Automotive Repair and Service Market Overview

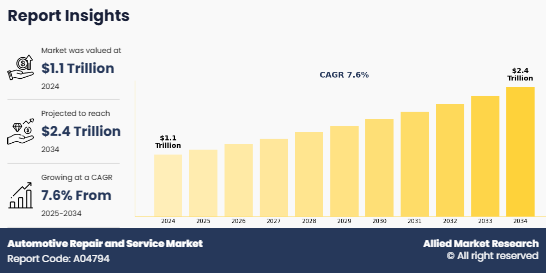

The global Automotive Repair and Service Market Size was valued at USD 1.1 trillion in 2024, and is projected to reach USD 2.4 trillion by 2034, growing at a CAGR of 7.6% from 2025 to 2034. The automotive repair and service market is driven by rising consumer demand for advanced, safety-enhancing components and the need for regular part replacements. Additionally, active expansion by service providers and component manufacturers is accelerating market growth.

Key Market Trends

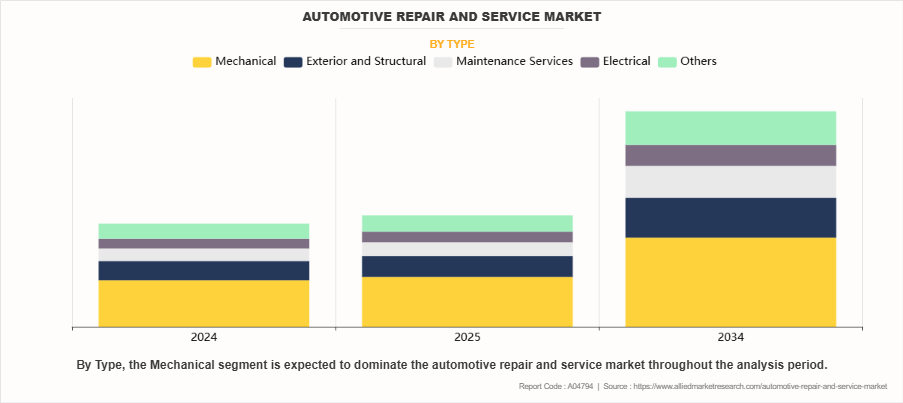

The mechanical repair segment holds the largest market share by type and is expected to maintain its dominance throughout the forecast period.

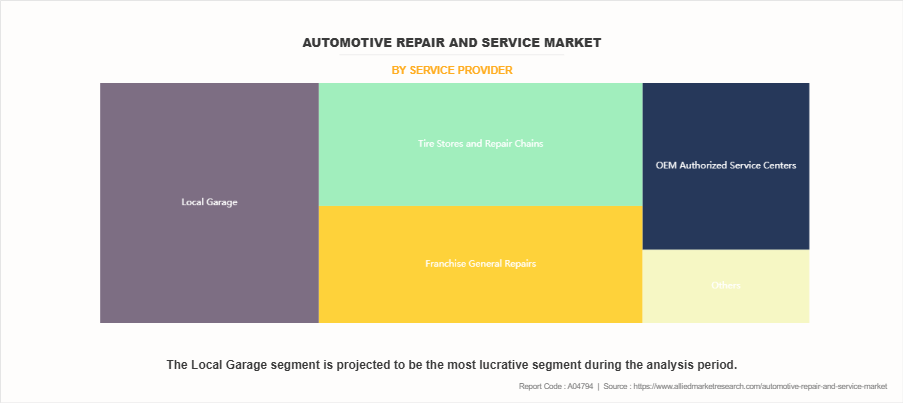

Among service providers, local garages lead the market and are projected to continue their dominance due to accessibility and cost-effectiveness.

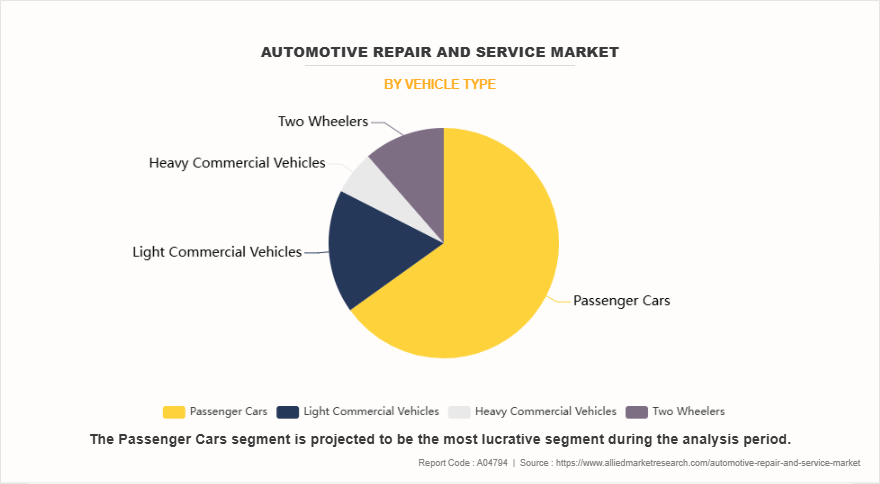

By vehicle type, passenger cars represent the largest share and are likely to remain the key revenue-generating segment.

