Automotive Interior Lighting Market Research, 2034

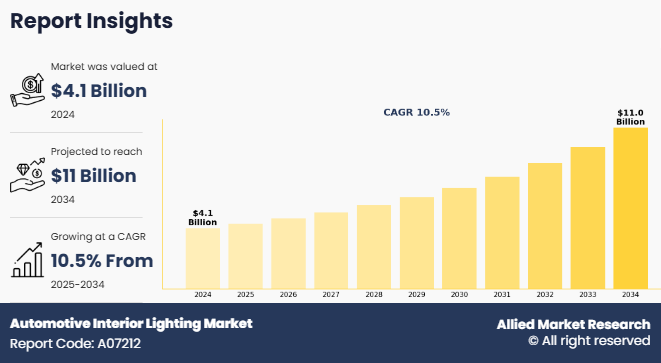

The global automotive interior lighting market size was valued at $4.1 billion in 2024, and is projected to reach $11 billion by 2034, growing at a CAGR of 10.5% from 2025 to 2034.

Automotive interior lighting refers to the integrated system of lights within a vehicle’s cabin designed to enhance visibility, safety, comfort, and aesthetics for occupants. This includes functional lighting such as dome lights, reading lamps, dashboard illumination, footwell lighting, and door panel lights, as well as ambient and accent lighting that create a personalized and pleasant in-cabin atmosphere. Modern interior lighting systems utilize energy-efficient technologies like LEDs, OLEDs, and fiber optics, offering customizable color options, brightness levels, and dynamic effects.

Key Takeaways

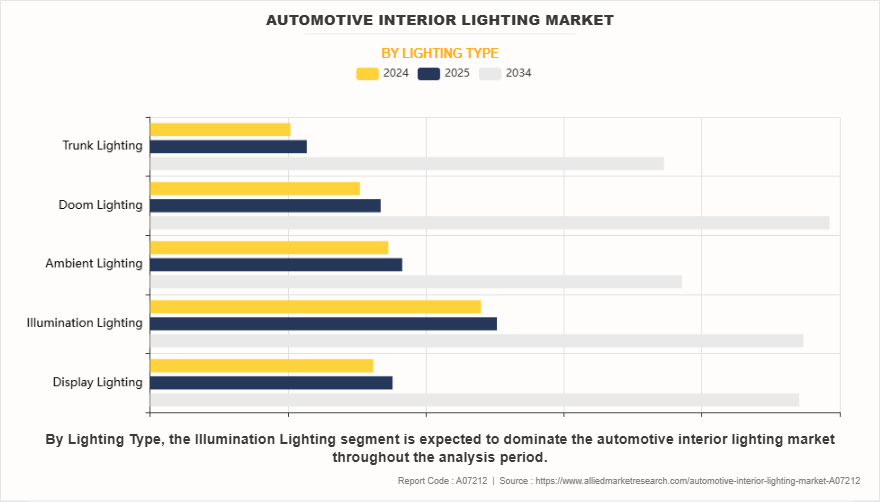

- On the basis of lighting type, the illumination lighting segment held the largest automotive interior lighting market share in 2024.

- By product type, the LED segment was the major shareholder in 2024.

- By vehicle type, the passenger vehicles segment dominated the market, in terms of share, in 2024.

- On the basis of application, the footwell lighting segment held the largest share in the global automotive interior lighting market in 2024

- By sales channel, the OEM segment was the major shareholder in 2024

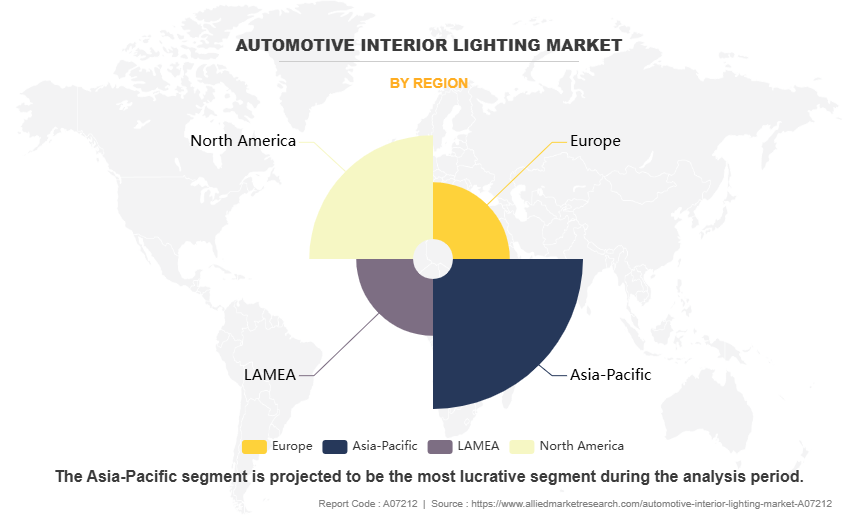

- Region wise, Asia-Pacific region held the largest market share in 2024.

