Automotive Resonator Intake Ducts Market Research, 2033

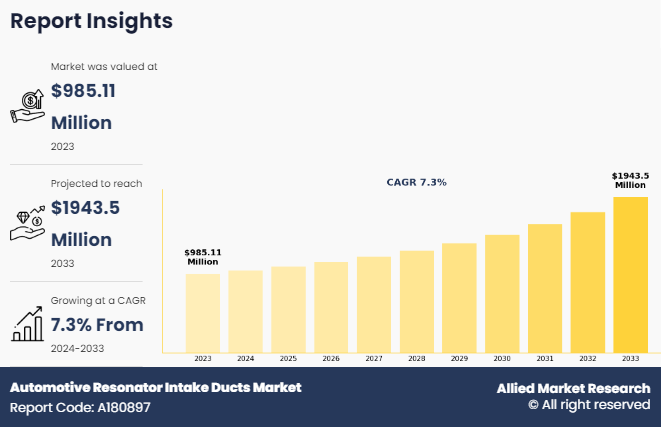

The global automotive resonator intake ducts market size was valued at $985.11 million in 2023, and is projected to reach $1943.5 million by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

An automotive resonator intake ducts market is a key component in a vehicle's air intake system, designed to optimize airflow to the engine and reduce unwanted noise. Positioned between the air filter and the intake manifold, it regulates the pressure and flow of air entering the engine, ensuring smoother combustion and improved engine efficiency. The resonator's primary function is to minimize noise caused by air pulsations, known as "intake noise," by using specially designed chambers that cancel out certain sound frequencies through acoustic tuning. This contributes to a quieter and more comfortable driving experience.

Key Takeaways

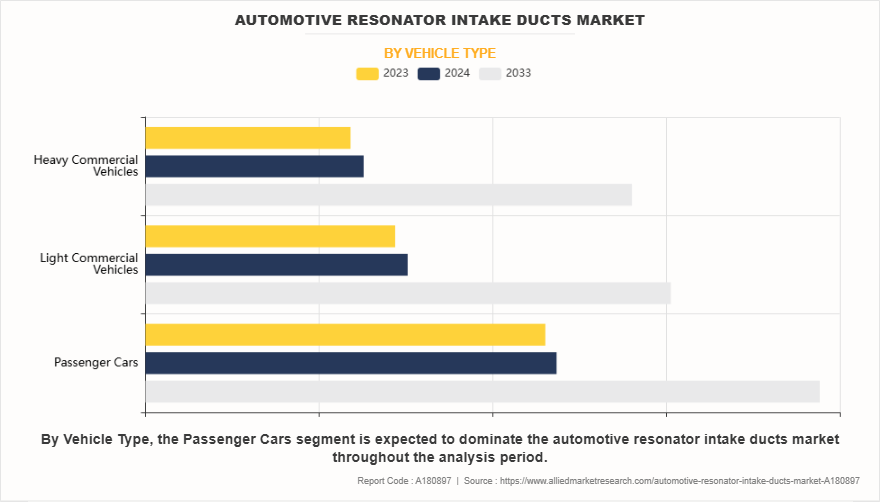

- On the basis of vehicle type, the passenger cars segment held the largest share in the automotive resonator intake ducts market in 2023.

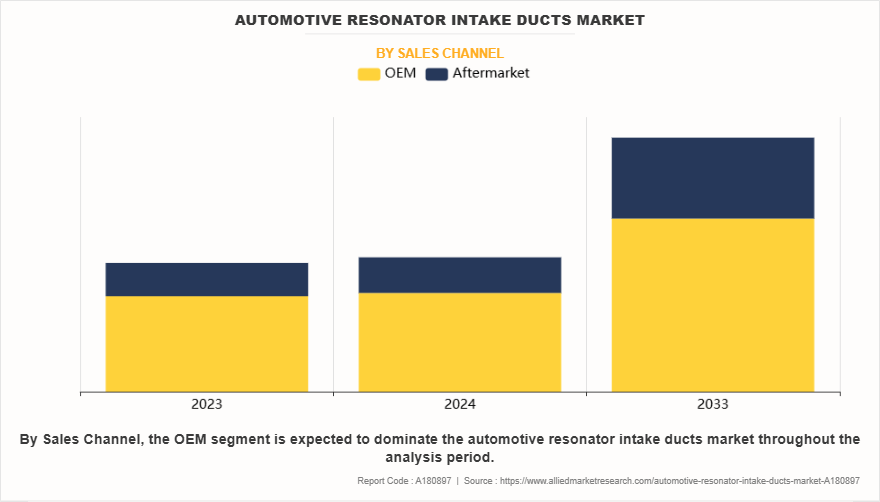

- By sales channel, the OEM segment was the major shareholder in 2023.

