Automotive Lithium-sulfur Battery Market Insights - 2035

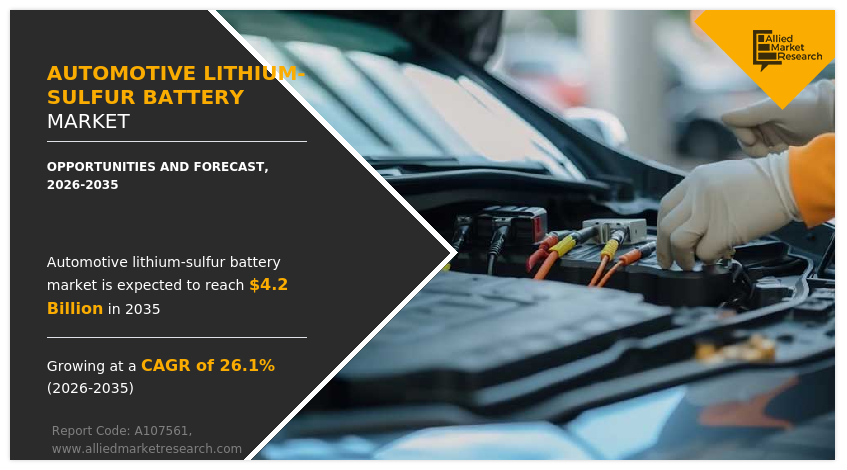

The global automotive lithium-sulfur battery market size was valued at USD 424.5 million in 2025, and is projected to reach USD 4,179 million by 2035, growing at a CAGR of 26.1% from 2026 to 2035.

Report Key Highlighters:

- The automotive lithium-sulfur battery market study covers 16 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2026-2035.

- The study incorporated research methodology aims to present a comprehensive outlook on global markets and aid stakeholders in making well-informed decisions to accomplish their ambitious growth goals.

- Over 1,000 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The automotive lithium-sulfur battery market is highly fragmented, with several players including Giner, Inc., Ilika, Johnson Matthey, LG Chem, Lyten Inc., Morrow Batteries, NexTech Batteries, PPBC and its licensees, Sion Power Corporation, and Williams Advanced Limited. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the automotive lithium-sulfur battery market.

Lithium-sulfur batteries are a type of rechargeable battery that uses lithium as the anode and sulfur as the cathode. They have gained significant attention in recent years due to their potential to offer higher energy density and lower costs compared to traditional lithium-ion batteries. Theoretical energy density of lithium-sulfur battery is around 2,600 Wh/kg. Thus, it is promising for the application in the field of high energy density battery. It has applications in large-scale automotive vehicles, which can enable efficient electric transportation. The low atomic weight of lithium and moderate atomic weight of sulfur means lithium-sulfur batteries are light. Increasing application and successful trails of prototype is a major step for its future commercialization. Government policies to phase out most of the fossil fuel-based vehicles will play a key role in the development of the automotive lithium-sulfur battery market.

In addition, the higher energy density of Li-S batteries means they can store more energy, potentially leading to increased driving range for electric vehicles (EVs) and improved performance. The automotive lithium-sulfur battery market share encompasses various stakeholders, including battery manufacturers, automotive manufacturers, research institutions, and government agencies. Battery manufacturers develop and produce lithium-sulfur batteries suitable for automotive applications, while automotive manufacturers integrate these batteries into their electric or hybrid vehicles. Increasing investment of major government organizations and private institutes to develop sustainable power resources across the world through renewable energy power generation has increased the demand for automotive lithium-sulfur battery industry.

The global automotive lithium-sulfur battery market expected to experience significant growth due to an growth in demand for electric vehicles, increased energy density, and cost reduction, are anticipated to drive the market growth. However, safety concerns and limited cycle life hinder the market growth. Further, increase in investment of government association and private enterprises and research and technological advancements are some of the factors that are expected to offer lucrative opportunities for the market growth during the forecast period.

