Automotive Motors Market Insights, 2032

The automotive motors market size was valued at $ 47203.12 Million in 2022, and is projected to reach $ 77,499.4 Million by 2032, registering a CAGR of 5.08% from 2023 to 2032.

Report Key Highlights:

The report covers a detailed analysis on automotive motors used in automotive industry.

The automotive motors market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

Motors are an integral part of a vehicle that help perform its operation smoothly. It is present in any vehicle operation that involves continuous rotational motion in any mechanical or electronic system, it has a motor present in it. Motors are involved in various applications of a vehicle such as power steering motors, seat cooling fans, battery cooling fans, power window motors, engine cooling fans, wiper system, and others where comfort is as important as the driving efficiency.

Key players operating in the global automotive motors market are BorgWarner Inc., Bühler Motor GmbH, Continental AG, Denso Corporation, Inteva Products, LLC, Johnson Electric Holdings Limited., Magna International Inc., Marelli Holdings Co., Ltd., Robert Bosch GmbH, and Valeo, among others. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion and collaboration to strengthen their market position.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In July 2019, Subsidiaries of DENSO Corporation, Asahi Manufacturing Co., Ltd. and Nippon Wiper Blade Co., Ltd. have merged to form DENSO Wiper Systems, Inc. which will offer safer and more reliable wiper systems..

- In July 2019, Toyota Motor Corporation and DENSO CORPORATION have formed a joint venture to do research and advanced development of next-generation, in-vehicle semiconductors.

- In May 2019, Johnson Electric Holdings Limited launched the new BLDC motor platform E6 for power tools. Its compact size makes the tool lighter and less user fatigue. This has helped the company to develop its portfolio in the power tools market.

The significant impacting factors in the growth of the automotive motors market include high demand for safety and convenience features, rise in requirement of electric vehicles, and stringent safety regulations set by government for automotive industry. Further, decrease in global vehicle production, increase in trend of shared mobility, wide number of applications employing the use of electric motors, and concept of autonomous cars have strong impact on the market. Each of these factors is anticipated to have a definite impact on the automotive motors market during the forecast period (2023-2032).

Key market trends, growth factors and opportunities

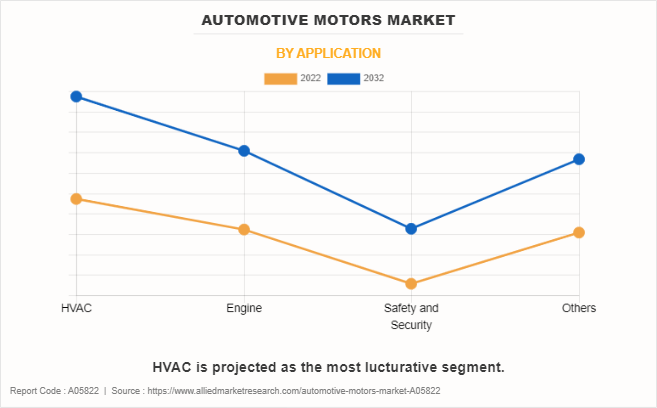

Factors, such as high demand for safety & security features and stringent safety regulations set by governments for the automotive industry, drive the growth of the safety & security motor applications. Further, rise in sale of luxury vehicles is opportunistic for the key players operating in the global automotive motors industry.

Wide number of applications employing the use of electric motors

Motors are used majorly in electric vehicles due to their simplicity, durability, and cost-effectiveness. These electric motors operate on the principle of electromagnetic induction, utilizing a rotating magnetic field generated by the stator to induce a current and produce torque in the rotor, propelling the vehicle forward. The absence of brushes and commutators in AC motors results in low maintenance and high efficiency.

There is a growing demand for features related to comfort, luxury, safety, and security benefits in the automotive industry. As international automobile manufacturers extend their reach and consumers' purchasing power for new cars grows, the demand for electric motors is experiencing significant growth. Enhanced lifestyles and economic conditions are driving shifts in consumer preferences worldwide. With rising purchasing power and disposable income, increased brand visibility, and competition among OEMs to provide enhanced features, it is anticipated that the automotive motors experience growth during the forecasted period.

Concept of autonomous cars

The technological advancements have resulted in the growth of connected infrastructure, which drives the growth of the market. Automation technologies are used in autonomous vehicles that enable them to stay connected, such as sensors, machine learning systems, processors, RADAR, LiDAR, cameras, and other hardware and software.

Autonomous vehicle technology facilitates the seamless coordination of an autonomous driving system to retain complete control over the vehicle and perceive the external environment. Similar to humans, autonomous vehicles need the ability to analyze judgments, interpret sensory data, and make informed decisions to respond intelligently to external factors. Autonomous vehicle technology plays a pivotal role in enabling these capabilities. Intelligent transportation systems are used that allow autonomous vehicles to plan and manage operations to optimize traffic flow. The focus on urban connectivity solutions drives the growth of autonomous vehicles as the deployment of LTE/5G small cells and public Wi-Fi end-to-end architectures is being implemented in both newly constructed and retrofitted modular street infrastructure assets.

