Automotive Radiator Market Research, 2032

The global automotive radiator market size was valued at $8.6 billion in 2023, and is projected to reach $13.5 billion by 2032, growing at a CAGR of 5.2% from 2024 to 2032.

Market Introduction and Definition

An automotive radiator is a heat exchanger device installed in vehicles; radiators are designed to regulate and expel the excess heat generated by the engine during its operation. Radiators are a critical component of automobiles and are integral to the engine cooling system, resulting in ensuring optimal engine performance and preventing it from overheating. A vehicle engine generates a substantial amount of heat, which can damage engine parts and lead to mechanical failures. Radiators ensure proper heat dispersion, thus ensuring the longevity of the engine and maintaining overall vehicle performance.

Key Takeaways

- The automotive radiator market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Automotive radiators industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- On April 6, 2023, KOYORAD Co., Ltd. announced the opening of its new manufacturing facility in Myanmar. The new manufacturing facility is expected to manufacture radiators and AC condensers, especially for the aftermarket. The company doesn’t offer its product to vehicle manufacturers but focuses solely on aftermarket demand, especially those that require repair and then replacement after collisions. The company is diversifying its manufacturing facility to other parts of the world, especially in the Asia-Pacific region, due to the ageing population in Japan and increased labor wages. The production facility diversification model help KOYORAD Co., Ltd. to speed up its production and compete with manufacturers operating in China and Taiwan.

- On May 2, 2019, Griffin Thermal Products and Evans Waterless Coolants announced a joint marketing program. The joint program between the two companies is anticipated to develop the product efficiency and maximize the cooling system in the radiator by combining a premium Griffin radiator with the unique advantages of Evans Waterless Coolant by improving performance and helping in increasing the life of an engine’s radiator and cooling system.

Key Market Dynamics

The global automotive radiator market growth is driven by several factors, such as growth in vehicle production, stringent regulations in the automobile industry, and rise in demand for electric and hybrid vehicles. However, fluctuations in prices of raw materials and high maintenance cost and perception of risk hamper the development of the market. In addition, the rising trend toward downsizing engine size and increasing aftermarket demand will provide ample of automotive radiator market opportunity during the forecast period. The automotive sector experienced a major transformation due to the strengthened regulations in the industry in recent times. The government regulation in reducing emissions from vehicles and making them safer and reducing overall vehicle weight has gained popularity. Lighter vehicles consume less fuel, emit fewer greenhouse gases, and have better handling and acceleration. Moreover, the growing sales of electric and hybrid vehicles have made it increasingly prevalent, in reducing vehicle weight to extending electric vehicle range and optimizing energy efficiency. However, the fluctuation in the price of raw materials is hindering the market growth. In recent years, the prices for raw materials, particularly aluminum, have grown immensely, majorly due to supply chain disruption, the COVID-19 pandemic and the impact of the Russia-Ukraine war. Aluminum is the third most traded metal and major manufacturers are China, Russia, and Canada. China utilizes over half of global raw aluminum production; the fluctuation in the prices of these raw materials resulted in manufacturers increasing the price of automotive radiators, thus hindering automotive radiator market forecast growth.

Market Segmentation

The automotive radiators market is segmented into product, material, vehicle type, distribution channel, and region. On the basis of product, the market is bifurcated into crossflow and down-flow. By material, the market is divided into aluminum, copper, brass, and plastic. By vehicle type, the market is analyzed into passenger vehicles and commercial vehicles. By distribution channel, the market is fragmented into OEM and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In China, one of the top manufacturers of automotive components globally, the region is one of the desirable locations to produce radiators because it has manufacturing advantages, technological capability, and cost-efficiency production capabilities. China also has a large pool of cheap and large labor force, which is one of the major factors contributing to the lower cost of producing automobile radiators. Similarly, the region has an abundance of natural resources, including steel and aluminum, which reduces the overall manufacturing cost. Furthermore, with the presence of advanced manufacturing facilities, including welding, metalworking, and radiator assembly of automobiles, the radiator manufacturing industry in China is expected to continue during the forecast period, thus driving the growth of the market.

Competitive Landscape

The major players operating in the automotive radiators market include Denso Corporation, Visteon Corporation, MODINE MANUFACTURING COMPANY, Valeo SA, Marelli Corporation, Faret International Holdings Limited, Mahle GmbH, KOYORAD Co., Ltd., CSF Cooling, and Griffin Thermal Products.

Other players in automotive radiators market include Mishimoto Automotive, Spectra Premium Industries, TYC Genera, Champion Cooling Systems, AKG Group and so on.