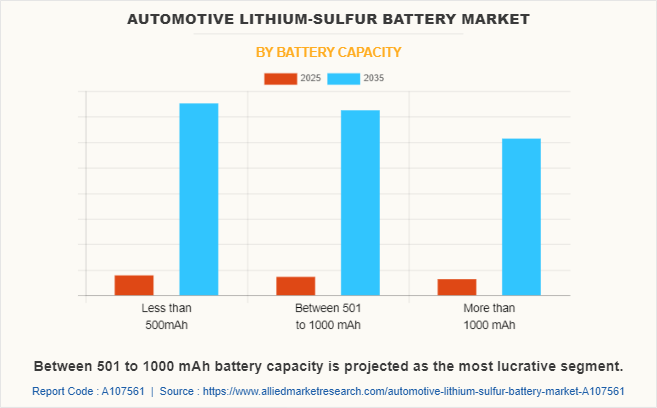

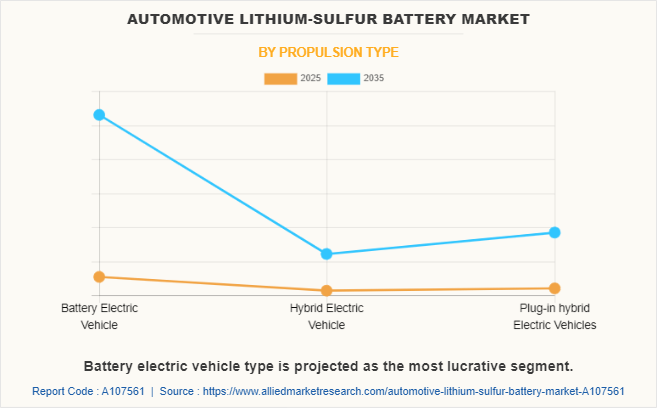

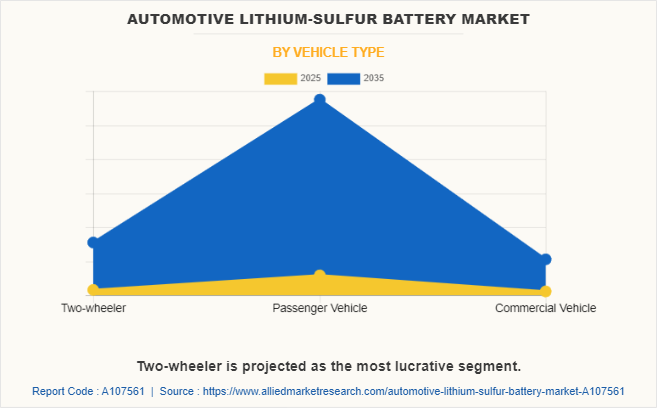

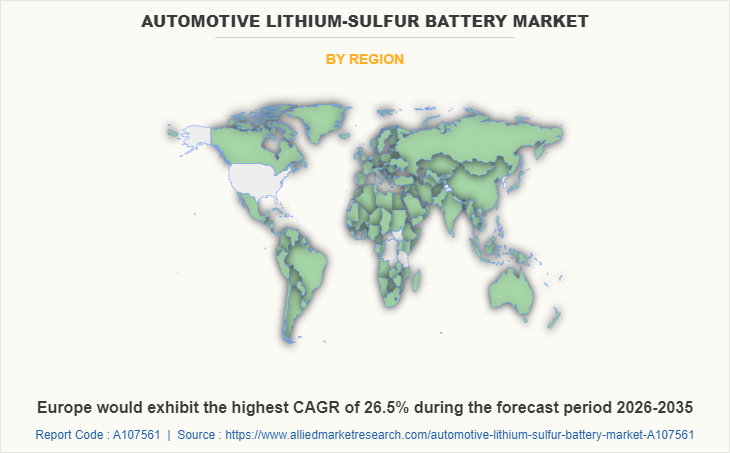

The market is segmented on the basis of battery capacity, propulsion type, vehicle type, and region. By battery capacity, it is categorized into less than 500mAh, between 501 to 1000 mAh, and more than 1000 mAh. By propulsion type, it is categorized into battery electric vehicle, hybrid electric vehicle, and plug-in hybrid electric vehicles. By vehicle type, it is categorized into two-wheeler, passenger vehicle, and commercial vehicle. Region-wise, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in the automotive lithium-sulfur battery market include Giner, Inc., Ilika, Johnson Matthey, LG Chem, Lyten Inc., Morrow Batteries, NexTech Batteries, PPBC and its licensees, Sion Power Corporation, and Williams Advanced Limited.