- By Material type, the plastic segment dominated the market, in terms of share, in 2023.

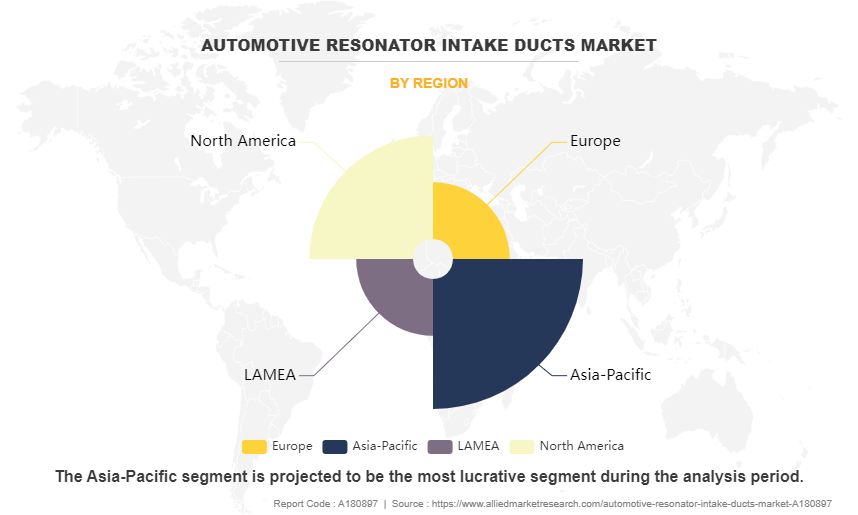

- Region wise, Asia-Pacific held the largest market share in in the automotive resonator intake ducts market in 2023.

The automotive resonator intake ducts industry aids in maintaining consistent air pressure, which enhances engine performance and fuel efficiency. Typically made from lightweight and durable materials such as plastic or rubber, resonator intake ducts are customized for specific vehicle models to meet performance, emissions, and noise, vibration, and harshness (NVH) standards. They are essential for both conventional and hybrid vehicles.

For instance, in February 2022, SiTime Corporation, a leader in MEMS timing solutions, has launched the SiTime XCalibur active resonator, a groundbreaking product designed to address supply chain challenges by using programmable semiconductors as a drop-in replacement for quartz crystal resonators. XCalibur offers superior performance and reliability, making it ideal for automotive.

For instance, in June 2024, The Honda launched the new 2025 Honda CR-V e:FCEV, the first U.S.-made hydrogen fuel cell electric vehicle with plug-in EV charging capability and a 270-mile EPA driving range, highlighting the growing focus on advanced automotive technologies. In vehicles like the Honda CR-V e:FCEV, components such as the automotive resonator intake duct play a crucial role in optimizing engine performance and reducing noise and vibration. These ducts help manage airflow, supporting efficient functioning of the fuel cell and other powertrain components, thereby enhancing overall vehicle performance, especially in cutting-edge models like the CR-V e:FCEV.

The rising demand for fuel-efficient and low-emission vehicles is driving growth in the automotive resonator intake ducts market. These ducts play a crucial role in optimizing airflow to the engine, improving combustion efficiency, and reducing emissions. As governments implement stricter environmental regulations, automakers are increasingly adopting advanced intake systems to meet these standards, as consumers preference for eco-friendly vehicles further boosts demand. Automotive resonator intake ducts, with their lightweight and efficient design, contribute significantly to achieving these performance and environmental goals. Furthermore, grow in emphasis on NVH optimization in modern vehicles has driven the demand for automotive sunroofs.