Rise in trend of shared mobility

Individuals who do not have the means to purchase a car enjoy seamless travel options through mobility services. According to data from the Bureau of Transportation Statistics, the estimated average cost of owning and operating a vehicle stands at approximately $8,858 per year, assuming an annual mileage of 15,000 miles. Mobility as a service (MaaS) reduces these costs for users by optimizing the use of transportation services like car sharing and ride-hailing. These services alleviate urban congestion and lower overall vehicle emissions.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive motors market analysis from 2022 to 2032 to identify the prevailing automotive motors market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive motors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive motors market trends, key players, market segments, application areas, and market growth strategies.

Automotive Motors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 77.5 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

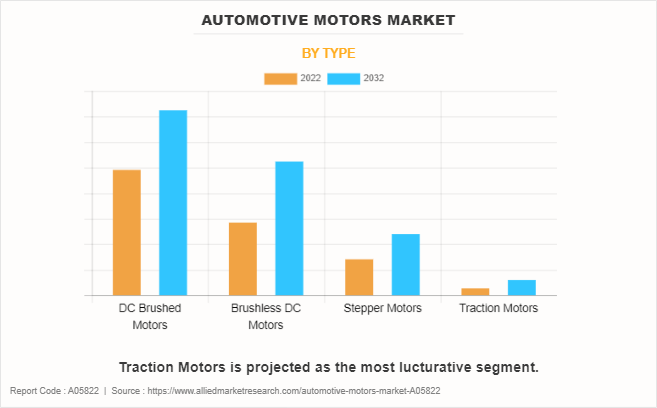

| By Type |

|

| By APPLICATION |

|

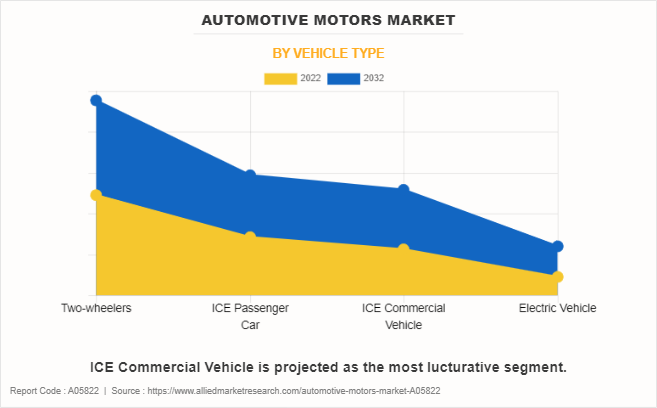

| By VEHICLE TYPE |

|

| By Region |

|

| Key Market Players | DENSO CORPORATION, Magna International Inc., BorgWarner Inc. , Robert Bosch GmbH, Marelli Holdings Co., Ltd. , Buhler Motor GmbH, Inteva Products, LLC, Valeo, Continental AG, Johnson Electric Holdings Limited |

Analyst Review

According to the insights of CXOs of leading companies, the automotive motors market is projected to witness a moderate growth rate, owing to growth in population along with increase in disposable income and rise in purchasing power. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative feature offerings.

The automotive motors market is driven by an increase in global vehicle production and high demand for safety & convenience features, resulting in surge for automotive motors across all the vehicle segments. In addition, the increase in popularity of electric vehicles is expected to make way for various innovations in automotive electric motors. Increase in number of motors installed in a car directly translates into better intelligence and increased convenience by reducing environmental impact. However, increased weight and rise in cost of the overall system restrict the market growth.

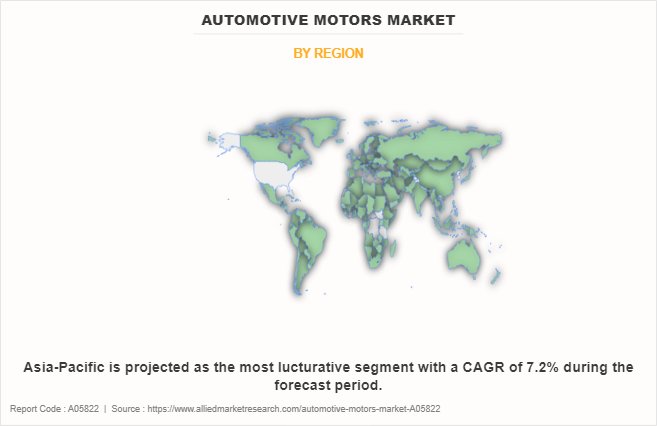

Moreover, a wide number of applications employing the use of electric motors and the concept of autonomous cars are expected to create lucrative opportunities in near future for the automotive motors market. Among the analyzed regions, Asia-Pacific accounted for the highest revenue in the global market in 2019. However, LAMEA is expected to grow at a higher rate, predicting lucrative opportunities for the key players operating in the automotive motors market.

Electric Vehicles are the upcoming trends of Automotive Motors Market in the world.

HVAC is the leading application of Automotive Motors Market

Asia Pacific is the largest regional market for Automotive Motors

$47 billion estimated industry size of Automotive Motors.

Robert Bosch is the top companies to hold the market share in Automotive Motors

Loading Table Of Content...

Loading Research Methodology...