Automotive Interiors Market Overview:

The global automotive interiors market was valued at $171,200.3 million in 2017, and is projected to reach $249,785.4 million by 2025, registering a CAGR of 4.7% from 2018 to 2025.

A vehicle’s interior, which comprises components such as headliners, cockpit modules, door panels, automotive seats, and others are specifically designed to provide comfort, grip, and sound insulation of the vehicle cabin. Interior trims, upholstery, and other adornments play a crucial role in the saleability of a car. In addition, vehicle interior is the first and foremost factor that influences a buyer’s perception regarding the quality of a vehicle.

The key players focus on product expansion to enhance their market share. For instance, in January 2017, Yanfeng Automotive Interiors introduced powered tambour door to enable large-scale illumination with maximum design flexibility. Also, Faurecia introduced active wellness seat, which detects the driver’s stress level or drowsiness and takes countermeasures to relieve those problems. The seat comes with enhanced features, such as massage facility and uniquely designed sensors, which measure the heartbeat and the breathing rhythm of the driver. Prominent players operating in the automotive interior market have adopted strategies, such as acquisition, partnership, expansion, and product launch, to increase their market share and expand their geographical presence.

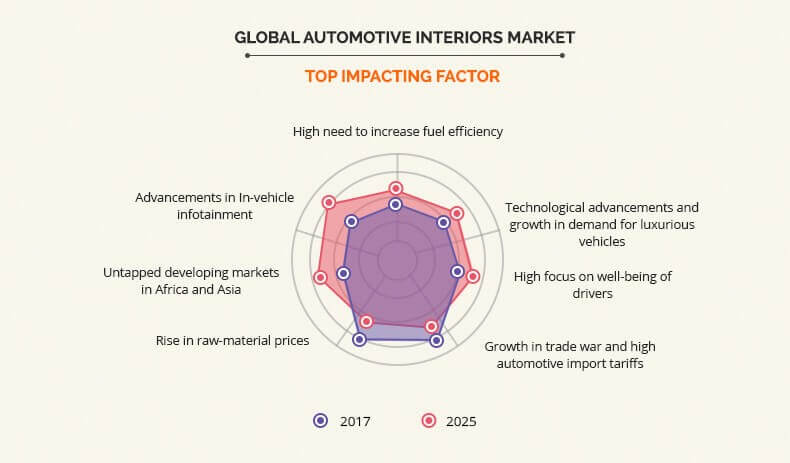

Need to increase fuel efficiency, technological advancement & growth in demand for luxurious vehicles, and focus on well-being of drivers are the major factors that drive the growth of the market. Currently, cars are equipped with advanced gadgets such as entertainment system, hands-free connectivity, and global position system (GPS), to enhance the driving experience. In January 2017, Ford launched Sync 3 Infotainment System, which facilitates hands-free telephone calls and allows the user to control music and other functions using voice commands to improve the driver experience. However, growth in trade war, increase in automotive import tariffs, and rise in raw material prices restrict the market growth.

The key players operating in the global automotive interiors market are Adient, Calsonic Kansei Corp., Faurecia Interior System, Grupo Antolin, Hyundai Mobis Company, IAC Group, Lear Corporation, Robert Bosch, Visteon Corporation, and Yanfeng Automotive Interiors.

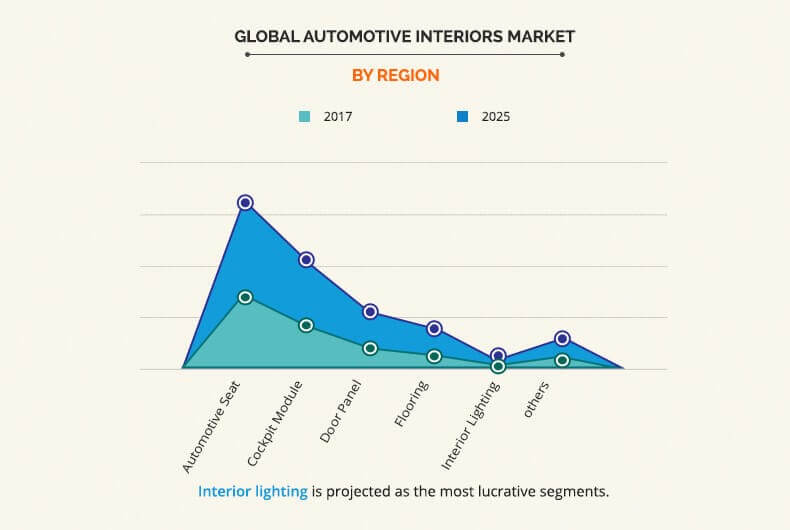

The global automotive interiors market is segmented based on vehicle type, component, and region. Based on vehicle type, it is categorized into passenger car, light commercial vehicle, and heavy commercial vehicle. Based on component, it is divided into cockpit module, flooring, door panel & acoustic systems, automotive seat, interior lighting, and others (sun visors, headliner & overhead systems). Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

Need to increase fuel efficiency, technological advancement & growth in demand for luxurious vehicles, and focus on well-being of drivers are the key factors that drive the growth of the automotive interiors industry. However, growth in trade war, increase in automotive import tariffs, and rise in raw material prices restrict the market growth. The market witnessed significant rise owing to anticipated growth from untapped developing markets in Africa and Asia. The advancement in in-vehicle infotainment also fueled the growth of the market in these regions. Each of these factors is expected to have a definite impact on the automotive interiors market during the forecast period.

