Automotive Gateway Market Insights, 2032

The global Automotive Gateway Market Size was valued at $4.6 billion in 2022, and is projected to reach $8.4 billion by 2032, growing at a CAGR of 6% from 2023 to 2032.

An automotive gateway is a pivotal component within a vehicle's electronic architecture, serving as the central control unit that manages and regulates data flow. It enables seamless communication between various onboard systems, such as infotainment, safety, and powertrain, by facilitating data exchange between different network protocols.

Market Dynamics

The increase in adoption of Advanced Driver Assistance Systems

The increase in adoption of Advanced Driver Assistance Systems (ADAS) drives growth in the automotive gateway market. ADAS includes a range of technologies designed to enhance vehicle safety and improve driving comfort by providing automated assistance to the driver. This trend has gained momentum due to a rise in focus on improving road safety, reducing accidents, and advancing toward autonomous driving capabilities.

One prominent example of ADAS is adaptive cruise control (ACC), which automatically adjusts the vehicle speed to maintain a safe distance from the vehicle ahead. ACC utilizes sensors such as radar and cameras to monitor traffic conditions and adjust the throttle or brakes accordingly. Another example is lane departure warning (LDW) systems, which use cameras to detect lane markings and alert the driver if the vehicle unintentionally drifts out of its lane.

Furthermore, technologies such as blind-spot monitoring (BSM) systems, forward collision warning (FCW), and automatic emergency braking (AEB) have become increasingly common in modern vehicles, contributing to the rise in ADAS adoption. These systems rely on a network of sensors, processors, and communication modules to collect and analyze data in real-time, enabling swift response to potential hazards on the road.

Moreover, the evolution of ADAS extends beyond individual features of integrated systems that offer comprehensive safety solutions. For instance, Tesla's Autopilot system combines adaptive cruise control, lane-keeping assist, and automatic lane changes to provide a semi-autonomous driving experience. Such integrated ADAS solutions require sophisticated communication networks facilitated by automotive gateway modules to ensure seamless coordination between various subsystems.

In addition, rapid technological advancements play a pivotal role in driving the automotive gateway market forward, ushering in a new era of connectivity, safety, and convenience within vehicles. These advancements include a wide range of innovations, from enhanced communication protocols to more sophisticated processing capabilities, all aimed at improving the overall driving experience and vehicle performance.

One example of rapid technological advancement in the automotive industry is the evolution of connected car technology. Vehicles today are equipped with an array of sensors, cameras, and communication modules that enable real-time data exchange between vehicles, infrastructure, and the cloud. This connectivity facilitates features such as vehicle-to-vehicle (V2V) communication, which enhances safety by allowing vehicles to exchange information about their speed, position, and intended maneuvers to avoid collisions and traffic congestion.

Furthermore, advancements in processing power and software algorithms have led to the development of advanced driver assistance systems (ADAS) that provide features such as adaptive cruise control, lane-keeping assist, and autonomous emergency braking. These systems rely on the seamless integration of various sensors and actuators throughout the vehicle, all managed and coordinated by the automotive gateway module.

In addition, the automotive industry has witnessed a shift toward electrification and autonomy, with electric vehicles (EVs) and autonomous vehicles (AVs) becoming increasingly prevalent. These vehicles require sophisticated communication networks to manage power distribution, battery monitoring, and autonomous driving functions. Automotive gateway modules serve as the central hub for coordinating these systems, ensuring seamless communication among the vehicle's various components and external networks.

Technological complexities

However, technological complexities bring challenges for market growth. Technological complexity in the automotive industry refers to the intricate integration of advanced software, electrical, and electronic architectures within vehicles. As cars evolve into sophisticated machines akin to robots, managing this complexity becomes paramount. It includes challenges such as the integration of numerous systems such as infotainment, navigation, driver-assist features, and autonomous driving technology. Moreover, the proliferation of sensors, actuators, and communication networks adds layers of intricacy. Addressing technological complexity requires robust software development practices, rigorous testing methodologies, and efficient communication protocols. It demands expertise in cybersecurity to safeguard against potential vulnerabilities. Overall, navigating technological complexity is crucial for automakers to deliver safe, reliable, and innovative vehicles in today's rapidly advancing automotive landscape.

