automakers prioritize cost-effectiveness alongside functionality, 32-bit ECUs remain the industry standard, driving their dominance in the automotive market.

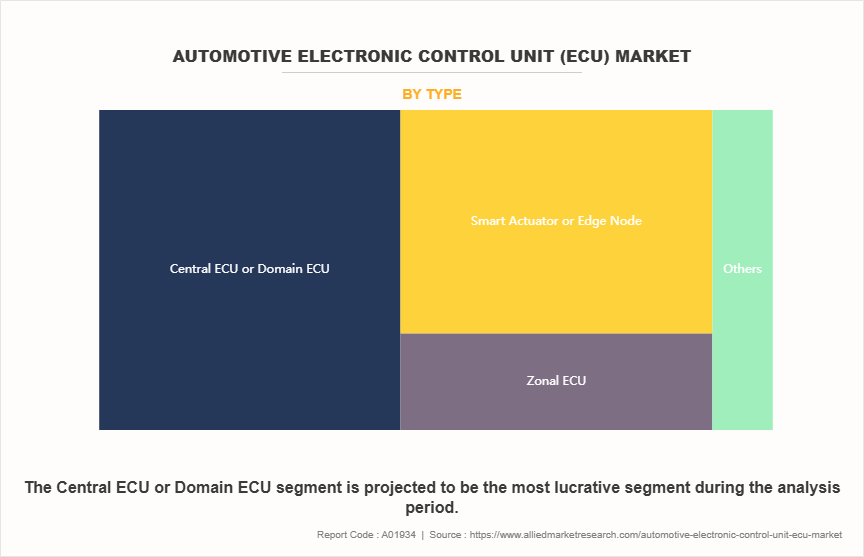

By Type

On the basis of type, the market is categorized into smart actuator or edge node, central ECU or domain ECU, zonal ECU, and others. The central ECU or domain ECU segment dominated the global market in the year 2023 due to the growing complexity of modern vehicles, especially with advancements in autonomous driving, electrification, and ADAS technologies. Central ECUs enable a more streamlined and efficient system architecture by managing multiple vehicle functions from a single unit, reducing the need for individual ECUs for each task. This centralization improves vehicle performance, reduces wiring and component weight, and enhances software management, making it a preferred solution for automakers looking to optimize vehicle systems and improve overall efficiency.

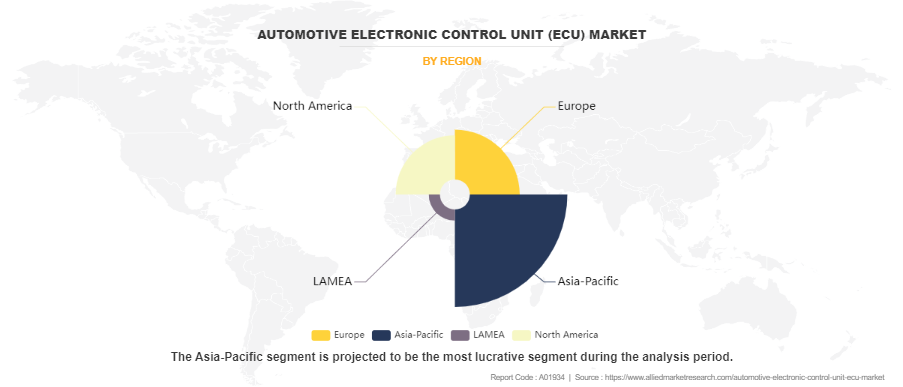

By Region

On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to its robust automotive manufacturing base and high vehicle demand. The region benefits from significant investments in automotive technology, particularly in countries like China and India, which are major production hubs for both domestic and international automakers. Additionally, the rapid adoption of advanced technologies, such as electric vehicles (EVs) and autonomous driving systems, fuels ECU demand in this region.

The presence of key ECU manufacturers and suppliers, coupled with a growing middle class and increasing consumer preference for technologically advanced vehicles, further drives automotive electronic control unit market growth. Asia-Pacific's leadership is also supported by favorable government policies promoting automotive innovation and infrastructure development.

Which are the Top Automotive Electronic Control Unit companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive electronic control unit industry.

- Aptiv

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd

- Hyundai Mobis Co. Ltd

- Lear Corporation

- Marelli Holdings Co., Ltd

- Panasonic Corporation

- Robert Bosch GmbH

- Pektron

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive electronic control unit market analysis from 2023 to 2035 to identify the prevailing automotive electronic control unit market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive electronic control unit (ECU) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive electronic control unit market trends, key players, market segments, application areas, and market growth strategies.

Automotive Electronic Control Unit (ECU) Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 257.7 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 366 |

| By Technology |

|

| By Application |

|

| By Mode |

|

| By ECU Capacity |

|

| By Type |

|

| By Region |

|

| Key Market Players | Lear Corp., DENSO CORPORATION, Panasonic Holdings Corporation, Pektron Group Ltd, Hitachi Astemo, Ltd., Marelli Holdings Co., Ltd, Aptiv, Continental AG, Robert Bosch GmbH, HYUNDAI MOBIS |

Analyst Review

The automotive electronic control unit (AECU) market is projected to show growth opportunities in the future. The demand for automotive with advanced safety features is estimated to grow during the forecast period, which in turn is expected to fuel the growth of the AECU market. Increase in incorporation of ECUs in electric and hybrid electric vehicles is anticipated to drive the growth of the market.

However, rise in number of ECUs in a single vehicle is expected to increase complexity for OEMs to design a rigid system, which will ultimately hamper the growth of market. The use of ECU in anti-theft system is expected to boost the growth of the market along with the need for driver assistance system for vehicles.

The significant impacting factors of the market include development in automotive market, stringent safety regulations set by governments in the automobile market, and manufacture of low-cost ECUs. In addition, advanced features in vehicles such as power steering system, climate control system, antilock braking system, body control system, and others is expected to positively impact the market growth.

Rise in demand for advanced driver assistance systems, integration of IOT and smart technologies in vehicles, and advancements in automotive electronics and connectivity are the drivers in Automotive Electronic Control Unit (ECU) Market in the globe

Passenger cars are the leading application of Automotive Electronic Control Unit (ECU) Market

Asia-Pacific is the largest regional market for Automotive Electronic Control Unit (ECU).

The estimated industry size of Automotive Electronic Control Unit (ECU) is $ 257.7 Bn

Powertrain is the leading technology in Automotive Electronic Control Unit (ECU) Market

Loading Table Of Content...

Loading Research Methodology...