Need to increase fuel efficiency

There is growth in demand for fuel-efficient vehicles because of rise in environmental concerns such as high pollution levels. Therefore, vehicle manufacturers focus on reducing the overall weight of the vehicles to increase fuel efficiency. They have replaced heavy steel components with materials such as high-strength steel, aluminum, or glass fiber-reinforced polymers, which decrease the weight of the vehicles by around 10%-60% depending upon various factors. They develop lightweight materials with high rigidity to reduce the weight of vehicles. For example, in 2016, Grupo Antolin collaborated with 3M to develop a polypropylene (PP) grade material to reduce weight and increase efficiency of the vehicles.

Technological advancements & growth in demand for luxurious vehicles

There is an increase in the technological advancements owing to rise in demand for attractive, comfortable, and aesthetic features in the automotive vehicles, especially passenger vehicles. However, Faurecia showcased the concept of customizable controls in January 2017 to solve the problem of bulky dashboard. This is expected to decrease the use of display screens and separate display panels.

Generally, luxurious car brands such as Audi and BMW, offer high quality equipment, comfort, performance, and technologically innovative automotive interiors. These manufacturers plan to use customizable controls that can easily be integrated into the dashboard materials. The sales of luxurious cars increased worldwide by around 4% from 2016 to 2017.

This rise in demand for luxurious cars is expected to increase the need for innovative automotive interiors solutions. Therefore, these factors are expected to increase the demand for innovative automotive interior solutions.

Growth in trade war and increase in automotive import tariffs

There is increasing uncertainty in the global trade due to rise in number of import tariffs. Recently, the U.S. government-imposed Section 301 tariffs on automotive parts sourced from China with a 10% duty that is expected to further increase to 25% from January 1, 2019. This is projected to hamper the growth of the automotive interiors market during the forecast period.

Untapped developing markets in Africa and Asia

The developing nations in Asia-Pacific and Africa offer numerous growth opportunities. The rise in the demand for passenger vehicles in this region is anticipated to increase during the forecast period. This facilitates many automotive vehicle manufacturers to set up manufacturing plants in Africa and Asia to cater to the local demand and leverage low manufacturing costs for exporting vehicles and parts.

In July 2018, Chinese car-maker, BAIC, set up an automotive assembly plant in South Africa, which is expected to build 50,000 vehicles by 2022. In addition, in January 2017, Volkswagen South Africa started production at its Kenyan facility in Thika. This provides an opportunity for vendors in the African market.

Key Benefits for Automotive Interiors Market:

This study comprises an analytical depiction of the global automotive interiors market along with current trends and future estimations to depict the imminent investment pockets.

The overall market potential is determined to understand the profitable trends to gain a strong foothold.

The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

The report includes the market share and trends of the key players in the automotive interiors market.

Automotive Interiors Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | GRUPO ANTOLIN, YANFENG AUTOMOTIVE INTERIORS, HYUNDAI MOBIS COMPANY, LTD., CALSONIC KANSEI CORPORATION, LEAR CORPORATION, INTERNATIONAL AUTOMOTIVE COMPONENTS GROUP S.A. (IAC), FAURECIA S.A, VISTEON CORPORATION, ROBERT BOSCH, ADIENT |

Analyst Review

The global automotive interiors market holds high potential for the automotive industry. The current business scenario witnessed growth owing to rise in demand for luxurious vehicles and increase in focus on well-being of drivers across the globe. The key players operating in the industry have adopted various techniques to provide advanced and innovative product offerings to customers.

Need to increase fuel efficiency, advancements in technology, and rise in demand for luxurious vehicles drive the growth of the global automotive interiors market. However, growth in trade war, increase in automotive import tariffs, and rise in raw material prices restrict the market growth. Furthermore, scope of improvement in the untapped developing markets in Africa & Asia and advancement in in-vehicle infotainment create lucrative opportunities for the automotive interiors market.

The key players operating in the automotive interiors market are Adient, Calsonic Kansei Corp., Faurecia Interior System, Grupo Antolin, Hyundai Mobis Company, IAC Group, Lear Corporation, Robert Bosch, Visteon Corporation, and Yanfeng Automotive Interiors.

Loading Table Of Content...