Automotive FPC Market Research, 2033

The global automotive FPC market size was valued at $344.0 million in 2023, and is projected to reach $539.2 million by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Flexible printed circuits, or FPCs for short, are more sophisticated electronics circuits that are built on flexible materials and have the ability to integrate various components. Polyimide and etched copper conductors make up FPC. A common method to attach FPCs is to just insert them into the connection. Connecting them with Flexible Flat Cables, or FFCs, is an additional option. These connectors come with characteristics to accommodate a wide range of space and use requirements for applications in all markets, making them perfect for tight-packaging applications. They also come in a number of pitch choices.

Owing to the expansion of linked devices, the growing need for FPC in the automotive sector, and the development of automotive electronics technology. With lucrative development prospects in the computer/peripheral, telecommunications, consumer electronics, automotive, aerospace, and defence industries during the projected period, the global automotive FPC market appears promising. Furthermore, the miniaturisation of electronic devices and the rise in demand for low-loss/high-speed printed circuit boards (PCBs) are new trends that directly affect industry dynamics and will propel market expansion in the years to come.

Key Takeaways

The automotive FPC market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive FPC industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Developments and Strategies

In October 2020, Nippon Mektron Ltd., also known as Mektec across the globe announced the availability of a new FPC structure in mass production that uses MPI (Modified-PI) as MPI FPC for High-Speed Transmission Applications, in addition to LCP (Liquid Crystal Polymer) base FPC.

In June 2020, CMK Corporation received the Technology Award from The Japan Institute of Electronics Packaging for its contribution to the development of motorcycle ECUs for Honda Motor Co., Ltd.

In March 2020, CMK Corporation received an outstanding quality performance award in FY2019 from Toyota Motor Corporation’s Hirose factory on March 25th as a result of an evaluation of their product quality.

Key Market Dynamics

The automotive flexible printed circuit (FPC) market is on an upward trajectory, fueled by the growing need for compact and adaptable electronic components in vehicles. FPCs are valued for their thin profile and flexibility, making them essential in various automotive applications, including control systems, infotainment, and lighting. Their durability under high temperatures and resistance to corrosion make them well-suited for the demanding environments within vehicles. As the automotive sector advances, the demand for these versatile circuits is projected to increase.

In addition, the automotive FPC market is experiencing growth due to the rising popularity of in-vehicle infotainment systems. Consumers increasingly desire vehicles with sophisticated features such as navigation, Bluetooth connectivity, and voice commands. These advanced systems rely on FPCs, which drives significant opportunities for the market's expansion.

Future Technological Advancements in Automotive FPC

The future of automotive flexible printed circuits (FPCs) is set to be defined by advancements in materials and design technologies. Emerging materials like high-performance polymers and composites are being developed to enhance the thermal and mechanical properties of FPCs. These new materials are designed to withstand higher temperatures, resist harsh environmental conditions, and offer greater flexibility, which is crucial for the increasingly complex and compact electronics in modern vehicles. As automotive designs become more sophisticated, the need for FPCs that can maintain high performance in challenging conditions will drive innovation in material science.

Another significant advancement is the integration of smart technologies within FPCs. The future will likely see FPCs embedded with advanced sensors and microelectronic components that enable real-time data collection and processing. This integration will support the development of advanced driver assistance systems (ADAS) , vehicle-to-everything (V2X) communications, and predictive maintenance technologies. By embedding these functionalities directly into the FPCs, manufacturers can create more compact and efficient electronic systems, which are essential for the evolution of autonomous and connected vehicles.

Lastly, improvements in manufacturing techniques will play a crucial role in shaping the future of automotive FPCs. Innovations such as high-precision printing methods, automated production lines, and advanced etching technologies will enhance the efficiency and accuracy of FPC production. These advancements will enable the creation of more complex and reliable circuit designs while reducing production costs and lead times. As the automotive industry continues to advance, these technological improvements will ensure that FPCs can meet the growing demands for high-performance, integrated electronic systems.