Parent Market Overview

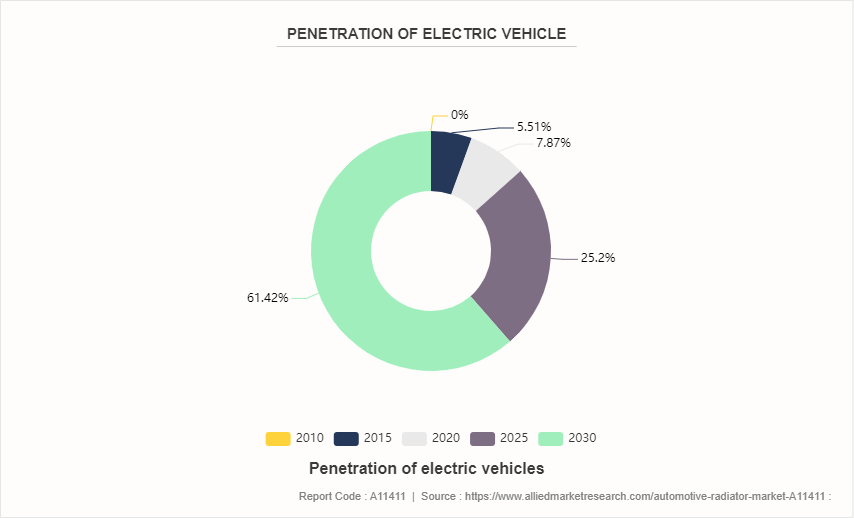

The global automotive radiator market size is witnessing strong growth owing to rise in preference toward EV and hybrid vehicles in Europe and North America region. Similarly, growth in disposable income in Asia-Pacific and Africa region is further driving the demand for automobiles, especially in the passenger car segment. According to data published by the International Energy Agency (IEA) , almost 1 in 3 cars on the roads in China by 2030 is set to be electric, and almost 1 in 5 in both the U.S. and the European Union. The agency also projects that global electric car sales will reach around 17 million units by the end of 2024 and will continue to grow till 2030; the share of electric vehicles in commercial fleets is also expected to witness a strong growth rate in the coming years. Thus, the growing automotive industry is anticipated to present a lucrative opportunity for the automotive radiators market.

Industry Trends:

- According to 2022, data from the Society of Indian Automobile Manufacturer the total passenger sales in India in FY 2022-2023 accounted for 38, 90, 114 units which was around 30, 69, 523 units in 2021-2022. During the same period, the sales of commercial vehicles increased from 7, 16, 566 to 9, 62, 468 units. India is witnessing increase in vehicle production and sales of automobiles which is anticipated to provide lucrative growth opportunities for the automotive radiators market during the review period.

- According to 2021 data from ICEX Spain Exportation and Investment. Spain is the 2nd largest automobile manufacturer in Europe and the 9th largest in the world; Spain has presence of 9 multinational companies and over 17 manufacturing facilities in the country. Similarly, the country manufactured around 2.1 million vehicles in 2021 which accounted for 10% of Spain GDP and 18% of its total export. The automobile industry in the region invested heavily in research and development and in modernizing its manufacturing facilities; 86% of the vehicles and 60% of the auto parts manufactured in the country were exported worldwide in 2021. The Spanish automobile production facilities are some of the most efficient and automated in Europe, with 1, 000 industrial robots for every 10, 000 employees. The automobile industry in the country is growing and is projected to present a lucrative investment opportunity for the automotive radiators manufacturer.

Key Sources Referred

- European Automobile Manufacturers Association

- U.S. Department of Energy

- International Energy Agency

- World Economic Forum

- National Highway Traffic Safety Administration

- International Organization of Motor Vehicle Manufacturers (OICA) :

- U.S. Department of Transportation (DOT)

- Environmental Protection Agency (EPA)

- National Institute of Standards and Technology (NIST)

- European Union Open Data Portal

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the automotive radiators market segments, current trends, estimations, and dynamics of the automotive radiators market analysis to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive radiators market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive radiators market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive radiators market trends, key players, market segments, application areas, and market growth strategies.

Automotive Radiator Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.5 Billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 280 |

| By Product |

|

| By Material |

|

| By Vehicle Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Griffin Thermal Products, Faret International Holdings Limited, Visteon Corporation, KOYORAD Co., Ltd., Denso Corporation, Marelli Corporation, CSF Cooling, Valeo SA, MAHLE GmbH, MODINE MANUFACTURING COMPANY |

Weight reduction, through utilising lightweight material in automotive radiators, are the upcoming trend in the industry.

Passenger vehicle is the upcoming application of the automotive radiator market.

Asia-Pacific is the largest regional market for the automotive radiator market.

The automotive radiator industry was valued at $8,269.3 million in 2022.

Denso Corporation, Visteon Corporation, Marelli Corporation and Faret International Holdings Limited are some of the major companies operating in the automotive radiator market.

Loading Table Of Content...