Automotive Fuse Market Overview

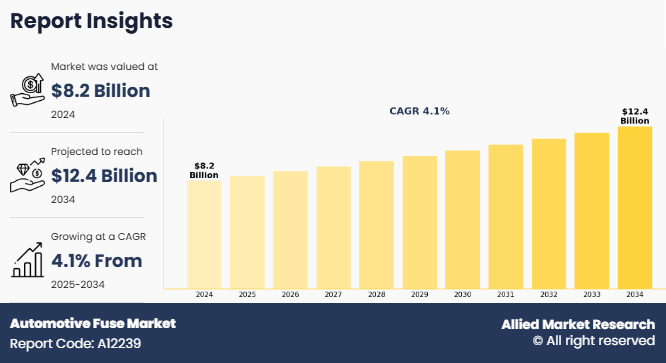

The global automotive fuse market was valued at $8.2 billion in 2024, and is projected to reach $12.4 billion by 2034, growing at a CAGR of 4.1% from 2025 to 2034.

The rising adoption of hybrid and electric vehicles is significantly contributing to the growth of the automotive fuse market. Hybrid and electric vehicles rely heavily on high-voltage electrical systems and advanced power electronics, which require enhanced circuit protection to ensure safe and reliable operation. Unlike conventional internal combustion engine vehicles, EVs and hybrid vehicle contain a larger number of electronic components, such as battery management systems, electric motors, inverters, onboard chargers, and regenerative braking systems all of these system require specialized fuses for overcurrent protection.

Report Key Highlighters:

- The automotive fuse industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2025-2034.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the automotive fuse market size.

- The automotive fuse market share is highly fragmented, into several players including Eaton Corporation, Littelfuse Inc., Mersen, Sensata Technologies, Inc., Blue Sea Systems, AEM Components, Optifuse, Schurter Electronics Component, Mouser Electronics, and Bel Fuse. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Additionally, as governments across the globe are increasingly promoting for cleaner transportation through subsidies, tax benefits, and stricter emission regulations, the demand for EVs and HEVs is rapidly growing. For example, according to the International Energy Agency (IEA), global electric car sales exceeded 14 million units in 2023, up from 10 million in 2022. This surge in electric vehicle adoption led to increased demand for high-voltage fuses especially designed to handle higher current loads and provide thermal and arc protection. Moreover, as the EV market continues to expand, fuse manufacturers are increasingly investing in research and development to design and develop compact, fast, and high-performance fuses tailored to the specific needs of electric powertrains, thus fueling the growth of the automotive fuse market demand during the review period.

The demand for automotive fuses is growing rapidly in modern vehicles due to the increasing complexity and electrification of automotive systems. Modern vehicles include a wide range of electronic features such as advanced driver assistance systems (ADAS), infotainment units, electric power steering, and smart lighting, all of which require reliable circuit protection. Hybrid and electric vehicles (EVs) further drive this demand, as they operate with high-voltage systems that need specialized fuses to safely manage power between batteries, inverters, and motors. Additionally, the rise of connected and autonomous vehicles adds more control units and sensors, increasing the need for multiple, precise fuse types.

A automotive fuses are safety component which are designed to protect electrical circuits in a vehicle. Automotive fuse work when additional electrical current flows in the circuit due to fault or electric overload. During electric fluctuation the fuse blows by melting its internal metal strip, which cuts off the power to that circuit. Thus helps in preventing damage to wiring, and electronic systems. Automotive fuses are located in key areas such as the engine bay and cabin fuse box.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On April 2022, Littelfuse completed the $540 million acquisition of C&K Switches, a global leader in high-performance electromechanical switches. This move significantly expanded Littelfuse’s footprint in end markets such as industrial, transportation, aerospace, and data communications. The company also enhanced its portfolio in human-machine interface components and helped broaden its customer base across critical applications.

- On March 2025, Littelfuse launched the 823A series fuses, its first surface-mount device (SMD) fuse rated for 1,000 V DC. This new product is specifically developed to be used in high-voltage automotive applications such as battery management systems (BMS), DC–DC converters, and onboard charging units in electric vehicles. The fuse is AEC-Q200 qualified and designed to operate reliably in harsh automotive environments.