However, High costs associated with advanced manufacturing technologies are hindering the growth of the automotive resonator intake ducts market growth. The production of these components often involves the use of specialized materials and complex fabrication techniques to ensure durability, lightweight design, and acoustic efficiency. These factors increase overall production expenses, making it challenging for manufacturers to maintain competitive pricing. In addition, smaller automotive companies and cost-sensitive markets face difficulties adopting such technologies, further limiting market expansion despite growing demand for high-performance intake systems. Moreover, challenges in meeting diverse regional regulations and standards are major factors that hamper the growth of the automotive resonator intake ducts market demand.

On the contrary, The expansion of electric and hybrid vehicle markets presents automotive resonator intake ducts market opportunity. As these vehicles emphasize efficiency and noise reduction, innovative intake duct designs are essential to manage airflow and acoustic performance in electric powertrains. The shift toward lightweight and compact components aligns with the design goals of EVs and hybrids. Manufacturers investing in advanced materials and customized resonator solutions can capitalize on this growing segment, driving demand for innovative and high-performance intake duct systems.

Segment Review

The global automotive resonator intake duct market is segmented on the basis of vehicle type, sales channel, material type and region. On the basis of vehicle type, the market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. By Sales Channel, the market is bifurcated into OEM, and Aftermarket. On the basis of material type, the market is segmented into composite, metal, plastic, and rubber. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Vehicle Type

On the basis of passenger cars, the passenger cars segment attained the highest market share in 2023. This is due to their widespread adoption and the increasing emphasis on noise reduction and fuel efficiency. These vehicles require optimized air intake systems to enhance engine performance while adhering to stringent emission and noise, vibration, and harshness (NVH) standards. Rising consumer demand for comfortable, fuel-efficient, and environmentally friendly vehicles further drives the need for advanced resonator intake ducts. The surge in production of compact and mid-sized passenger cars, coupled with technological advancements in intake systems, contributes significantly to their dominant market position in this segment.

By Sales channel

On the basis of sales channel, the OEM segment acquired the highest market share in 2023. This is due to their established relationships with automotive manufacturers and their ability to supply high-quality, custom-designed parts that meet specific vehicle requirements. OEMs ensure precise fitment, durability, and performance, making their products the preferred choice for vehicle manufacturers. Additionally, the growing demand for advanced automotive components and the need for compliance with stringent environmental and noise regulations have further solidified the dominance of OEMs in this market, as they lead in innovation and offer reliable, cost-effective solutions.

By Region

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the automotive resonator intake duct market. This is due to its well-established automotive industry and high demand for advanced vehicle technologies. The region's strong consumer preference for fuel-efficient and low-emission vehicles drives the adoption of optimized intake systems. Additionally, stringent environmental regulations and noise, vibration, and harshness (NVH) standards encourage automakers to integrate advanced resonator intake ducts. The presence of key automotive manufacturers and suppliers, coupled with increasing investments in research and development for lightweight and durable components, further boosts the market. Growing demand for electric and hybrid vehicles also contributes to North America's leadership.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to the region's booming automotive industry, driven by rising vehicle production and sales in countries like China, India, and Japan. Rapid urbanization, increasing disposable incomes, and growing demand for passenger cars and commercial vehicles fuel market growth. In addition, the shift toward fuel-efficient and low-emission vehicles, supported by government regulations and incentives, has boosted the adoption of advanced intake systems. The region's cost-effective manufacturing capabilities, availability of raw materials, and presence of key automotive suppliers and OEMs further accelerate the adoption of resonator intake ducts in Asia-Pacific.

The report focuses on growth prospects, restraints, and trends of the automotive resonator intake ducts market. The study provides Porters five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the automotive resonator intake duct market.

Competitive Analysis

The report analyzes the profiles of key players operating in the automotive resonator intake duct market such as Mahle GmbH, MANN+HUMMEL, Bosch Mobility Solutions, Denso Corporation, Tenneco Inc., Samvardhana Motherson Group, Aisin Corporation, Faurecia, Donaldson Company, Inc., and K&N Engineering, Inc. Â These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive resonator intake ducts industry.

Rise in demand for fuel-efficient and low-emission vehicles.