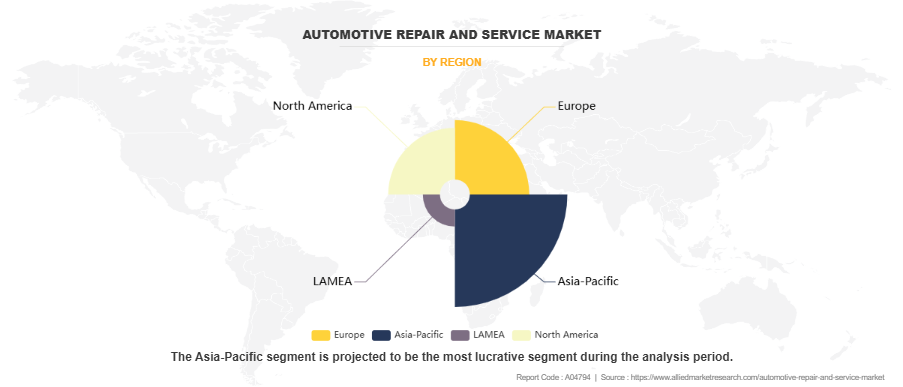

Regionally, the Asia-Pacific market dominates the global landscape and is anticipated to retain its leadership position during the forecast period.

Market Size & Forecast

2034 Projected Market Size: USD 2.4 trillion

2024 Market Size: USD 1.1 trillion

Compound Annual Growth Rate (CAGR) (2025-2034): 7.6%

Key Takeaways

- The Automotive Repair and Service Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious Automotive Repair and Service Market Growth objectives.

Market Dynamics

Automotive repair and service refer to the maintenance and repair of different automotive services and parts, namely gear oil, engine oil, brake oil, and others. In this service, the auto repair technicians perform routine checks & services of vehicles and diagnose malfunctioning vehicles, identify issues, discuss various options with their customers, and find ways to fix them.

Furthermore, it comprises companies that offer aftermarket maintenance and servicing of the vehicles to improve the life of the vehicle by replacing the vehicle products such as tires, batteries, wear & tear parts, air filters, cabin filters, oil filters, wiper blades, collision body, starters & alternators, and others. For instance, in June 2022, MyTVS Accessories launched its ‘Life360’ digital platform to offer its customers a range of automotive repair services. It adopted a subscription-based model, which costs $60 (INR 5,000) for a three-year subscription and offers end-to-end repair services ranging from mechanical, collision and maintenance services, to diagnostics, roadside assistance, accessories, and vehicles.

In addition, in 2024, as per research, the average age of vehicles on the U.S. roads reached a record 12.6 years, an increase from 12.5 years in 2023. This trend is largely attributed to the high cost of new vehicles, with average prices exceeding $45,000, making it financially challenging for many consumers to purchase new cars. Consequently, consumers are opting to maintain and repair their existing vehicles, thus increasing demand for automotive repair and maintenance services. Notably, over 110 million vehicles fall within the 6 to 14-year age range, which is considered the prime period for aftermarket services. This aging fleet presents significant opportunities for service providers, as older vehicles typically require more frequent and extensive maintenance. The trend underscores the importance of the automotive repair sector in supporting vehicle longevity and reliability, especially as consumers seek cost-effective alternatives to new vehicle purchases.

Furthermore, the rise of shared mobility services, including ride-hailing and car-sharing platforms, has led to increased vehicle utilization, thereby accelerating wear and tear. Fleet vehicles used in these services often cover significantly more miles annually compared to privately owned vehicles, thus necessitating more frequent maintenance and repairs. For instance, electric vehicles (EVs) used in high-mileage applications like ride-hailing can bridge the higher upfront costs within 8 to 12 months due to lower fuel and maintenance expenses. However, the increased usage intensity also means that components such as brakes, tires, and suspension systems require more regular servicing. This trend is driving the demand for specialized maintenance services tailored to the needs of high-utilization vehicles, thereby presenting opportunities for service providers to develop targeted solutions for the shared mobility sector.