Segmental Analysis

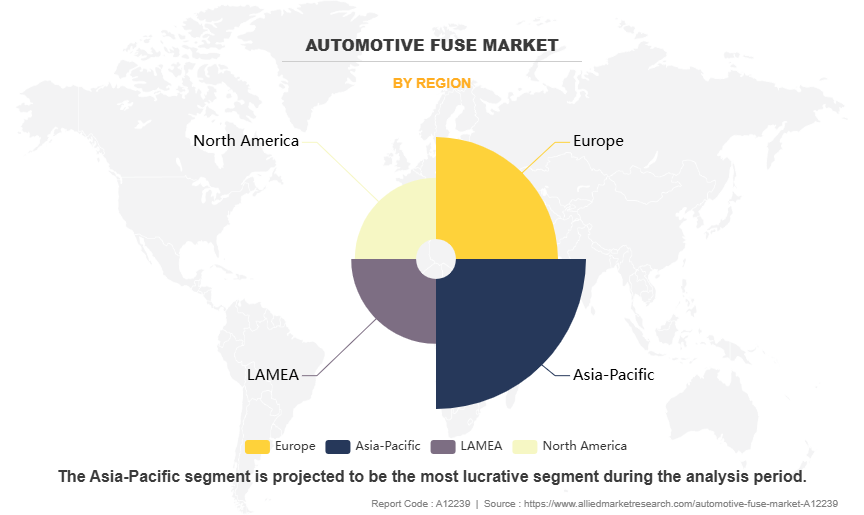

The automotive fuse market is segment is segmented into type, voltage, application and region. Based fuse on type the global market is segregated into blade, glass tube, semiconductor, and others. Based on voltage the market is analyzed into 12 & 24V, 24-48V, 49-150V, and 151-300V. Based on application the market is segregated into auxiliary fuse, engine fuse, PCU fuse, and others. Region wise the global market is analysed into North America, Europe, Asia-Pacific and LAMEA.

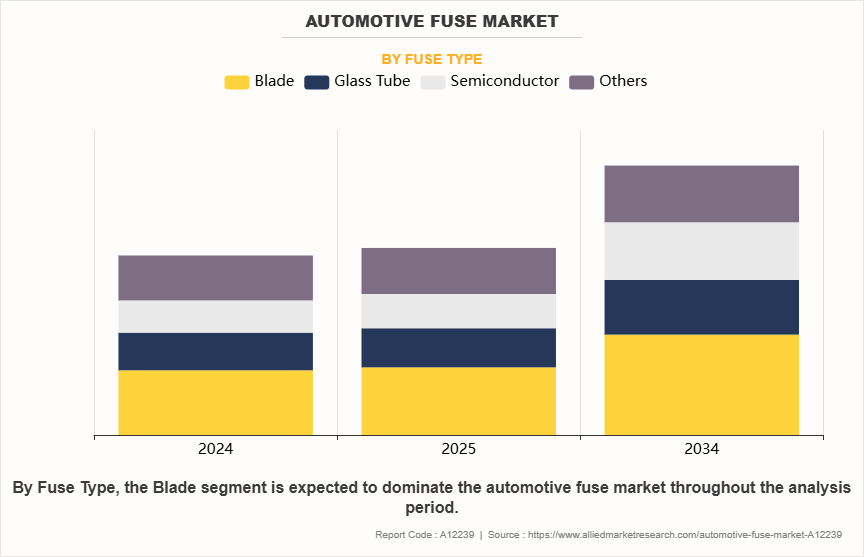

By Fuse Type

Based on fuse type the global automotive fuse market forecast is segregated into blade, glass tube, semiconductor, and others. The blade segment dominated the global market share in 2024, owing to blade fuse are commonly used in modern vehicles, blade fuses are color-coded by amperage rating for easy identification and replacement. They are designed to interrupt the circuit when the current exceeds a safe level, preventing damage to vehicle electronics and wiring. Blade fuse are increasingly used due to their compact size, ease of use, and wide availability make them a standard choice for protecting circuits in passenger vehicles.