Growth in demand for electric vehicle

As the world transitions towards sustainable transportation and governments push for stricter emission regulations, the demand for EVs is on the rise. Li-S batteries present an attractive option to meet the increasing energy storage needs of these vehicles. The demand for EVs is driven by several factors, including environmental consciousness, government incentives, and improvements in charging infrastructure.

Li-S batteries, with their potential for higher energy density compared to conventional lithium-ion batteries, play a crucial role in meeting the expectations of consumers and automakers for longer driving ranges. With higher energy density, Li-S batteries enable EVs to travel further on a single charge, alleviating concerns about range anxiety and making electric vehicles a more viable option for everyday use. The ability to achieve longer driving ranges helps to address one of the primary barriers to EV adoption and contributes to the overall market growth.

Furthermore, Li-S batteries offer potential cost advantages. The abundance and low cost of sulfur, a key component in Li-S batteries, make them an attractive option for automakers aiming to produce EVs at more affordable prices. Lower costs can help make EVs more accessible to a broader consumer base and drive the overall demand for electric vehicles. As the demand for EVs continues to grow globally, the need for advanced battery technologies like Li-S becomes more pronounced. Automakers and battery manufacturers are investing in research and development to improve the performance and durability of Li-S batteries, making them even more compelling for electric vehicle applications. The growing demand for electric vehicles, coupled with the unique advantages of Li-S batteries, presents a significant opportunity for the expansion of the automotive lithium-sulfur battery market share in the automotive industry.

Increased energy density

Energy density refers to the amount of energy that can be stored in a battery per unit weight or volume. Li-S batteries have the potential to offer significantly higher energy density compared to conventional lithium-ion batteries, making them an attractive choice for electric vehicle (EV) manufacturers and consumers. The increased energy density of Li-S batteries directly translates into longer driving ranges for electric vehicles. With higher energy density, EVs can travel farther on a single charge, addressing one of the key concerns for consumers - range anxiety. Longer driving ranges enhance the practicality and usability of electric vehicles, making them more appealing to a broader range of consumers.

Moreover, increased energy density opens opportunities for various automotive applications. It enables the development of lighter and more compact battery packs, freeing up valuable space within the vehicle for other components or enhancing passenger comfort. The reduced weight of Li-S batteries can also contribute to improved overall vehicle efficiency and performance.

In addition, the demand for increased energy density stems from the need for fast-charging capabilities. Li-S batteries with higher energy density can potentially support faster charging rates, reducing the time required for recharging an electric vehicle. This aspect further enhances the convenience and usability of EVs, aligning with the growing expectations of consumers for rapid charging infrastructure. Thus, the quest for increased energy density is a significant driver for the demand of Li-S batteries in the automotive market. The potential for longer driving ranges, improved vehicle efficiency, and faster charging capabilities positions Li-S batteries as a promising technology for the future of electric vehicles, driving the transition to sustainable and clean transportation.

Limited cycle life

Cycle life refers to the number of charge and discharge cycles a battery can undergo before its performance and capacity significantly degrade. The limited cycle life of Li-S batteries poses challenges for their long-term reliability and cost-effectiveness.

The dissolution and shuttle effect of polysulfides is one of the major factors contributing to the limited cycle life of Li-S batteries. During cycling, sulfur in the cathode undergoes chemical reactions, forming polysulfides that can dissolve into the electrolyte and migrate to the anode. This continuous process leads to the loss of active material and irreversible capacity fade, ultimately reducing the battery's cycle life.