These systems contribute not only to practical visibility during low-light conditions but also play a vital role in brand differentiation and luxury appeal. In connected and electric vehicles, lighting is increasingly used for human-machine interaction (HMI), providing visual cues for notifications, drive modes, and safety alerts. As consumer demand grows for advanced, intelligent, and mood-enhancing cabin environments, automotive interior lighting industry continues to evolve as a critical element of vehicle design and user experience.

For instance, in April 2025, Marelli partnered with the automotive industry to launch automotive lighting innovations at Auto Shanghai 2025. Through this partnership, Marelli provides technologies, including the world’s first OLED TFT applied to the Pixel Rear Lamp, Near-Field Ground Projection, and the Thin Lit Line Headlamp. These innovations reflect Marelli’s objective to redefine smart mobility experiences and accelerate the evolution of automotive lighting through close collaboration and co-creation with customers. Moreover, In December 2024, ams OSRAM, a global leader in intelligent sensors and emitters, has partnered with Valeo, a leading automotive technology company, to introduce advanced cabin lighting solutions. Through this partnership, ams OSRAM provides intelligent LEDs that are integrated with Valeo’s dynamic ambient lighting systems, aiming to deliver a highly customizable and interactive experience in the automotive interior lighting industry.

The increase in demand for premium and customizable in-cabin experiences is significantly boosting the automotive interior lighting market size. Consumers now seek personalized environments that enhance comfort, mood, and aesthetics while driving. Ambient lighting, multicolor options, and user-controlled brightness settings are becoming standard in both luxury and mid-range vehicles. This trend is pushing automakers to integrate advanced, adaptive lighting solutions that align with modern expectations for style, functionality, and immersive driving experiences. Furthermore, rise in the adoption of LED, OLED, and ambient lighting technologies, and surge in electric and autonomous vehicles requiring advanced lighting systems. However, high cost of advanced lighting technologies is restricting the adoption of automotive interior lighting systems in budget vehicles. Features like OLED panels, dynamic ambient lighting, and intelligent controls significantly increase production costs, making them less feasible for entry-level models. As a result, many manufacturers limit such offerings to premium segments, creating a gap in demand and slowing market penetration across the broader automotive landscape, especially in cost-sensitive regions. Moreover, Complex integration with existing vehicle electronics and systems are major factor that hamper the growth of the automotive interior lighting market growth. On the contrary, The growing aftermarket demand for customizable interior lighting kits presents a lucrative opportunity for the automotive interior lighting market demand. Vehicle owners increasingly seek affordable ways to personalize their car interiors with features like ambient lighting strips, RGB LEDs, and starlight headliners. This trend is driven by rising interest in DIY modifications and aesthetic upgrades, enabling lighting manufacturers and retailers to tap into a broad consumer base beyond original equipment installations.

Segment Review

The automotive interior lighting market is segmented on the basis of lighting type, product type, vehicle type, application, sales channel, and region. On the basis of lighting type, the market is divided into display lighting, illumination lighting, ambient lighting, doom lighting, trunk lighting. By product type, it is classified into LED, OLED, halogen, and xenon. On the basis of vehicle type, it is categorized into passenger vehicle, commercial vehicle, and electric vehicle. By application, it is categorized into dashboard lighting, footwell lighting, door panel lighting, centre consol lighting, headliner lighting, and others. On the basis of vehicle type, the market is segmented into passenger vehicle, commercial vehicle, and electric vehicles. On the basis of sales channel, the market is bifurcated into OEM, and aftermarket. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Lighting Type

On the basis of lighting type, the illumination lighting segment acquired the highest market share in 2024 in the automotive Interior lighting market trends. This is due to its essential role in ensuring visibility and safety within the vehicle cabin. This segment includes dome lights, map lights, and reading lights, which are standard across all vehicle types—from economy to luxury. Unlike accent or display lighting, illumination lighting is a fundamental requirement rather than an optional feature. The widespread integration of LED technology has also made these systems more energy-efficient and cost-effective, further driving their adoption. As a result, illumination lighting continues to dominate in terms of volume and market penetration.

