Automotive Kingpin Market Research, 2033

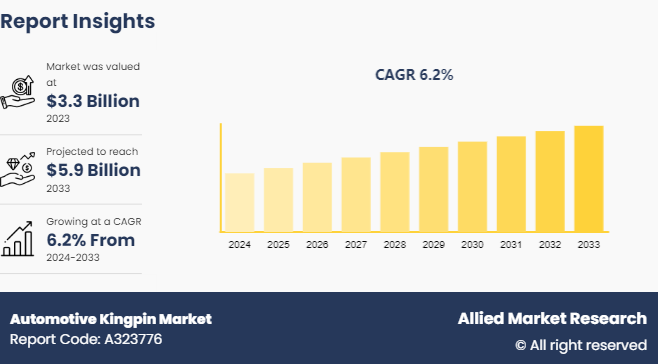

The global automotive kingpin market was valued at $3.3 billion in 2023, and is projected to reach $5.9 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Market Introduction and Definition

The automotive kingpin system is a crucial component in the suspension of systems of vehicles, especially in heavy-duty applications vehicles such as trucks and trailers. It serves as the pivot point between the axle assembly and the chassis, allowing for steering and supporting the weight of the vehicle. The kingpin's design and quality significantly impact the vehicle's handling, stability, and overall performance. The growth of the automotive kingpin market is majorly taking place due to a heavy surge in demand for heavy commercial vehicles on a global level. In addition, as the economy is growing and rapid infrastructure developments are taking place, the requirement for efficient transportation is also rising simultaneously, thereby propelling the demand for trucks and trailers equipped with reliable suspension systems. Kingpins provide a pivot point for the front wheels, ensuring precise and controlled steering, which is critical for the maneuverability of heavy-duty vehicles. They facilitate smooth and responsive steering actions, which are essential for safe driving, especially in large commercial vehicles.

Key Takeaways

The automotive kingpin market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive kingpin industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Strategies and Developments

In December 2021, Eurowagon, a polish based railway car pool company, collaborated with Nexxiot, a trade tech company, and launched safety digital products and services. Eurowagon and Nexxiot have extended their cooperation by moving to equip Eurowagon's fleet with the latest Kingpin sensors, which monitor the loading of semi-trailers onto pocket rail wagons. Nexxiot's Kingpin Monitor hardware offer new standards in safety and process automation to different asset types.

In April 2021, Dana Inc. launched the new ultimate dana kingpin knuckle kits in conjuction with the Easter Jeep Safari in Moab, Utah. The kits include all of the top-quality components required to install a kingpin assembly for more robust off-road performance on Jeep vehicles. The solution is a time-saving alternative to searching and ordering each component individually. The kits feature an updated knuckle design that delivers added strength to the axle while improving turning radius and steering. Available for Jeep JK, JL, and JT models, the ultimate dana kingpin knuckle kits are the newest addition to the dana builder axle program.

In 2024, Diesel Technic SE, a company based in Germany, launched a new automotive kingpin solution. This product is part of the DT Spare Parts brand and includes a comprehensive kingpin kit designed for commercial vehicles. The kit is built to meet high-quality standards, ensuring durability and reliability for heavy-duty applications.

In 2024, Stemco Products Inc., launched the Qwitkit King Pin kit solution. The solution launched no-ream steel bushings and pins. These components are designed to provide optimal lubrication to high-wear areas and hold significantly more grease than standard sets, extending the lifespan of the kingpin. The QwikKit King Pin helps in rapid installations compared to traditional original equipment (OE) and aftermarket king pins, reducing shop time and maintenance costs.

Key Market Dynamics

Growing production of vehicles and rising vehicle maintenance requirements are the two primary factors driving the growth of the automotive kingpin market share. Moreover, increasing focus on lightweight automotive components is an important factor restraining the growth of the automotive kingpin market. Furthermore, high investment during manufacturing and threat from alternatives are the two significant factors resulting in the growth of the automotive kingpin market opportunity.

