Automotive Natural Gas Vehicle Market Overview

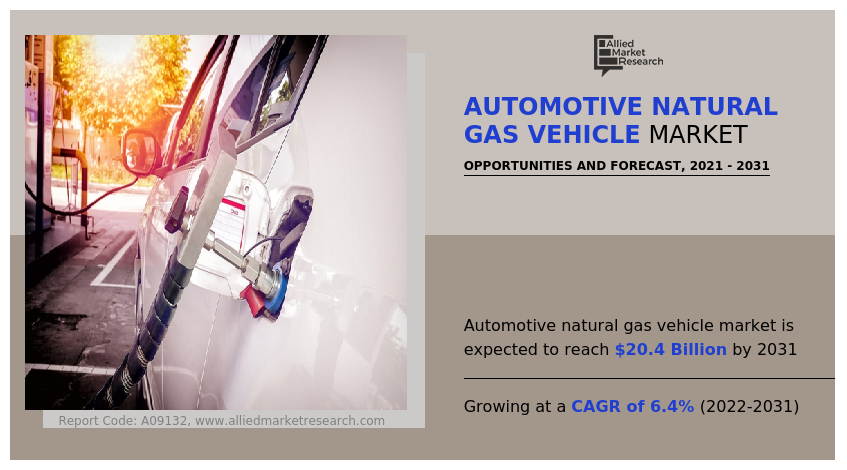

The global automotive natural gas vehicle market was valued at USD 11.1 billion in 2021, and is projected to reach USD 20.4 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031. The growth of the global automotive natural gas vehicle market is propelling due to increase in fuel costs, government initiatives to develop & expand natural gas distribution infrastructure, and rise in environmental awareness. However, rise in demand for electric vehicle is the factor that hampers the growth of the market. Furthermore, growth in demand from emerging countries is the factor expected to offer growth opportunities during the forecast period.

Key Market Trend & Insights

- Governments are expanding natural gas infrastructure to boost NGV adoption and cut carbon footprints.

- India plans 100 LNG fueling stations by 2030 and a $60 billion investment to increase natural gas share from 6.2% to 15%.

- Rising environmental awareness and stringent emission regulations are driving demand for cleaner fuel vehicles.

- Natural gas vehicles emit significantly lower CO2 and pollutants, improving air quality.

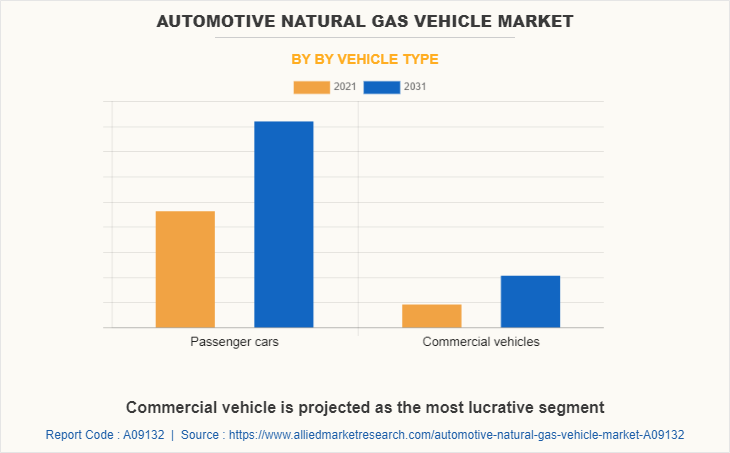

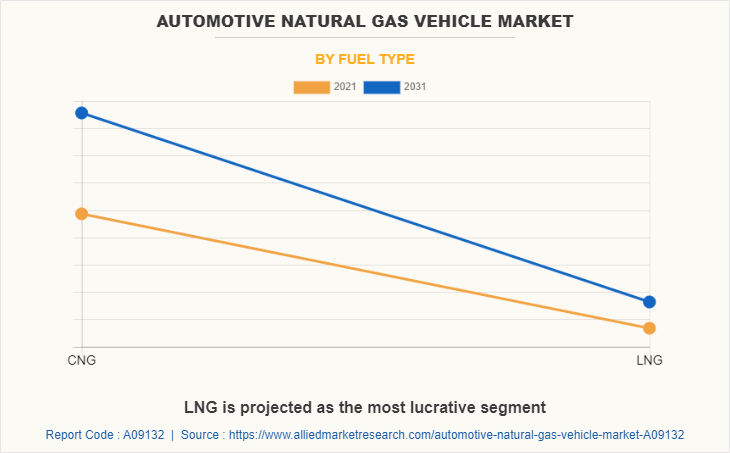

- LNG fuel type and commercial vehicles are expected to show strong growth.