Growing demand for connected vehicles

The rise in demand for connected vehicles is fueled by an increase in consumer expectations for advanced features, safety, and convenience. This trend is evident worldwide, with analysts projecting that nearly 70% of worldwide vehicle sales are expected to consist of connected vehicles within the next two years. In India, surge in demand for advanced connected features is driven by the country's growing tech-savvy population, further propelling the automotive human-machine interface industry.

Moreover, the growth of the connected car market in the U.S. is propelled by increase in vehicle safety and security norms, alongside the demand for vehicle-to-vehicle (V2V) connectivity technology. As consumers become more reliant on technology in their daily lives, the expectation for seamless connectivity extends to their vehicles, driving the automotive industry toward a future where connectivity is a fundamental aspect of vehicle design and functionality.

Segmentation

The automotive gateway market is segmented on the basis of type, application, technology, and region. On the basis of type, the market is classified into CAN, LIN, FlexRay, and Gigabit Ethernet. On the basis of end user, the market is bifurcated into passenger and commercial. On the basis of technology, the market is categorized into vehicle-to vehicle, and vehicle-to-grid. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America. and Middles East & Africa.

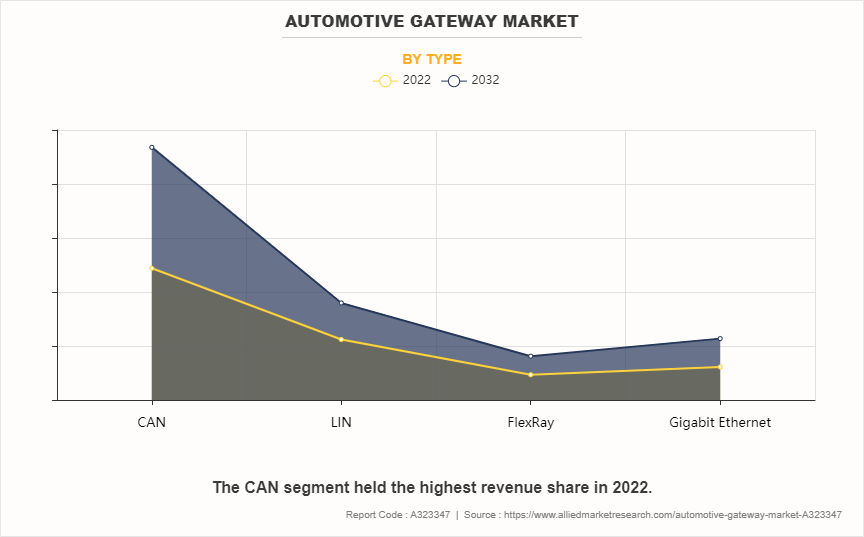

By Type

On the basis of type, the market is classified into CAN, LIN, FlexRay, and Gigabit Ethernet. The CAN segment dominated the global Automotive Gateway Market Size in the year 2022 and is likely to remain dominant during the forecast period. CAN, known for its reliability and widespread adoption across various automotive applications, serves as a backbone for in-vehicle networks. Its robustness in transmitting data efficiently and securely has made it a preferred choice for automotive gateway systems. Moreover, CAN's compatibility with a wide range of automotive components and its ability to handle real-time data requirements contribute to its continued dominance. As automotive technology continues to advance, the reliance on CAN-based automotive gateways is expected to persist. With the automotive industry increasingly emphasizing connectivity, safety, and efficiency, CAN's proven track record positions it as a cornerstone technology, ensuring its enduring prominence in the automotive gateway market throughout the forecast period.