By Product Type

On the basis of product type, the LED segment acquired the highest market share in 2024 in the automotive interior lightings market. This is due to its energy efficiency, long lifespan, low heat generation, and cost-effectiveness. LEDs are widely adopted across all vehicle segments—from budget to luxury—making them the most versatile and accessible lighting solution. Their ability to offer vibrant colors, compact designs, and customizable brightness levels makes them ideal for various applications, including ambient, dashboard, and footwell lighting. As OEMs and aftermarket players increasingly prefer LEDs for their performance and design flexibility, this segment continues to dominate the market, far ahead of newer technologies like OLED and laser lighting.

By Vehicle Type

On the basis of vehicle type, the passenger vehicle segment acquired the highest market share in 2024 in the automotive interior lightings market. This is due to their high global production volume and strong consumer demand for comfort, aesthetics, and personalization. Interior lighting features such as ambient lighting, dashboard illumination, and footwell lighting are widely integrated into passenger vehicles across various price segments. Automakers increasingly focus on enhancing the in-cabin experience in these vehicles to appeal to customers seeking both functionality and luxury. The growing trend of digital cockpits, infotainment systems, and mood lighting further accelerates the adoption of advanced lighting technologies in the passenger car segment, solidifying its market dominance.

By Region

Region-wise, Asia-Pacific attained the highest market share in 2024 and emerged as the leading region in the automotive interior lighting market. This is driven by its large automotive production base, rising disposable incomes, and growing demand for feature-rich vehicles. Countries such as China, Japan, South Korea, and India are major contributors, supported by robust manufacturing infrastructure and strong OEM presence. Increasing consumer preference for advanced, customizable lighting in mid-range and premium vehicles further fuels market growth. The rapid adoption of electric vehicles and smart mobility solutions in the region is encouraging automakers to integrate innovative interior lighting systems, solidifying Asia-Pacific's position as the leading region in this market.

Meanwhile, North America is projected to grow at the fastest rate in the automotive interior lighting market during the forecast period, driven by rising demand for luxury vehicles, electric vehicles (EVs), and advanced driver-assistance systems (ADAS). Consumers in the region increasingly seek personalized, premium in-cabin experiences, boosting the adoption of ambient and smart lighting solutions. Strong investments in automotive innovation, the presence of key market players, and growing interest in connected and autonomous vehicles are encouraging OEMs to enhance interior aesthetics and functionality through advanced lighting technologies. Government incentives for EVs also contribute to increased adoption of intelligent lighting systems.

The report focuses on growth prospects, restraints, and trends of the Automotive Interior Lightings market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Automotive Interior Lighting market.

Competitive Analysis

The report analyses the profiles of key players operating in the Automotive Interior Lightings market such as KOITO MANUFACTURING CO., LTD., Valeo S.A., HELLA GmbH & Co. KGaA, Stanley Electric Co., Ltd., ams-OSRAM AG., Marelli Holdings Co., Ltd., Lumax Industries, Robert Bosch GmbH, Koninklijke Philips N.V., and Grupo Antolin. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive interior lightings market.

Increase in Demand for Premium and Customizable In-Cabin Experiences.

The increase in demand for premium and customizable in-cabin experiences is significantly boosting the growth of the automotive interior lighting market. For instance, in April 2023, OSRAM launched a new range of cabin lighting systems specifically designed for electric vehicles, aiming to enhance energy efficiency, passenger comfort, and interior aesthetics. These advanced lighting solutions incorporate dynamic ambient lighting and smart control features, aligning with the evolving design needs of EVs. Furthermore, modern consumers expect more than just functionality from their vehicles—they seek ambiance, personalization, and an immersive driving environment. Interior lighting plays a critical role in enhancing the visual appeal and comfort of the cabin through features such as ambient lighting, multicolor LED systems, and mood-based illumination. In addition, customizable lighting allows users to select colors and intensity to match their preferences or driving conditions, adding a personal touch to the vehicle experience. This trend is particularly strong in mid-range and luxury vehicles, but is increasingly penetrating the mass market due to technological advancements and cost-effective lighting solutions. Automakers are integrating smart lighting systems that respond to voice commands, drive modes, and infotainment settings. As the focus on driver and passenger experience continues to rise, demand for advanced interior lighting systems is expected to grow steadily across all vehicle segments.

Rise in Adoption of LED, OLED, and Ambient Lighting Technologies.