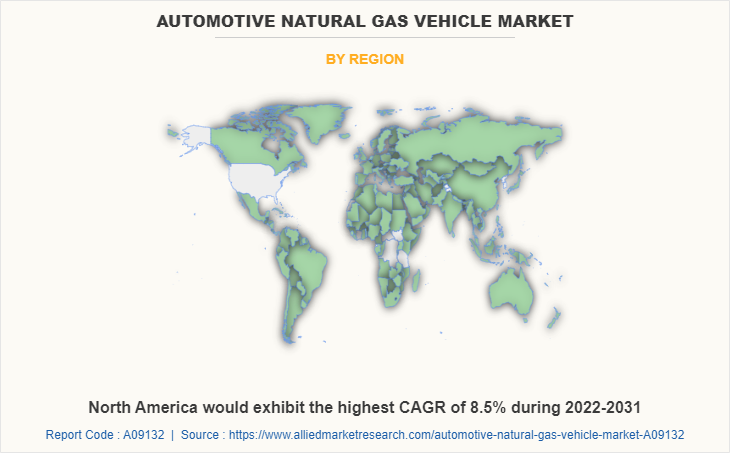

- North America is projected to register the highest CAGR during the forecast period.

Market Size & Forecast

- 2031 Projected Market Size: USD 20.4 billion

- 2021 Market Size: USD 11.1 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 6.4%

Introduction

Natural gas vehicle is a type of alternative fuel vehicles which utilizes natural gas such as compressed natural gas (CNG), liquefied natural gas (LNG) as a fuel to operate the vehicle. Natural gas vehicles work in similar manner as the gasoline powered engine does. A natural gas vehicle stores the natural gas in a fuel tank, or cylinder, typically at the back of the vehicle. The fuel system transfers the high-pressure gas from the fuel tank to combustion chamber with the aid of fuel lines. Then, inside combustion chamber, the fuel is mixed with air and then compressed, and ignited by a spark plug. Moreover, natural gas vehicles have high performance and low emissions.

Market Segmentation

The automotive natural gas vehicle market is segmented on the basis of fuel type, vehicle type, and region. By fuel type, it is bifurcated into CNG and LNG. By vehicle type, it is classified into passenger cars and commercial vehicles. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top Natural Gas Vehicle companies

The following are the leading companies in the IoT market. These players have adopted various strategies to increase their market penetration and strengthen their position in the natural gas vehicle industry.

- AB Volvo

- BMW AG

- CNH Industrial N.V.

- Ford Motor Company

- Honda Motor Co., Ltd.

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Navistar International Corporation

- Nissan Motor Co., Ltd

- Tata Motors

- Toyota Motor Corporation

- Volkswagen AG

What are the Top Impacting Factors

Key Market Driver

Government initiatives to develop & expand natural gas distribution infrastructure

Governments of various countries are taking initiatives to reduce carbon footprints by encouraging use of natural gas-based vehicles. Governments in numerous countries across the globe are taking initiatives to develop and expand the natural gas distribution infrastructure to shift toward natural gas-based vehicles instead of petrol or diesel-based vehicles. For instance, in November 2021, in India, the ministry of petroleum and natural gas announced the construction of 100 LNG fueling stations on the major national highways across the country to replace diesel and petrol with cleaner fuel in long-haul vehicles and to achieve the target of 15% share for natural gas in India’s total energy mix by 2030.

In addition, in 2020, in India, Union Minister of petroleum, natural gas and steel, announced that central government is expected to invest $60 billion over the period of next four year to envisaging a gas-based economy by increasing the share of natural gas in India’s primary energy mix from 6.2% to 15% by 2030. Such initiatives taken by government for the development and expansion of natural gas infrastructure are anticipated to foster the growth of the automotive natural gas vehicle industry during the forecast period.

Rise in environmental awareness

Automobiles are a major source of ozone, particulate matter, and other smog-forming pollutants. The dangers of air pollution on one's health are enormous. Poor air quality exacerbates respiratory illnesses such as asthma & bronchitis, raises the risk of life-threatening disorders such as cancer, and costs the health-care system a lot of money. Particulate pollution is responsible for up to 30,000 deaths prematurely each year. Vehicles, engines and motorized equipment that emit exhaust and evaporative pollutants are illustrations of these sources.