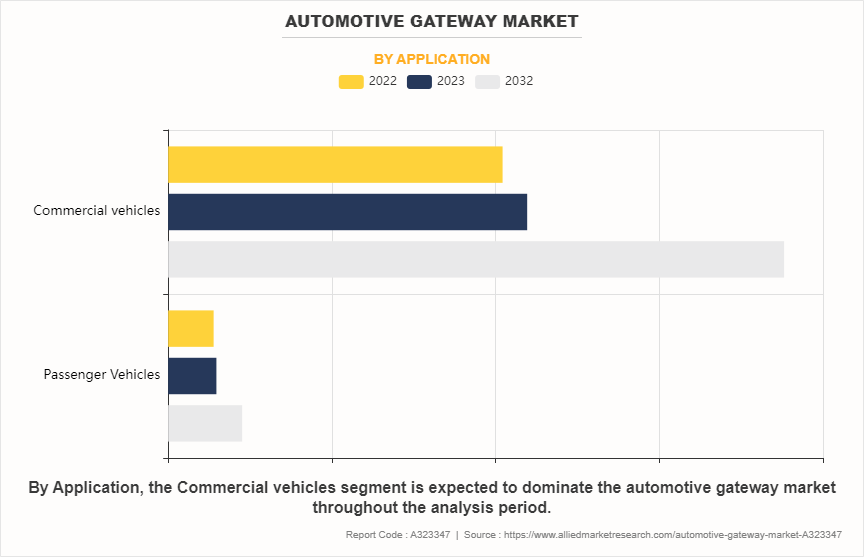

By Application

On the basis of application, the market is bifurcated into passenger and commercial. The commercial segment dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. This dominance stems from the commercial sector's substantial reliance on vehicles for diverse operations, ranging from logistics and transportation to construction and public services. Commercial entities prioritize efficient vehicle management, necessitating robust communication networks facilitated by automotive gateways. These gateways serve as vital components in modern commercial vehicles, enabling seamless integration of various electronic systems and protocols, optimizing performance, safety, and data exchange. Moreover, as commercial operations increasingly adopt advanced technologies like IoT and telematics, the demand for sophisticated automotive gateway solutions escalates. Hence, the commercial sector's enduring dominance in the automotive gateway market is driven by its reliance on vehicles for essential operations and the imperative for advanced connectivity solutions to enhance efficiency and productivity.

By Technology

On the basis of technology, the Automotive Gateway Industry is categorized into vehicle-to vehicle, and vehicle-to-grid. The vehicle-to-vehicle segment had the dominating Automotive Gateway Market Share in the year 2022 and is likely to remain dominant during the forecast period. As automotive technology advances, the demand for seamless data exchange between vehicles increases, crucial for enabling features like autonomous driving and cooperative collision avoidance. Vehicle-to-vehicle communication relies heavily on robust gateway systems to manage and regulate data flow efficiently across diverse communication protocols. These gateways serve as central hubs, ensuring secure and reliable interconnection between vehicles, facilitating real-time exchange of information about road conditions, traffic patterns, and potential hazards. Additionally, regulatory initiatives mandating the integration of vehicle communication technologies further propel the Automotive Gateway Market Growth of this segment. Consequently, the vehicle-to-vehicle segment maintains its dominance in the automotive gateway market, driven by the imperative for safer, smarter, and more connected transportation ecosystems.