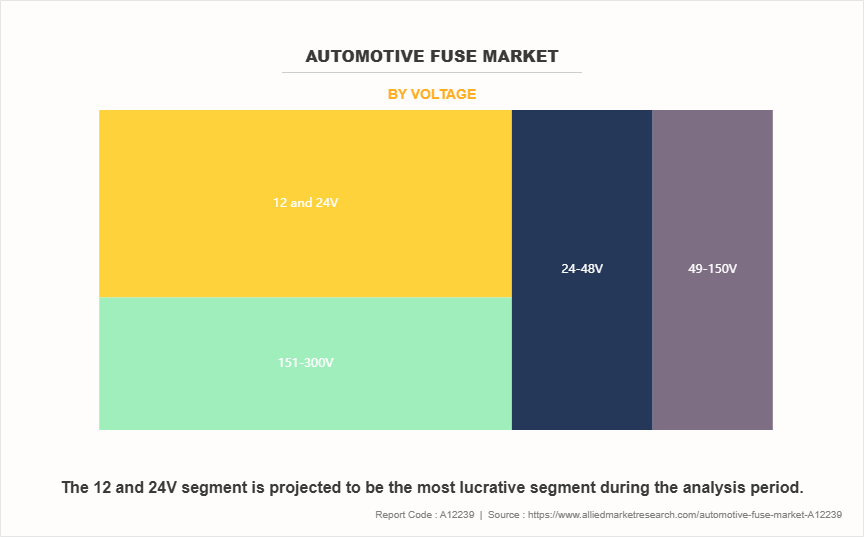

By Voltage Type

On the basis of voltage, the automotive fuse market size is categorized into 12 & 24V, 24-48V, 49-150V, and 151-300V. The 12 & 24V segment dominated the global market share in 2024, owing to the 12V system is standard in most passenger cars, while 24V systems are typically used in commercial trucks, buses, and off-road vehicles. Fuses in this voltage category are used for common components such as headlights, wipers, entertainment systems, and starter motors.

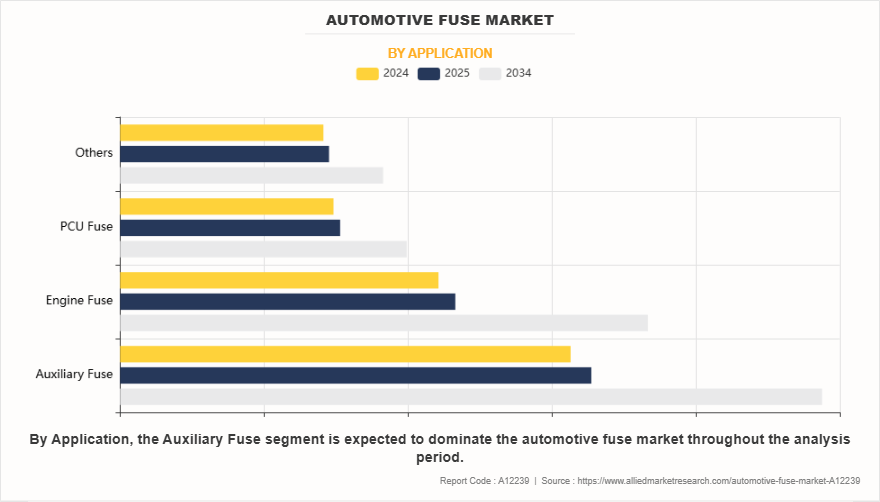

By Application

Based on application the global automotive fuse market is segmented into auxiliary fuse, engine fuse, PCU fuse, and others. The auxiliary fuse segment dominated the global market share in 2024, owing to these fuse are designed to protect secondary or non-essential electrical systems in a vehicle, such as interior lighting, power windows, infotainment systems, and seat heaters. These fuses ensure that if a fault occurs in any auxiliary component, it does not affect the vehicle's primary driving functions. Auxiliary fuses are typically found in the cabin fuse box and are often blade or glass tube types.

By Region

On the basis of region the global market is analyzed into North America, Europe, Asia-Pacific and LAMEA. The Asia-Pacific dominated the global market share in 2024, owing to rapid vehicle production, rising electrification, and expanding automotive infrastructure across key countries such as China, India, Japan, and South Korea.