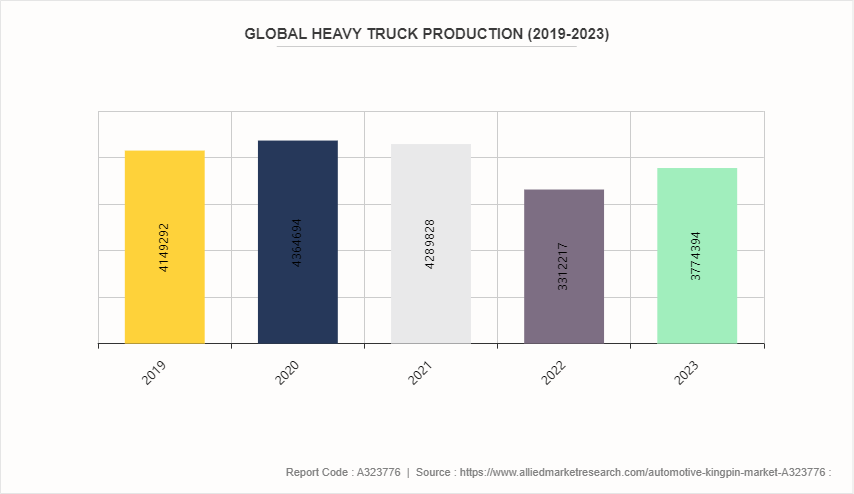

The increase in the manufacturing of vehicles is resulting in the simultaneous rise of the automotive kingpin market. The automotive kingpins are essential components in the steering mechanism of commercial vehicles and heavy-duty trucks. Furthermore, due to the rise in the number of vehicles on the road, there is a high requirement for regular maintenance and replacement of exhausted parts.

Market Segmentation

The automotive kingpin market size is segmented into product type, vehicle type, sales channel, and region. On the basis of product type, the automotive kingpin market size is bifurcated into kits and individual parts. Based on vehicle type, the market is divided into light commercial vehicle, heavy commercial vehicle, and off-road vehicle. By sales channel, the marketit is bifurcated into OEM and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

In April 2024, ?Kongsberg Automotive (KA) launched its plant in Ramos Arizpe, Mexico, marking a considerable milestone for the company. The upgraded plant spans over 15, 500 square meters and is equipped with advanced technologies to support the manufacture of flow control systems (FCS) products such as raucous couplings, high-performance hoses such as fluoro-comp as well as powertrain, and battery electric vehicle (BEV) applications for commercial vehicles.

In August 2022, Imperial Auto Industries Limited, a renowned auto parts maker in India, acquired SB Rohrform- und Schlauchtechnik GmbH, a tubes and lines business company, in Pleidelsheim, Germany, and converted it into its technical development and manufacturing location for European car, engine and truck OEMs. The new facility will witness the expansion in prototype and series production with warehousing capability shortly to meet supply chain expectations in the European Union. This 100% acquisition by Imperial Auto in Germany was done to complement its strategy in Indianapolis, (U.S.) and 19 manufacturing locations in India for producing best-in-class products at highly competitive pricing for global OEMs. This strategic move will increase the sale of kingpin auto parts in Germany by Imperial Auto Industries Limited.

Both original equipment manufacturers (OEM) and the aftermarket segments are experiencing growth due to the high vehicle fleet and replacement needs in the Asia-Pacific Region. For Instance, Tresa Motors, a Bangalore-based company OEM invested between $60.5 million to $121 million in establishing both the manufacturing and R&D facilities.

European manufacturers are focusing on sustainable production methods and materials to reduce the environmental impact. In addition, the shift towards electric commercial vehicles is influencing the design and material selection for kingpins to accommodate new vehicle dynamics. For instance, as per the International Energy Agency (IEA) source In Europe, new electric car registrations reached nearly 3.2 million in 2023, increasing by almost 20% relative to 2022. In the European Union, sales amounted to 2.4 million, with similar growth rates.

The expansion of commercial vehicle fleets in response to economic growth and infrastructure projects is driving market demand in Middle East and Africa. As per Statista source Egypt sold 62, 730 of the commercial vehicle units in 2021 and Saudi Arabia, sold around 80, 720 commercial vehicle units and was the largest market. In addition, local distributors and international manufacturers are forming partnerships to meet the growing demand for automotive components.

Competitive Analysis

The major players operating in the automotive kingpin market include Bosch (Germany) , Continental SA (Germany) , Valeo SA (France) , ACDelco (U.S.) , Michelin Group (France) , Meritor Inc. (U.S.) , Dana Limited (U.S.) , PE Automotive (Germany) , JG Automotive (Spain) , Elgin Industries (U.S.) , Diesel Technic SE (Germany) , Belton Group (UK) , Stemco Products Inc. (U.S.) , Mulberry Fabrications Limited (UK) and Schaffler Technologies (Germany) . The following players adopted product launch, and collaboration strategies to increase their market share in the automotive kingpin market forecast.

The other players in the automotive kingpin industry include Ferdinand Bilstein GmBh (Germany) , Lema Srl (Italy) , GKN Automotive (UK) , Thyssenkrupp AG (Germany) , SKF Group (Sweden) , NSK Ltd. (Japan) , NTN Corporation (Japan) , Hitachi Automotive Systems (Japan) , Hyundai Wia (South Korea) , and Mando Corporation (South Korea)

Industry Trends

The automotive industry is increasingly focusing on efficiency, safety, sustainability, and technological advancements of kingpin design and materials. Innovations such as lightweight materials, improved durability, and integrated sensors for real-time monitoring are gaining traction.

