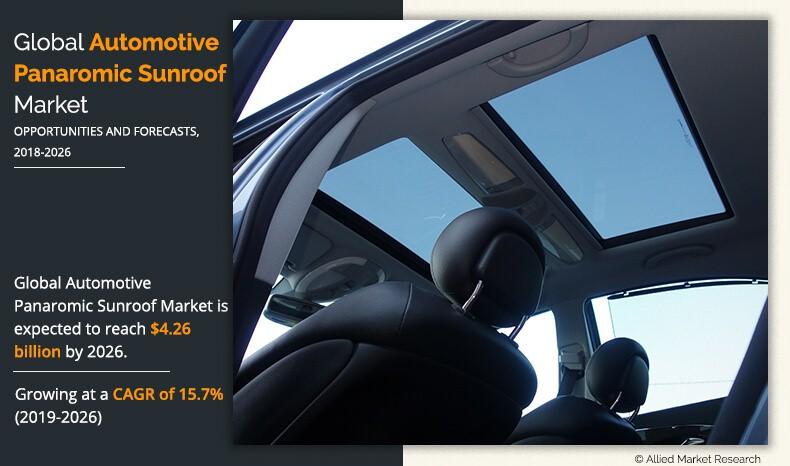

Automotive Panoramic Sunroof Market Statistics - 2026

The global automotive panoramic sunroof market size was valued at $1.31 billion in 2018, and is projected to reach $4.26 billion by 2026, registering a CAGR of 15.7% from 2019 to 2026. Europe accounted for the highest share in 2018, and is anticipated to maintain its lead in the global automotive panoramic sunroof market throughout the forecast period.

Panoramic sunroof is a large sunroof that covers the entire roof of a vehicle. It is significantly larger than a traditional sunroof, and may be clear or tinted. This sunroof is either made of a single solid panel of glass or multiple panels. When the roof is opened, the single panel will simply slide toward the back of the vehicle. In the other version, the multiple panels will stack upon each other to the back of the roof opening. Furthermore, this sunroof does not disappear inside the vehicle’s roof as there is not adequate room. They are designed to cover maximum view so that passengers in both front and rear seats can enjoy the fresh air and sunlight.

The factors such as rise in innovation in glass technology and increase in demand for safety, comfort, and convenience drive the growth of the automotive panoramic sunroof market. However, high integration & maintenance cost and low penetration of power sunroof in low segment vehicles is anticipated to hinder the growth of the market. Further, rise in penetration of solar sunroof in electric vehicles and increase in sale of automotive vehicles provide lucrative growth opportunity for the key players operating in the panoramic sunroof market.

The global automotive panoramic sunroof market is segmented on the basis of material type, vehicle type, and region. Based on material type, the market is bifurcated into glass and fiber. By vehicle type, it is divided into hatchback, sedan, sport utility vehicle (SUV), battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug in hybrid vehicle (PHEV). Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Material Type

Fiber is projected as the most lucrative segments

The key players including Aisin Seiki Co. Ltd., CIE Automotive SA, Donghee Industrial Co. Ltd., Inalfa Roof Systems Group BV, Webasto SE, Yachiyo Industry Co. Ltd., Inteva Products, Automotive Sunroof-Customcraft (ASC) Inc., BOS Group, Magna International Inc., and others hold the major automotive panoramic sunroof market share.

By Vehicle Type

Hatchback is projected as the most lucrative segments

Rise in innovations in glass technology

Technological advancements and innovations help sunroof glass manufacturers create various types of glasses, such as tempered glass, laminated glass, and green glass, which provide protection from ultraviolet rays. For instance, Mercedes-Benz is offering panoramic vario-roof with magic sky control to SLK model that offers a pleasant atmosphere in the vehicle. Furthermore, this technology uses innovative new features of glass, that is, transparent or darkened that offer an open-air experience during cold weather through transparent glass and prevention of direct sunlight by affording haven of shades. In addition, the Webasto’s new innovative product named solar sunroof coupled with novel convertible roof system used in the Volkswagen Eos provides flexibility to better control natural light. Thus, rise in innovations in glass technology boosts the growth of the automotive panoramic sunroof market.

By Region

Asia-Pacific would exhibit the highest CAGR of 17.1% during 2019-2026.