The automotive repair and service industry is primarily involved in the replacement of damaged vehicle parts or the addition of new components in existing vehicles. Customers are required to replace various components of their vehicles at specific intervals. For instance, passenger vehicles typically need tire replacements every 3–4 years, depending on driving conditions and road quality. This necessity has resulted in a robust and expanding automotive aftermarket. Moreover, the repair & service market is gaining considerable momentum due to the increasing customer inclination toward installing advanced components to enhance vehicle appearance and ensure safer driving experiences. This growing interest among consumers is expected to drive the growth of the aftermarket segment, which in turn is expected to contribute significantly to the expansion of the automotive repair and service market in the coming years.

Furthermore, the active participation of automotive component manufacturers is accelerating market growth. For example, in 2024, Jiffy Lube International, Inc. expanded its footprint by opening a new state-of-the-art service center in Shelby Township, Michigan, for offering a broad range of automotive services including brakes, tire care, fluid exchanges, and advanced engine diagnostics. Thus, owing to all these factors, the Automotive Repair and Service Market Demand is anticipated to witness substantial growth during the Automotive Repair and Service Market Forecast period

However, electric vehicles (EVs) have significantly different maintenance profiles compared to internal combustion engine (ICE) vehicles, primarily due to having fewer moving parts and no need for oil changes, spark plugs, or timing belts. A report by the U.S. Department of Energy highlights that EVs typically have 40% lower scheduled maintenance costs than ICE vehicles. Additionally, regenerative braking in EVs reduces brake wear, further minimizing routine service requirements. According to Consumer Reports, EV owners can expect to save around $4,600 in maintenance and repair costs over the lifetime of the vehicle. However, despite lower routine maintenance needs, EV repairs—especially for batteries and electrical systems—can be significantly more expensive. For example, average EV repair bills were 29% higher than ICE vehicles in Q1 2024 (InsideEVs). As EV adoption increases globally, the traditional repair service model must evolve, focusing on software diagnostics, battery condition, and electrical systems to remain relevant in the changing sector.

Also, electric vehicles (EVs) present a shift in maintenance dynamics compared to internal combustion engine (ICE) vehicles. While EVs have fewer moving parts and generally lower routine maintenance requirements, certain aspects, such as battery management and specialized components, can lead to higher repair costs. In the first quarter of 2024, the average repair cost for EVs in the U.S. was $6,066, approximately 29% higher than the $4,703 average for ICE vehicles. This disparity is attributed to factors like the need for specialized labor and parts. However, over the vehicle's lifetime, EV owners can expect to save about $4,600 in maintenance and repair costs compared to ICE vehicle owners. As EV adoption grows, service providers must adapt by investing in training and equipment to handle EV-specific maintenance, ensuring they can meet the evolving needs of the automotive market.

Various raw materials, such as steel, aluminum, and leather, are used in the manufacturing of vehicle components and accessories. The global supply chain disruptions and continued tariffs on the import of steel and aluminum—especially from key Automotive Repair and Service Industrylike China and the EU—are adversely impacting many players in the automotive sector. In addition, crude oil derivatives such as nylon, polyurethane, and polyester continue to serve as key inputs in the production of various automotive parts, including tires, seat fabrics, and interior covers. Furthermore, rubber—both natural and synthetic—remains an essential material in the automotive industry, yet it experiences frequent price volatility due to climate issues and geopolitical tensions in major rubber producing regions.

The pricing of these materials significantly influences the overall cost of automotive components. As these materials are heavily traded on commodity exchanges, global economic uncertainties and inflationary pressures continue to drive periodic fluctuations in their prices. Consequently, the rise in raw material costs is expected to negatively affect vendors in the automotive components and accessories market. Given these persistent cost pressures, increasing prices of raw materials are anticipated to hinder the growth of the automotive repair and service market during the forecast period.

The automotive industry is undergoing a significant transformation driven by stringent safety regulations, rapid technological advancements, and the transition to electric vehicles (EVs). These shifts are unlocking a broad range of growth opportunities for companies across the value chain. For instance, regulatory emphasis on vehicle safety is accelerating demand for advanced driver-assistance systems (ADAS), integrated dashboard cameras, and Bluetooth-enabled hands-free systems, creating new revenue streams for automotive suppliers and service providers.