Vehicles utilized on roadways for passenger or freight transportation are considered on-road sources. Vehicles, motors, and equipment used for construction, agriculture, recreation, and a variety of other applications are examples of off-road sources. To reduce the environmental impact of the vehicle sector, governments all over the world have passed strict environmental restrictions. For instance, a group of 21 state attorneys general, the District of Columbia, and several large U.S. cities encouraged the U.S. government to implement stringent automobile emission laws in September 2021. Automobile manufacturers create alternative fuel-powered vehicles that provide a greener driving experience with little or no hazardous emissions.

The use of natural gas as a transport fuel has two environmental advantages; for instance, natural gas is a clean burning fuel with very low nitrogen oxides and soot emissions, thus substantially improving the local air quality. In addition to this, natural gas produces less CO2 for every unit of energy consumed by the vehicle. CNG is employed to power passenger cars and city buses. These vehicles emit 5-10% less CO2 than comparable gasoline-powered vehicles.

The recent environmental changes, such as increase in global warming across the globe, have led to rise in awareness among the people to spend the income to buy vehicles powered by natural gas that are less harmful to the environment compared to conventional vehicles. Moreover, governments across the globe have imposed stringent norms for the vehicle emission. Increasing government norms related to vehicle emission is expected to propel the demand for natural gas vehicles, which in turn is anticipated to boost the growth of the automotive natural gas vehicle market across the globe.

Restraints

Rise in demand for electric vehicle

Climate changes are taking place all over the world. Countries across the globe are taking initiatives to reduce their greenhouse gases and carbon dioxide emission. Several countries across the globe are adopting electric vehicle to achieve their net zero emission target, which in turn is increasing the demand for electric vehicles across the globe. Electric vehicle runs on clean energy and has zero emission as compared to traditional gasoline powered engine. Electric vehicle has an electric motor that runs on electric power supplied by the battery, thereby, eliminating the need of any other type of engine. The rise in interest of consumers toward electric vehicles is likely to hamper the growth of the market during the forecast period as electric vehicle are non-emission vehicles and do not require fuels such as gasoline and diesel.

In addition, electric vehicle comprises of less automotive parts in comparison to traditional vehicle, which results in reduced maintenance cost and lower overall expenses. Thus, rise in demand for electric vehicle is a major factor that restrains the growth of the automotive natural gas vehicle market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive natural gas vehicle market analysis from 2021 to 2031 to identify the prevailing automotive natural gas vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive natural gas vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive natural gas vehicle market trends, key players, market segments, application areas, and market growth strategies.

Automotive Natural Gas Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 20.4 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 226 |

| By Fuel Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Ford Motor Company, Cummins, Inc., CNH Industrial, Volkswagen AG, BMW Group, Tata Motors, Nissan Motor Co., Ltd., Toyota Motor Corporation, Navistar, Inc., Honda Motor Co., Ltd., Mercedes-Benz Group AG, AB Volvo |

Analyst Review

The global automotive natural gas vehicle market is expected to witness significant growth, owing to increase in fuel costs, government initiatives to develop & expand natural gas distribution infrastructure, and rise in environmental awareness.

The demand for automobiles in emerging countries is expected to expand dramatically in the future years as a result of urbanization and increased industrial activity. Manufacturers are increasingly building production plants in emerging countries due to rise in demand for automobiles in the region. Developing nations have observed an increase in the production of automobiles owing to factors such as favorable government policies, increasing GDP, and rising consumer spending.

Emerging companies and market leaders in many industries throughout emerging nations, such as e-commerce, the food industry, and others, have boosted demand for delivery and transportation solutions, therefore boosting the production of heavy commercial vehicles. Further, with the increase in demand for vehicles, the demand for natural gas such as CNG & LNG based vehicles is increasing as it is an environment-friendly and cost-effective alternative to petrol and diesel. As a result, governments across various countries in the region promoting their use over traditional fuels. Owing to this, the natural gas vehicles have gained popularity, which in turn is expected to fuel the demand for natural gas during the forecast period.

Key players that operate in this market AB Volvo, BMW AG, CNH Industrial N.V., Ford Motor Company, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Navistar International Corporation, Nissan Motor Co., Ltd., Tata Motors, Toyota Motor Corporation, and Volkswagen AG.

The global automotive natural gas vehicle market was valued at $11.1 billion in 2021 and is projected to reach $20.4 billion in 2031, registering a CAGR of 6.4%.

The leading players include AB Volvo, BMW AG, CNH Industrial N.V., Ford Motor Company, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Navistar International Corporation, Nissan Motor Co., Ltd, Tata Motors, Toyota Motor Corporation, and Volkswagen AG.

The leading application is passenger cars.

The largest regional market is Asia-Pacific.

The upcoming trends include expansion of natural gas distribution infrastructure and greater adoption of LNG vehicles.

Loading Table Of Content...