Automotive OEM Coatings Market Overview:

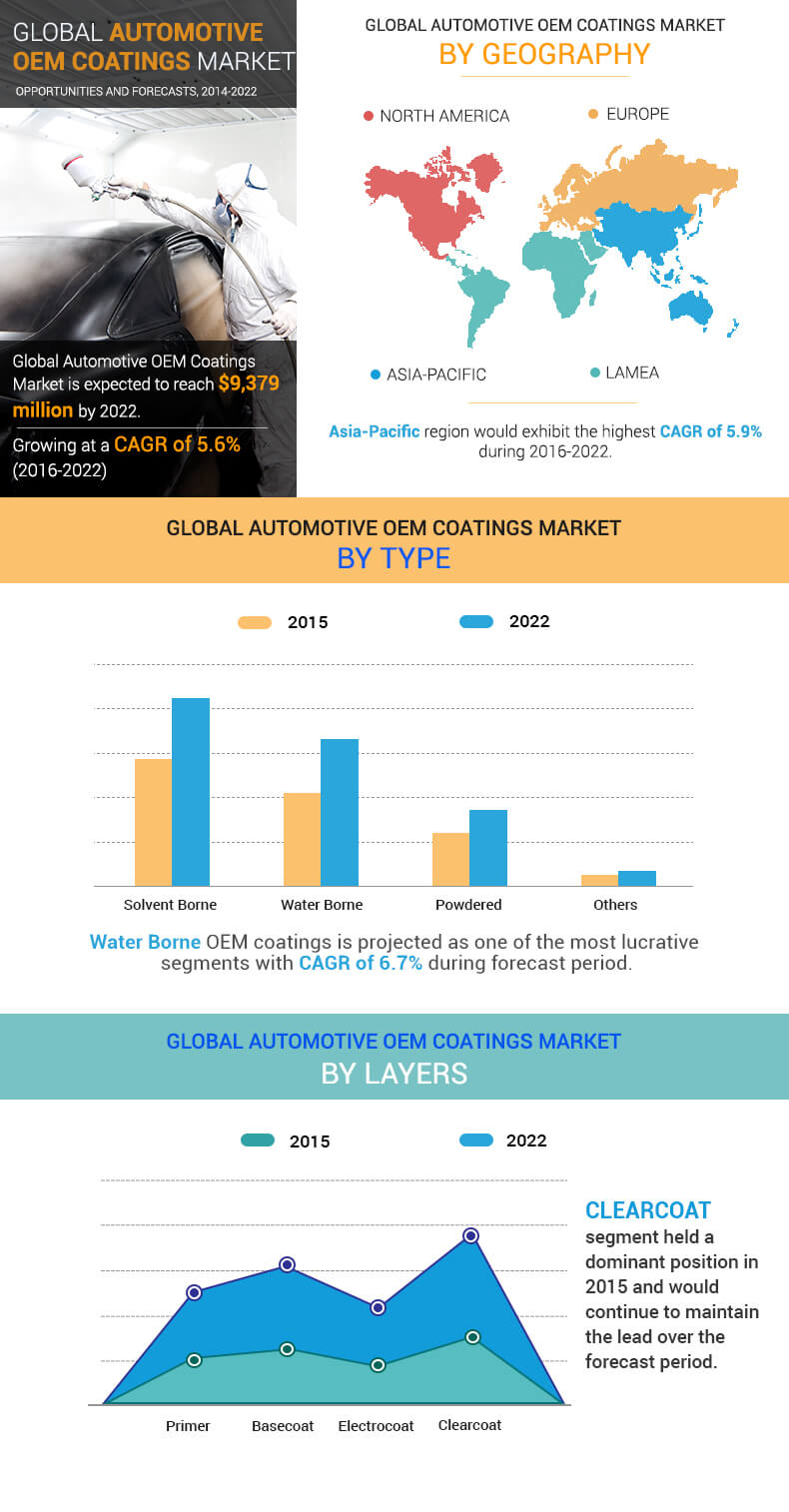

Global Automotive OEM Coatings Market size was valued at $6,426 million in 2015, and is expected to reach $9,379 million by 2022, registering a CAGR of 5.6% between 2016 and 2022. Automotive coatings are used to coat the surfaces of automobiles and exemplify the futuristic technologies, which are capable of manufacturing durable surfaces, maximizing overall efficiency while meeting environmental norms. Moreover, they enhance the overall durability and appearance of a vehicle and also safeguard it from UV radiation, extreme temperature, and foreign particles.