Additionally, in response to changing consumer preferences, there is rising demand for enhanced comfort, aesthetic appeal, and premium in-vehicle experiences—particularly in the passenger vehicle segment. This trend is opening up opportunities for innovation in infotainment systems, customizable controls, and high-quality interior materials. Automakers like Audi and BMW are capitalizing on this by integrating luxury features and setting new industry standards.

The Government of India’s 2023 stimulus package, aimed at revitalizing the automotive sector and fostering sustainable growth, further reinforces opportunities for domestic and international players to invest in modernization and R&D. Furthermore, aftermarket service providers are expanding their offerings to meet evolving customer needs. For example, in June 2023, LKQ Corporation’s subsidiary Elitek Vehicle Services broadened its portfolio by offering on-site mobile diagnostics, remote diagnostics, and remote programming—enhancing customer convenience and opening new business avenues.

Collectively, these developments are driving strong demand and unlocking significant growth potential in the automotive repair and service market, especially in the areas of diagnostics, safety features, and smart mobility solutions, throughout the forecast period.

The factors such as increase in automotive sales, growth of automotive post sale services, and stringent government regulations to replace or upgrade vehicle components supplement the growth of the automotive repair and service market. However, volatile prices of raw materials and rise in demand for shared mobility are the factors expected to hamper the growth of the automotive repair and service market. In addition, rise in trend of vehicle customization coupled with increase in disposable income and increase in automotive safety norms & demand for technologically advanced features create market opportunities for the key players operating in the automotive repair and service market.

Segment Analysis

The automotive repair and service market is segmented on the basis of type, service provider, vehicle type, propulsion type, and region. By type, the market is divided into mechanical, exterior & structural, and maintenance services. By service provider, it is fragmented into franchise general repairs, OEM authorized service centers, local garage, tire stores & repair chains, and others. By vehicle type, it is categorized into passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers. By propulsion type, it is further classified into internal combustion engine (ICE) and electric. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Based on type, the mechanical segment has the dominating market share in the year 2024 and is likely to remain dominant during the forecast period. This is attributed to the consistent need for maintenance and replacement of critical vehicle components such as brakes, engines, transmissions, and suspensions. These parts experience natural wear and tear from regular usage, especially in aging vehicles, which form a large portion of the global fleet. Mechanical failures are often urgent and safety-related, prompting immediate attention. Additionally, mechanical repairs generally cost more and are more labor-intensive, further contributing to the segment’s revenue dominance. With increasing vehicle longevity and growing demand for used vehicles, the need for mechanical services is projected to stay high.

By Service Providers

Based on service providers, the local garage segment has dominating automotive repair and service market share in the year 2024 and is likely to remain dominant during the forecast period. This is attributed to the consistent need for maintenance and replacement of critical vehicle components such as brakes, engines, transmissions, and suspensions. These parts experience natural wear and tear from regular usage, especially in aging vehicles, which form a large portion of the global fleet. Mechanical failures are often urgent and safety-related, prompting immediate attention. Additionally, mechanical repairs generally cost more and are more labor-intensive, further contributing to the segment’s revenue dominance. With increasing vehicle longevity and growing demand for used vehicles, the need for mechanical services is projected to stay high.

By Vehicle Type

Based on vehicle type, the passenger cars segment has the dominating automotive repair and service market share in the year 2024 and is likely to remain dominant during the forecast period. This is attributed to their overwhelming presence in global vehicle fleets, particularly in densely populated urban areas. These vehicles are used extensively for daily commuting, leading to frequent maintenance needs such as oil changes, brake replacements, and tire rotations. The rise in private vehicle ownership, driven by increasing disposable income and urbanization, especially in developing regions, contributes to this segment's growth. Additionally, technological advancements and increasing consumer expectations for safety and performance further drive regular servicing. As passenger car sales remain strong and older vehicles stay on roads longer, service demand continues to rise.

By Propulsion Type

Based on propulsion type, the ICE segment has the dominating automotive repair and service market share in the year 2024 and is likely to remain dominant during the forecast period. This is attributed to their widespread use and deeply established servicing infrastructure. Despite the rising adoption of electric vehicles, ICE vehicles still constitute the majority of the global vehicle fleet, especially in regions with limited EV charging infrastructure. Regular maintenance requirements—such as oil changes, emissions testing, and engine diagnostics—make ICE vehicles frequent visitors to repair shops. The market is also driven by the availability of spare parts and the familiarity of mechanics with ICE technologies. As developing economies continue to favor ICE vehicles due to lower upfront costs, this segment is expected to maintain dominance.