The rising demand for fuel-efficient and low-emission vehicles is significantly driving the growth of the automotive resonator intake duct market. Governments worldwide are enforcing stricter emission standards and fuel efficiency regulations, compelling automakers to integrate advanced components that optimize engine performance. Resonator intake ducts play a crucial role in enhancing airflow management, reducing engine noise, and improving combustion efficiency, making them essential for modern vehicles. With consumers increasingly prioritizing environmentally friendly and cost-efficient vehicles, manufacturers are focusing on lightweight and durable resonator intake systems to meet these demands. In addition, the rapid adoption of hybrid and electric vehicles, which require specialized intake systems for noise and vibration control, is further propelling the market. Technological advancements in materials and design are enabling the development of resonators that not only comply with stringent standards but also contribute to the overall performance and sustainability of vehicles, ensuring steady market growth.

Grow in emphasis on NVH optimization in modern vehicles.

The growing emphasis on noise, vibration, and harshness (NVH) optimization in modern vehicles is a key driver of demand in the automotive resonator intake duct market. Automakers are prioritizing NVH control to enhance overall driving comfort and meet consumer expectations for quieter, smoother rides. Resonator intake ducts play a crucial role in minimizing intake noise generated by air pulsations in the engine, ensuring acoustic refinement without compromising performance. As stringent NVH regulations and customer demand for premium vehicle experiences rise, manufacturers are adopting advanced resonator designs tailored for optimal sound suppression. In addition, the shift towards lightweight materials and compact designs in resonators supports vehicle efficiency while maintaining effective noise reduction. This trend is particularly significant in hybrid and electric vehicles, where NVH control is critical due to the absence of traditional engine noise masking. The increasing focus on NVH optimization continues to drive innovation and growth in automotive resonator intake ducts market size.

Increase in adoption of lightweight and durable materials in automotive components.

The increasing adoption of lightweight and durable materials in automotive components is significantly boosting demand in the automotive resonator intake ducts market share. Automakers are striving to reduce vehicle weight to enhance fuel efficiency, lower emissions, and comply with stringent environmental regulations. Resonator intake ducts made from advanced materials such as high-performance plastics and composites offer the perfect balance of durability, lightweight design, and cost-effectiveness. These materials not only reduce the overall vehicle weight but also enhance the duct's acoustic and thermal performance, ensuring optimized airflow and noise reduction. The push for hybrid and electric vehicles, where weight savings are critical for improving battery efficiency and range, further amplifies the demand for lightweight resonator intake ducts. In addition, advancements in material technology, such as the development of reinforced plastics and 3D printing, enable manufacturers to produce highly efficient and durable designs, driving the market's growth across various vehicle segments.

High costs associated with advanced manufacturing technologies.

High costs associated with advanced manufacturing technologies are a significant challenge hampering the growth of the automotive resonator intake ducts market trends. The production of these components requires specialized materials, precision engineering, and sophisticated manufacturing processes to meet the demands for lightweight, durability, and acoustic optimization. These factors drive up production costs, making it difficult for manufacturers to maintain competitive pricing while ensuring quality. Smaller automotive companies and cost-sensitive markets face barriers to adopting such advanced components, further limiting market penetration. In addition, fluctuating raw material prices and the high initial investment required for research, development, and manufacturing infrastructure add to the financial burden. These costs are especially challenging for regions with lower vehicle production volumes, where economies of scale cannot offset the expenses. As a result, despite growing demand for high-performance resonator intake ducts, the high costs associated with advanced manufacturing technologies remain a constraint on market growth.

Challenges in meeting diverse regional regulations and standards.

Challenges in meeting diverse regional regulations and standards are significantly hindering the growth of the automotive resonator intake ducts market insights. Each region enforces specific guidelines related to emissions, noise levels, and material compliance, which vary widely and require manufacturers to adapt their products to meet these localized requirements. This diversity adds complexity to the design, testing, and certification processes, increasing development time and costs. For instance, stricter noise, vibration, and harshness (NVH) regulations in developed regions demand advanced acoustic solutions, while emerging markets prioritize cost-effective components, creating a challenging balance for manufacturers. Additionally, the need for compliance with varying environmental and safety standards limits standardization and scalability, reducing production efficiency. Smaller manufacturers, in particular, struggle to allocate resources to address these regulatory differences. These challenges not only slow innovation but also restrict market expansion, particularly in cost-sensitive and regulation-intensive regions, impacting the overall growth of the market.