Regulatory standards regarding vehicle safety and emissions are evolving globally. Compliance with these standards is driving innovation in automotive components, including kingpins. Manufacturers must stay updated with regulations such as vehicle weight limits, emissions standards, and safety certifications. For instance, as per Monolithic Power Source, ISO 26262 provides the framework for risk analysis, design, deployment, validation, verification, and configuration of vehicles.

The demand for automotive kingpins is closely tied to the production and sales of commercial vehicles, including trucks and trailers. Economic factors, such as freight volumes, construction activity, and infrastructure development, are influencing the demand for commercial vehicles and, consequently, kingpin assemblies.

The use of advanced materials such as high-strength steel and composites is improving the durability and performance of kingpins in the UK region. In addition, advances in manufacturing technologies, including computer numerical control (CNC) machining and additive manufacturing, are enabling the production of kingpins with higher precision and consistency in the UK region. For instance, in November 2023, The Department of Business and Trade in the UK published an advanced manufacturing plan to support different sectors including automotive.

The automotive industry is witnessing significant changes driven by electrification, automation, and connectivity. These trends are important in impacting vehicle design, including suspension systems. Furthermore, electric vehicles (EVs) and autonomous vehicles require adaptations in kingpin design to accommodate different weight distributions and handling characteristics.

In February 2023, Anstee Indication Systems, a UK-based company, launched a smart kingpin solution that features a self-checking system to detect and alert. The new solution also helps in enhancing road safety, and fleet compliance, and reduces operational costs for fleet operators. The solution is also available in Canada and sold by Hayworth equipment.

The automotive kingpin market is part of a complex global supply chain. Factors such as raw material availability, manufacturing capabilities, transportation logistics, and geopolitical developments can influence the cost and availability of kingpin components.

Sustainability concerns are increasingly shaping the automotive industry. Manufacturers are exploring eco-friendly materials and production processes to reduce environmental impact. This trend is leading to the adoption of recycled materials and alternative manufacturing methods in the kingpin production.

The aftermarket for automotive kingpins presents opportunities for manufacturers, distributors, and service providers. As vehicles are aging, there is a growing need for replacement parts and maintenance services. Companies offering high-quality aftermarket kingpin assemblies and related services can capitalize on this demand.

China's ongoing infrastructure projects, including road construction, urban development, and logistics networks, are driving the demand for heavy-duty vehicles equipped with reliable kingpin systems.

The development of kingpins with recyclable materials is aligning with Japan’s focus on sustainability and waste reduction.

Key Sources Referred

Monolithic Power

Ajot

Schaffler

Kongsberg Automotive

Imperial Auto

Euro Wagen Nexxiot Press Release

Spicer Sparts

International Energy Agency (IEA)

News on Projects

ET Auto

Stemco

Diesel Technic Partner Portal

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive kingpin market analysis from 2024 to 2033 to identify the prevailing automotive kingpin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive kingpin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive kingpin market trends, key players, market segments, application areas, and market growth strategies.

Automotive Kingpin Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.9 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Thyssenkrupp AG (Germany), Belton Group (UK), Mando Corporation (South Korea), Lema Srl (Italy), PE Automotive (Germany), Hyundai Wia (South Korea), GKN Automotive (UK), Diesel Technic SE (Germany), Hitachi Automotive Systems (Japan), SKF Group (Sweden), Stemco Products Inc. (U.S.), JG Automotive (Spain), Continental SA (Germany), Bosch (Germany), NTN Corporation (Japan), Elgin Industries (U.S.), Schaffler Technologies (Germany), Michelin Group (France), NSK Ltd. (Japan), Mulberry Fabrications Limited (UK), Ferdinand Bilstein GmBh (Germany), Valeo SA (France), Dana Limited (U.S.), ACDelco (U.S.), Meritor Inc. (U.S.) |

Regulatory standards regarding vehicle safety and emissions are evolving globally and the use of advanced materials such as high-strength steel and composites is improving the durability and performance of kingpins in the UK.

The kit segment is the leading application of Automotive Kingpin Market.

Asia-Pacific is the largest regional market for Automotive Kingpin.

$5.9 Billion is the estimated industry size of the Automotive Kingpin Market.

Bosch (Germany), Continental SA (Germany), Valeo SA (France), ACDelco (U.S.), Michelin Group (France), Meritor Inc. (U.S.), Dana Limited (U.S.), PE Automotive (Germany), JG Automotive (Spain), Elgin Industries (U.S.), Diesel Technic SE (Germany), Belton Group (UK), Stemco Products Inc. (U.S.), Mulberry Fabrications Limited (UK) and Schaffler Technologies (Germany), Ferdinand Bilstein GmBh (Germany), Lema Srl (Italy), GKN Automotive (UK), Thyssenkrupp AG (Germany), SKF Group (Sweden), NSK Ltd.

Loading Table Of Content...