By Region

Based on region, the Asia-Pacific region has the dominating automotive repair and service market share in the year 2024, and is likely to remain dominant during the forecast period. This is attributed to rapid urbanization, rising vehicle ownership, and a booming middle-class population. Countries like China, India, and Japan are major automotive manufacturing and consumer hubs, with millions of vehicles requiring regular servicing. Additionally, the region's expanding road networks, increasing average vehicle age, and cost-conscious consumers favor local garages and independent workshops. Governments in the region are also investing in infrastructure and encouraging vehicle maintenance compliance, further boosting market activity. The combination of volume, economic growth, and developing aftermarket ecosystems ensures Asia-Pacific’s continued dominance during the forecast period.

Which are the top Automotive Repair and Services companies globally

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive repair and service industry.

- Asbury Automotive Group, Inc.

- Carmax Autocare Center

- CarParts.com, Inc.

- EUROPART

- Firestone Complete Auto Care

- Hance's European

- Inter Cars S.A.

- Jiffy Lubes International, Inc.

- LKQ Corporation

- M&M Automotive

- MEKO

- Mobivia Groupe

- myTVS Accessories

- Safelite Group

- Sun Auto Service

- USA Automotive

- Wrench, Inc.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive repair and service market analysis from 2024 to 2034 to identify the prevailing automotive repair and service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive repair and service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive repair and service market trends, key players, market segments, application areas, and market growth strategies.

Automotive Repair and Service Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.4 trillion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 300 |

| By Type |

|

| By Service provider |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | Inter Cars, M&M Automotive, USA Automotive, Wrench, Inc., Firestone Complete Auto Care, Safelite Group, Carmax Autocare Center, SUN AUTO SERVICE, Jiffy Lube International, Inc., Mobivia, Hance's European, CarParts.com, Inc., LKQ Corporation, TVS Automobile Solutions Pvt. Ltd., EUROPART, MEKO, Asbury Automotive Group |

Analyst Review

This section provides the opinions of various top-level CXOs in the global automotive repair and service market. Based on interviews with top executives of leading companies, the increasing customer preference for periodic vehicle maintenance and the rising average age of vehicles—now at 13.6 years in the U.S. as of 2024 (S&P Global Mobility)—is expected to significantly drive growth in the automotive repair and service industry. For example, in September 2023, LKQ Corporation unified its service offerings under the Elitek Vehicle Services brand, providing on-site mobile diagnostics, remote programming, and ADAS calibrations. This strategic move strengthened its position as the largest independent provider of such services across the U.S.

Moreover, the repair and service market is gaining traction due to customer inclination toward installing advanced vehicle components, enhancing both appearance and safety. This trend has led to growth in the aftermarket service segment, which in turn is accelerating the overall development of the automotive repair and service market. The role of automotive component manufacturers is also crucial. For instance, Jiffy Lube International, Inc. expanded its service center network in 2024, launching new outlets across key U.S. metros, including a flagship location in Shelby Township, Michigan, offering comprehensive services like tire care, brakes, and diagnostics.

The Automotive Repair and Service Industrygrowth is further supplemented by factors such as increase in vehicle sales, expansion of post-sale automotive services, and strict regulatory norms related to vehicle safety and emissions, which necessitate regular component upgrades. However, challenges such as volatile raw material prices and rise in Automotive Repair and Service Market Demand for shared mobility are expected to hamper growth in certain segments. On the brighter side, trends like vehicle customization, rising disposable income, and the growing enforcement of advanced automotive safety standards are expected to open lucrative opportunities for key players in the global automotive repair and service market.

Among the analyzed regions, Asia-Pacific continues to be the largest revenue contributor, followed by Europe, North America, and LAMEA. According to recent forecasts, LAMEA is projected to experience the highest growth during the Automotive Repair and Service Market Forecast period due to increased awareness of road safety and surge in the sales of pre-owned vehicles. These factors are expected to create several growth opportunities for market players operating in the automotive repair and service space across this region.

The automotive repair and service market was valued at $1,126.60 billion in 2024 and is estimated to reach $2,354.49 billion by 2034, exhibiting a CAGR of 7.6% from 2025 to 2034.

From 2025-2034 would be forecast period in the market report.

$1,126.60 billion is the market value of Automotive repair and service market in 2022. The market is studied across North America, Europe, Asia-Pacific, and LAMEA.

2024 is base year calculated in the Automotive repair and service market report. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

Asbury Automotive Group, Inc., Carmax Autocare Center, CarParts.com, Inc., EUROPART, Firestone Complete Auto Care, Hance's European are the top companies hold the market share in Automotive Tire Market.

Loading Table Of Content...

Loading Research Methodology...