Regional/Country Market Outlook

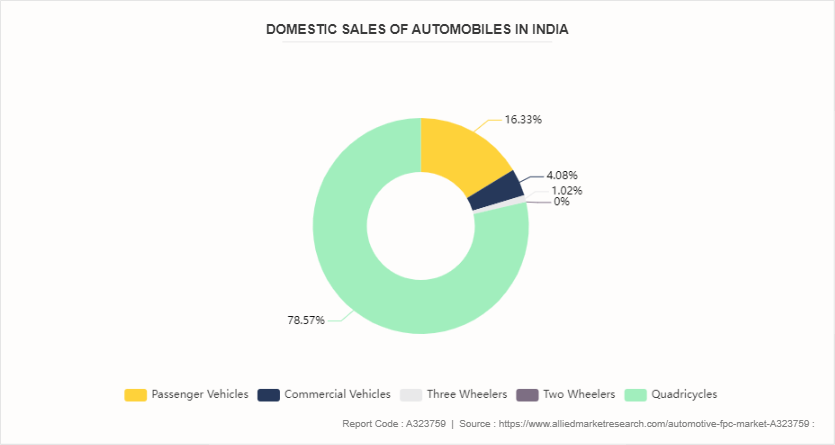

Asia Pacific region is the generated the largest revenue in automotive FPC market share, owing to the growing automotive industries in China, Japan, and India. The expanding production and sales of passenger and commercial cars, combined with rising consumer disposable money, drive demand for control arms. Consumers in this region support affordable vehicles with dependable suspension systems. The region also benefits from a robust supply chain and the presence of major auto control arm manufacturers.

Competitive Landscape

The major players operating in the automotive FPC market size include Nippon Mektron, Tripod, CMK Corporation, Chin Poon Industrial, AT&S, TTM, Wus Printed Circuit, KCE Electronics, and Meiko Electronics.

Industry Trends:

In 2020, the International Organization of Motor Vehicle Manufacturers estimated that 70.50 million passenger cars would be produced worldwide (OICA) .

According to Automotive World magazine observations, the fabrics required to upholster a standard car's interior, including the seat coverings, weigh roughly 30 kg (651 lbs)

According to a study by the Victoria Transport Policy Institute (VTPI) , more than 70% of fully autonomous vehicles will be used for ride-sharing, with only 30% likely to be privately owned.

According to the Insurance Institute for Highway Safety (IIHS) , good head restraints can result in 11% reduction in injury claim rates.

Key Sources Referred

International Organization of Motor Vehicle Manufacturers

Society of Indian Automobile Manufacturers

Victoria Transport Policy Institute

IOPscience

ANSI Organisation

U.S. Department of Transportation

National Aeronautics and Space Administration

International Transport Forum

Maryland Department of Natural Reseources

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive FPC market segments, current trends, estimations, and dynamics of the automotive FPC market analysis from 2022 to 2032 to identify the prevailing automotive FPC market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive FPC industry segmentation assists to determine the prevailing automotive FPC market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global automotive FPC market forecast statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive FPC market trends, key players, market segments, application areas, and automotive FPC market growth strategies.

Automotive FPC Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 539.2 Million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 324 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Chin Poon Industrial, CMK Corporation, Nippon Mektron, AT&S, KCE Electronics, TTM, Wus Printed Circuit, Meiko Electronics, Tripod |

The fuel automotive is the leading application of Automotive FPC Market.

The upcoming trends of automotive FPC market include rise in the number of electric vehicles and increasing complexity in automotive electronics.

Asia-Pacific is the largest regional market for Automotive FPC.

The global automotive FPC market was valued at $344.0 million in 2023.

Nippon Mektron, Tripod, CMK Corporation, Chin Poon Industrial are the top companies to hold the market share in Automotive FPC.

Loading Table Of Content...