Expansion of electric and hybrid vehicle markets requiring innovative intake duct designs.

The expansion of electric and hybrid vehicle markets presents a lucrative opportunity for the automotive resonator intake ducts market forecast. Unlike traditional internal combustion engine vehicles, electric and hybrid vehicles require specially designed intake systems to manage airflow, cooling, and noise suppression. Resonator intake ducts play a vital role in reducing noise, vibration, and harshness (NVH), which are critical in these quieter vehicles where engine noise masking is absent. The growing adoption of lightweight materials in resonator designs aligns with the need to improve vehicle range and efficiency. Furthermore, the rapid growth of the electric and hybrid vehicle market, driven by environmental regulations and increasing consumer demand for eco-friendly transportation, is boosting the need for innovative solutions in this space. Manufacturers investing in advanced materials and customized resonator technologies for electric and hybrid vehicles are well-positioned to capitalize on this expanding market segment, driving significant growth opportunities in the coming years.

Advancements in 3D printing and material technologies for cost-effective production.

Advancements in 3D printing and material technologies offer a lucrative opportunity for the automotive resonator intake ducts market by enabling cost-effective and efficient production. 3D printing, or additive manufacturing, allows for the creation of complex and customized resonator designs with precision, reducing material waste and production time. This technology is particularly beneficial for prototyping and small-batch manufacturing, where traditional methods can be expensive and time-consuming. For instance, November 2023, the automaker acquired the first Stratasys F3300 3D printer, representing a pivotal advancement in manufacturing, significantly influencing the automotive resonator intake ducts market. By utilizing 3D printing technology, manufacturers can produce customized, lightweight, and durable resonator intake ducts that optimize vehicle performance, minimize noise, and adhere to environmental standards. This capability to rapidly prototype and manufacture complex designs enhances both the efficiency and cost-effectiveness of developing resonator intake ducts, aligning with the industry's ongoing transition to more advanced, sustainable automotive components.

In addition, innovations in lightweight and durable materials, such as reinforced plastics and composites, enhance the performance of resonator intake ducts while meeting stringent environmental and regulatory standards. These advancements also support the integration of multifunctional components, optimizing space and efficiency in modern vehicles, including hybrids and EVs. By reducing manufacturing costs and increasing design flexibility, 3D printing and advanced materials empower manufacturers to produce high-quality resonators that cater to evolving market demands, fostering growth and innovation in the automotive industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive resonator intake ducts market analysis from 2023 to 2032 to identify the prevailing automotive resonator intake duct market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive resonator intake duct market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive resonator intake duct market trends, key players, market segments, application areas, and market growth strategies.

Automotive Resonator Intake Ducts Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.9 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 485 |

| By Vehicle Type |

|

| By Sales Channel |

|

| By Material Type |

|

| By Region |

|

| Key Market Players | K&N Engineering, Inc., Donaldson Company, Inc., Robert Bosch GmbH, MANN+HUMMEL, Faurecia, AISIN CORPORATION, DENSO CORPORATION, Samvardhana Motherson Group, MAHLE GmbH, Tenneco Inc. |

$985.1 million is the estimated industry size of Automotive Resonator Intake Ducts

Mahle GmbH, MANN+HUMMEL, Robert Bosch GmbH, Denso Corporation, Tenneco Inc., Samvardhana Motherson Group, Aisin Corporation, Faurecia, Donaldson Company, Inc., and K&N Engineering, Inc.

Upcoming trends in the global automotive resonator intake ducts market include the increasing demand for lightweight and durable materials, such as composites and advanced plastics, to enhance fuel efficiency and reduce emissions.

The leading application of the automotive resonator intake ducts market is in reducing engine noise and vibrations in internal combustion engine (ICE) vehicles.

Asia-Pacific is the largest regional market for Automotive Resonator Intake Ducts

Loading Table Of Content...

Loading Research Methodology...