The limited cycle life of Li-S batteries translates into decreased longevity and the need for more frequent battery replacements. This factor can be a deterrent for potential electric vehicle buyers and automakers, as it impacts the overall cost of ownership and vehicle reliability. The higher replacement frequency can also lead to increased waste and environmental concerns. To address the limited cycle life challenge, extensive research and development efforts are underway. Scientists and engineers are exploring various strategies such as new sulfur cathode materials, protective coatings, and advanced electrolyte formulations to mitigate the dissolution and shuttle effect of polysulfides. These approaches aim to improve the stability and cycle life of Li-S batteries, making them more viable for automotive applications.

Increase in investment of government association and private enterprises

Government associations and private enterprises recognize the importance of advancing battery technologies to support the transition towards electric vehicles and sustainable transportation. As a result, they are allocating significant resources and funding towards research, development, and commercialization of high-energy density batteries, including Li-S batteries. These investments enable extensive research and development efforts focused on overcoming the technical challenges associated with Li-S batteries. Scientists and engineers are working on optimizing sulfur cathode materials, electrolyte compositions, and cell designs to enhance energy density, cycle life, and safety performance. With increased financial support, these advancements can be accelerated, making Li-S batteries more attractive for automotive applications.

Furthermore, the involvement of government associations and private enterprises facilitates collaboration between academia, research institutions, battery manufacturers, and automakers. The combined expertise and resources of different stakeholders enable a multidisciplinary approach to tackle the complexities of Li-S battery development and ensure their suitability for automotive use. The investment influx also helps in scaling up production capabilities and establishing efficient manufacturing processes for Li-S batteries. Increased funding enables the optimization of production lines, automation, and quality control measures, leading to cost reduction, improved yield, and enhanced consistency in battery performance. These advancements pave the way for larger-scale production of Li-S batteries, making them more commercially viable for widespread adoption in the automotive sector. Moreover, government incentives and policies that encourage the use of electric vehicles and support battery technology development further drive investment in the automotive lithium-sulfur battery market.

Recent Developments

In September 2021, Lyten, Inc. launched LytCell EV lithium-sulfur (Li-S) battery platform. This innovation is optimized specifically for the electric vehicle (EV) market and is designed to deliver three times (3X) the gravimetric energy density of conventional lithium-ion (Li-ion) batteries.

In March 2021, NexTech Batteries signed an agreement with Mullen Technologies to deliver one of the most advanced Lithium Sulphur battery technology. Lithium-sulfur batteries offer significant weight and cost advantages over industry-incumbent lithium-ion.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive lithium-sulfur battery market analysis from 2025 to 2035 to identify the prevailing automotive lithium-sulfur battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive lithium-sulfur battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive lithium-sulfur battery market trends, key players, market segments, application areas, and market growth strategies.

Automotive Lithium-sulfur Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 4.2 billion |

| Growth Rate | CAGR of 26.1% |

| Forecast period | 2025 - 2035 |

| Report Pages | 249 |

| By Battery Capacity |

|

| By Propulsion Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Giner Inc., PPBC and its licensees, Morrow Batteries, Sion Power Corporation, WAE Technologies Limited, Lyten, Inc., NexTech Batteries, Johnson Matthey, Ilika, LG Chem |

Growth in demand for electric vehicles, increased energy density, and cost reduction are the upcoming trends of Automotive Lithium-sulfur Battery Market in the world.

Enhanced energy density is the leading application of Automotive Lithium-sulfur Battery Market.

Asia-Pacific is the largest regional market for Automotive Lithium-sulfur Battery.

Estimated to reach $4,179.0 million by 2035, registering a CAGR of 26.1% from 2025 to 2035.

Giner, Inc., Ilika, Johnson Matthey, LG Chem, Lyten Inc., Morrow Batteries, NexTech Batteries, PPBC and its licensees, Sion Power Corporation, and Williams Advanced Limited top companies to hold the market share in Automotive Lithium-sulfur Battery.

Loading Table Of Content...

Loading Research Methodology...