China, is the world’s largest automotive market, and is experiencing high EV penetration, backed by aggressive government incentives and strong investment in battery and power electronics manufacturing. This is significantly increasing the demand for high-voltage and fast automotive fuses. Likewise, India is witnessing strong growth in vehicle production, rising vehicle ownership, and expansion of the passenger and commercial vehicle segments. Additionally, the government's push toward EV adoption and the localization of auto component manufacturing is further supporting the market growth.

Likewise, Japan and South Korea, are globally recognized for their technological advancements and automotive innovation, and are significantly contributing to automotive fuse market growth. These countries are increasingly investing in development of advanced driver-assistance systems (ADAS), connected car technologies, further driving the market demand.

Stringent in Vehicle Safety Regulations

Stringent of vehicle safety regulations are playing a major role in the growth of the automotive fuse industry. Governments and regulatory bodies across the globe are enforcing stricter safety standards to reduce road accidents and enhance occupant protection. Additionally, automakers are increasingly integrating a wide range of advanced safety features in vehicles, such as advanced driver-assistance systems (ADAS), anti-lock braking systems (ABS), electronic stability control (ESC), lane-keeping assist, and automatic emergency braking, all of these system rely on sophisticated electrical and electronic systems which require robust circuit protection.

To ensure reliable operation of these safety critical components, high-performance fuses are essential to prevent damage caused by electrical faults, overcurrent, or short circuits. As these regulations are evolving and are implementing more safety regulations, the demand for dependable and miniaturized fuses are further growing.

For instance, regions like Europe and North America have introduced mandates requiring new vehicles to be equipped with ADAS features, pushing OEMs to upgrade vehicle electrical architectures. Similarly, in emerging countries, regulatory bodies are gradually aligning their vehicles with global standards. As a result, the demand for advanced automotive fuse solutions for protecting complex and sensitive electrical circuits is further growing.

Development of Smart Fuses and Intelligent Fuse Boxes

The development of smart fuses and intelligent fuse boxes offers a significant opportunity for the automotive fuse market. As vehicles become increasingly connected, electrified, and software-driven, there is growing demand for smarter electrical protection systems. Smart fuses and intelligent fuse boxes are designed to offer real-time diagnostics, remote monitoring, and programmable protection, which are aligned with the evolving needs of modern automotive electrical architectures.

Unlike conventional fuses which break the circuit during a fault, smart fuses can detect abnormal conditions, log events, and send signal to a central control unit. This capability offers predictive maintenance, faster troubleshooting, and improved vehicle safety in both ICE and electric and hybrid vehicles, where electrical complexity is much higher.

Moreover, intelligent fuse boxes further enhance system efficiency by replacing bulky, hard-wired fuse panels with compact, software-configurable modules allowing for adaptive current management and space-saving designs. These advanced systems contribute to weight reduction, easier assembly, and higher flexibility in vehicle design. Thus, the shift toward smart fuses and intelligent fuse boxes represents a major growth opportunity for the automotive fuse market in the coming years.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive fuse market analysis from 2024 to 2034 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive fuse market trends, key players, market segments, application areas, and market growth strategies.

Automotive Fuse Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 12.4 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By Application |

|

| By Fuse Type |

|

| By Voltage |

|

| By Region |

|

| Key Market Players | Blue Sea Systems, Schurter Group, Sensata Technologies, Inc., Eaton Corporation PLC, AEM Components, Littlefuse Inc., Bel Fuse Inc., Mersen S.A., Mouser Electronics, OptiFuse, LLC |

Increasing use composite and ecofriendly materials are the upcoming trends in the automotive fuse.

The auxiliary fuse is the leading segment of the automotive fuse market.

Asia-pacific is the largest regional market for automotive fuse market.

The automotive fuse market was valued at $8,240.0 million in 2024 and is estimated to reach $12,367.14 million by 2034, exhibiting a CAGR of 4.14% from 2025 to 2034.

Eaton Corporation, Littelfuse Inc., Mersen, Sensata Technologies, Inc., Blue Sea Systems, AEM Components are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...