The rise in adoption of LED, OLED, and ambient lighting technologies is significantly increasing demand in the automotive interior lighting market. For instance, in June 2024, Melexis, an influential player in automotive LED drivers for ambient lighting, has expanded its LIN RGB product line with the introduction of the MLX81123. This new solution provides a compact, affordable option tailored for automotive ambient lighting applications. Moreover, these advanced lighting solutions offer enhanced energy efficiency, greater design flexibility, and improved illumination quality compared to traditional lighting systems. LEDs are now widely used due to their durability, low power consumption, and vibrant color options, making them ideal for applications such as ambient, dashboard, and footwell lighting. Furthermore, as OLED technology, known for its ultra-thin form factor and uniform light output, is gaining traction in high-end models, allowing automakers to create sleek and modern interior designs. Ambient lighting, which enhances cabin ambiance and passenger comfort, has evolved into a key feature in premium and even mid-range vehicles. These technologies also support smart control options, enabling users to personalize lighting colors, patterns, and intensity. As automakers prioritize both aesthetics and energy efficiency, the shift toward LED, OLED, and ambient lighting is driving steady market expansion.

High Cost of Advanced Lighting Technologies in Budget Vehicles.

The high cost of advanced lighting technologies is hampering the demand for automotive interior lighting in budget vehicles. Technologies such as OLED, dynamic ambient lighting, and intelligent lighting systems significantly increase production and integration costs. For price-sensitive segments, especially in emerging markets, manufacturers often avoid including these features to maintain affordability. As a result, interior lighting enhancements are largely restricted to mid-range and premium vehicles, limiting widespread adoption. In addition, integrating advanced lighting systems often requires updated vehicle architectures, software compatibility, and more complex electronic control units, further adding to the cost. Budget vehicle manufacturers face challenges balancing functionality, aesthetics, and cost-efficiency, leading to the exclusion of advanced interior lighting features. While consumer interest in customizable and stylish interiors is growing across all segments, the high upfront cost of these lighting systems continues to be a barrier. This cost-pressure slows down mass-market penetration and affects the overall growth potential of the automotive interior lighting market.

Growing Aftermarket Demand for Customizable Interior Lighting Kits.

The growing aftermarket demand for customizable interior lighting kits presents a lucrative opportunity for the automotive interior lighting market. Vehicle owners, especially younger consumers, are increasingly interested in personalizing their car interiors to enhance aesthetics, comfort, and driving experience. Aftermarket lighting kits—such as ambient RGB strips, starlight headliners, footwell lighting, and dashboard accents—allow users to upgrade their vehicles without investing in expensive factory-installed features. These kits are widely available online and in automotive accessory stores, often offering easy installation and compatibility with various vehicle models. The popularity of DIY car modifications and influencer-driven automotive trends on social media platforms is further fueling this demand. For instance, in April 2025, DIY project to install footwell lights in their Maruti XL6, enhancing the vehicle’s cabin ambiance and visibility. This personalized upgrade reflects a growing trend among consumers to customize interior lighting for improved aesthetics, comfort, and a premium in-car experience, demonstrating that even entry-level vehicles are increasingly embracing ambient lighting features. In emerging markets, where factory-installed premium features are less common, the aftermarket offers an affordable way to access similar enhancements. With ongoing innovations in smart lighting and app-controlled systems, aftermarket products continue to evolve, creating strong growth potential for manufacturers and retailers operating in the automotive lighting accessories space.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive interior lighting market analysis from 2024 to 2034 to identify the prevailing automotive interior lighting market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive interior lighting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive interior lighting market trends, key players, market segments, application areas, and market growth strategies.

Automotive Interior Lighting Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 11 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 465 |

| By Lighting Type |

|

| By Product Type |

|

| By Vehicle type |

|

| By Application |

|

| By Sales channel |

|

| By Region |

|

| Key Market Players | Stanley Electric Co., Ltd., Grupo Antolin., Valeo S.A., Lumax Industries, KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., Koninklijke Philips N.V., ams-OSRAM AG., HELLA GmbH & Co. KGaA, Robert Bosch GmbH |

Surge in Electric and Autonomous Vehicles Requiring Advanced Lighting Systems

Footwell Lighting is the leading application of the automotive interior lighting market.

Asia-Pacifc is the largest regional market for automotive interior lighting

$1.4 billion is the estimated industry size of automotive interior lighting.

KOITO MANUFACTURING CO., LTD., Valeo S.A., HELLA GmbH & Co. KGaA, Stanley Electric Co., Ltd., ams-OSRAM AG., Marelli Holdings Co., Ltd., Lumax Industries, Robert Bosch GmbH, Koninklijke Philips N.V., and Grupo Antolin.

Loading Table Of Content...

Loading Research Methodology...