The global automotive OEM coatings market is segmented based on type, layer, vehicle type, and geography. The type segment is categorized into solvent-borne, waterborne, powdered, and others. Based on layer, the market is divided into primer, basecoat, electrocoat, and clearcoat. On the basis of vehicle type, the market is divided into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. The light commercial vehicles segment is anticipated to register a significant CAGR during the forecast period. Geographically, the market is analyzed across market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

Top Investment Pockets

The passenger cars segment offers maximum market potential in the automotive OEM coatings market, owing to increase in demand for passenger cars and general utility vehicles globally with rise in public transportation expenditure and increase in inclination of consumers towards efficient and easy transportation needs boost the overall demand for automotive OEM coatings in the passenger cars segment. The use of automotive OEM coatings in light commercial vehicles has witnessed major developments, owing to constant growth in per capita disposable incomes and rise in demand for commercial utility vehicles. The passenger cars segment is expected to register a CAGR of 5.8% during the forecast period. However, rise in concerns related to the environmental hazards associated with the solvent-borne automotive coatings may affect the overall market growth in the developed and the developing countries, but investments in R&D in new production alternatives are expected to provide opportunities for growth in the future.

Segment Review

The clearcoat segment dominated the global market in 2014 and is anticipated to maintain its dominance throughout the forecast period growing at a significant CAGR of 5.8%.

Geography Review

The European region accounted for more than 30% share of the total revenue in 2015, followed by Asia-Pacific and North America. Developing countries in the Asia-Pacific region are anticipated to register steady growth rates owing to increase in growth of the overall economy. Moreover, rise in investments by key manufacturers in the region is another key aspect that fuels the growth in the market.

Key players have economically invested higher values in R&D activities to develop advanced products to cater the requirements of the market. The key players operating in the automotive OEM coatings industry include Axalta Coating Systems, BASF SE, PPG Industries, Nippon Paint, Kansai Paint, AkzoNobel, Sherwin-Williams Company, KCC Paint, Bayer AG, and Arkema SA.

The other players in the automotive OEM coatings market value chain (profiles not included in the report) include Beckers Group, Cabot Corporation, Berger Paints, Eastman Chemical Company, Valspar Corporation, Clariant AG, Deft, Inc., Jotun A/S, Royal DSM, Lord Corporation, and Solvay S.A. among others.

Key Benefits for Automotive OEM Coatings Market:

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and their automotive OEM coatings market share for building strategies.

- It outlines the current trends and future scenario of the automotive OEM coatings market size from 2015 to 2022 to understand the prevailing opportunities and potential investment pockets.

- Major countries in four major regions, namely, North America, Asia-Pacific, Europe, and LAMEA have been mapped according to their individual revenue contribution in the automotive OEM coatings market analysis at regional and country level.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study.

- The profiles of key players along with their contribution in automotive OEM coatings market growth are enlisted in the report.

Automotive OEM Coatings Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Layer |

|

| By Vehicle Type |

|

| By Geography |

|

| Key Market Players | NIPPON PAINT, ARKEMA SA, PPG INDUSTRIES, KANSAI PAINT, AXALTA COATING SYSTEMS, BASF SE, SHERWIN WILLIAMS COMPANY, BAYER AG, KCC PAINT, AKZO NOBEL |

Analyst Review

Automotive OEM coatings are specialty paints and coatings used in automobiles to protect the underlying metal or synthetic body panels from harsh environment. Initially, chromium, lead and other heavy metals were employed in automotive coatings. In addition, with the introduction of various environmental regulations, the use of toxic chemicals has been prohibited, which has further resulted in a switch to water-based paints and coatings.

High demand from passenger cars and light commercial vehicle segments boost the growth of the market. Moreover, increase in demand from developing countries, such as China and India, owing to rapid urbanization and rise in consumer spending capabilities drive the market growth.

The European automotive OEM coatings market offers promising opportunities for the manufacturers, owing to enhanced production of automobiles in Germany, France, Czech Republic, and UK and increase in number of manufacturers. In addition, the increase in demand for efficient and cost-effective coating solutions and increase in disposable incomes in the developing economies, such as Poland, Russia, and Netherlands, drives the European market. Asia-Pacific is estimated to account for the largest market share, followed by North America.

Loading Table Of Content...