Rise in demand for safety, comfort, and convenience features

Increase in demand for safety, comfort, and aesthetic features have led to several technological advancements in vehicles such as installation of sunroofs that allow better air circulation. Leading automobile manufacturer are launching wide range of vehicles with panoramic sunroof features. For instance, Kia Motors India, Inc., a world-class quality vehicles manufacturer has launched new KX3, a sports utility vehicle (SUV) in China. Moreover, rise in advance technologies to remove fog or frost from the windows to enhance visibility in all-weather condition with the better illumination, subsequently increases the comfort level of the passengers. Thus, rise in demand for safety and comfortable features in automobiles boosts the growth of the automotive panoramic sunroof market.

High integration and maintenance cost

A sunroof can start leaking or stop working due to several reasons, such as broken motors, faulty tracks, and shattered or chipped glass. Integration and repair of sunroofs is expensive. The components such as rain sensors, power-operated sliding glass panel, aluminum or plastic handles, and other hardware are cheaper than steel or carbon fiber. These components are integrated in single plate, which in turn adds up to the weight of sunroof. Further, they require frequent maintenance, which is expected to hinder the growth of the automotive panoramic sunroof market.

Rise in penetration of solar sunroof in electric vehicles

Governments in the Asia-Pacific region are actively promoting environment friendly vehicles in their respective countries since the Climate Change Agreement in Paris. For instance, Panasonic manufactures the 180-watt roof for Toyota Prius Prime model in the Japanese market. Moreover, the State of Delaware is offering tax-free businesses that provide an electric charging station for electric and hybrid vehicles. The constant support & funding from various governments for the development of solar roof technology & infrastructure is anticipated to create lucrative growth opportunities for the players operating in the automotive panoramic sunroof market.

Key Benefits for Automotive Panoramic Sunroof Market:

- This study presents the analytical depiction of the global automotive panoramic sunroof market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market opportunity is determined by understanding the profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2018 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive Panoramic Sunroof Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | CIE Automotive, BOS Group, Inalfa Roof Systems Group B.V., Webasto Group, Aisin Seiki Co., Ltd., DONGHEE, Automotive Sunroof-Customcraft (ASC) Inc., Inteva Products, Yachiyo Industry Co. Ltd., Magna International Inc. |

Analyst Review

Panoramic sunroof systems generally use a multi-panel roofing design that provides openings above the front and rear seats instead of offering a single option in the middle part of the vehicle. These sunroof systems can be operable or fixed panels depending on what the manufacturer offers and typically uses a top-slider or spoiler mechanism to get the desired result. It offers advantages such as natural air conditioning, enhanced sense of openness, emergency escape, and others.

The factors such as rise in innovation in glass technology and increase in demand for safety, comfort, and convenience features drive the growth of the automotive panoramic sunroof market. However, high integration & maintenance cost and low penetration of power sunroof in low segment vehicles are expected to hinder the growth of the market. Further, rise in penetration of solar sunroof in electric vehicles and increase in sale of automotive vehicles are anticipated to provide lucrative growth opportunity for the key players operating in the automotive panoramic sunroof market.

Among the analyzed regions, currently, Europe is the highest revenue contributor, and is expected to maintain the lead during the forecast period, followed by Asia-Pacific, North America, and LAMEA.

Panoramic sunroof is a large sunroof that covers the entire roof of a vehicle. It is significantly larger than a traditional sunroof and may be clear or tinted. This sunroof is either made of a single solid panel of glass or multiple panels.

The automotive panoramic sunroof market growth is anticipated to reach $4.26 billion by the year 2026.

The report sample for automotive panoramic sunroof market report can be obtained on demand from the website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The market trends in automotive panoramic sunroof are rising innovation in glass technology and rise in demand for safety, comfort and convenience features.

The leading players in automotive panoramic sunroof market includes Aisin Seiki Co. Ltd., CIE Automotive SA, Donghee Industrial Co. Ltd., Inalfa Roof Systems Group BV, and Webasto SE. These players adopted different strategies so as to hold major market share in the automotive panoramic sunroof market.

The statistical data of the top market players of automotive panoramic sunroof industry can be obtained from the company profile section mentioned in the report.

The automotive panoramic sunroof market segment includes material type and vehicle type from the year 2019 to 2026.

The sunroof is typically installed above the front seats and are compact whereas, panoramic sunroof covers almost full area of the roof which is the major difference between sunroof and panoramic sunroof.

The factors such as rise in innovation in glass technology and increase in demand for safety, comfort, and convenience drive the growth of the automotive panoramic sunroof market.

Asia-Pacific countries such as China, Japan, and India dominated the Asia-Pacific automotive panoramic sunroof industry.

Loading Table Of Content...