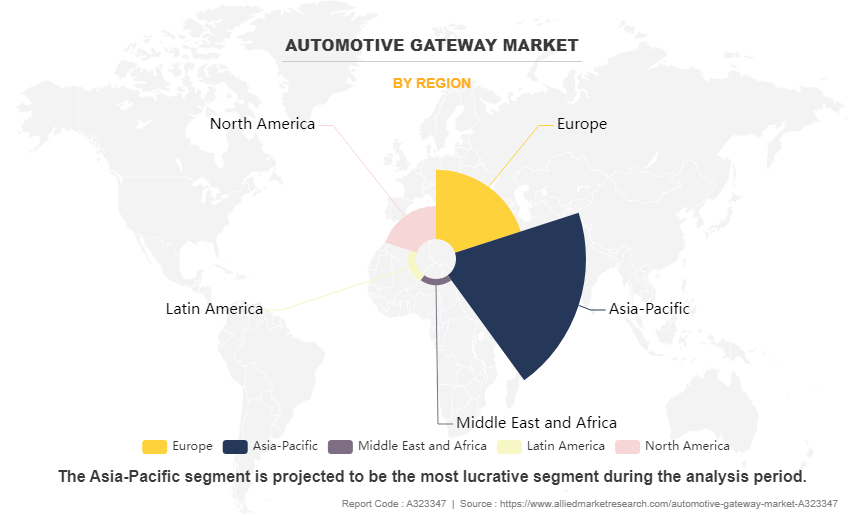

By Region

On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America. and Middles East & Africa. The Asia-Pacific region dominated the global market in the year 2022 and is likely to remain dominant during the Automotive Gateway Market Forecast period. Also, it the fastest growing region with the CAGR of 6.5% from 2023 to 2032. This dominance can be attributed to several factors, including the region's robust automotive manufacturing sector, technological advancements, and increasing demand for connected vehicles. With a rapidly growing middle class and urbanization, countries in the Asia-Pacific region have witnessed a surge in automotive sales, prompting manufacturers to integrate advanced communication systems like gateways into their vehicles. Additionally, favorable government initiatives promoting the adoption of electric vehicles and smart transportation systems further propel Automotive Gateway Industry growth. Moreover, the presence of key automotive players and a burgeoning ecosystem of automotive technology providers contribute to the region's dominance. Overall, these factors position the Asia-Pacific region as a pivotal hub for innovation and expansion in the automotive gateway market.

Competition Analysis

The key players in the automotive gateway market are Bosch, Continental, Aptiv, Denso, Marelli, NXP, Infineon, Broadcom, Texas Instruments, and STMicroelectronics.

Key Market Developments

- August 2021: NXP Semiconductors and Marvell Technology Group announced a strategic partnership to develop automotive gateway solutions, aiming to enhance vehicle connectivity and security.

- October 2021: Renesas Electronics Corporation launched its new automotive gateway solution, integrating advanced security features and high-speed connectivity to support next-generation vehicle architectures.

- February 2022: Continental AG unveiled its latest automotive gateway control unit, designed to facilitate seamless communication between various vehicle networks and enhance data processing capabilities for connected car applications.

- June 2022: Infineon Technologies AG acquired Cypress Semiconductor Corporation, consolidating their expertise in automotive gateway solutions, and expanding their portfolio to offer comprehensive connectivity solutions for automotive applications.

- December 2022: Texas Instruments Incorporated introduced its latest automotive gateway processor, featuring enhanced performance and efficiency to meet the surge in demand for connectivity and data processing in modern vehicles.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive gateway market analysis from 2022 to 2032 to identify the prevailing automotive gateway market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive gateway market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive gateway market trends, key players, market segments, application areas, and market growth strategies.

Automotive Gateway Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.4 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Texas Instruments, Continental, Infineon, BOSCH, bombas marelli (sundyne corporation), Denso, Aaptiv, Broadcom, STMicroelectronics, NXP |

Analyst Review

In the rapidly evolving landscape of automotive technology, the automotive gateway market stands as a crucial enabler of innovation and connectivity. As CXOs assess the market dynamics, they encounter a country where vehicle architecture shift toward sophisticated electronic systems, demanding robust communication infrastructures. The automotive central gateway module market research reports offer invaluable insights, guiding CXOs to capitalize on emerging opportunities and navigate through challenges. With the IoT node and gateway market projected to grow significantly, CXOs must strategize to harness the potential synergies between IoT and automotive gateway technologies.

The forecasted growth of the automotive gateway market underscores its pivotal role in shaping the future of connected vehicles. As vehicles become increasingly autonomous and interconnected, the demand for seamless data exchange and integration across diverse communication protocols intensifies. CXOs are tasked with leveraging this market trend to enhance vehicle functionality, safety, and user experience. Reports on the evolution of automotive gateway modules highlight the transition toward service-oriented architectures, emphasizing performance-focused requirements.

Amidst these developments, CXOs must remain vigilant of competitive landscapes and emerging technologies. Comprehensive analyses offer insights into prominent players and market trends, empowering CXOs to make informed decisions and stay ahead of the curve. The extensive insights provided by Automotive Central Gateway Module Market reports equip CXOs with the knowledge needed to navigate through market disruptions and capitalize on emerging opportunities.

The global automotive gateway market was valued at $4.6 billion in 2022, and is projected to reach $8.4 billion by 2032, growing at a CAGR of 6.0% from 2023 to 2032.

From 2023-2032 would be forecast period in the market report.

$4.6 billion is the market value of automotive gateway market in 2022.

2022 is base year calculated in the automotive gateway market report.

Bosch, Continental, Aptiv, Denso, Marelli, NXP, Infineon, Broadcom, Texas Instruments are the top companies hold the market share in automotive gateway market.

Loading Table Of Content...

Loading Research Methodology...